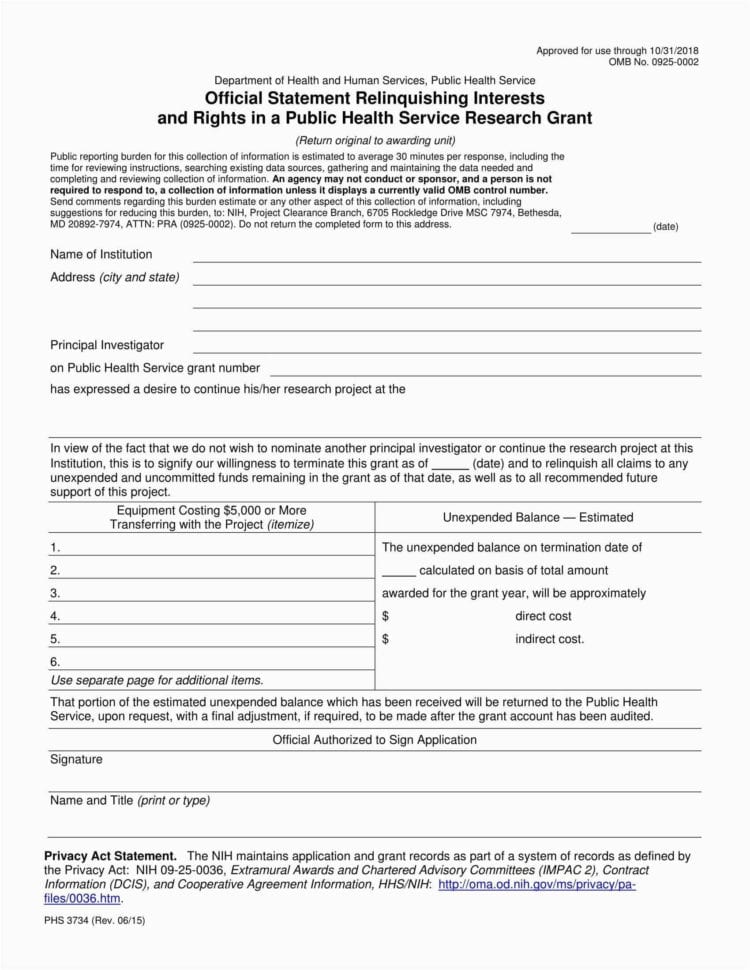

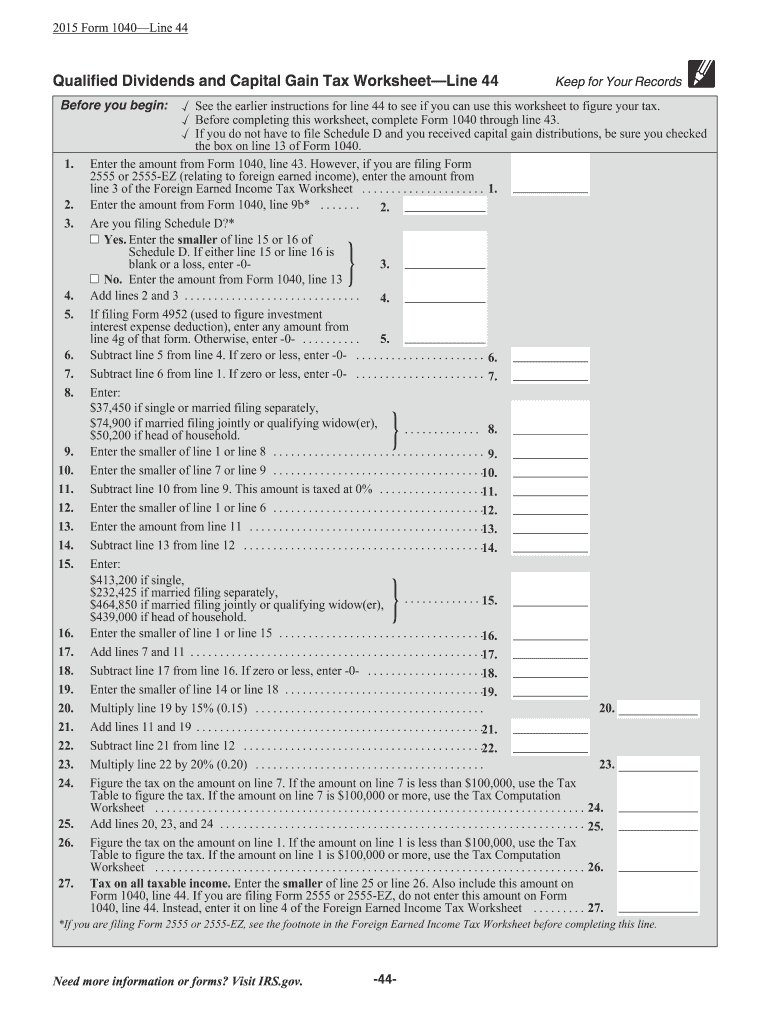

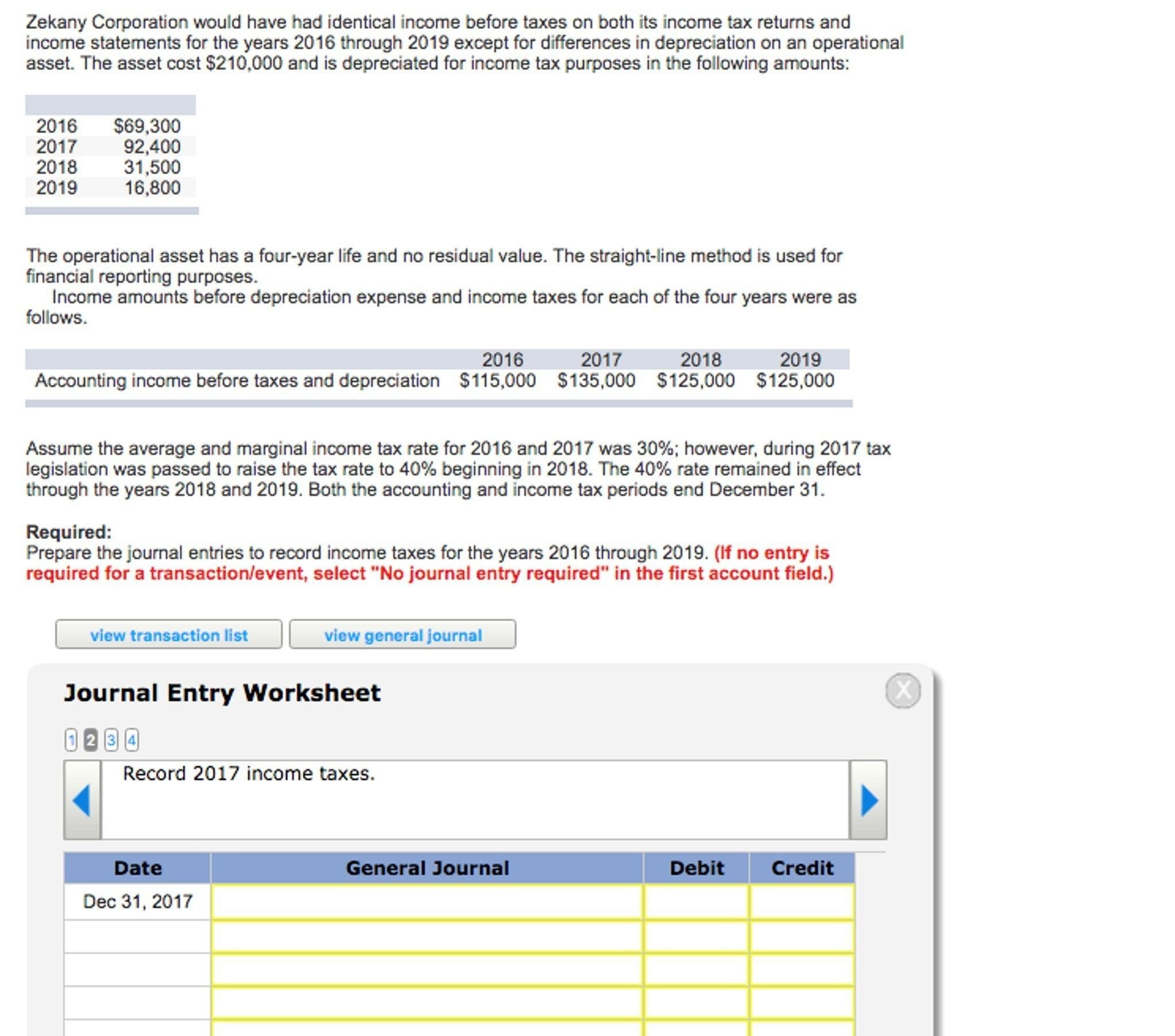

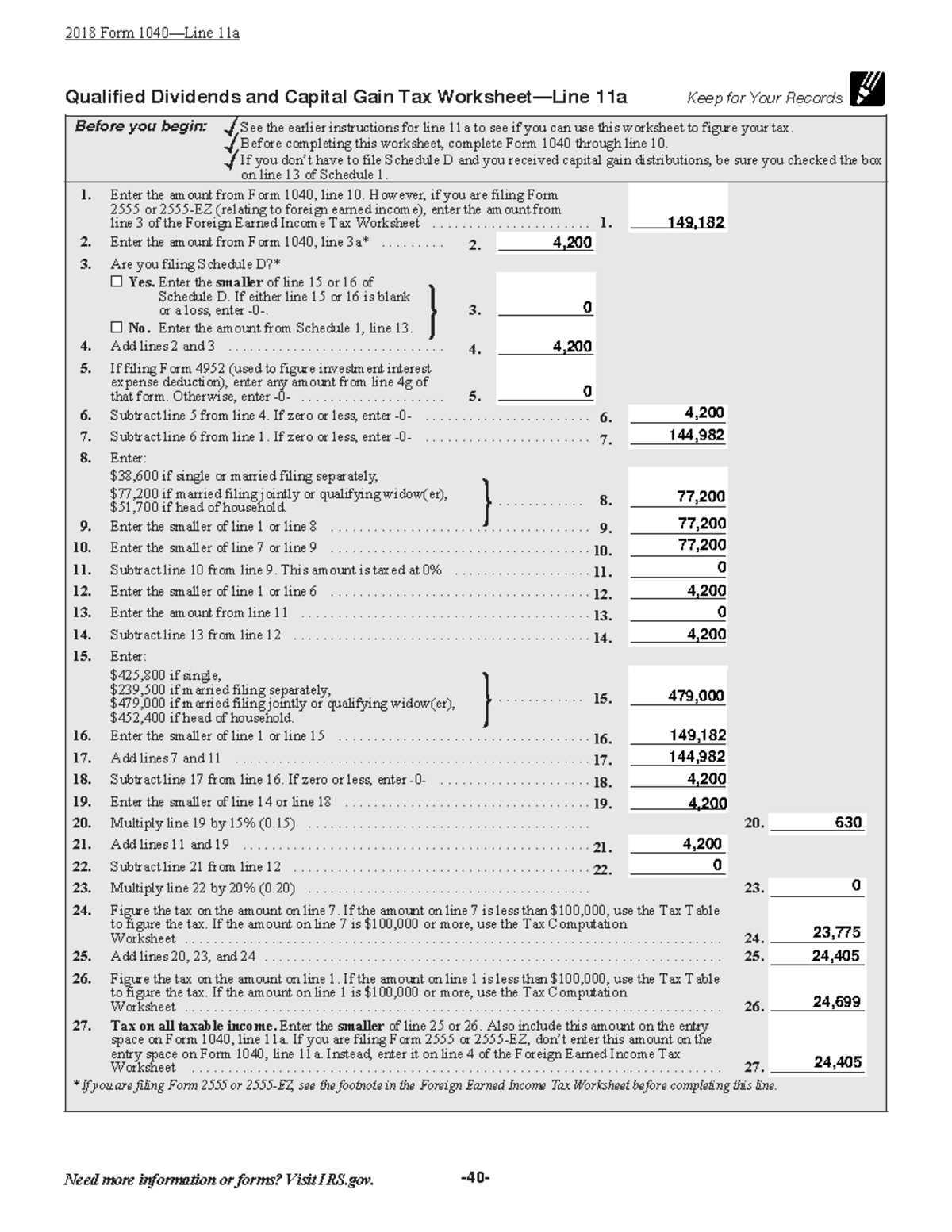

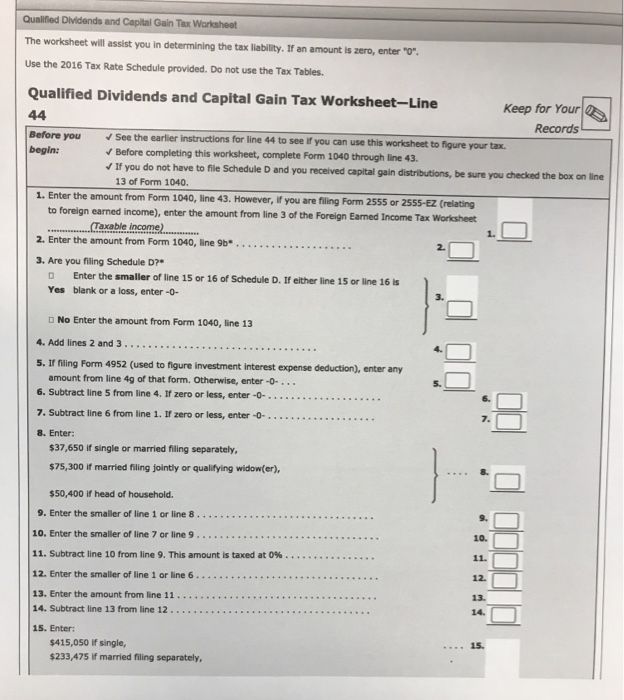

Worksheet For Qualified Dividends - Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with. Web division with 1 digits divisor, 2 quotient & Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web line 2a—total ordinary dividends; Qualified dividends and capital gain tax worksheet. Web these worksheets have division questions with missing numbers. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it. Web schedule d tax worksheet. Foreign earned income tax worksheet.

Qualified Dividends And Capital Gains Worksheet 2018 —

Turbo tax describes one method for your dividends to be. Web schedule d tax worksheet. 2 dividend with remainders worksheets math problems: A qualified dividend is the internal revenue code assigned to. Web these worksheets have division questions with missing numbers.

Qualified Dividends And Capital Gain Tax Worksheet 2020

Turbo tax describes one method for your dividends to be. 2 dividend with remainders worksheets math problems: A qualified dividend is the internal revenue code assigned to. Web qualified dividends and capital gain tax worksheet. Web qualified dividend and capital gains tax worksheet?

Qualified Dividends And Capital Gains Worksheet 2018 —

Web 1 best answer. Web capital gains and qualified dividends. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status [1]. Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet.

Qualified Dividend And Capital Gain Worksheet

Foreign earned income tax worksheet. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with.

62 Final Project Two SubmissionQualified Dividends and Capital Gains

Web schedule d tax worksheet. Turbo tax describes one method for your dividends to be. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status [1]. The qualified dividends and.

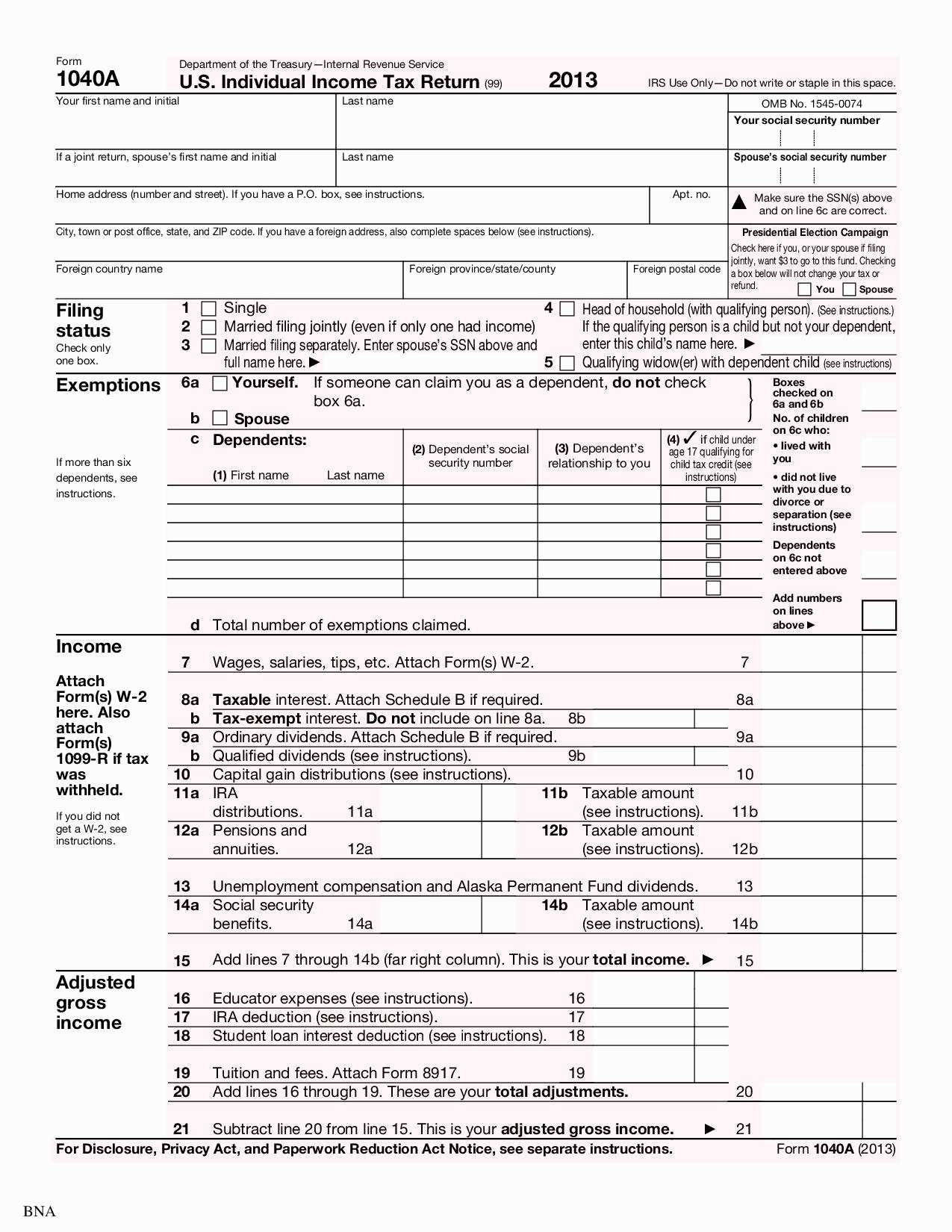

1040a Capital Gains Worksheet

2 dividend with remainders worksheets math problems: Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it. Qualified dividends and capital gain tax worksheet. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Use the qualified dividends and.

Qualified Dividends And Capital Gain Tax Worksheet —

Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status [1]. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web qualified dividend and capital gains.

Qualified dividends and capital gain tax worksheet

Dividends paid by certain foreign companies may or may not be qualified. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web qualified dividends and capital gain tax worksheet—line 11a. Foreign earned income tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the.

2017 Qualified Dividends and Capital Gain Tax Worksheet

Web capital gains and qualified dividends. Web 1 best answer. Web schedule d tax worksheet. 2 dividend with remainders worksheets math problems: Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the.

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Ordinary income is everything else or taxable income minus qualified income. Web schedule d tax worksheet. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with. Web nonqualified dividends include: Qualified dividends and capital gain tax worksheet.

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gain tax worksheet—line 11a. Dividends paid by certain foreign companies may or may not be qualified. Web capital gains and qualified dividends. Web nonqualified dividends include: Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web schedule d tax worksheet. Web line 2a—total ordinary dividends; Ordinary income is everything else or taxable income minus qualified income. Use the qualified dividends and capital gain tax worksheet in the instructions for. Students will have to multiply to answer some questions. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status [1]. For the desktop version you can switch to forms mode and open the. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web division with 1 digits divisor, 2 quotient & Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web qualified dividends and capital gain tax worksheet. Web how do you know if your dividend is qualified?

Web Qualified Dividends And Capital Gain Tax Worksheet—Line 12A Keep For Your Records.

Web line 2a—total ordinary dividends; Web report your qualified dividends on line 9b of form 1040 or 1040a. Web these worksheets have division questions with missing numbers. The qualified dividends and capital gain tax worksheet.

Use The Qualified Dividends And Capital Gain Tax Worksheet In The Instructions For.

2 dividend with remainders worksheets math problems: Web how do you know if your dividend is qualified? Foreign earned income tax worksheet. Qualified dividends and capital gain tax worksheet.

Web The Tax Rate On Qualified Dividends Is 0%, 15% Or 20%, Depending On Your Taxable Income And Filing Status [1].

Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet—line 11a. Web nonqualified dividends include: Ordinary income is everything else or taxable income minus qualified income.

For Tax Year 2022, The 20% Maximum Capital Gain Rate Applies To Estates And Trusts With.

Web qualified dividend and capital gains tax worksheet? Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the.