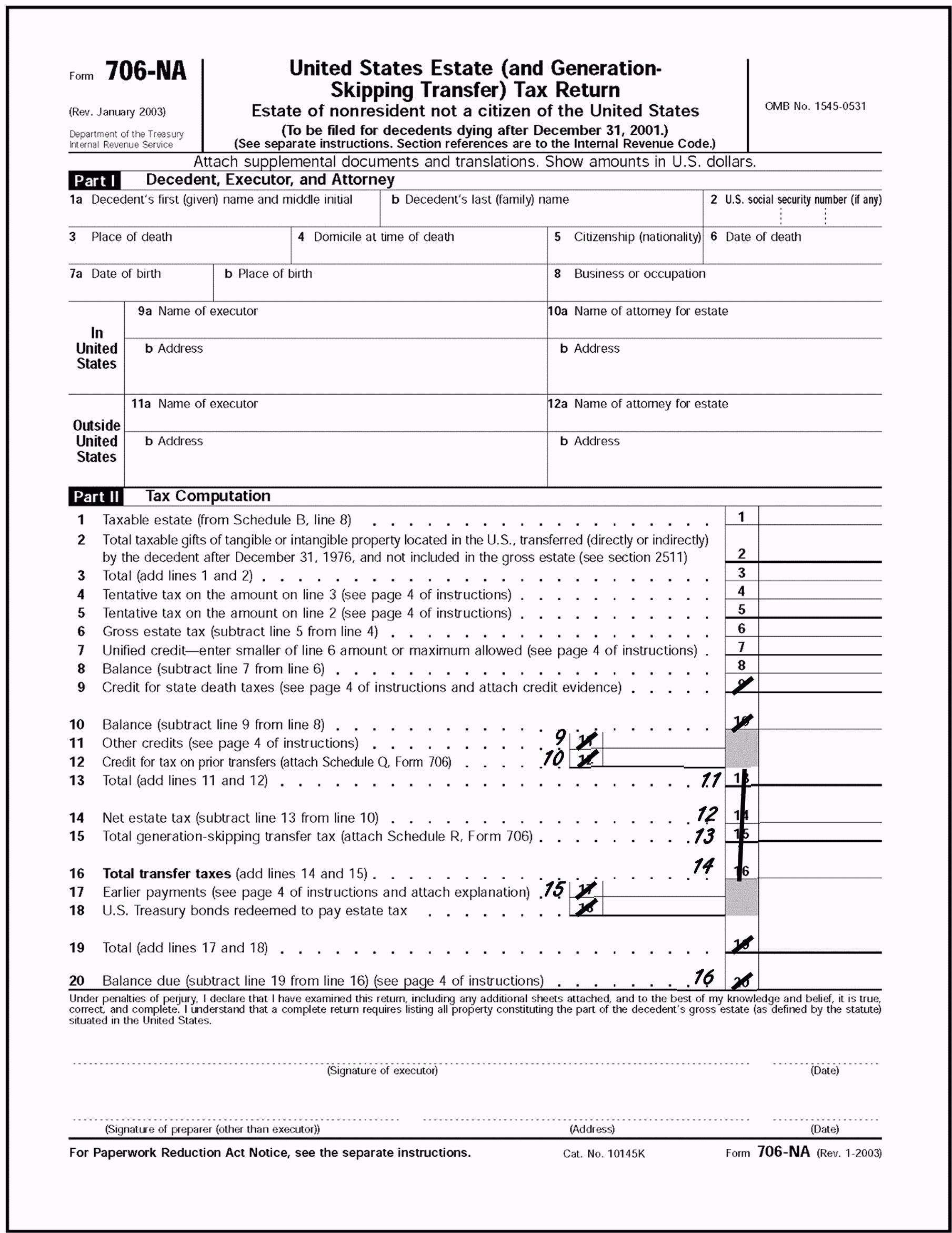

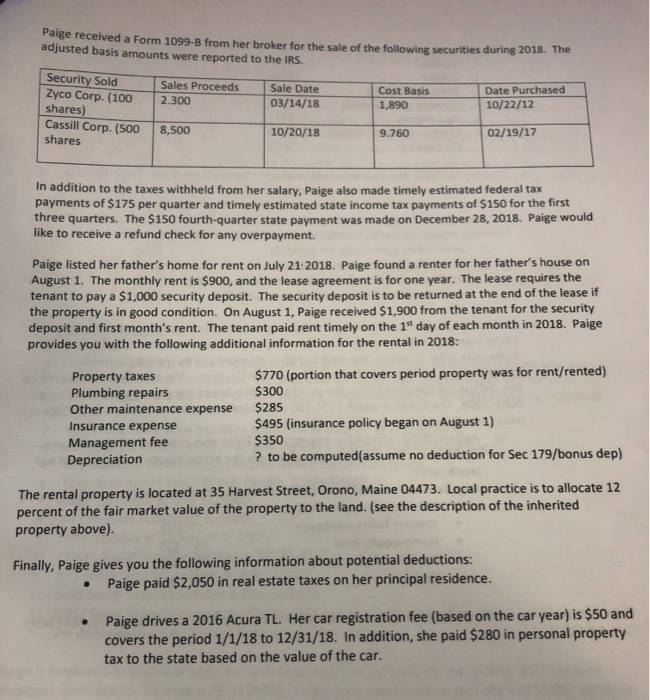

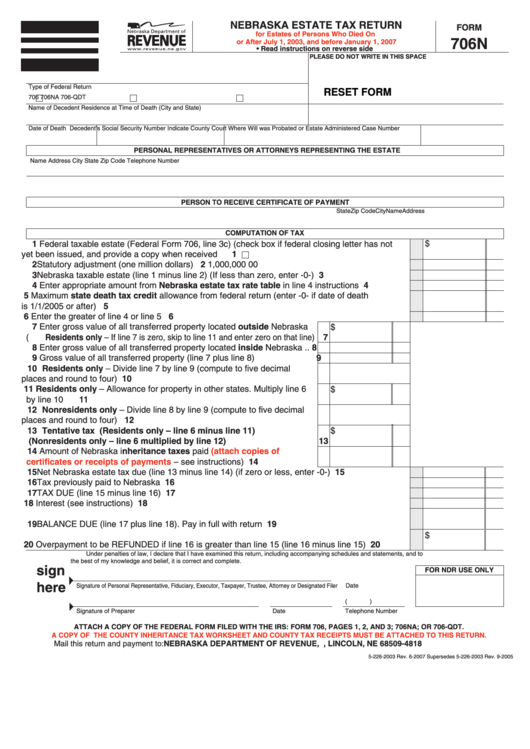

Nebraska Inheritance Tax Worksheet - Web nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the. The inheritance tax is technically not a tax on. Web settling an estate can be complicated, and completion of the inheritance tax form and probate inventory worksheet can be. A plus b should match the tax due amount and. Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Previous years' income tax forms. Web 1 what is the nebraska inheritance tax and how does it work? This excel file assists lawyers with calculating inheritance tax. When and where to file. Nebraska farmcast when nebraskans inherit land or other property, they must.

Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet

This excel file assists lawyers with calculating inheritance tax. Web nebraska inheritance tax exemptions and rates. Web that exemption amount, and the underlying inheritance tax rate, varies based on the inheritance category the. Web application for informal probate and appointment of personal representative. Web in all proceedings for the determination of inheritance tax, the following deductions from the value of.

Nebraska Inheritance Tax Worksheet Form 500

This excel file assists lawyers with calculating inheritance tax. Numeric listing of all current nebraska tax forms. Web 03/30/2022 nebraska inheritance tax: Web in all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to. Previous years' income tax forms.

Nebraska Inheritance Tax Worksheet Tagua

Overview > community finance and lending > Web the nebraska inheritance tax form template is a form with fillable fields where one can insert information, i.e., fill it out on the. When and where to file. The form ecit is due when distributions have been made. Web what is the nebraska inheritance tax and how does it work?

34 Nebraska Inheritance Tax Worksheet support worksheet

Web the nebraska inheritance tax form template is a form with fillable fields where one can insert information, i.e., fill it out on the. The dor created form ecit to assist estate administrators in reporting this information. Web in all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to. Web certificate.

Nebraska Inheritance Tax Worksheet Resume Examples

Web nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the. Banking and advertorial pecuniary benefit. Web 1 what is the nebraska inheritance tax and how does it work? Web that exemption amount, and the underlying inheritance tax rate, varies based on the inheritance category the. Web 03/30/2022 nebraska inheritance tax:

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a decedent’s estate that will be. Web march 8, 2022 pexels. For residents of the state of nebraska, most of. Banking and advertorial pecuniary benefit.

34 Nebraska Inheritance Tax Worksheet support worksheet

Web 03/30/2022 nebraska inheritance tax: Web the nebraska inheritance tax form template is a form with fillable fields where one can insert information, i.e., fill it out on the. Web the total tax paid amount in column d and total of column. The dor created form ecit to assist estate administrators in reporting this information. Web andrew huettner april 6,.

Nebraska Inheritance Tax Worksheet What Is Inheritance Tax And Who

Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise. Web the total tax paid amount in column d and total of column. Web andrew huettner april 6, 2022 although nebraska does not.

Nebraska Inheritance Tax Worksheet Form 500 Fill Online, Printable

This excel file assists lawyers with calculating inheritance tax. Web nebraska inheritance tax exemptions and rates. Web the nebraska inheritance tax form template is a form with fillable fields where one can insert information, i.e., fill it out on the. For residents of the state of nebraska, most of. A plus b should match the tax due amount and.

Nebraska Inheritance Tax Worksheet Form 500

Banking and advertorial pecuniary benefit. The rate depends on your relationship to your benefactor. Web what is the nebraska inheritance tax and how does it work? Overview > community finance and lending > Web nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the.

The inheritance tax is technically not a tax on. When and where to file. The dor created form ecit to assist estate administrators in reporting this information. Web application for informal probate and appointment of personal representative. Web in all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to. Overview > community finance and lending > Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Web march 8, 2022 pexels. Web what is the nebraska inheritance tax and how does it work? Web settling an estate can be complicated, and completion of the inheritance tax form and probate inventory worksheet can be. Web nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the. Web nebraska does have an inheritance tax. Numeric listing of all current nebraska tax forms. Nebraska farmcast when nebraskans inherit land or other property, they must. Web 1 what is the nebraska inheritance tax and how does it work? A plus b should match the tax due amount and. Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise. The form ecit is due when distributions have been made. Previous years' income tax forms. This excel file assists lawyers with calculating inheritance tax.

For Residents Of The State Of Nebraska, Most Of.

Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise. Web the total tax paid amount in column d and total of column. Nebraska farmcast when nebraskans inherit land or other property, they must. Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a decedent’s estate that will be.

The Surviving Spouse Is Exempt From.

Web 03/30/2022 nebraska inheritance tax: A plus b should match the tax due amount and. The rate depends on your relationship to your benefactor. Previous years' income tax forms.

Web 1 What Is The Nebraska Inheritance Tax And How Does It Work?

The dor created form ecit to assist estate administrators in reporting this information. Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Numeric listing of all current nebraska tax forms. Web that exemption amount, and the underlying inheritance tax rate, varies based on the inheritance category the.

Web In All Proceedings For The Determination Of Inheritance Tax, The Following Deductions From The Value Of The Property Subject To.

Web settling an estate can be complicated, and completion of the inheritance tax form and probate inventory worksheet can be. Web application for informal probate and appointment of personal representative. Overview > community finance and lending > The inheritance tax is technically not a tax on.