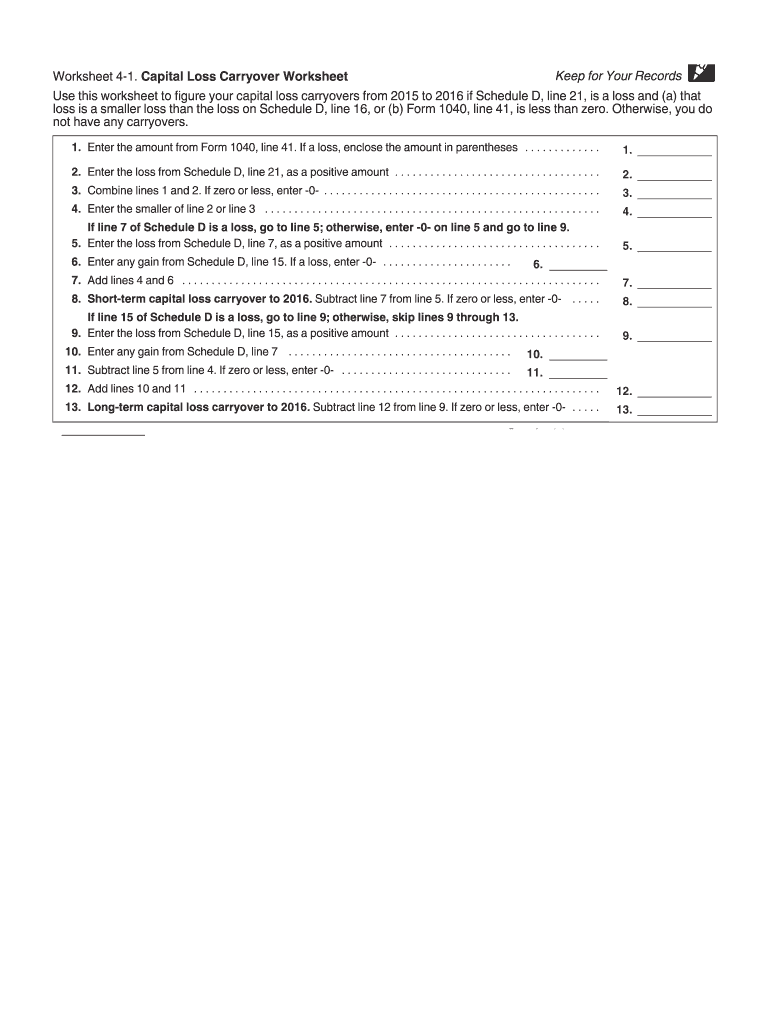

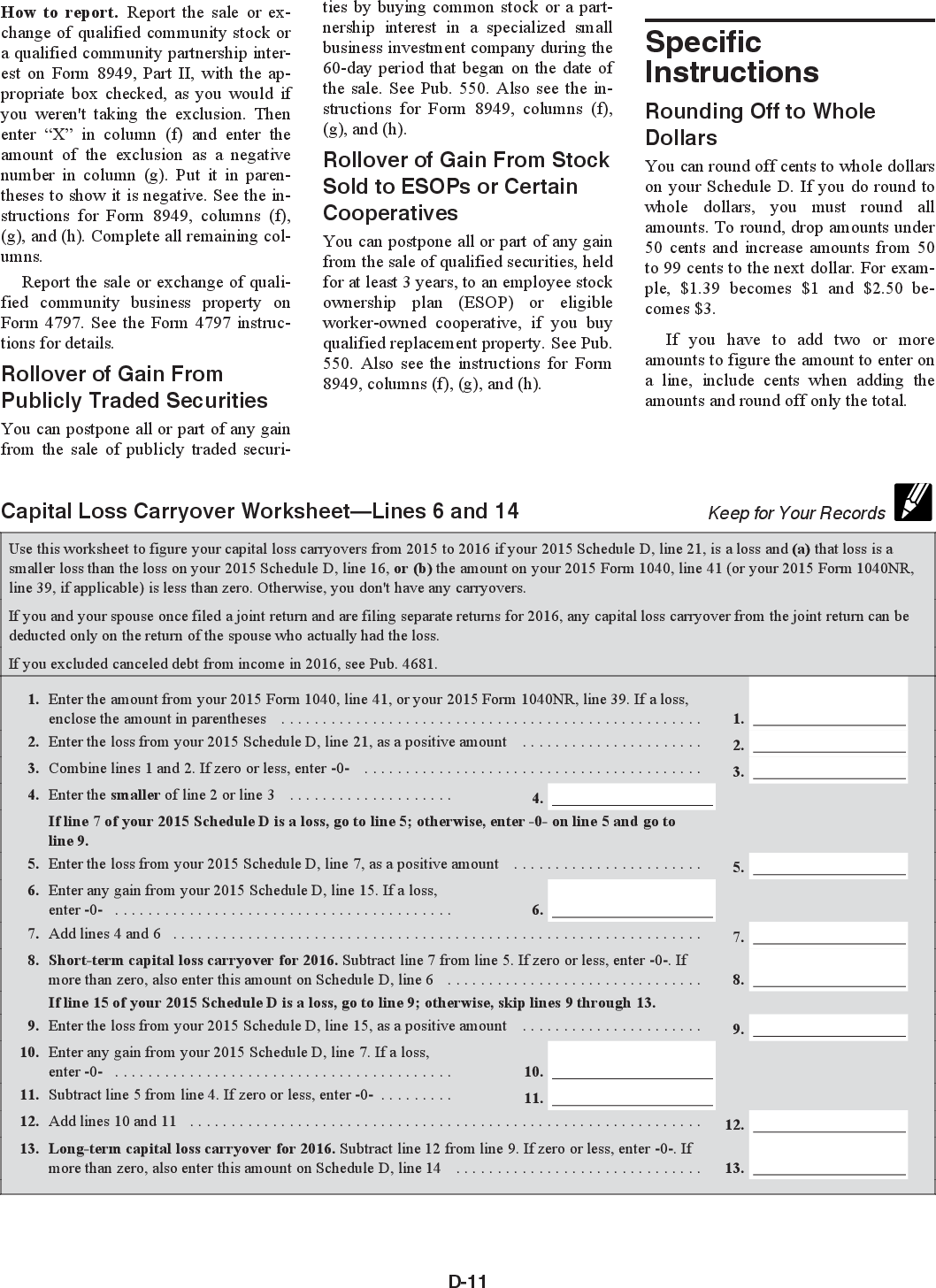

California Capital Loss Carryover Worksheet - 540 schedule d from 2019, which is the proper line for capital loss carryover? Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from. It is not a form,. The 2020 capital loss carryover to 2021 is. Web code) california conforms to federal law concerning the following: Web to calculate a capital loss carryover, subtract your capital gains from your capital losses in a tax year. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from. Web california capital gain or loss adjustment do not complete this schedule if all of your california gains. Web ca has its own sch d and ca capital loss carryover worksheet will be in your paperwork last year. It's not actually reported on a line in your 2020 return.

Capital loss carryover worksheet Fill out & sign online DocHub

To add to tt2020 line 6 ( califorinia. It's not actually reported on a line in your 2020 return. Web 1 best answer. If line 8 is a net capital loss, enter the smaller of. The definition of capital assets (irc sec.

Carryover Worksheet Turbotax

To add to tt2020 line 6 ( califorinia. Web use the worksheet below to figure your capital loss carryover to 2023. Web 2020 instructions for schedule d 541 capital gain or loss general information specific line instructions references in these. Web use the worksheet on this page to figure your capital loss carryover to 2021. Web california capital loss carryover.

What Is A Federal Carryover Worksheet

Web 1 best answer. Line 9 if line 8 is a net capital loss, enter the smaller of. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss. Web for more details see pub. Web.

21+ 2020 Capital Loss Carryover Worksheet ShilpaDaanya

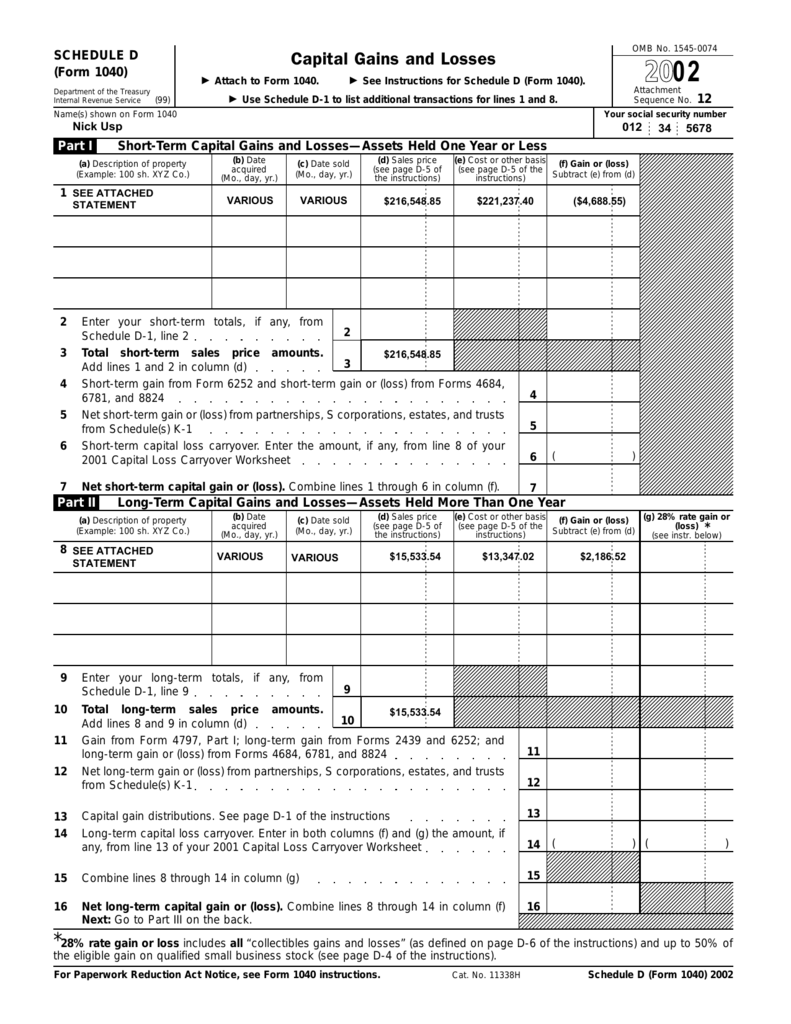

(b) date acquired (mm/dd/yyyy) (c) date sold. Capital loss carryover worksheet lines 6 and 14 keep for your records use this worksheet to figure. So clearly line 6 is not the right one to show the carryover. Web california capital gain or loss adjustment do not complete this schedule if all of your california gains. Web use this worksheet to.

California Capital Loss Carryover Worksheet

Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. It is not a form,. 540 schedule d from 2019, which is the proper line for capital loss carryover? Capital loss carryover worksheet lines 6 and 14 keep for your records use this.

Capital Loss Carryover Worksheet slidesharedocs

Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from. Use get form or simply click on the template preview to. The.

Capital Loss Carryover Worksheet Example Educational worksheets, Tax

Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the.

California Capital Loss Carryover Worksheet

(b) date acquired (mm/dd/yyyy) (c) date sold. Web california capital gain or loss adjustment do not complete this schedule if all of your california gains. Example, 100 shares 7% preferred of “z” co. Web 1 best answer. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a.

California Capital Loss Carryover Worksheet

Example, 100 shares 7% preferred of “z” co. Line 9 if line 8 is a net capital loss, enter the smaller of. Web 2020 instructions for schedule d 541 capital gain or loss general information specific line instructions references in these. Web 1 best answer. Web code) california conforms to federal law concerning the following:

California Capital Loss Carryover Worksheet

Web california capital loss carryover from 2017 if any. If line 8 is a net capital loss, enter the smaller of. Web 2020 instructions for schedule d 541 capital gain or loss general information specific line instructions references in these. Line 9 if line 8 is a net capital loss, enter the smaller of. Web use this worksheet to figure.

It is not a form,. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. It's not actually reported on a line in your 2020 return. (b) date acquired (mm/dd/yyyy) (c) date sold. Web california capital gain or loss adjustment do not complete this schedule if all of your california gains. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. Web for more details see pub. If line 8 is a net capital loss, enter the smaller of. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from. Web code) california conforms to federal law concerning the following: Line 9 if line 8 is a net capital loss, enter the smaller of. Web 2020 instructions for schedule d 541 capital gain or loss general information specific line instructions references in these. To add to tt2020 line 6 ( califorinia. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. Capital loss carryover worksheet lines 6 and 14 keep for your records use this worksheet to figure. Click the button get form to open it and begin. Web california capital loss carryover from 2017 if any. Web use the worksheet on this page to figure your capital loss carryover to 2021. The definition of capital assets (irc sec. Use get form or simply click on the template preview to.

Web 1 Best Answer.

So clearly line 6 is not the right one to show the carryover. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. Web california capital gain or loss adjustment do not complete this schedule if all of your california gains. Web to calculate a capital loss carryover, subtract your capital gains from your capital losses in a tax year.

Web Ca Has Its Own Sch D And Ca Capital Loss Carryover Worksheet Will Be In Your Paperwork Last Year.

To add to tt2020 line 6 ( califorinia. (b) date acquired (mm/dd/yyyy) (c) date sold. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from. Use get form or simply click on the template preview to.

If Line 8 Is A Net Capital Loss, Enter The Smaller Of.

Capital loss carryover worksheet lines 6 and 14 keep for your records use this worksheet to figure. Web code) california conforms to federal law concerning the following: Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss. Click the button get form to open it and begin.

Web Use The Worksheet On This Page To Figure Your Capital Loss Carryover To 2021.

Web california capital loss carryover from 2017 if any. Line 9 if line 8 is a net capital loss, enter the smaller of. Web 1 (a) description of property: 540 schedule d from 2019, which is the proper line for capital loss carryover?