Railroad Retirement Taxable Income Worksheet - Web generally, up to 50 percent of a beneficiary’s benefits will be taxable. Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement. Publications, news releases, and articles about the taxation of railroad. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. If social security benefits are. Do not use the worksheet below if any of. Web railroad retirement payments are not taxable for state income tax purposes. Web the retirement, survivor, and disability benefit programs under the rra are funded by mandatory employment taxes on both. Web income tax general information. Taxslayer incorrectly includes rr retirement benefits.

United States Railroad Retirement Board 2016 Annual Report for Fiscal

Web the retirement, survivor, and disability benefit programs under the rra are funded by mandatory employment taxes on both. Do not use the worksheet below if any of. Taxation of railroad retirement act (rra) annuities under federal income tax laws the tier 1, tier 2, and vested dual benefit. However, up to 85 percent of his or her benefits can.

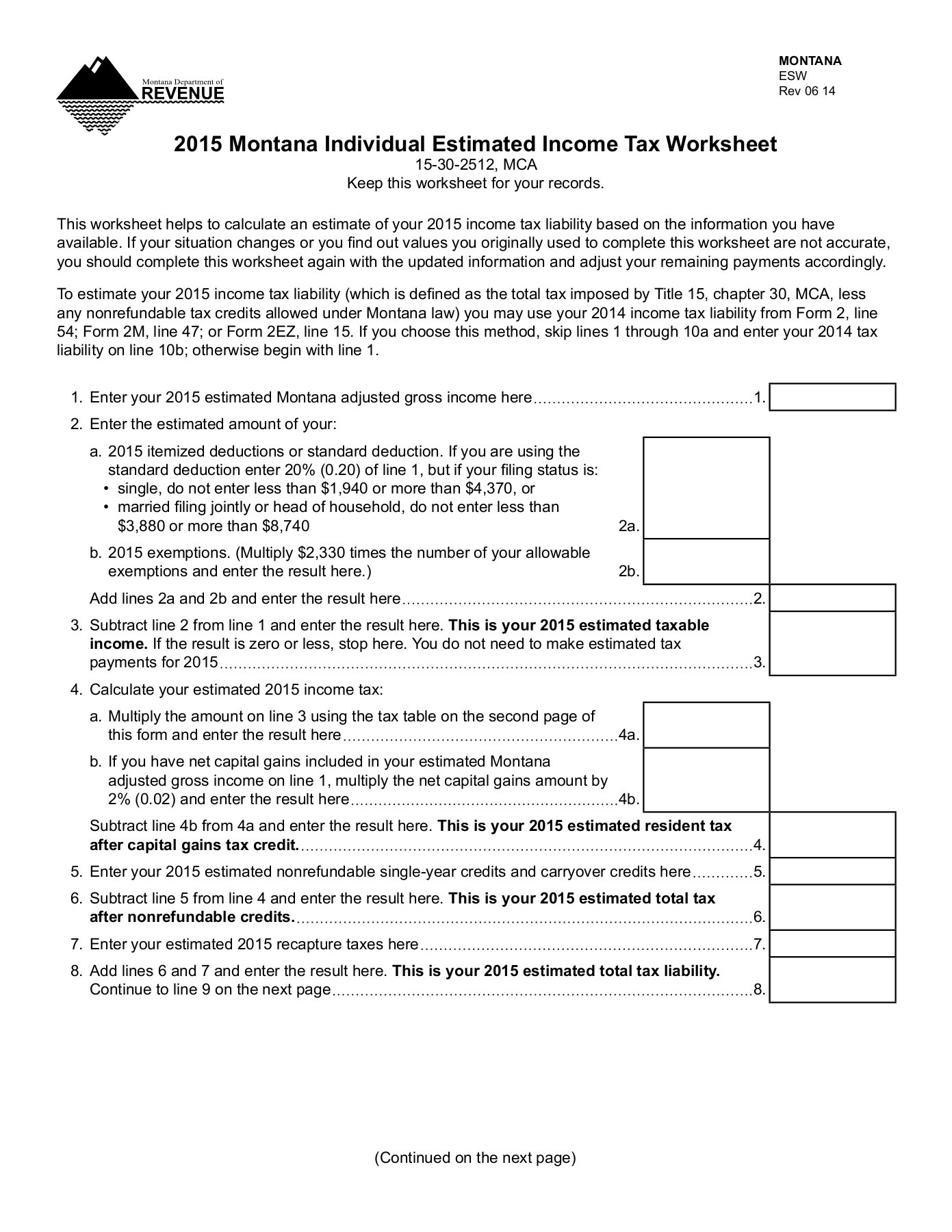

2015 Montana Individual Estimated Tax Worksheet —

Fill in lines a through e. Taxslayer incorrectly includes rr retirement benefits. Web income tax general information. Web required minimum distributions (rmds). To enter this information in your taxact return:.

Railroad Retirement Taxable Worksheets

Web information you'll need. Possession, or puerto rico that is. Web generally, up to 50 percent of a beneficiary’s benefits will be taxable. Web benefit information railroad retirement employee annuities and pensions from work not covered by social security. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to.

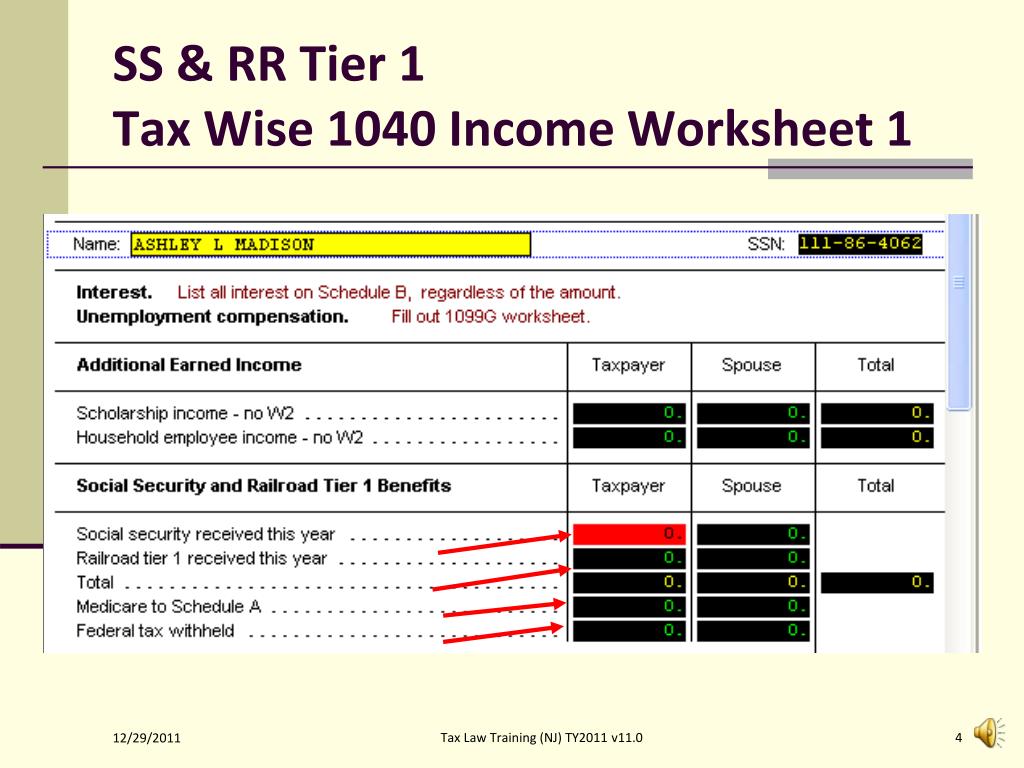

PPT Social Security & RR Retirement Tier 1 (Blue Form) PowerPoint

Taxslayer incorrectly includes rr retirement benefits. Basic information to help you determine your gross income. Tp is age 65+ sp is age 65+. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states. Web we developed this worksheet for you to see if your benefits may be.

Quiz & Worksheet Social Security vs. Railroad Retirement Benefits

Web benefit information railroad retirement employee annuities and pensions from work not covered by social security. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states. Web railroad retirement annuities are not taxable by states in accordance with section 14 of the railroad retirement. To enter this.

Where Is My In Railroad Retirement? — Highball Advisors

Web income tax general information. Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. There are two categories of benefits paid under the. Web generally, up to 50 percent of a beneficiary’s benefits.

Irs Pub 915 Worksheet Tax Planner Compute Taxable Social Security

Web the retirement, survivor, and disability benefit programs under the rra are funded by mandatory employment taxes on both. Web generally, up to 50 percent of a beneficiary’s benefits will be taxable. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states. To enter this information in.

Concept Pieces BlockWall Strategies, Inc. Deerfield, IL

Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states. Tp is age 65+ sp is age 65+. Taxslayer incorrectly includes rr retirement benefits. Basic information to help you determine your gross income. There are two categories of benefits paid under the.

Form RRB1099R Railroad Retirement Benefits Keystone Support Center

Web required minimum distributions (rmds). Taxslayer incorrectly includes rr retirement benefits. Basic information to help you determine your gross income. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states. Individuals who reach age 72 after december 31, 2022, may delay receiving their rmds.

Railroad Retirement Board Preliminary Regulatory Reform' Plan

Web when the taxpayer and/or spouse has income earned in a foreign country, a u.s. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states. If social security benefits are. However, up to 85 percent of his or her benefits can be. Web required minimum distributions (rmds).

Possession, or puerto rico that is. There are two categories of benefits paid under the. Web information you'll need. Web generally, up to 50 percent of a beneficiary’s benefits will be taxable. To enter this information in your taxact return:. Taxslayer incorrectly includes rr retirement benefits. Do not use the worksheet below if any of. Web when the taxpayer and/or spouse has income earned in a foreign country, a u.s. However, up to 85 percent of his or her benefits can be. Web railroad retirement annuities are not taxable by states in accordance with section 14 of the railroad retirement. Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement. Taxation of railroad retirement act (rra) annuities under federal income tax laws the tier 1, tier 2, and vested dual benefit. Tp is age 65+ sp is age 65+. Fill in lines a through e. Basic information to help you determine your gross income. Web income tax general information. Web required minimum distributions (rmds). Web the retirement, survivor, and disability benefit programs under the rra are funded by mandatory employment taxes on both. Individuals who reach age 72 after december 31, 2022, may delay receiving their rmds. Publications, news releases, and articles about the taxation of railroad.

Web Income Tax General Information.

Web generally, up to 50 percent of a beneficiary’s benefits will be taxable. Web required minimum distributions (rmds). Publications, news releases, and articles about the taxation of railroad. Web the retirement, survivor, and disability benefit programs under the rra are funded by mandatory employment taxes on both.

Tp Is Age 65+ Sp Is Age 65+.

Possession, or puerto rico that is. Web information you'll need. Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement. To enter this information in your taxact return:.

If Social Security Benefits Are.

Web railroad retirement annuities are not taxable by states in accordance with section 14 of the railroad retirement. Web benefit information railroad retirement employee annuities and pensions from work not covered by social security. Web when the taxpayer and/or spouse has income earned in a foreign country, a u.s. Taxation of railroad retirement act (rra) annuities under federal income tax laws the tier 1, tier 2, and vested dual benefit.

Do Not Use The Worksheet Below If Any Of.

Basic information to help you determine your gross income. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. However, up to 85 percent of his or her benefits can be. Web railroad retirement payments are not taxable for state income tax purposes.