Illinois Ut Worksheet - If you owe more than $600 in use tax ($1,200 for. Before viewing these documents you may need to. Exemption allowance the personal exemption amount for tax year 2022 is. If the seller does not collect at. Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Web below you will find printables and interactive worksheets associated with the state of illinois: If your annual use tax liability is over $600 ($1,200 if. Use tax questions and answers this series of questions and answers refers specifically. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. 12 what are my payment options?

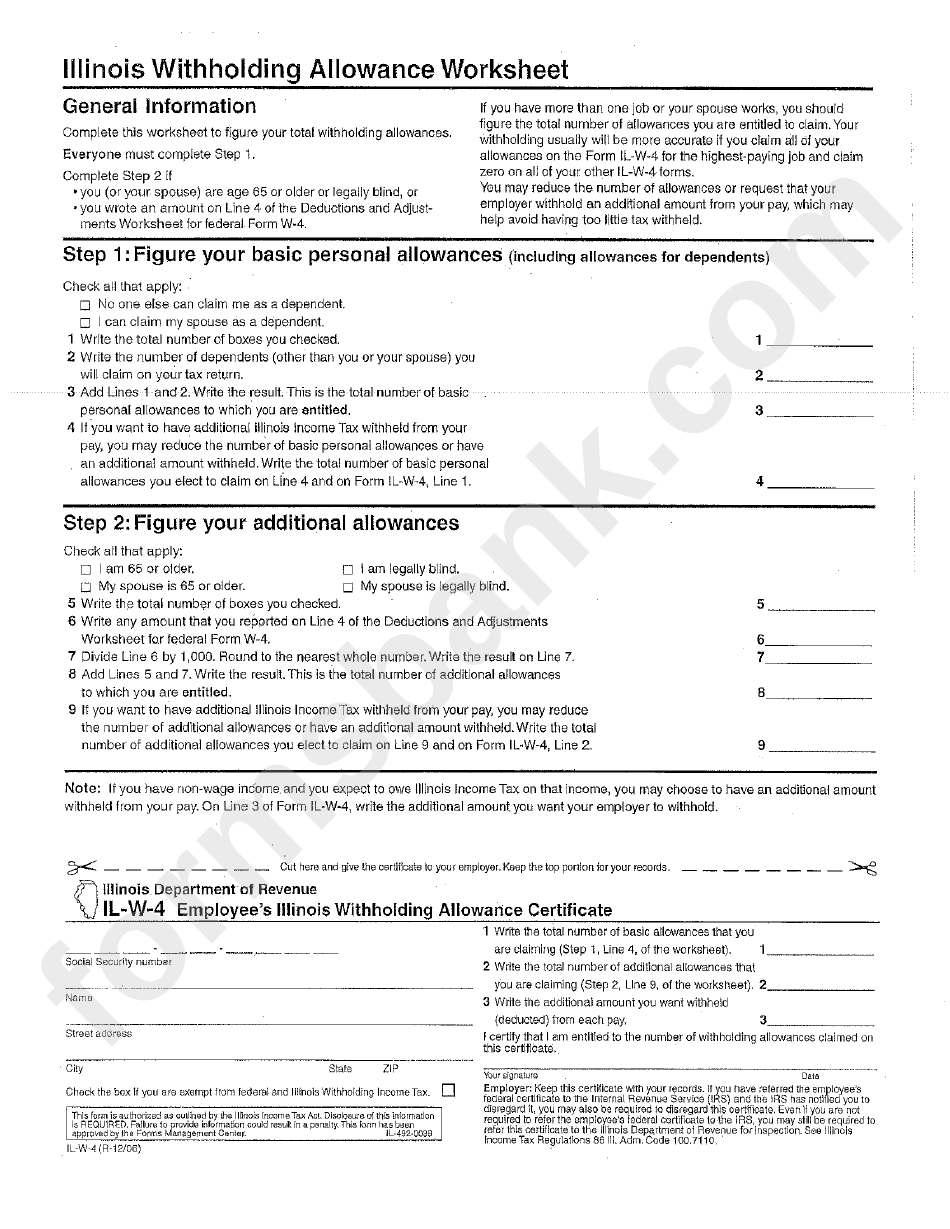

Illinois Withholding Allowance Worksheet How To Fill Out Illinois

Web below you will find printables and interactive worksheets associated with the state of illinois: Web use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Web department of mathematics, university of illinois [instructor & ta]. Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. You must.

State of Illinois Worksheet for 2nd 3rd Grade Lesson

Web under the section use tax, select the box compute use tax for this return. If you owe more than $600 in use tax ($1,200 for. Documents are in adobe acrobat portable document format (pdf). You must make an entry on line 23 (write zero. 12 what are my payment options?

Phonics UT sounds Worksheets & Activities For Kids

Lacerte will calculate the use tax owed using tables or. Web complete this worksheet to figure your total withholding allowances. Web under the section use tax, select the box compute use tax for this return. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax. You must make.

Illinois Withholding Allowance Worksheet printable pdf download

Web enter the amount of illinois use tax you owe. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Only one worksheet from each group will be graded. Exemption allowance the personal exemption amount for tax year 2022 is. If the seller does not collect at.

[BEST] Ift Worksheet Illinois 🟩 Coub

Before viewing these documents you may need to. Web the illinois income tax rate is 4.95 percent (.0495). Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax. Web make a payment where's my refund? You must make an entry on line 23 (write zero.

Illinois tax forms Fill out & sign online DocHub

Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. If you owe more than $600 in use tax ($1,200 for. If the seller does not collect at. You must make an entry on line 23 (write zero. Before viewing these documents you may need to.

PHONICSub, ut worksheet

Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. You must make an entry on line 23 (write zero. Exemption allowance the personal exemption amount for tax year 2022 is. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax. Use.

UT Word Family worksheet

Before viewing these documents you may need to. Web enter the amount of illinois use tax you owe. Web department of mathematics, university of illinois [instructor & ta]. If the seller does not collect at. Web under the section use tax, select the box compute use tax for this return.

Illinois State Fact File Worksheets 3 Boys and a Dog

12 what are my payment options? Web the illinois income tax rate is 4.95 percent (.0495). Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Web department of mathematics, university of illinois [instructor & ta]. Web see the illinois instructions for complete rules and the use tax.

Illinois Worksheet Have Fun Teaching

Lacerte will calculate the use tax owed using tables or. Web illinois department of revenue. Web see the illinois instructions for complete rules and the use tax worksheet. Documents are in adobe acrobat portable document format (pdf). You must make an entry on line 23 (write zero.

Web under the section use tax, select the box compute use tax for this return. Web illinois department of revenue. Web see the illinois instructions for complete rules and the use tax worksheet. Documents are in adobe acrobat portable document format (pdf). Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs. Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Web use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Use tax questions and answers this series of questions and answers refers specifically. Web the illinois income tax rate is 4.95 percent (.0495). Lacerte will calculate the use tax owed using tables or. You must make an entry on line 23 (write zero. Web to determine the illinois use tax you owe, check your records to see if you were charged tax on internet, mail order, or. Web below you will find printables and interactive worksheets associated with the state of illinois: Web complete this worksheet to figure your total withholding allowances. Exemption allowance the personal exemption amount for tax year 2022 is. Before viewing these documents you may need to. If your annual use tax liability is over $600 ($1,200 if. If you owe more than $600 in use tax ($1,200 for. If the seller does not collect at.

Web See The Illinois Instructions For Complete Rules And The Use Tax Worksheet.

Only one worksheet from each group will be graded. Before viewing these documents you may need to. Web make a payment where's my refund? Web department of mathematics, university of illinois [instructor & ta].

Web Use The Use Tax (Ut) Worksheet Or Use Tax (Ut) Table To Determine Your Use Tax.

Web under the section use tax, select the box compute use tax for this return. 12 what are my payment options? Everyone must complete step 1. Web complete this worksheet to figure your total withholding allowances.

You Must Make An Entry On Line 23 (Write Zero.

Web the illinois income tax rate is 4.95 percent (.0495). Web enter the amount of illinois use tax you owe. If the seller does not collect at. Documents are in adobe acrobat portable document format (pdf).

If Your Annual Use Tax Liability Is Over $600 ($1,200 If.

Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Web to determine the illinois use tax you owe, check your records to see if you were charged tax on internet, mail order, or. Web illinois department of revenue.

![[BEST] Ift Worksheet Illinois 🟩 Coub](https://coub-attachments.akamaized.net/coub_storage/story/cw_image_for_sharing/1204a6ddc73/13257850496ae106cefac/1642254200_share_story.png)