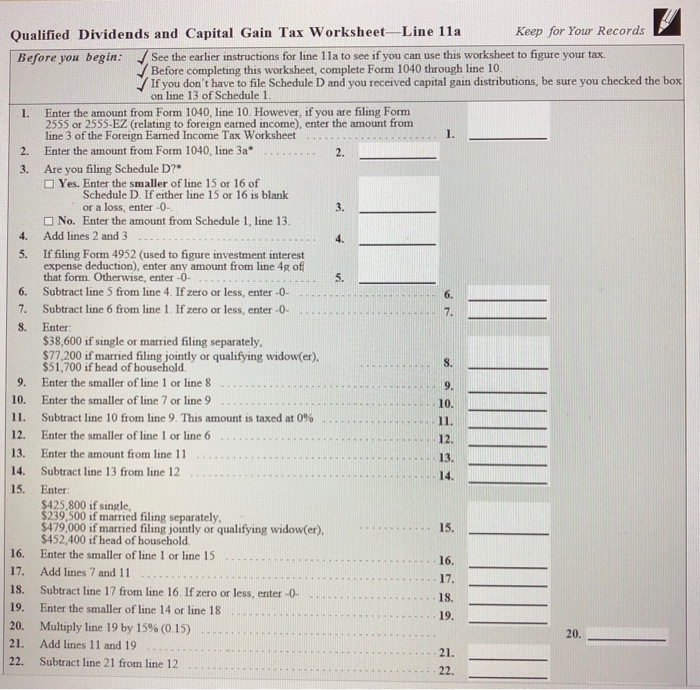

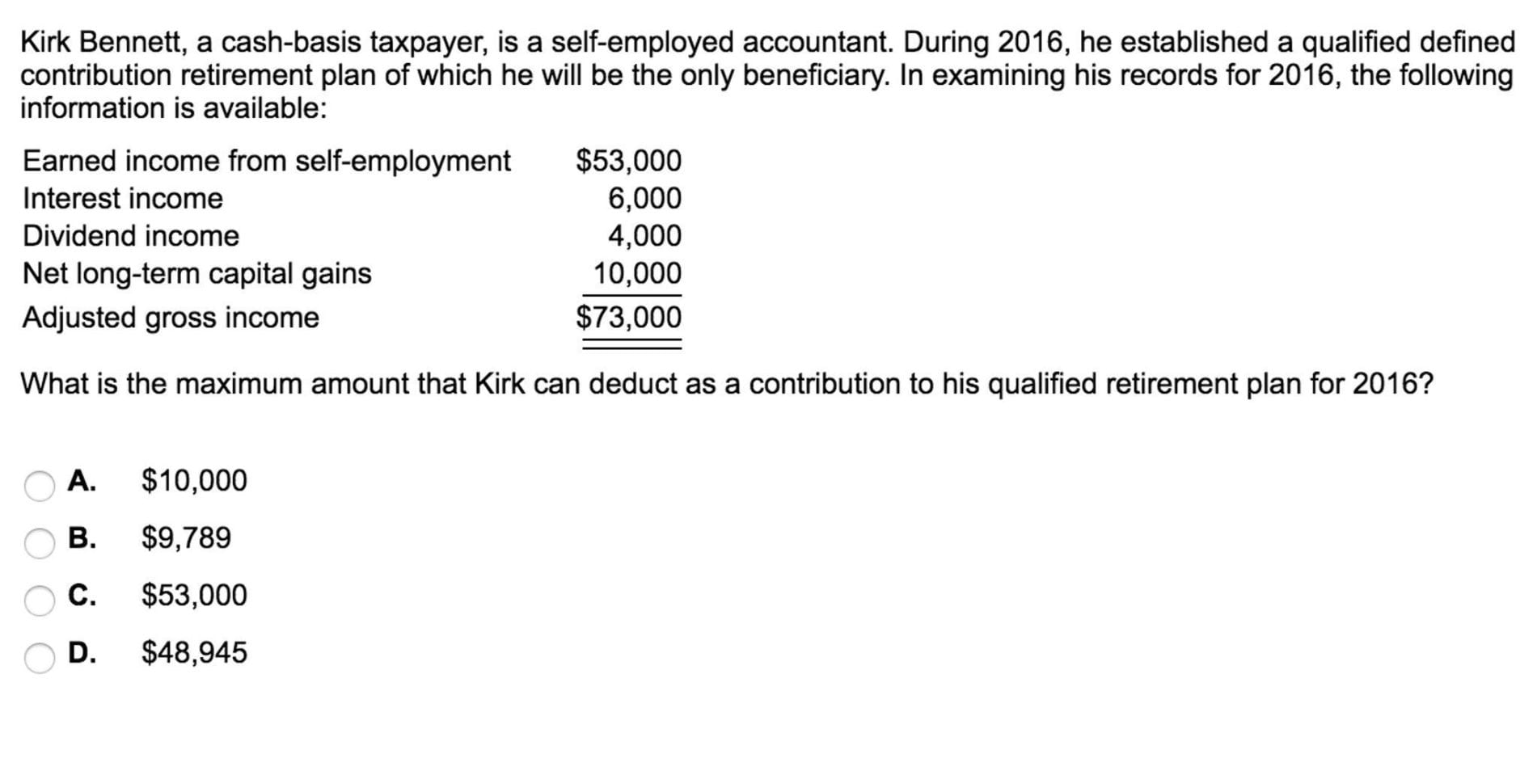

Qualified Dividend Worksheet - Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. Web the dividend income from the 8,000 shares held at least 61 days should be qualified dividend income. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c). Web how to calculate the total adjustment amount on form 1116. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web what is the qualified dividend and capital gain tax worksheet? Web qualified dividends and capital gain tax worksheet—line 11a. Web qualified dividends or a net capital gain for 2023. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Web shows total ordinary dividends that are taxable.

Solved Create Function Calculating Tax Due Qualified Divi

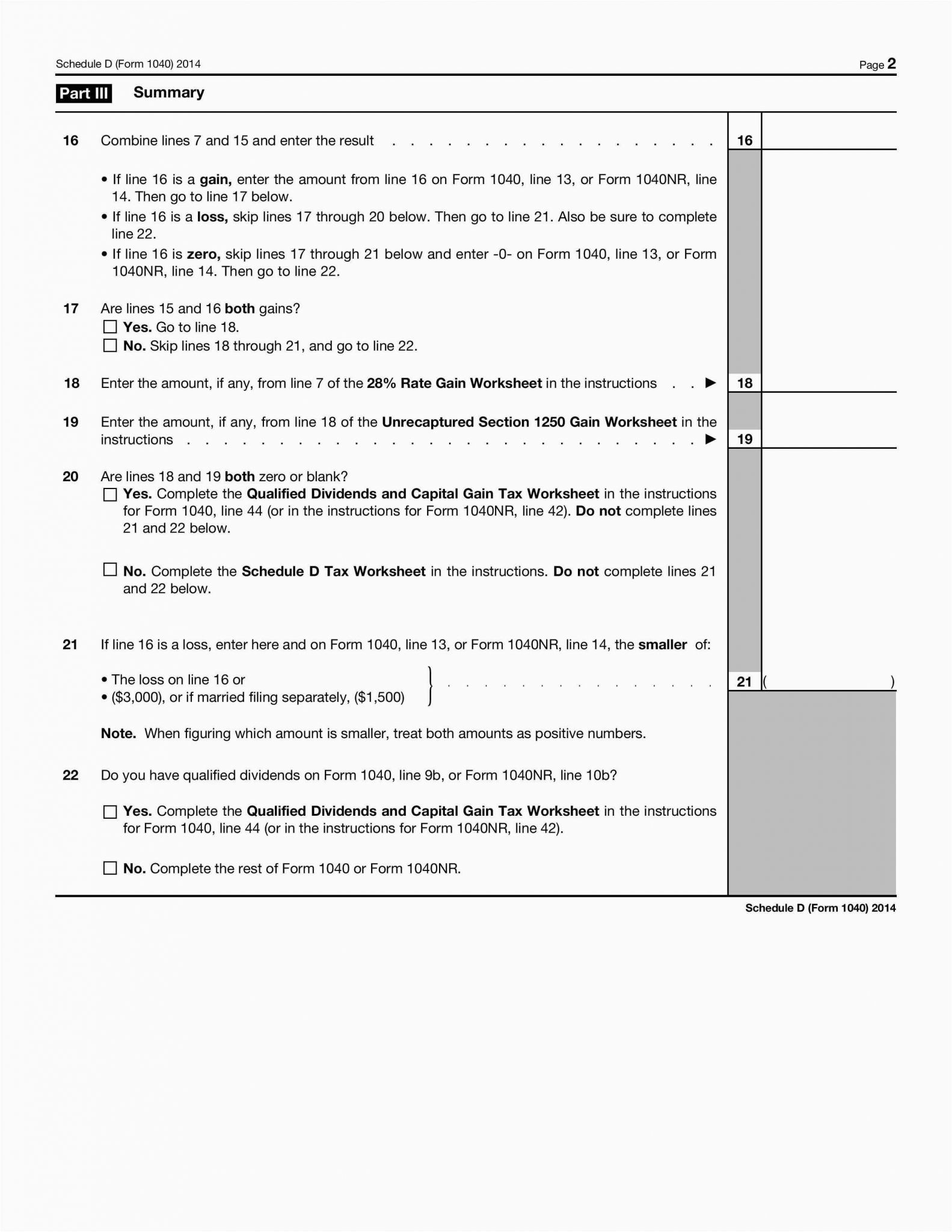

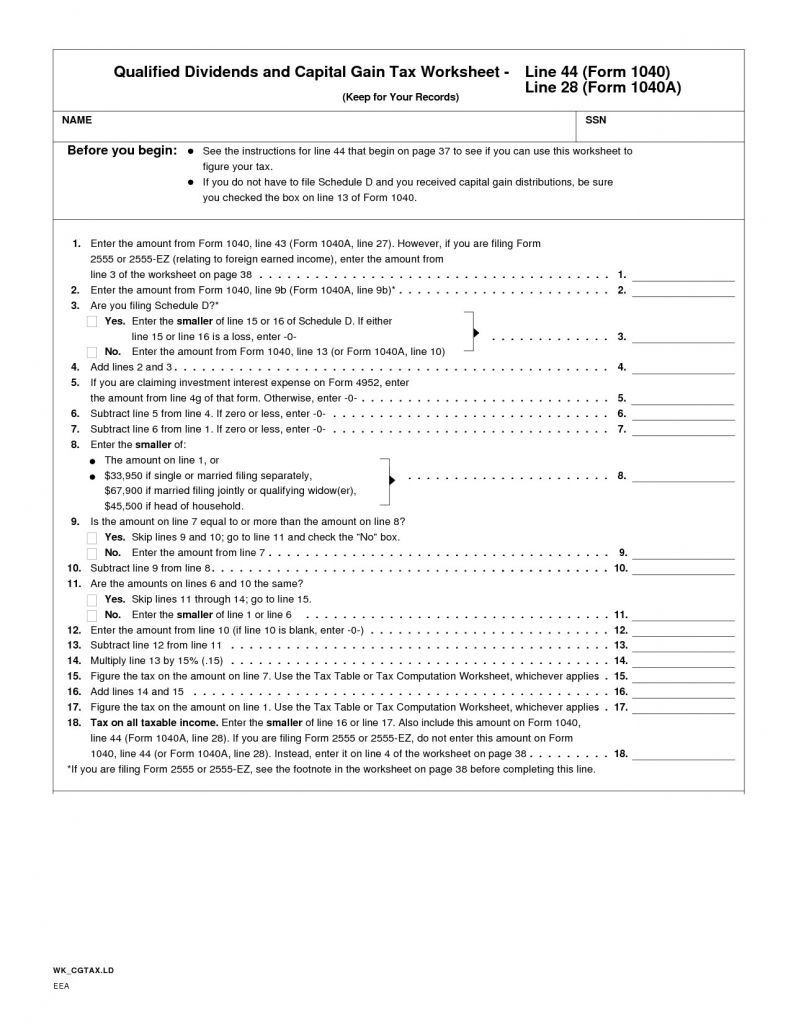

Qualified dividends and capital gain tax worksheet. Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Basically, the 5%.

qualified dividends and capital gain tax worksheet 2019 Fill Online

Web what is the qualified dividend and capital gain tax worksheet? Dividends paid by certain foreign companies may or may not be qualified. Web how to calculate the total adjustment amount on form 1116. Basically, the 5% ratio is the amount from the. Web qualified dividends or a net capital gain for 2023.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c). Qualified dividends and capital gain tax worksheet. Web what is the qualified dividend and capital gain tax worksheet? For the desktop version you can switch to forms mode and open the worksheet to see it. Web a.

Qualified Dividends And Capital Gains Worksheet 2018 —

Foreign earned income tax worksheet. Figuring out the tax on your qualified dividends can be. Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which. Web the dividend income from the 8,000 shares held at least 61 days should be qualified dividend income. You can find them in the.

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Web shows total ordinary dividends that are taxable. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web nonqualified dividends include: Web the purpose of the qualified dividends.

20++ Qualified Dividends And Capital Gains Worksheet 2020

Web the dividend income from the 8,000 shares held at least 61 days should be qualified dividend income. Web report your qualified dividends on line 9b of form 1040 or 1040a. Qualified dividends and capital gain tax worksheet. You can find them in the form. Web how to calculate the total adjustment amount on form 1116.

41 1040 qualified dividends worksheet Worksheet Live

Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c). Web what is the qualified dividend and capital gain tax worksheet? Basically, the 5% ratio is the amount from the. Web shows total ordinary dividends that are taxable. Web complete this worksheet only if line 18 or.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

You can find them in the form. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Use the qualified dividends and capital gain tax worksheet. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Web the.

Qualified Dividends And Capital Gain Worksheet

Figuring out the tax on your qualified dividends can be. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Basically, the 5% ratio is the amount from the. Web qualified dividends and capital gain tax worksheet (2022) • see form.

Qualified Dividends and Capital Gain Tax Worksheet 2016

Foreign earned income tax worksheet. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. Web the dividend income from the 8,000 shares held at least 61 days should be qualified dividend income. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web qualified.

You can find them in the form. For the desktop version you can switch to forms mode and open the worksheet to see it. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Web all about the qualified dividend worksheet. Web qualified dividends or a net capital gain for 2023. Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which. Foreign earned income tax worksheet. Web qualified dividends and capital gain tax worksheet—line 11a. Use the qualified dividends and capital gain tax worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web shows total ordinary dividends that are taxable. Web nonqualified dividends include: Qualified dividends and capital gain tax worksheet. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web report your qualified dividends on line 9b of form 1040 or 1040a. Dividends paid by certain foreign companies may or may not be qualified. Web the dividend income from the 8,000 shares held at least 61 days should be qualified dividend income. Web how to calculate the total adjustment amount on form 1116. If you have never come across a qualified dividend worksheet, irs shows how one looks like;. Web 2022 worksheet instructions for each fund and share class owned, enter the total ordinary dividends reported in box 1a of.

Web Report Your Qualified Dividends On Line 9B Of Form 1040 Or 1040A.

Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Foreign earned income tax worksheet. Web 2022 worksheet instructions for each fund and share class owned, enter the total ordinary dividends reported in box 1a of. If you have never come across a qualified dividend worksheet, irs shows how one looks like;.

Web Nonqualified Dividends Include:

Basically, the 5% ratio is the amount from the. Web how to calculate the total adjustment amount on form 1116. Figuring out the tax on your qualified dividends can be. You can find them in the form.

Web Taxpayers Who Have Received Qualified Dividends And/Or Experienced Capital Gains Can Download The Qualified.

Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Web qualified dividends and capital gain tax worksheet—line 11a.

Web Shows Total Ordinary Dividends That Are Taxable.

Web what is the qualified dividend and capital gain tax worksheet? Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. Web qualified dividends or a net capital gain for 2023. Qualified dividends and capital gain tax worksheet.