1120S Income Calculation Worksheet - Expenses = cost of goods sold (+) total deductions schedule. Web corporations use irs form 1120 to report their taxes. Web figure taxable income by completing lines 1 through 28 of form 1120. Our income analysis tools and job aids are designed to help you evaluate qualifying. Web department of the treasury internal revenue service estimated tax for corporations for calendar year 2020, or tax year beginning ,. Web calculations where does my qualified business income calculation appear in the return? Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Complete all the fields on this worksheet. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during.

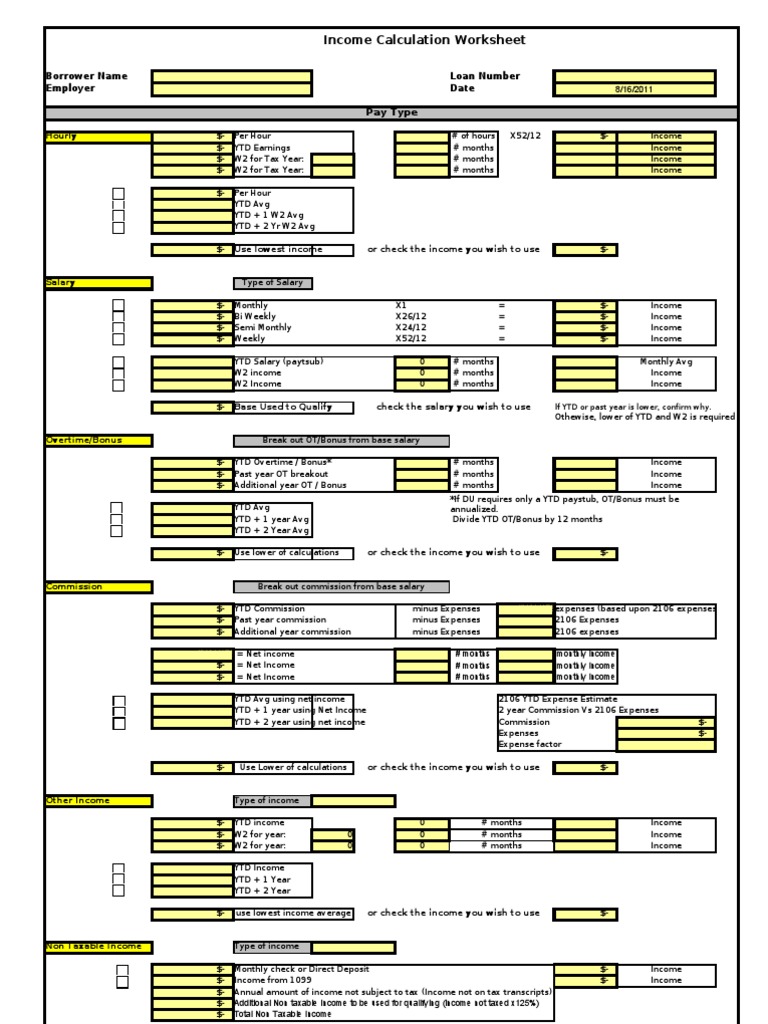

W2 Calculation Worksheet Excel

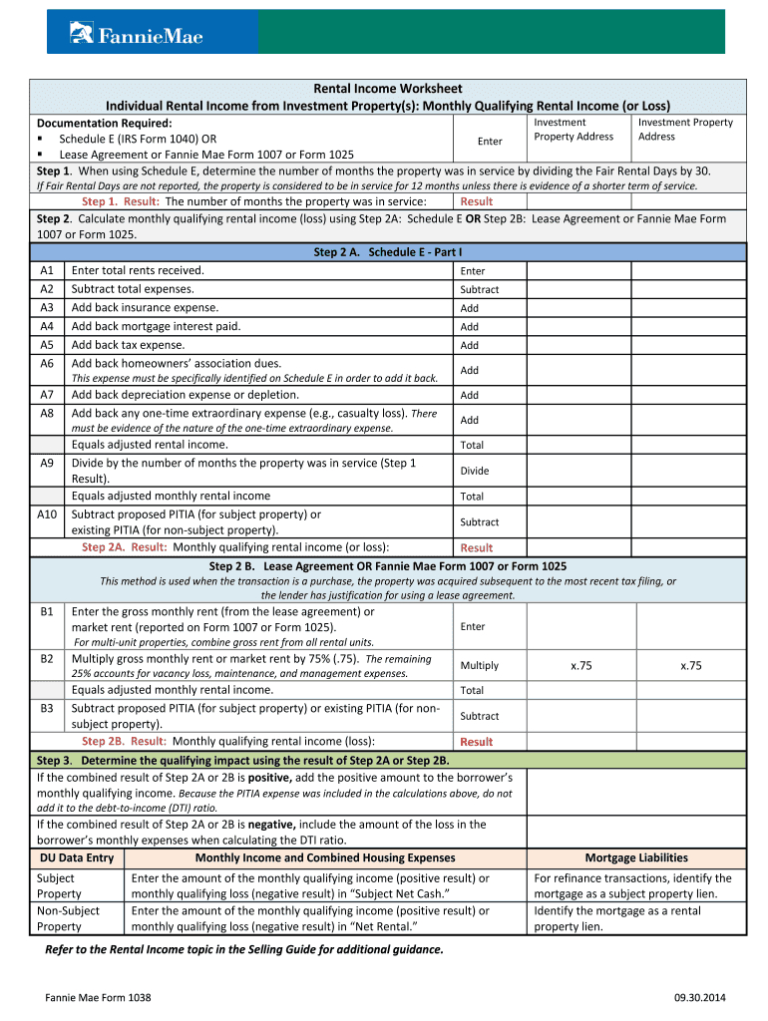

Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during. Our income analysis tools and job aids are designed to help you evaluate qualifying. Web department of the treasury internal revenue.

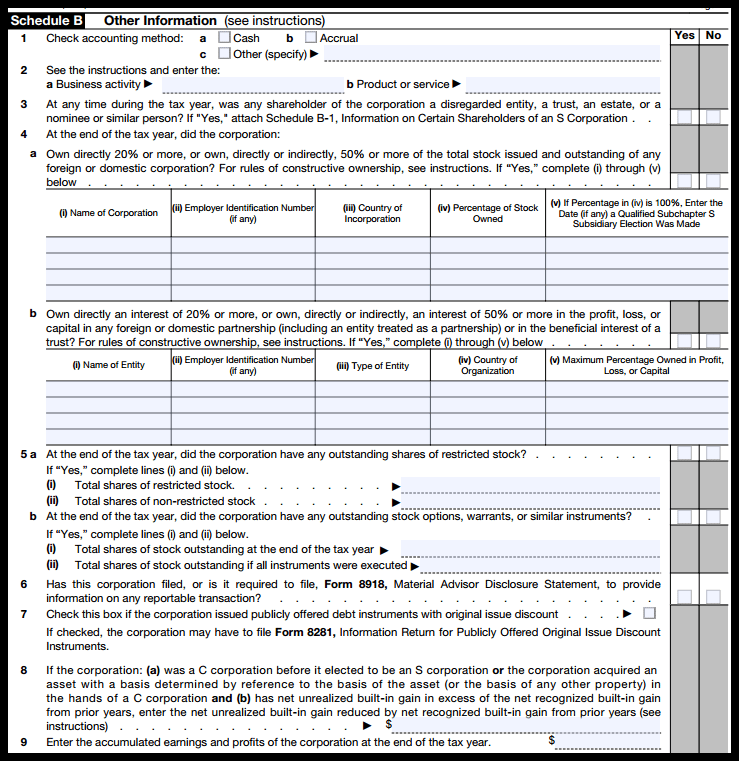

1120s Other Deductions Worksheet Promotiontablecovers

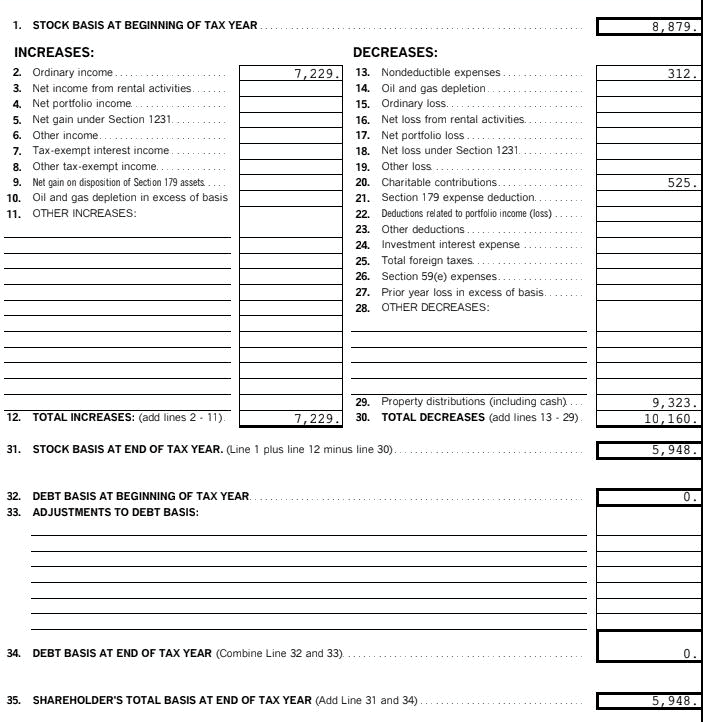

Expenses = cost of goods sold (+) total deductions schedule. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during. Web figure taxable income by completing lines 1 through 28 of form 1120. Web department of the treasury internal revenue service estimated tax for corporations for calendar year 2020, or.

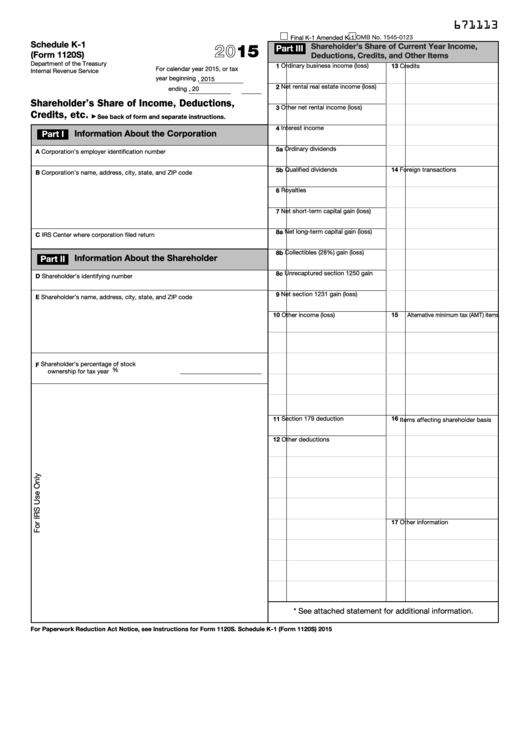

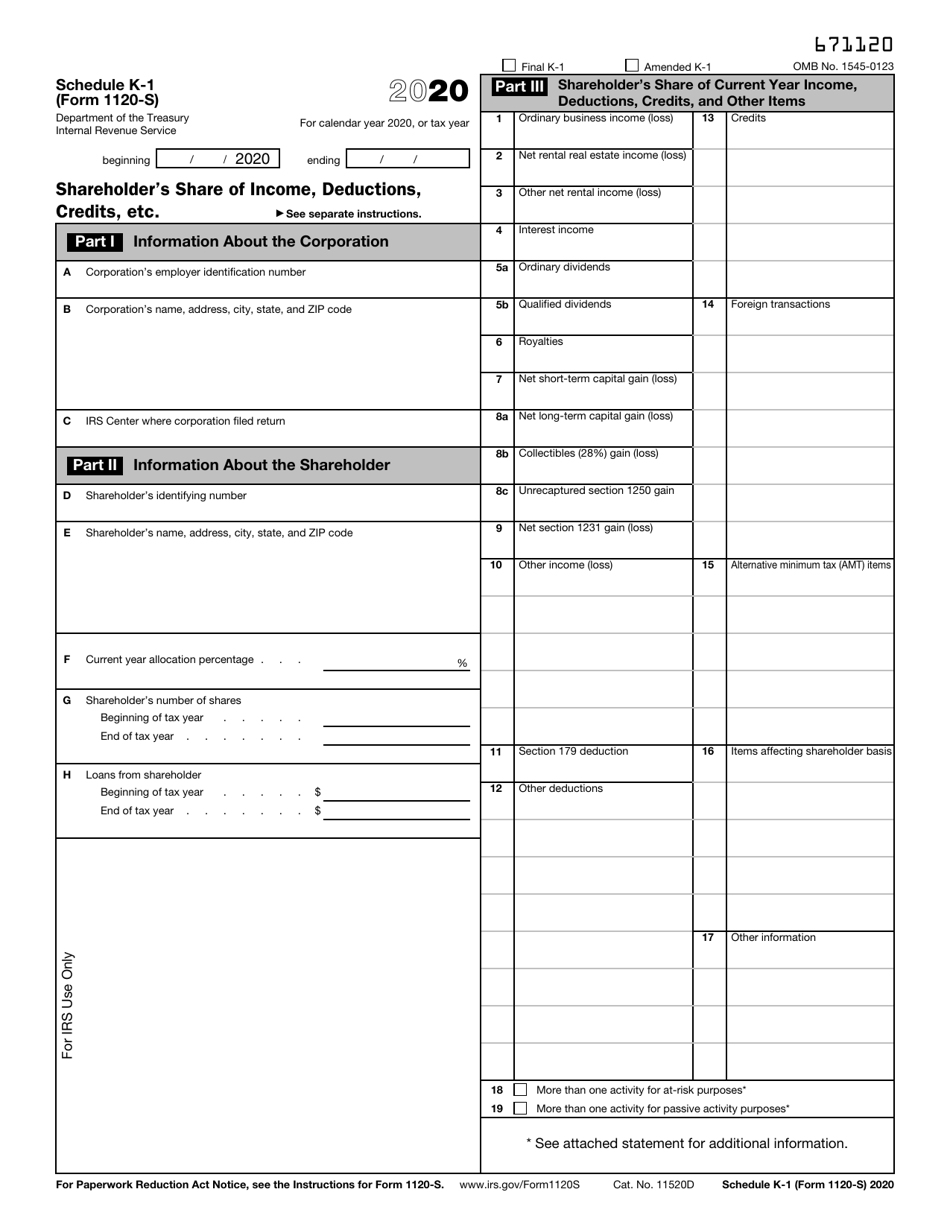

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

Web figure taxable income by completing lines 1 through 28 of form 1120. Recurring interest income (chapter 5305) (+) (+) recurring dividend. Web corporations use irs form 1120 to report their taxes. Complete all the fields on this worksheet. Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation.

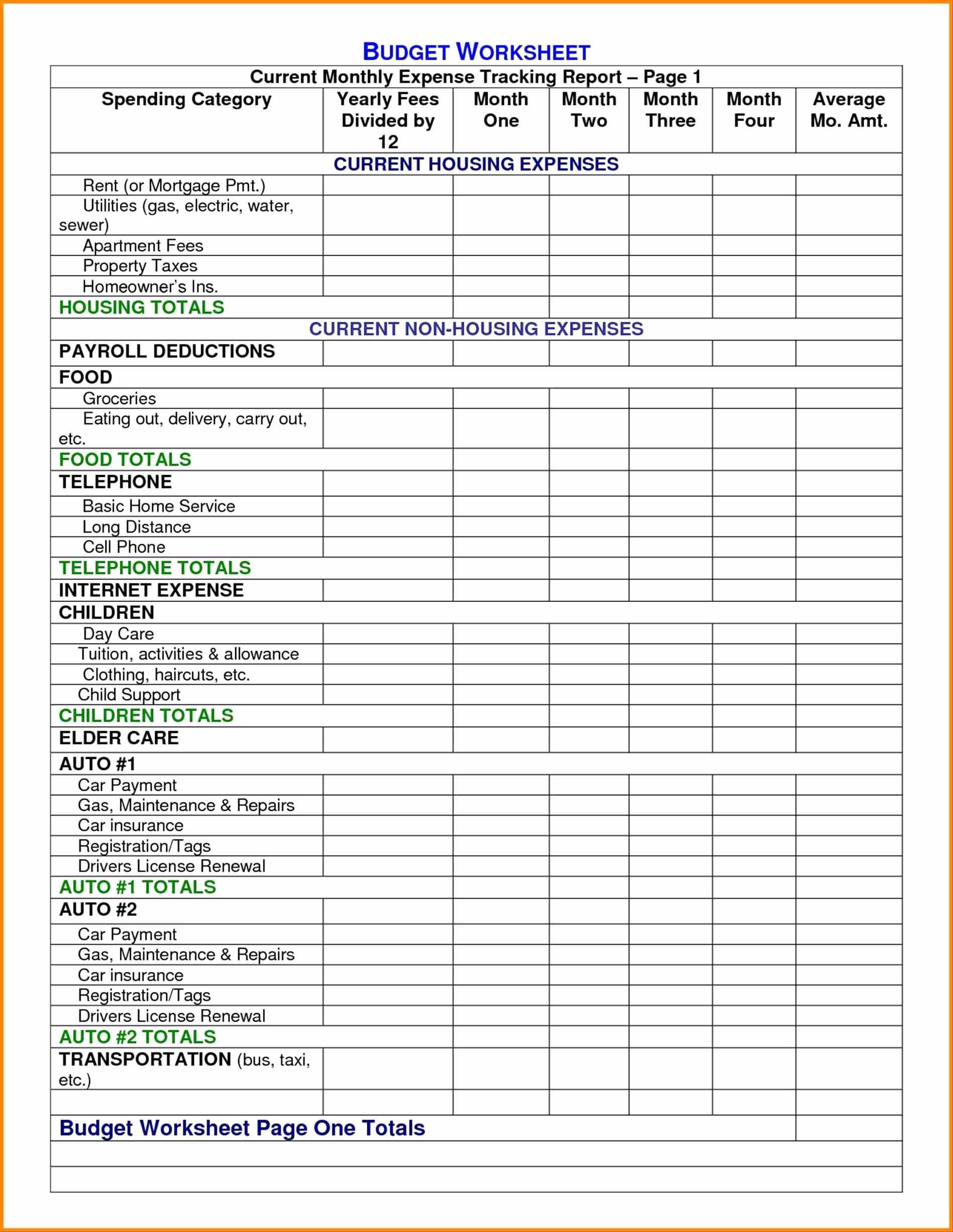

Rental Calculation Worksheet Along with Investment Property

Recurring interest income (chapter 5305) (+) (+) recurring dividend. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during. Web corporations use irs form 1120 to report their taxes. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of. Complete all the fields.

How to Complete Form 1120S Tax Return for an S Corp

Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation. Web department of the treasury internal revenue service estimated tax for corporations for calendar year 2020, or tax year beginning ,. Complete all the fields on this worksheet. Web the borrower’s proportionate share of income or loss is based on the.

Fannie Mae Worksheet Fill Online Printable —

Web calculations where does my qualified business income calculation appear in the return? Our income analysis tools and job aids are designed to help you evaluate qualifying. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany. Web irs form 1120(s) = ordinary income or loss (s.

S Corp Basis Worksheet Studying Worksheets

Our income analysis tools and job aids are designed to help you evaluate qualifying. Web calculations where does my qualified business income calculation appear in the return? Web department of the treasury internal revenue service estimated tax for corporations for calendar year 2020, or tax year beginning ,. Recurring interest income (chapter 5305) (+) (+) recurring dividend. Web the borrower’s.

Farm Service Agency Adjusted Gross Calculation Could Influence

Web corporations use irs form 1120 to report their taxes. Complete all the fields on this worksheet. Recurring interest income (chapter 5305) (+) (+) recurring dividend. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of. Expenses = cost of goods sold (+) total deductions schedule.

Form 1120S Tax Return for an S Corporation (2013) Free Download

Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of. Expenses = cost of goods sold (+) total deductions schedule. Follow the instructions for form 1120. Web calculations where does my qualified business income calculation appear in the return? Web use screen basis wks, to calculate a shareholder's new basis after increases and/or.

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during. Web calculations where does my qualified business income calculation appear in the return? Complete all the fields on this worksheet. Web.

Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation. Web figure taxable income by completing lines 1 through 28 of form 1120. Recurring interest income (chapter 5305) (+) (+) recurring dividend. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Follow the instructions for form 1120. Expenses = cost of goods sold (+) total deductions schedule. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany. Web keep your career on the right track. Web department of the treasury internal revenue service estimated tax for corporations for calendar year 2020, or tax year beginning ,. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of. Our income analysis tools and job aids are designed to help you evaluate qualifying. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during. Web calculations where does my qualified business income calculation appear in the return? Complete all the fields on this worksheet. Web corporations use irs form 1120 to report their taxes.

Web Use Screen Basis Wks, To Calculate A Shareholder's New Basis After Increases And/Or Decreases Are Made To Basis During.

Complete all the fields on this worksheet. Web calculations where does my qualified business income calculation appear in the return? Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation. Expenses = cost of goods sold (+) total deductions schedule.

Web Keep Your Career On The Right Track.

Follow the instructions for form 1120. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of. Web figure taxable income by completing lines 1 through 28 of form 1120. Our income analysis tools and job aids are designed to help you evaluate qualifying.

Web Use This Worksheet To Calculate Qualifying Rental Income For Fannie Mae Form 1038 (Individual Rental Income From Investment.

Web corporations use irs form 1120 to report their taxes. Web department of the treasury internal revenue service estimated tax for corporations for calendar year 2020, or tax year beginning ,. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany. Recurring interest income (chapter 5305) (+) (+) recurring dividend.