Business Tax Expenses Worksheet - Web this excel expense template provides a straightforward spreadsheet format and calculates totals for you. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web 4 reasons to use an excel spreadsheet for business expenses. Web according to the irs, business expenses must be both ordinary and necessary to be deductible. This worksheet allows you to itemize your tax deductions for a given year. Web a small business expense report template is a tool to track daily or weekly expenses. Let’s say your taxable income for the year was. Id # tax year ordinary suppliesthe purpose of. Do not report these expenses elsewhere. Web include all ordinary and necessary business expenses not deducted elsewhere on schedule c.

business tax worksheet

List the type and amount of. Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file. Web if you have additional income, such as business or farm income or loss, unemployment compensation, or prize or. Web expenses for business use of your home. Web below are the different.

Small Business Tax Deductions Worksheets

Web this handout provides a simple worksheet for business owners to track expenses. Web small business worksheet client: Web below are the different types of spreadsheets for business expense; Web 4 reasons to use an excel spreadsheet for business expenses. Let’s say your taxable income for the year was.

Business Expense Spreadsheet For Taxes Business worksheet

Web if you have additional income, such as business or farm income or loss, unemployment compensation, or prize or. Id # tax year ordinary suppliesthe purpose of. Do not report these expenses elsewhere. Web small business worksheet client: Your expenses, divided into lump sums by categories such as home office,.

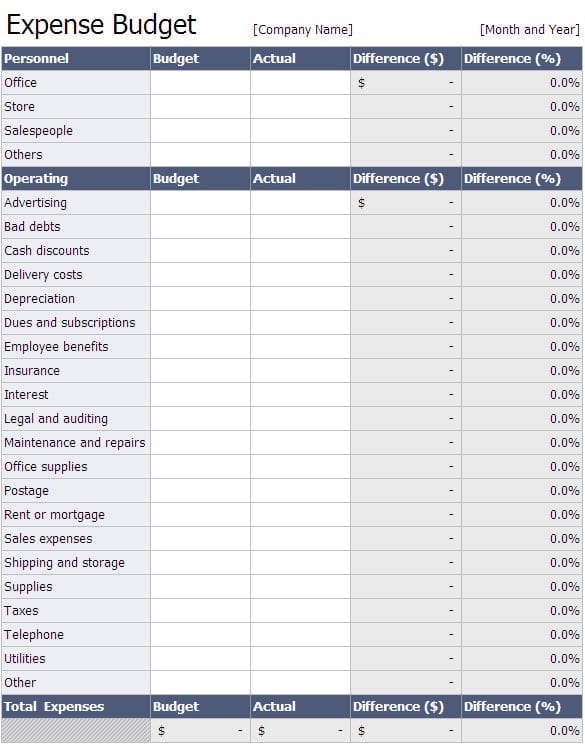

Business Expenses Template Excel Templates

Web include all ordinary and necessary business expenses not deducted elsewhere on schedule c. Let’s say your taxable income for the year was. Web if you have additional income, such as business or farm income or loss, unemployment compensation, or prize or. Attach form 8829 unless using the simplified. List the type and amount of.

Small Business And Expenses Spreadsheet Template Natural Riset

List the type and amount of. Web your income, divided by each source. Web according to the irs, business expenses must be both ordinary and necessary to be deductible. Web 4 reasons to use an excel spreadsheet for business expenses. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use.

Business Expense Spreadsheet For Taxes Awesome 50 Inspirational and

Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. This worksheet allows you to itemize your tax deductions for a given year. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web expenses for business use of your.

Business Tax Expense Worksheet

Web your income, divided by each source. List the type and amount of. Web this excel expense template provides a straightforward spreadsheet format and calculates totals for you. Web include all ordinary and necessary business expenses not deducted elsewhere on schedule c. Web small business worksheet client:

Tax Spreadsheet For Small Business Spreadsheet Downloa tax worksheet

Your expenses, divided into lump sums by categories such as home office,. List the type and amount of. It can be adjusted to include whatever. Web small business worksheet client: Do not report these expenses elsewhere.

Tax Expenses Spreadsheet Spreadsheet Downloa tax expenses spreadsheet

Web 4 reasons to use an excel spreadsheet for business expenses. The irs allows you to deduct $5,000 in business startup costs and $5,000 in organizational. Web expenses for business use of your home. Web include all ordinary and necessary business expenses not deducted elsewhere on schedule c. It can be used as a ledger or as.

Business Expenses Spreadsheet Template Expense Spreadsheet Business

Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file. It can be used as a ledger or as. Web a small business expense report template is a tool to track daily or weekly expenses. Web small business worksheet client: Web in 2022, the income limits for all.

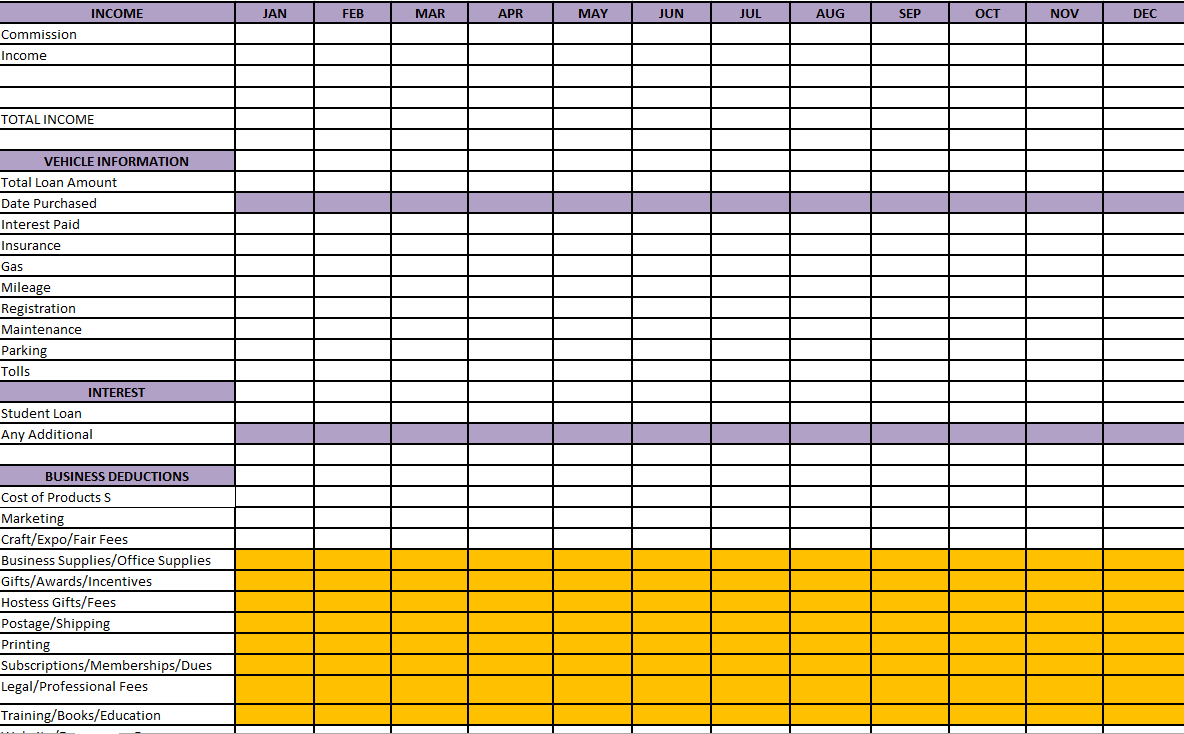

Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Let’s say your taxable income for the year was. Web 4 reasons to use an excel spreadsheet for business expenses. Web this excel expense template provides a straightforward spreadsheet format and calculates totals for you. Web expenses for business use of your home. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web below are the different types of spreadsheets for business expense; Your expenses, divided into lump sums by categories such as home office,. Let’s take a look at some of the key benefits of. Web include all ordinary and necessary business expenses not deducted elsewhere on schedule c. The irs allows you to deduct $5,000 in business startup costs and $5,000 in organizational. Do not report these expenses elsewhere. Web the legal structure of the business and other factors such as allowable business expenses and special deductions will all be. It can be used as a ledger or as. Web if you have additional income, such as business or farm income or loss, unemployment compensation, or prize or. Web we have created a business income & expense template that will help you navigate organizing your business. This worksheet allows you to itemize your tax deductions for a given year. Id # tax year ordinary suppliesthe purpose of. Web small business worksheet client: Web according to the irs, business expenses must be both ordinary and necessary to be deductible.

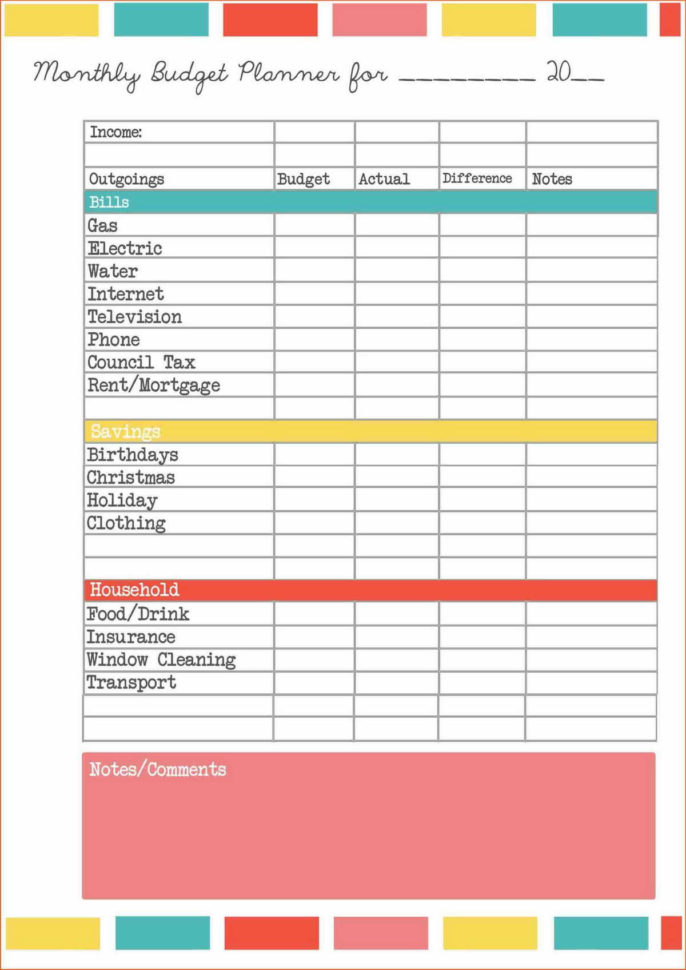

Web We Have Created A Business Income & Expense Template That Will Help You Navigate Organizing Your Business.

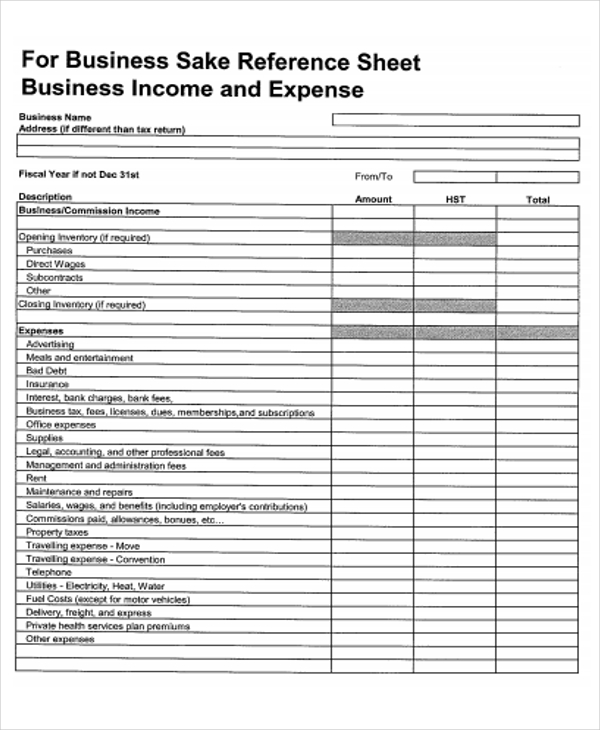

Do not report these expenses elsewhere. Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file. Web a small business expense report template is a tool to track daily or weekly expenses. This worksheet allows you to itemize your tax deductions for a given year.

Web This Handout Provides A Simple Worksheet For Business Owners To Track Expenses.

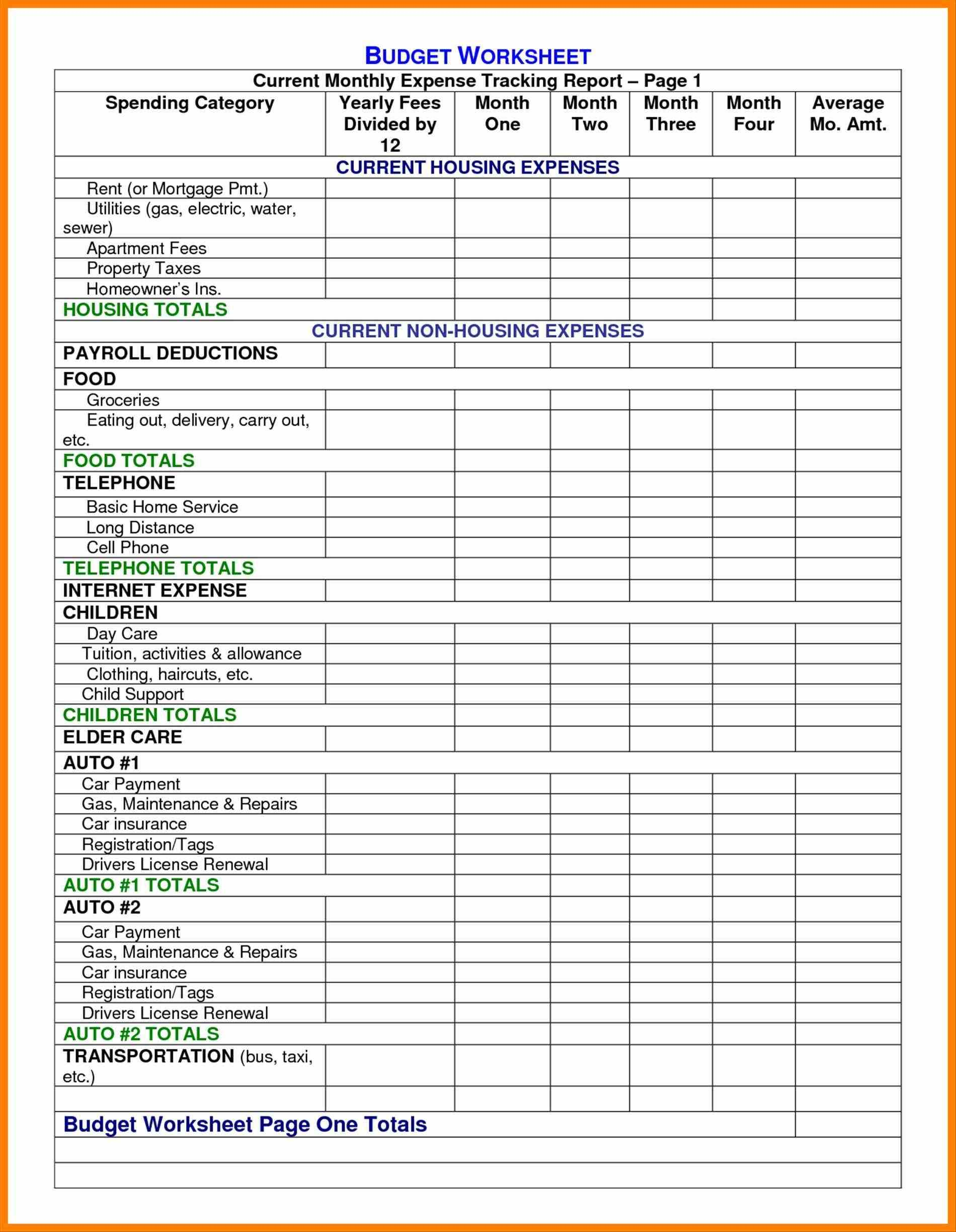

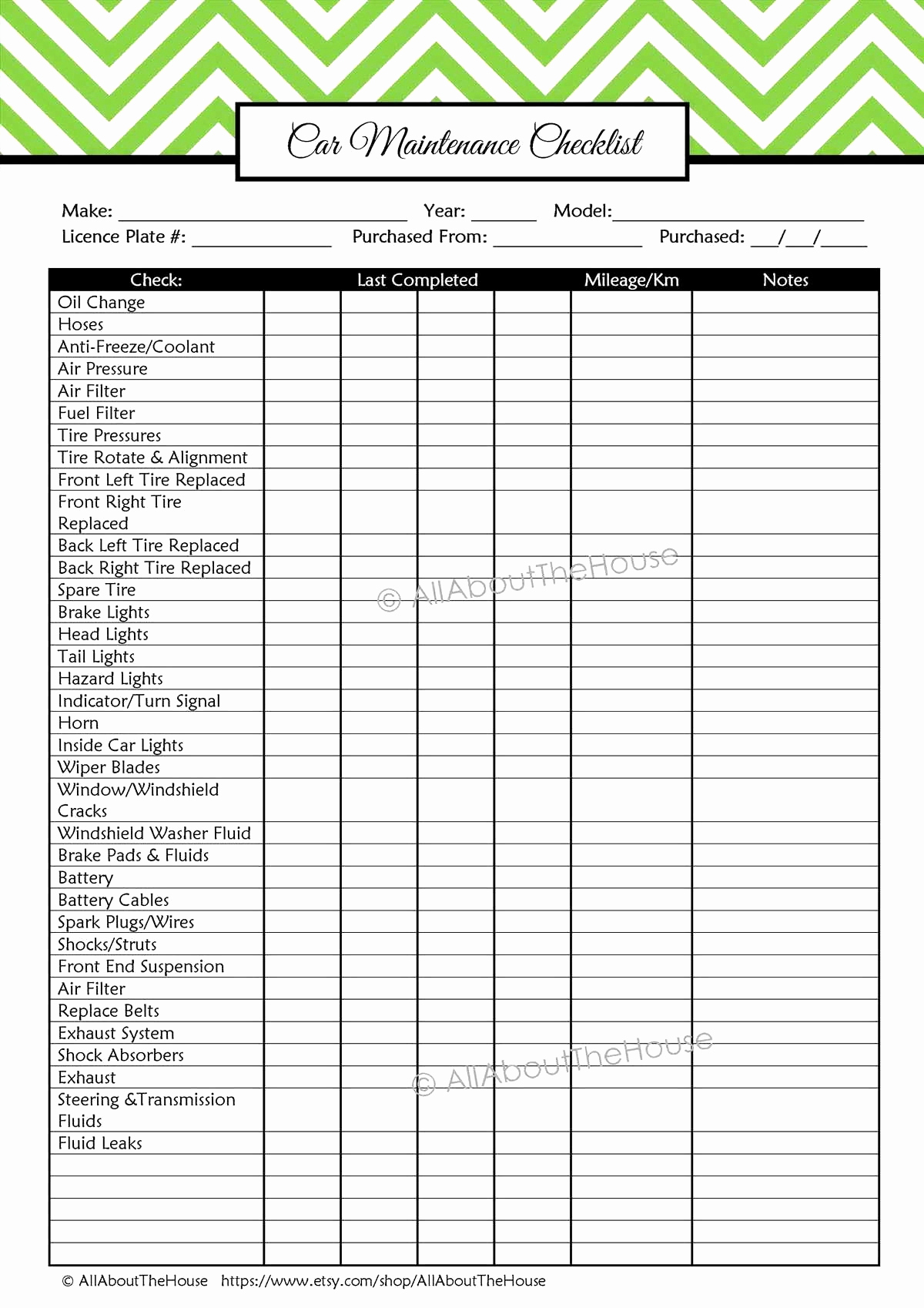

Web expenses for business use of your home. Web this excel expense template provides a straightforward spreadsheet format and calculates totals for you. Web 4 reasons to use an excel spreadsheet for business expenses. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use.

Web Include All Ordinary And Necessary Business Expenses Not Deducted Elsewhere On Schedule C.

Web according to the irs, business expenses must be both ordinary and necessary to be deductible. Let’s say your taxable income for the year was. List the type and amount of. Web below are the different types of spreadsheets for business expense;

The Irs Allows You To Deduct $5,000 In Business Startup Costs And $5,000 In Organizational.

Your expenses, divided into lump sums by categories such as home office,. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web the legal structure of the business and other factors such as allowable business expenses and special deductions will all be. It can be adjusted to include whatever.