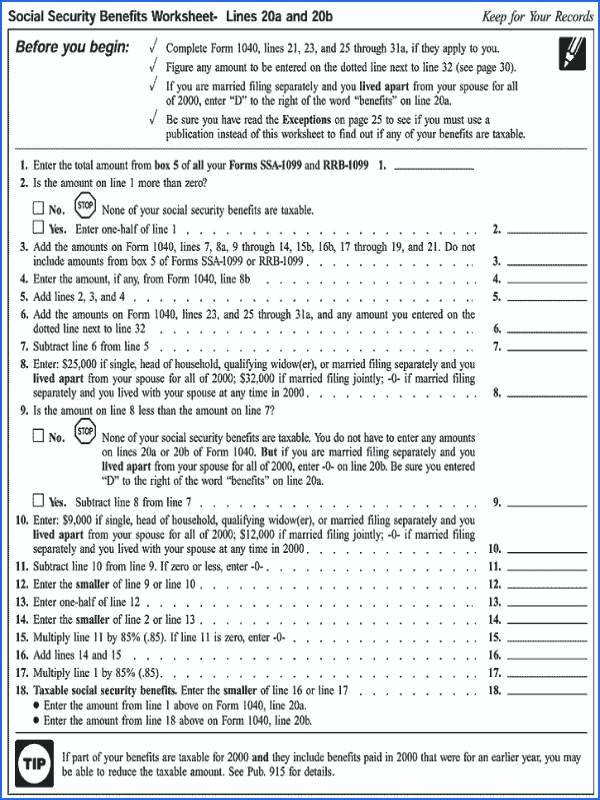

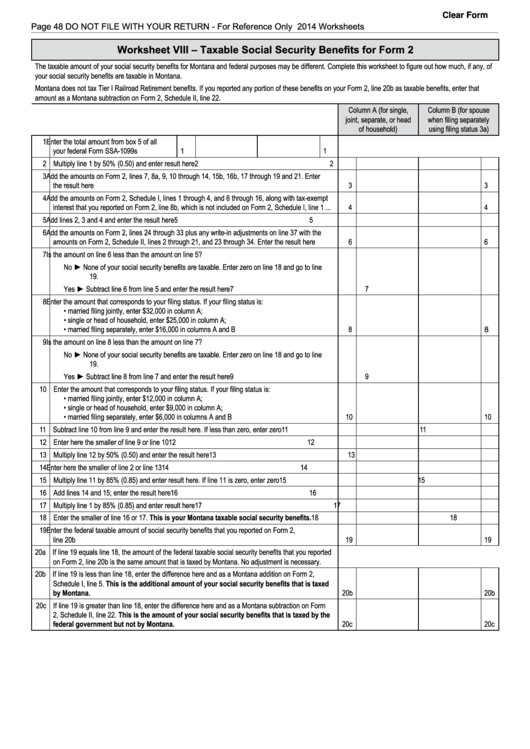

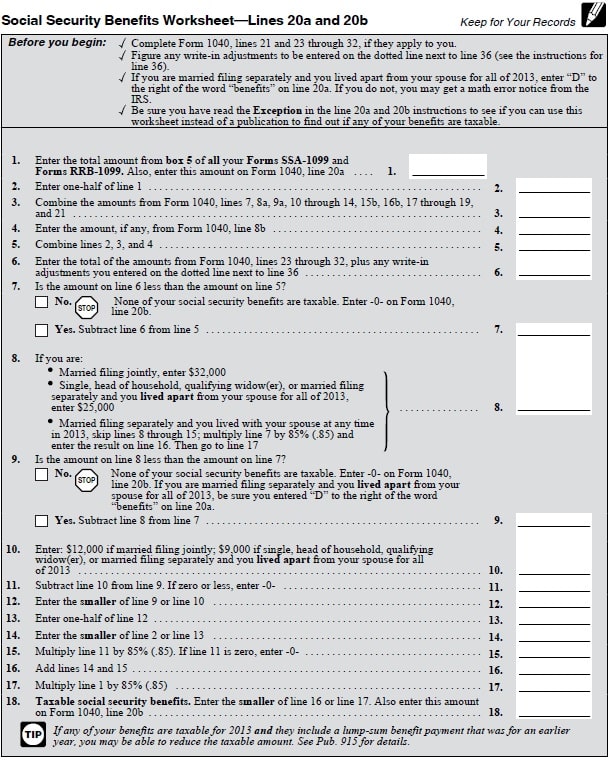

Social Security Taxable Income Worksheet - Web ssi provides monthly payments to people with disabilities and older adults who have little or no income or resources. Web say you file individually, have $50,000 in income and get $1,500 a month from social security. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. If you file a federal tax return as an individual and your combined income is: More than $44,000, up to 85. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Web social security benefits worksheet (2019) caution: Web new mexico includes all social security benefits in the taxable income base, though the state provides a. You file a federal tax return as an individual and.

2022 Taxable Social Security Worksheet

The irs reminds taxpayers receiving social. Do not use this worksheet if any of the following apply. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. See social security benefit adjustment worksheet instructions. Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1.

10++ Social Security Tax Worksheet

Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web get a fillable taxable social security worksheet 2023 template online. More than $44,000, up to 85. Web 2020 social security taxable.

2018 Form 1040 Social Security Fillable Worksheet 1040 Form Printable

Web here's how to know. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. You file a federal tax return as an individual and. 1) if the taxpayer made.

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

Web say you file individually, have $50,000 in income and get $1,500 a month from social security. Web 2021 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. It is prepared through the joint. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Web.

Irs Social Security Tax Worksheet

It is prepared through the joint. The irs reminds taxpayers receiving social. A new tax season has arrived. If you file a federal tax return as an individual and your combined income is: Web get a fillable taxable social security worksheet 2023 template online.

Irs Pub 915 Worksheet Tax Planner Compute Taxable Social Security

Web up to 50% of your social security benefits are taxable if: Web new mexico includes all social security benefits in the taxable income base, though the state provides a. The irs reminds taxpayers receiving social. More than $44,000, up to 85. Web social security benefits worksheet (2019) caution:

Taxable Social Security Worksheet 2021

Web june 21, 2022 social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. A new tax season has arrived. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Do not use this worksheet if any of the following apply. 1) if.

IRS Instruction 943 20202021 Fill out Tax Template Online US Legal

See social security benefit adjustment worksheet instructions. Web june 21, 2022 social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Complete and sign it in seconds from your desktop. Web generally, you can.

Is Social Security Tax Deductible

Complete and sign it in seconds from your desktop. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web 2021 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. See social security benefit adjustment worksheet instructions. Web we developed this worksheet for you to see if.

Navigate Taxable Social Security With This 2023 Worksheet Style

Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Complete and sign it in seconds from your desktop. More than $34,000, up to 85. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: Web 2020 social security taxable benefits worksheet keep for your records publication.

It is prepared through the joint. Web get a fillable taxable social security worksheet 2023 template online. More than $34,000, up to 85. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: See social security benefit adjustment worksheet instructions. A new tax season has arrived. Web here's how to know. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: The irs reminds taxpayers receiving social. More than $44,000, up to 85. Web 2021 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Web social security benefits worksheet (2019) caution: Web ssi provides monthly payments to people with disabilities and older adults who have little or no income or resources. Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits. Web say you file individually, have $50,000 in income and get $1,500 a month from social security. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. If you file a federal tax return as an individual and your combined income is:

More Than $34,000, Up To 85.

Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Do not use this worksheet if any of the following apply. Web say you file individually, have $50,000 in income and get $1,500 a month from social security. A new tax season has arrived.

Web New Mexico Includes All Social Security Benefits In The Taxable Income Base, Though The State Provides A.

Web up to 50% of your social security benefits are taxable if: Web ssi provides monthly payments to people with disabilities and older adults who have little or no income or resources. Web social security benefits worksheet (2019) caution: Web we developed this worksheet for you to see if your benefits may be taxable for 2022.

Web Taxpayers Receiving Social Security Benefits May Have To Pay Federal Income Tax On A Portion Of Those Benefits.

It is prepared through the joint. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Complete and sign it in seconds from your desktop. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

Web Between $25,000 And $34,000, You May Have To Pay Income Tax On Up To 50 Percent Of Your Benefits.

Web 2021 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Web it also includes unemployment compensation, taxable social security benefits, pensions, annuities, and. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: You file a federal tax return as an individual and.