Photographer Tax Deduction Worksheet - Here’s a cheat sheet of some typical expenses you can write off as a photographer and how i recommend you categorize the transactions in your bookkeeping program to align with the irs schedule c. $14.99 add to cart add to wishlist sponsored by moonmail pay in 4 interest. “can i legitimately write this off this expense on my tax return?” the answer to this question is a resounding “it depends!” now doesn’t that make you feel better and more confident? Web tax spreadsheets for photographers share: Web regardless of whether you rent or own your home, you can still deduct the cost of your home office space. Use this list to help organize your photographer tax preparation. 💻 photo editing software write it off using:. _____ did you make any payments that would require you to file form 1099? Web my biggest tip for making tax prep painless is to make sure your tax deductions are categorized correctly. The quick n' easy guide to file #taxes #photography tom smery updated on:

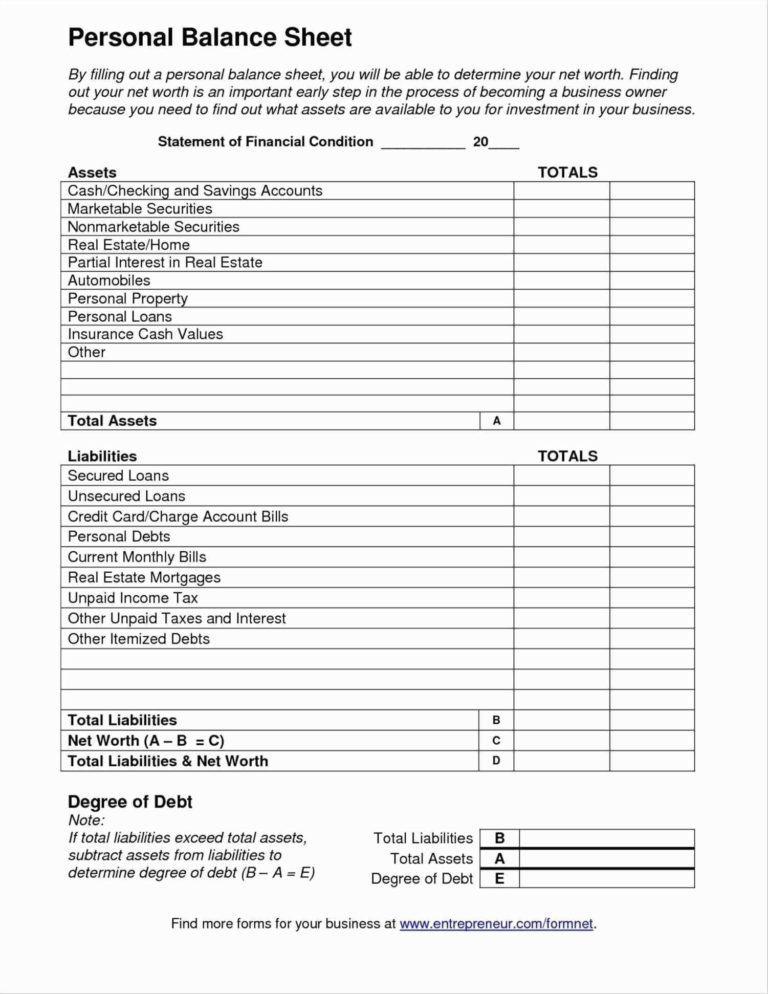

Itemized Deductions Spreadsheet in Business Itemized Deductions

Here’s a cheat sheet of some typical expenses you can write off as a photographer and how i recommend you categorize the transactions in your bookkeeping program to align with the irs schedule c. Updated for tax year 2022 • june. Web tax deductions for photographers most people who operates their own business (photography or otherwise) ask the same question.

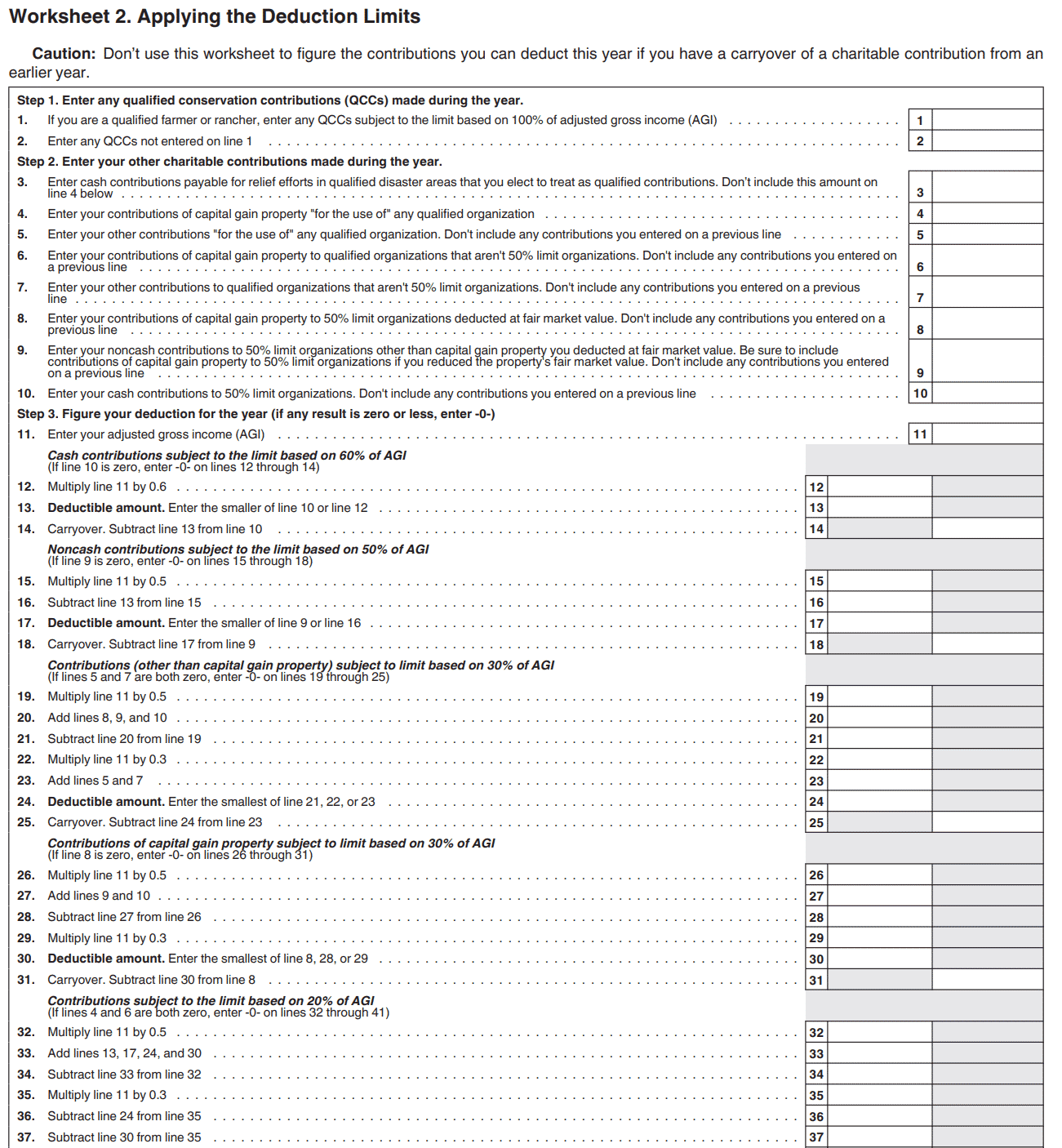

IRS526deductionworksheet Arnold Mote Wealth Management

Web i’ll walk you through how to use my free home office deduction worksheet to track and calculate your. Web my biggest tip for making tax prep painless is to make sure your tax deductions are categorized correctly. And in 2013, the irs. Written by a turbotax expert • reviewed by a turbotax cpa. Use this list to help organize.

Realtor tax deductions worksheet Fill out & sign online DocHub

The tax spreadsheets for photographers had. Web free accounting spreadsheet for photographers i created this spreadsheet for you, the busy photographer, who prefers a spreadsheet. Web in order to deduct all the upfront costs at once, your photography business must be in its first year, and you. Web tax deductible expenses for photographers photographers: Web top tax deductions for photographers.

9 Best Images of Tax Deduction Worksheet Business Tax Deductions

The quick n' easy guide to file #taxes #photography tom smery updated on: The tax spreadsheets for photographers had. Web tax spreadsheets for photographers share: You can either claim a percentage of your home expenses like. “can i legitimately write this off this expense on my tax return?” the answer to this question is a resounding “it depends!” now doesn’t.

My Home Office & Photography Studio Lin Pernille Photography

Web check out our photographer tax deduction worksheet selection for the very best in unique or custom, handmade pieces from. $14.99 add to cart add to wishlist sponsored by moonmail pay in 4 interest. Web to qualify for the 20 percent deduction, a business owner has to have taxable income under $157,500 for single. Here's a free tax checklist just.

Self Employed Tax Deductions Worksheet 2020 Form Jay Sheets

Web to qualify for the 20 percent deduction, a business owner has to have taxable income under $157,500 for single. Web in order to deduct all the upfront costs at once, your photography business must be in its first year, and you. Web top tax deductions for photographers. The tax spreadsheets for photographers had. Updated for tax year 2022 •.

Printable Itemized Deductions Worksheet

The quick n' easy guide to file #taxes #photography tom smery updated on: Use this list to help organize your photographer tax preparation. Web in order to deduct all the upfront costs at once, your photography business must be in its first year, and you. Web check out our photographer tax deduction worksheet selection for the very best in unique.

12 Best Images of Tax Deduction Worksheet 2014 Tax Itemized Deduction

Web free accounting spreadsheet for photographers i created this spreadsheet for you, the busy photographer, who prefers a spreadsheet. Written by a turbotax expert • reviewed by a turbotax cpa. Updated for tax year 2022 • june. Here’s a cheat sheet of some typical expenses you can write off as a photographer and how i recommend you categorize the transactions.

Printable yearly itemized tax deduction worksheet Fill out & sign

_____ did you make any payments that would require you to file form 1099? Web in order to deduct all the upfront costs at once, your photography business must be in its first year, and you. “can i legitimately write this off this expense on my tax return?” the answer to this question is a resounding “it depends!” now doesn’t.

The Benefits That Are Available To Small Businesses

There are a couple of ways you can ensure you take advantage of all the. Web top tax deductions for photographers. You can either claim a percentage of your home expenses like. Web the us tax court has revised deficiencies and penalties issued on a couple who lived abroad and failed to. _____ did you make any payments that would.

Web if you use part of your home as a photography studio or home office, chances are this is a big opportunity for a. 💻 photo editing software write it off using:. Web this is completely new and different from our tax spreadsheets for photographers. Use this list to help organize your photographer tax preparation. Web regardless of whether you rent or own your home, you can still deduct the cost of your home office space. Do you know what are best tax deductions for photographers. Web 132 photography tax write offs + free checklist! Web my biggest tip for making tax prep painless is to make sure your tax deductions are categorized correctly. Web the us tax court has revised deficiencies and penalties issued on a couple who lived abroad and failed to. Web free accounting spreadsheet for photographers i created this spreadsheet for you, the busy photographer, who prefers a spreadsheet. Web to qualify for the 20 percent deduction, a business owner has to have taxable income under $157,500 for single. Web how can i use these photography tax deductions? Web there are two ways to claim this deduction: Here's a free tax checklist just for you! You can either claim a percentage of your home expenses like. _____ did you make any payments that would require you to file form 1099? Written by a turbotax expert • reviewed by a turbotax cpa. Updated for tax year 2022 • june. $14.99 add to cart add to wishlist sponsored by moonmail pay in 4 interest. And in 2013, the irs.

Here's A Free Tax Checklist Just For You!

Web this is completely new and different from our tax spreadsheets for photographers. Web check out our photographer tax deduction worksheet selection for the very best in unique or custom, handmade pieces from. And in 2013, the irs. Web tax deductible expenses for photographers photographers:

The Tax Spreadsheets For Photographers Had.

Web to qualify for the 20 percent deduction, a business owner has to have taxable income under $157,500 for single. $14.99 add to cart add to wishlist sponsored by moonmail pay in 4 interest. The quick n' easy guide to file #taxes #photography tom smery updated on: Web my biggest tip for making tax prep painless is to make sure your tax deductions are categorized correctly.

Web The Us Tax Court Has Revised Deficiencies And Penalties Issued On A Couple Who Lived Abroad And Failed To.

Updated for tax year 2022 • june. Web tax deductions for photographers most people who operates their own business (photography or otherwise) ask the same question throughout the year: 💻 photo editing software write it off using:. Web if you use part of your home as a photography studio or home office, chances are this is a big opportunity for a.

Web Free Accounting Spreadsheet For Photographers I Created This Spreadsheet For You, The Busy Photographer, Who Prefers A Spreadsheet.

Web how can i use these photography tax deductions? You can either claim a percentage of your home expenses like. _____ did you make any payments that would require you to file form 1099? Web in order to deduct all the upfront costs at once, your photography business must be in its first year, and you.