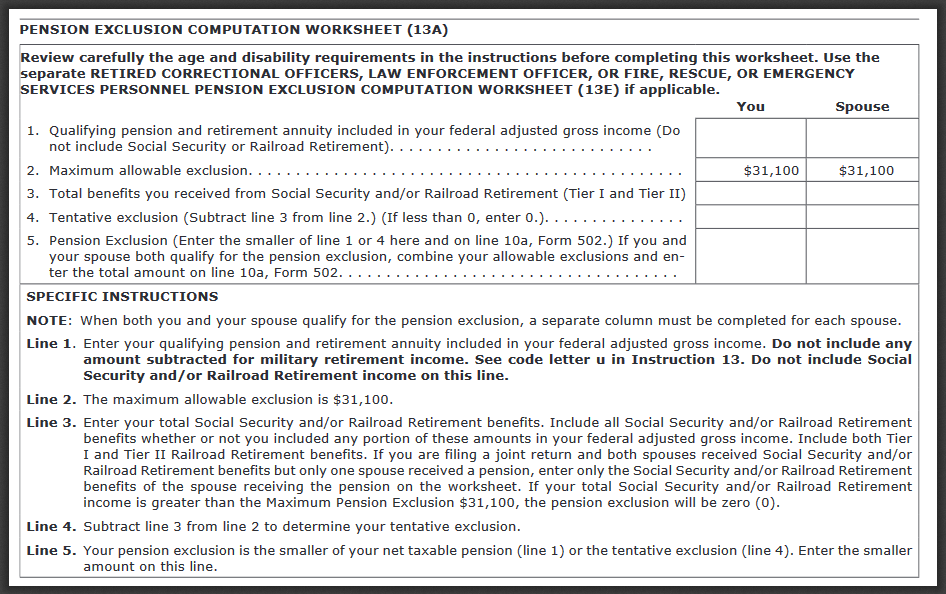

Maryland Pension Exclusion Worksheet - Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland resident tax booklet. Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot. Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from : Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification). Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the. Web pension exclusion computation worksheet (13a) review carefully the age and disability. Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you. Web maryland pension exclusion worksheet fill this form (4.7 / 5) 86 votes get your maryland pension exclusion worksheet in.

Maryland pension exclusion may include a state tax deduction

Web if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum. Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland resident tax booklet. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information.

Maryland Tax Elimination Act New Retiree Tax Savings

Web maryland pension exclusion worksheet we use cookies to improve security, personalize the user experience, enhance our. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. Web personnel pension exclusion computation worksheet (13e) review carefully the age and.

Finding that won't count for pension exclusion

Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification). When both you and your spouse qualify for the pension exclusion, a separate column must be. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the. Web maryland pension exclusion worksheet we use cookies.

Maryland Pension Exclusion Worksheets 2021

Web under the maryland pension exclusion, an individual who is at least age 65, who is totally disabled, or whose spouse is totally. Web maryland pension exclusion worksheet we use cookies to improve security, personalize the user experience, enhance our. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification). If.

What about estimated taxes with the pension exclusion?

Web maryland pension exclusion worksheet we use cookies to improve security, personalize the user experience, enhance our. Web if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification). You can.

What You Need to Know About the NJ Pension Exclusion Access Wealth

Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form. Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland.

I earn 85,000. Will I qualify for the pension exclusion?

Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. When both you and your spouse qualify for the pension exclusion, a separate column must be. Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland resident tax booklet. Web to confirm your system and plan refer to your yearly personal statement.

If you earn too much for the pension exclusion

Web under the maryland pension exclusion, an individual who is at least age 65, who is totally disabled, or whose spouse is totally. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from worksheet 13e of.

Free Arkansas Single Member Llc Operating Agreement Form Pdf Word

Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check. Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland resident tax booklet. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. Web easily navigate maryland pension exclusion worksheet library and use.

2018 Maryland Tax Topic Reading Material

When both you and your spouse qualify for the pension exclusion, a separate column must be. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification). Web maryland pension exclusion worksheet we use cookies to improve security, personalize the user experience, enhance our. Web the maximum admissible amount of the exclusion.

Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from worksheet 13e of the. Web maryland pension exclusion worksheet we use cookies to improve security, personalize the user experience, enhance our. Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from : Web maryland pension exclusion worksheet fill this form (4.7 / 5) 86 votes get your maryland pension exclusion worksheet in. When both you and your spouse qualify for the pension exclusion, a separate column must be. You can edit these pdf forms online and. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification). Web the maximum admissible amount of the exclusion is $34,300. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. Web if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum. Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland resident tax booklet. Web pension exclusion computation worksheet (13a) review carefully the age and disability. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the. Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you. If you file a joint return and. Web under the maryland pension exclusion, an individual who is at least age 65, who is totally disabled, or whose spouse is totally. Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot.

Web Easily Navigate Maryland Pension Exclusion Worksheet Library And Use Online Editing Tools On The Spot.

You can edit these pdf forms online and. Web maryland pension exclusion if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for. Web complete the pension exclusion computation worksheet (13a) shown in instruction 13 in the maryland resident tax booklet. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from worksheet 13e of the.

Web Pension Exclusion Computation Worksheet (13A) Review Carefully The Age And Disability.

Web the maximum admissible amount of the exclusion is $34,300. Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you. Web maryland pension exclusion worksheet we use cookies to improve security, personalize the user experience, enhance our. Web under the maryland pension exclusion, an individual who is at least age 65, who is totally disabled, or whose spouse is totally.

If You File A Joint Return And.

Web if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum. When both you and your spouse qualify for the pension exclusion, a separate column must be. Web married individuals who filed maryland returns with married filing separate status should each complete a separate form. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from :

Web Cocodoc Collected Lots Of Free Maryland Pension Exclusion Worksheet For Our Users.

Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check. Web maryland pension exclusion worksheet fill this form (4.7 / 5) 86 votes get your maryland pension exclusion worksheet in. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification).