Capital Loss Carryover Worksheet - Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Sale of property bought at various times. Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your.

worksheet. 2013 Capital Loss Carryover Worksheet. Grass Fedjp Worksheet

Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Web capital loss carryover worksheet line 19. Sale of property bought at various times. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a.

Capital Loss Carryover Worksheet slidesharedocs

Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Web capital loss carryover worksheet line 19..

California Capital Loss Carryover Worksheet

Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Sale of property bought at various times. Web to figure any capital loss carryover to 2023,.

California Capital Loss Carryover Worksheet

Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Sale of property bought at various times. Web to figure any capital loss carryover to 2023,.

2021 Capital Loss Carryover Worksheets

Sale of property bought at various times. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a.

21+ 2020 Capital Loss Carryover Worksheet ShilpaDaanya

Sale of property bought at various times. Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web to figure any capital loss carryover to 2023,.

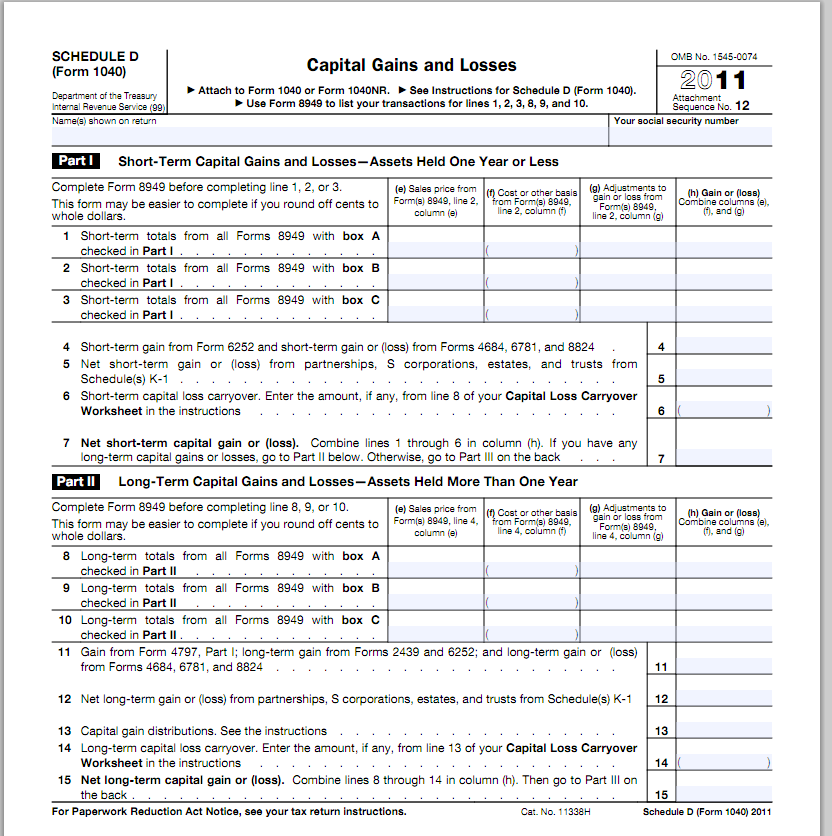

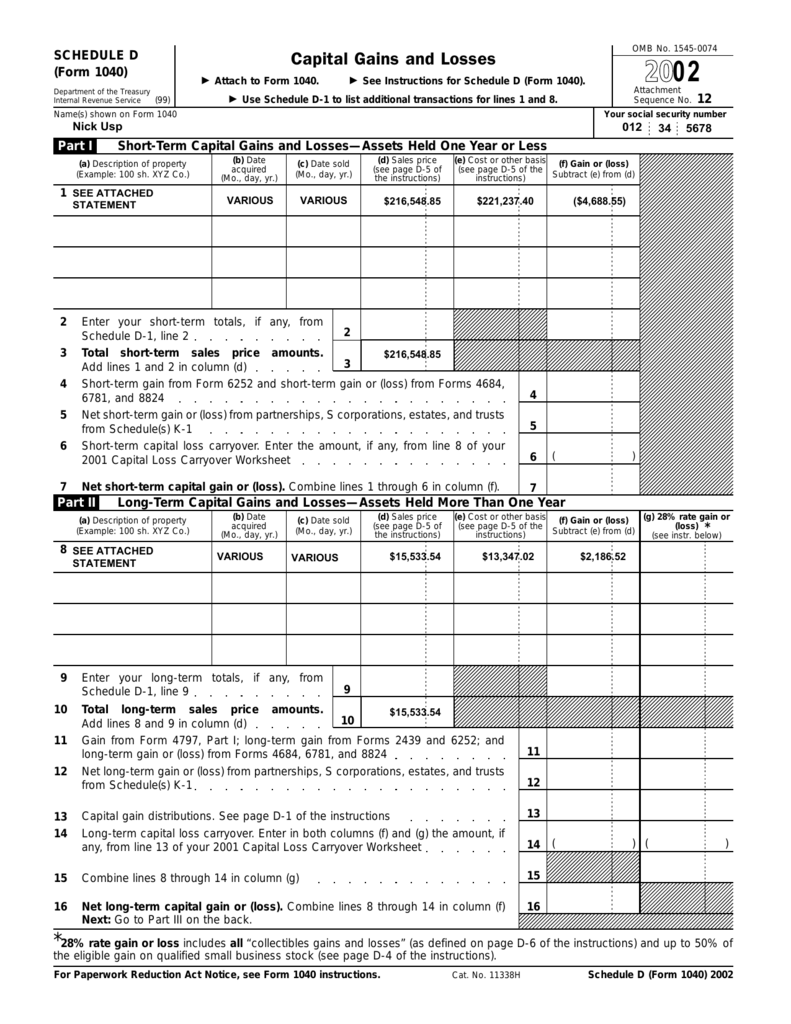

TaxHow » You Win Some, You Lose Some. And Then You File Schedule D

Sale of property bought at various times. Web capital loss carryover worksheet line 19. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a.

Capital Loss Carryover Worksheet Example Educational worksheets, Tax

Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Sale of property bought at various times..

Capital Loss Carryover Worksheet 2020 Fill Online, Printable

Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Sale of property bought at various times. Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a.

Capital Loss Carryover Worksheet slidesharedocs

Web capital loss carryover worksheet line 19. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Sale of property bought at various times. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a.

Sale of property bought at various times. Web capital loss carryover worksheet line 19. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your.

Sale Of Property Bought At Various Times.

Web capital loss carryover worksheet line 19. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover.