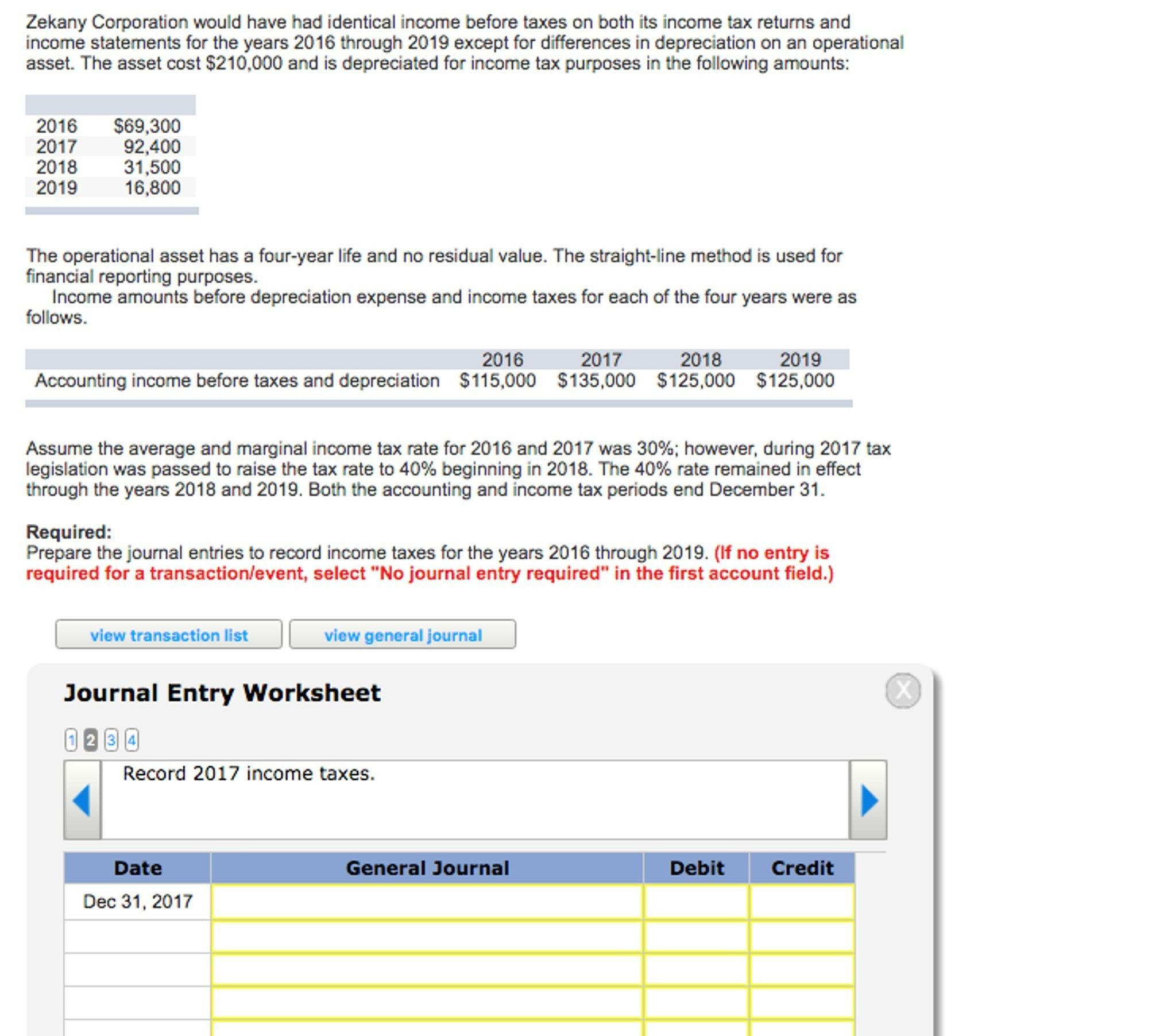

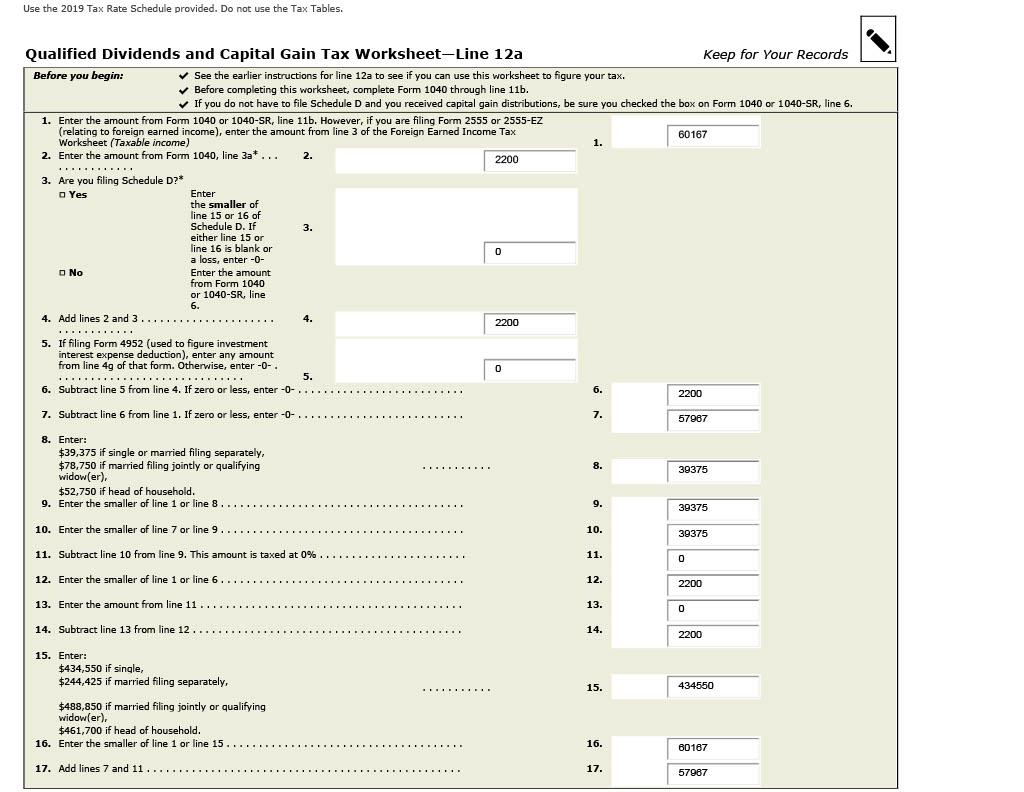

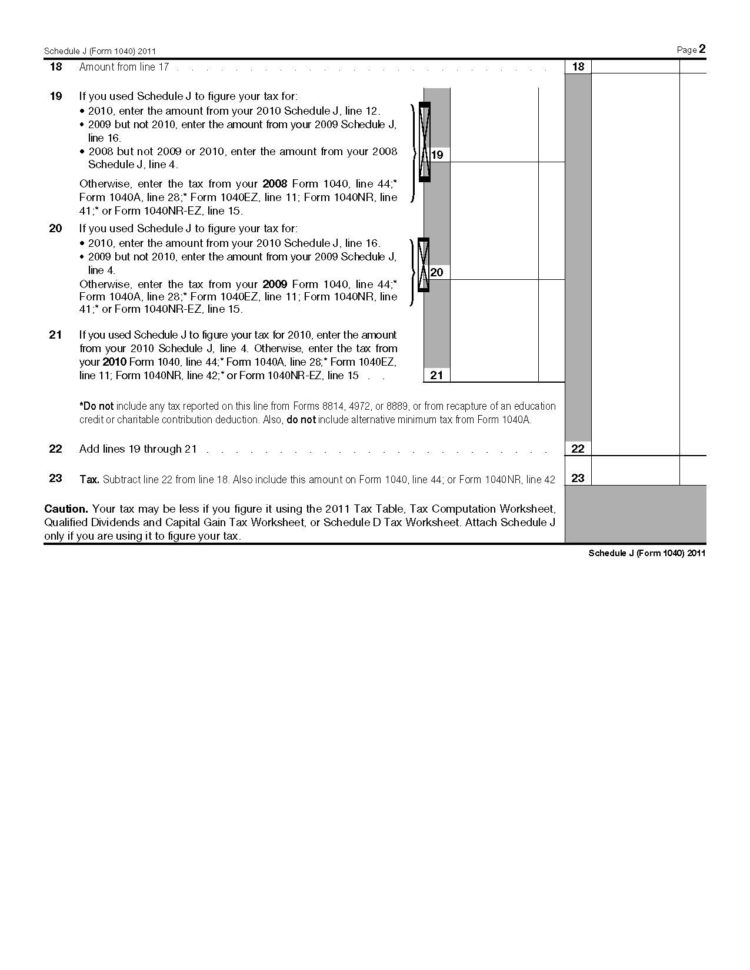

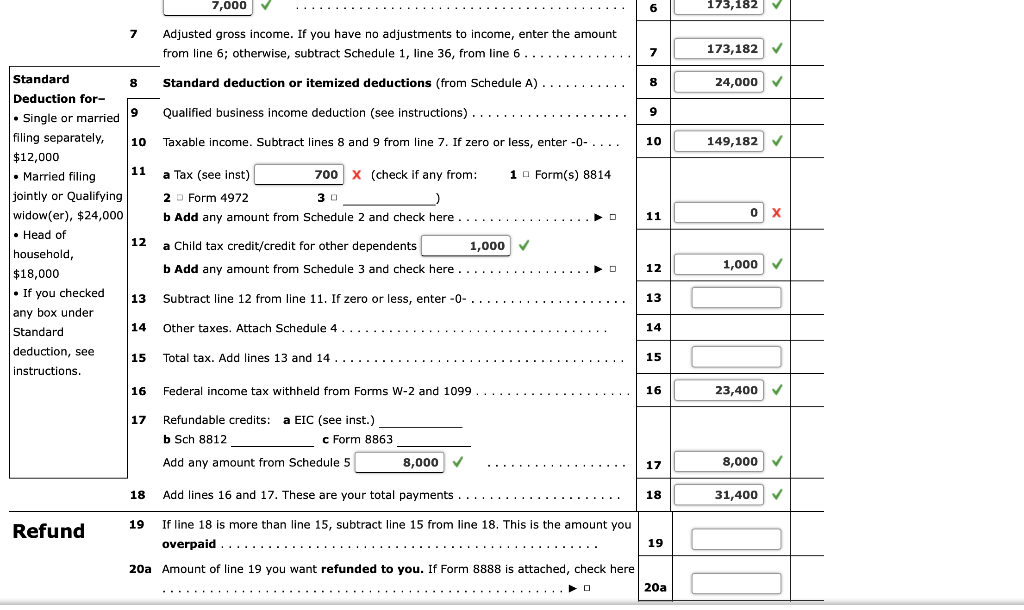

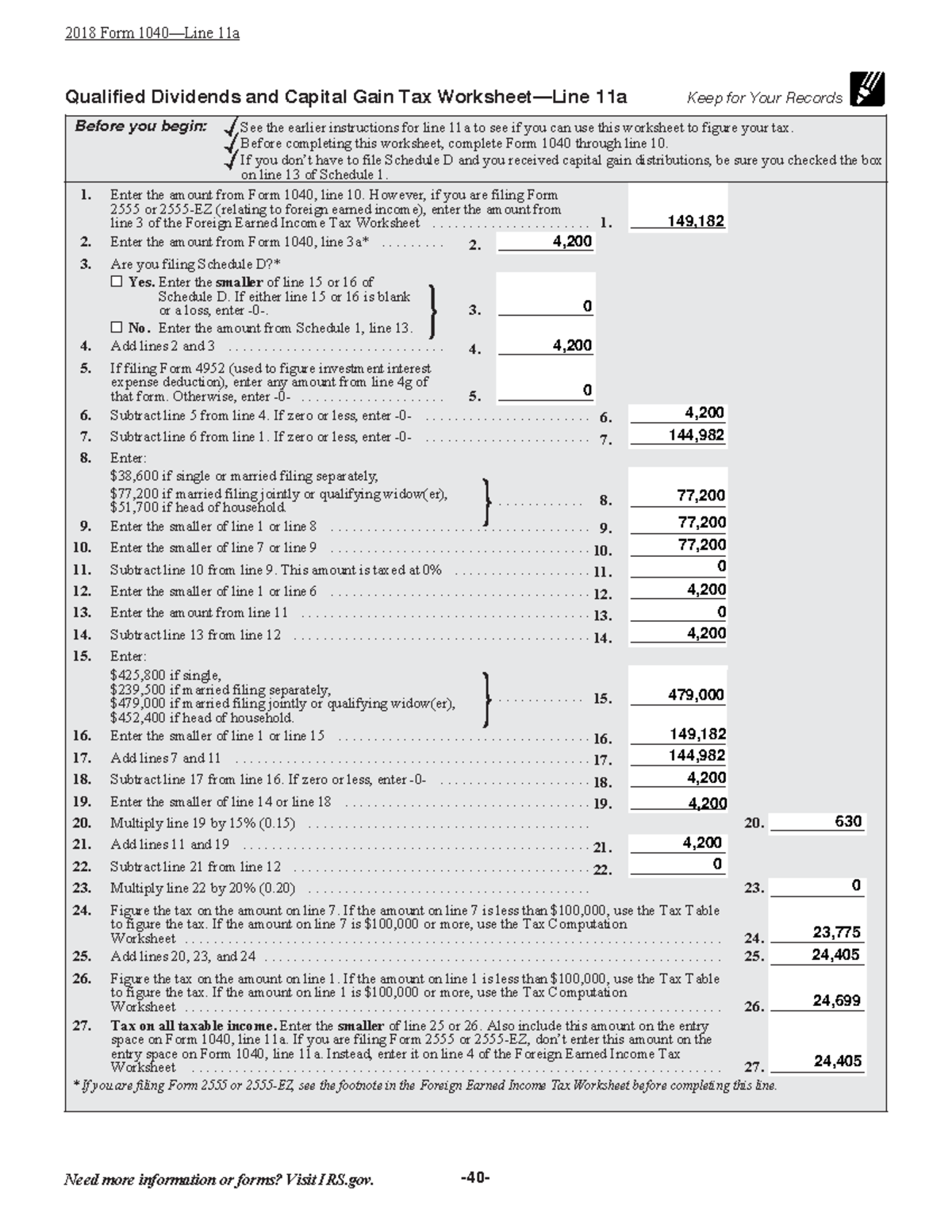

Qualified Dividends And Capital Gain Tax Worksheet - Web tools or tax rosea. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. For the desktop version you can switch to forms mode and open the worksheet to see it. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? It is for a single taxpayer, but. Our publications provide fast answers to tax questions for. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. (form 1040) department of the treasury internal revenue service (99) capital gains and losses.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web tax on all taxable income (including capital gains and qualified dividends). Prior to completing this file, make sure you fill out. If “yes,” attach form 8949. Our publications provide fast answers to tax questions for. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Web tools or tax rosea. Web qualified dividends and capital gain tax worksheet. Web 1 best answer. Qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if. In order to use the qualified dividends and.

Solved Please help me with this 2019 tax return. All

Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web qualified dividends and capital gain tax worksheet. Enter the smaller of line 45 or line 46. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Our.

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Ordinary income is everything else or taxable income minus qualified income. Web qualified dividends and capital gain tax worksheet. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. It is for a single taxpayer, but. Use the qualified dividends and capital gain tax worksheet.

Instructions Schedule Schedule 5 Qualified Dividends

Web report your qualified dividends on line 9b of form 1040 or 1040a. Our publications provide fast answers to tax questions for. Web tools or tax rosea. Prior to completing this file, make sure you fill out. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income.

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

Web tax on all taxable income (including capital gains and qualified dividends). Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Use the qualified dividends and capital gain tax worksheet. Web report your qualified dividends on line 9b of form 1040 or 1040a. Enter the smaller of line.

Qualified Dividends And Capital Gain Tax Worksheet 2016 —

Enter the smaller of line 45 or line 46. If “yes,” attach form 8949. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web tax on all taxable income (including capital.

Qualified Dividends and Capital Gain Tax Worksheet 2016

Web qualified dividends and capital gain tax worksheet. Our publications provide fast answers to tax questions for. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Web how is the qualified dividends and capital gain tax worksheet used? Web the irs recently released the new inflation adjusted.

Qualified Dividends and Capital Gain Tax Worksheet 2019

Web how is the qualified dividends and capital gain tax worksheet used? Web tools or tax rosea. Web tax on all taxable income (including capital gains and qualified dividends). Use the qualified dividends and capital gain tax worksheet to figure your. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

If “yes,” attach form 8949. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if. Web tax on all taxable income (including capital gains and qualified dividends). Web use the qualified.

Web tools or tax rosea. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. Qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if. Web tax on all taxable income (including capital gains and qualified dividends). Ordinary income is everything else or taxable income minus qualified income. Web qualified dividends and capital gain tax worksheet. Prior to completing this file, make sure you fill out. Web report your qualified dividends on line 9b of form 1040 or 1040a. If “yes,” attach form 8949. Use the qualified dividends and capital gain tax worksheet to figure your. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. For the desktop version you can switch to forms mode and open the worksheet to see it. (form 1040) department of the treasury internal revenue service (99) capital gains and losses. Web how is the qualified dividends and capital gain tax worksheet used? Our publications provide fast answers to tax questions for. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web 1 best answer. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? In order to use the qualified dividends and.

Web Irs Introduced The Qualified Dividend And Capital Gain Tax Worksheet As An Alternative To Schedule D And Added The.

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Prior to completing this file, make sure you fill out.

Web Get Qualified Dividends Tax Worksheet Right Now, Together With An Archive Of Thousands Of Legal Templates And Pdf Files At Formspal.

(form 1040) department of the treasury internal revenue service (99) capital gains and losses. Use the qualified dividends and capital gain tax worksheet to figure your. Use the qualified dividends and capital gain tax worksheet. In order to use the qualified dividends and.

It Is For A Single Taxpayer, But.

Ordinary income is everything else or taxable income minus qualified income. Enter the smaller of line 45 or line 46. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web tax on all taxable income (including capital gains and qualified dividends).

If “Yes,” Attach Form 8949.

Qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Our publications provide fast answers to tax questions for.