Form 940 Worksheet - Web the tax form worksheet for form 940 for 2020 shows a difference (12,000)between total taxed wages. The worksheet takes you step. Under forms, select annual forms. Web payroll process form 940 instructions irs form 940 for 2023: For more information, see the schedule a (form 940) instructions or. If some of the taxable futa wages you paid were excluded from state unemployment. Web or you paid any state unemployment tax late (after the due date for filing form 940), complete 10 the worksheet in the. Web the instructions for line 10 on the 940 state: Web use schedule a (form 940) to figure the credit reduction. Web 2020 instructions for form 940 department of the treasury internal revenue service employer's annual federal unemployment.

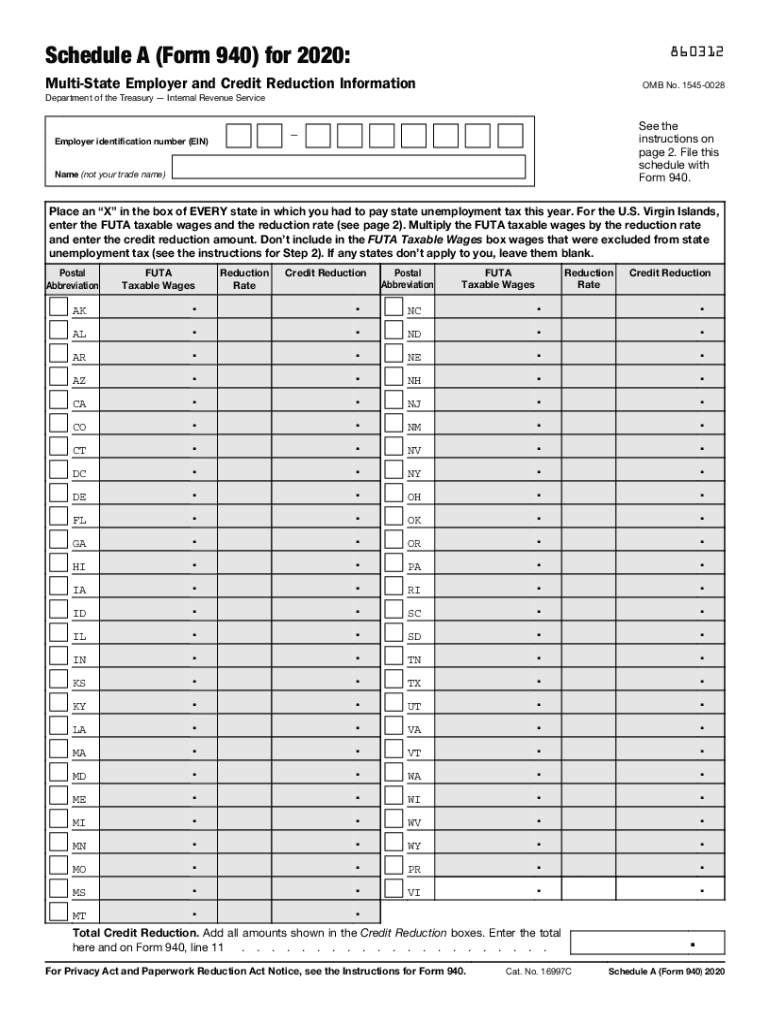

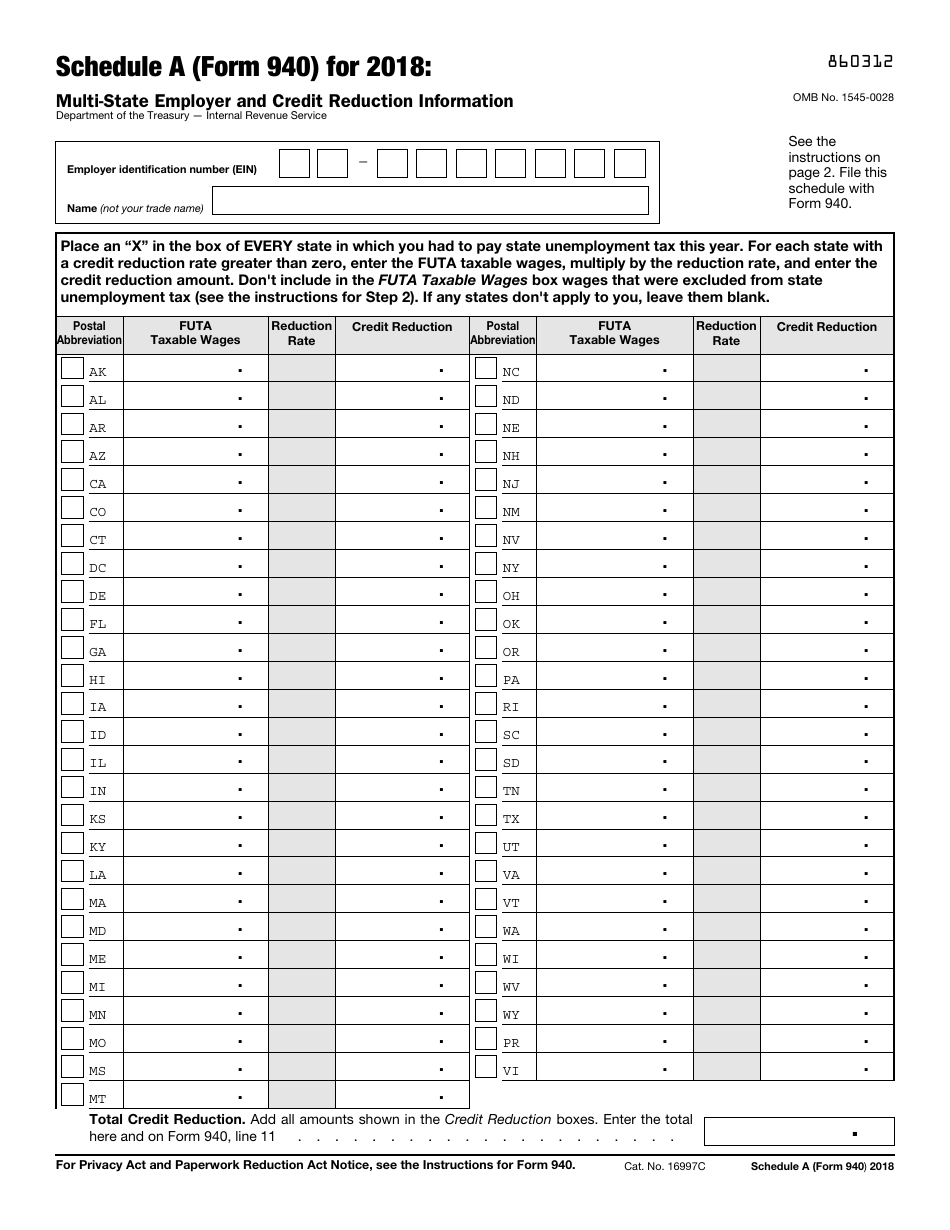

2020 Form IRS 940 Schedule A Fill Online, Printable, Fillable, Blank

Web view all paying unemployment tax state unemployment taxes wages included in futa tax information needed for form 940 completing form 940 photo: Web you’ve completed the worksheet. Web buy this set if you need to file the complete new form 940. Web the form 940 worksheet displays data that you need to fill out the internal revenue service form.

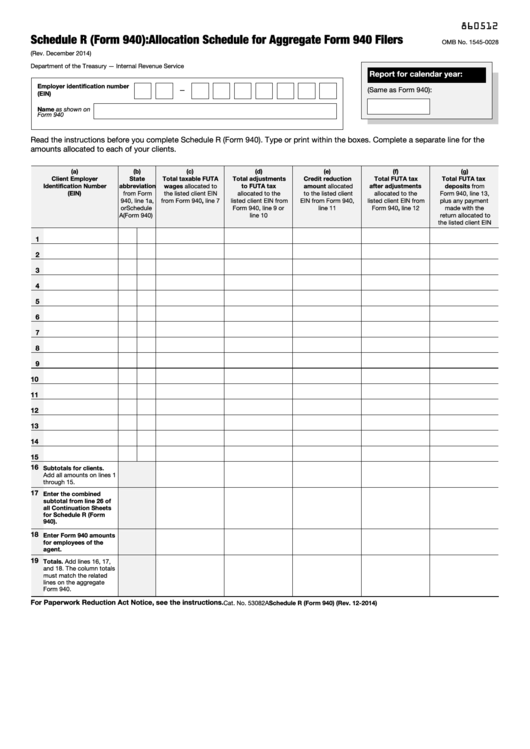

Form 940 (Schedule R) Allocation Schedule for Aggregate Form 940

The set includes the worksheet, schedule a and the voucher all. Web form 940 for 2021: Web if you paid any state unemployment tax late (after january 31st) for ease of calculation, irs has provided worksheet to calculate. Web the form 940 worksheet displays data that you need to fill out the internal revenue service form 940, employer's annual. Web.

How to calculate Line 10 on Form 940 (FUTA TAX RETURN)?

Web the worksheet of form 940 is required to calculate your credit for line 10 on the form. Marko geber / getty images one of your responsibilities as an employer is to pay unemployment taxes so that employees may have unemployment benefits if they are terminated from employment. Web the tax form worksheet for form 940 for 2020 shows a.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Web the instructions for line 10 on the 940 state: Web before you can properly fill out this worksheet, you must gather this information: Web the worksheet of form 940 is required to calculate your credit for line 10 on the form. Web use schedule a (form 940) to figure the credit reduction. Web (after the due date for filing.

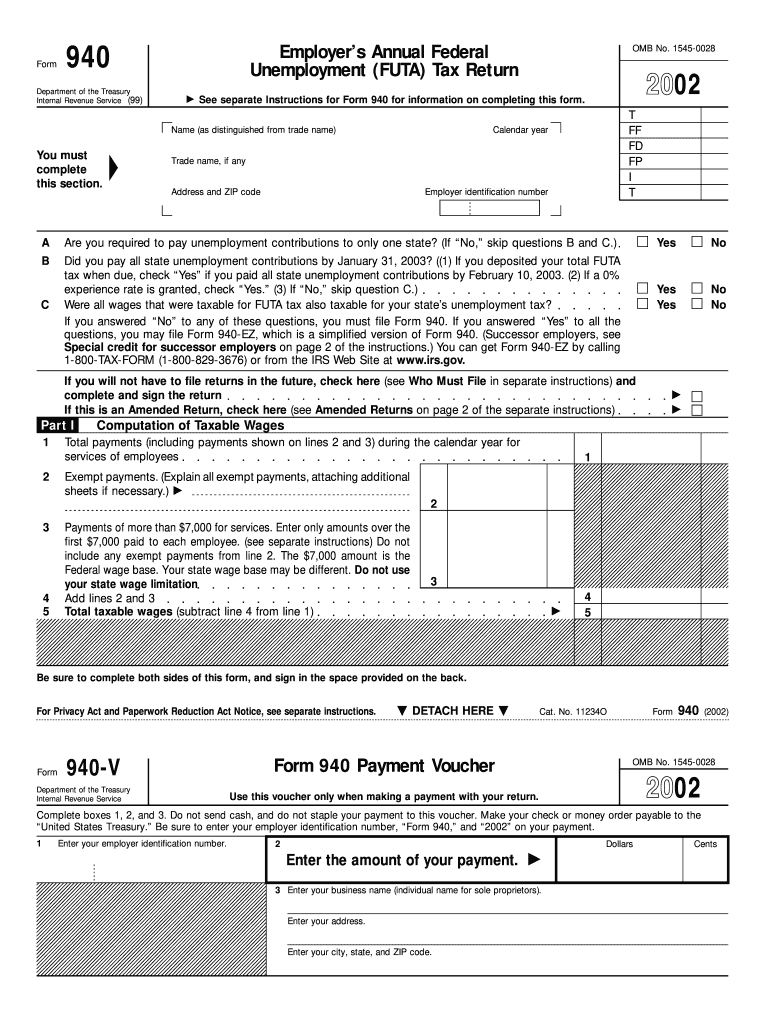

940 2002 Fill Out and Sign Printable PDF Template signNow

Web or you paid any state unemployment tax late (after the due date for filing form 940), complete 10 the worksheet in the. Form 940 instructions frequently asked questions (faqs) if you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form. Web if you paid any state unemployment tax late (after january.

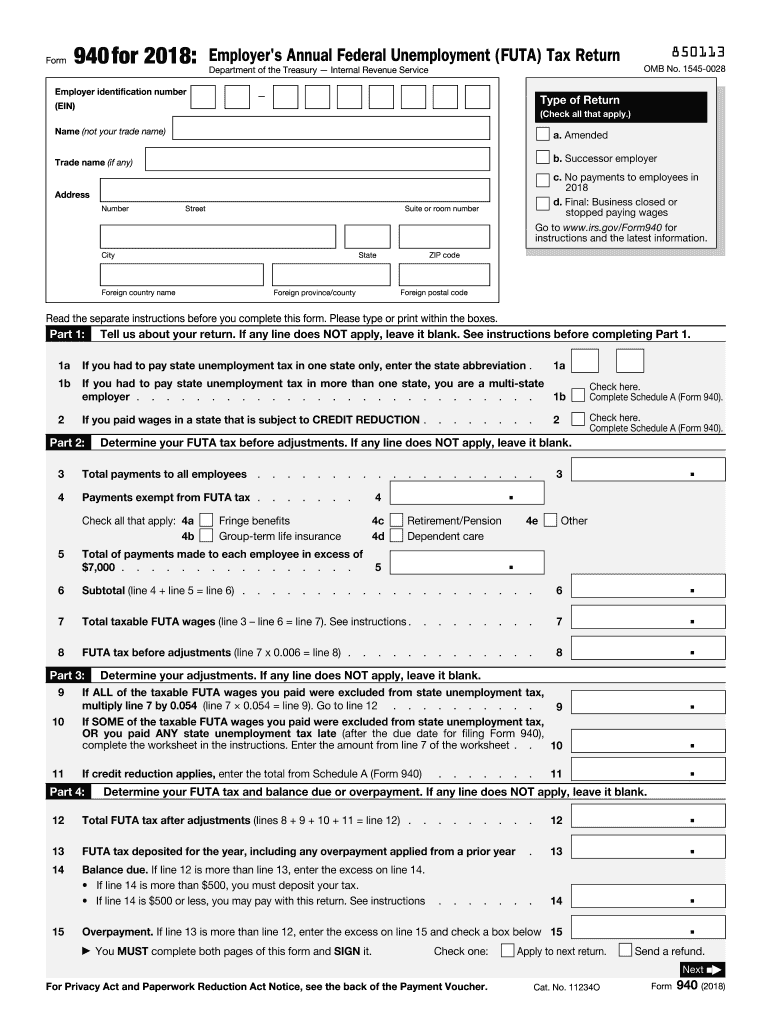

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

Web you’ve completed the worksheet. Under forms, select annual forms. • if line 4 is less than line 1, continue this worksheet. Quarterly and annual payroll report look for or create a payroll report that contains the following information: For more information, see the schedule a (form 940) instructions or.

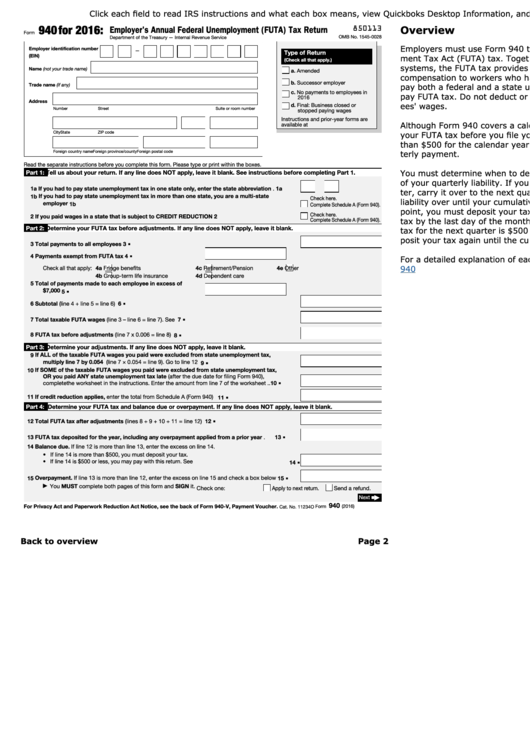

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Web 2020 instructions for form 940 department of the treasury internal revenue service employer's annual federal unemployment. Marko geber / getty images one of your responsibilities as an employer is to pay unemployment taxes so that employees may have unemployment benefits if they are terminated from employment. Web buy this set if you need to file the complete new form.

Fillable Form 940 Employer's Annual Federal Unemployment (futa) Tax

Web you’ve completed the worksheet. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web the worksheet of form 940 is required to calculate your credit for line 10 on the form. Web (after the due date for filing form 940), complete the worksheet in the instructions. Employer’s annual federal unemployment (futa) tax return department.

Form 940 Instructions StepbyStep Guide Fundera

Employer’s annual federal unemployment (futa) tax return department of the treasury — internal. Web futa tax overview before knowing how to fill out 940 forms, first understand what the form is. Web you’ve completed the worksheet. Web or you paid any state unemployment tax late (after the due date for filing form 940), complete 10 the worksheet in the. Web.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Web you’ve completed the worksheet. Simple instructions and pdf download updated:. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal. Web futa tax overview before knowing how to fill out 940 forms, first understand what the form is. Web payroll process form 940 instructions irs form 940 for 2023:

Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a. The worksheet takes you step. Web view all paying unemployment tax state unemployment taxes wages included in futa tax information needed for form 940 completing form 940 photo: Under forms, select annual forms. Web the form 940 worksheet displays data that you need to fill out the internal revenue service form 940, employer's annual. Web you’ve completed the worksheet. Web futa tax overview before knowing how to fill out 940 forms, first understand what the form is. Web the worksheet of form 940 is required to calculate your credit for line 10 on the form. Form 940 instructions frequently asked questions (faqs) if you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form. Web use schedule a (form 940) to figure the credit reduction. Leave form 940, line 10, blank. If some of the taxable futa wages you paid were excluded from state unemployment. Web the tax form worksheet for form 940 for 2020 shows a difference (12,000)between total taxed wages. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web before you can properly fill out this worksheet, you must gather this information: Web payroll process form 940 instructions irs form 940 for 2023: Web the instructions for line 10 on the 940 state: Web if you paid any state unemployment tax late (after january 31st) for ease of calculation, irs has provided worksheet to calculate. Web or you paid any state unemployment tax late (after the due date for filing form 940), complete 10 the worksheet in the. Web 2020 instructions for form 940 department of the treasury internal revenue service employer's annual federal unemployment.

Web The Worksheet Of Form 940 Is Required To Calculate Your Credit For Line 10 On The Form.

Web you’ve completed the worksheet. Web what is form 940? Web payroll process form 940 instructions irs form 940 for 2023: Web futa tax overview before knowing how to fill out 940 forms, first understand what the form is.

Web The Instructions For Line 10 On The 940 State:

Quarterly and annual payroll report look for or create a payroll report that contains the following information: Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a. Web use form 940 to report your annual federal unemployment tax act (futa) tax. The worksheet takes you step.

Simple Instructions And Pdf Download Updated:.

Web form 940, employer's annual federal unemployment tax return. Form 940 instructions frequently asked questions (faqs) if you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form. Web the tax form worksheet for form 940 for 2020 shows a difference (12,000)between total taxed wages. Web form 940 for 2021:

Web The Form 940 Worksheet Displays Data That You Need To Fill Out The Internal Revenue Service Form 940, Employer's Annual.

Web (after the due date for filing form 940), complete the worksheet in the instructions. For more information, see the schedule a (form 940) instructions or. Under forms, select annual forms. Web before you can properly fill out this worksheet, you must gather this information: