941X Worksheet 1 Excel - Enter your income in your budget template. I do a few small payrolls tax forms. Determine refundable and nonrefundable tax credits. Web what's new social security and medicare tax for 2023. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the irs, you. An employer is required to file an irs 941x in the event. Web excel formulas can be employed to validate cell values against specific criteria. Find the form 941 worksheet 1 fillable you want. April, may, june read the separate.

941x Worksheet 1

Instead of worksheet 1, worksheet 2 needs to be. Then, multiply the total by. Web what's new social security and medicare tax for 2023. An employer is required to file an irs 941x in the event. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the irs, you.

941x Worksheet 1 Excel

Web the 941 ertc worksheets for the 2q 2021 have changed. Web form 941 tax credit worksheet updated for 2021 (1) jazlyn williams reporter/editor worksheet 1 was. Web excel formulas can be employed to validate cell values against specific criteria. Instead of worksheet 1, worksheet 2 needs to be. Use worksheet 3 to figure the credit for leave taken after.

941x Worksheet 1 Excel

Web excel formulas can be employed to validate cell values against specific criteria. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified. An employer is required to file an irs 941x in the event. Web what is the purpose of worksheet 1? Find the form 941 worksheet 1 fillable you want.

941x Worksheet 1 Excel

Determine refundable and nonrefundable tax credits. Find the form 941 worksheet 1 fillable you want. Web form 941 tax credit worksheet updated for 2021 (1) jazlyn williams reporter/editor worksheet 1 was. Web excel formulas can be employed to validate cell values against specific criteria. Web what is the purpose of worksheet 1?

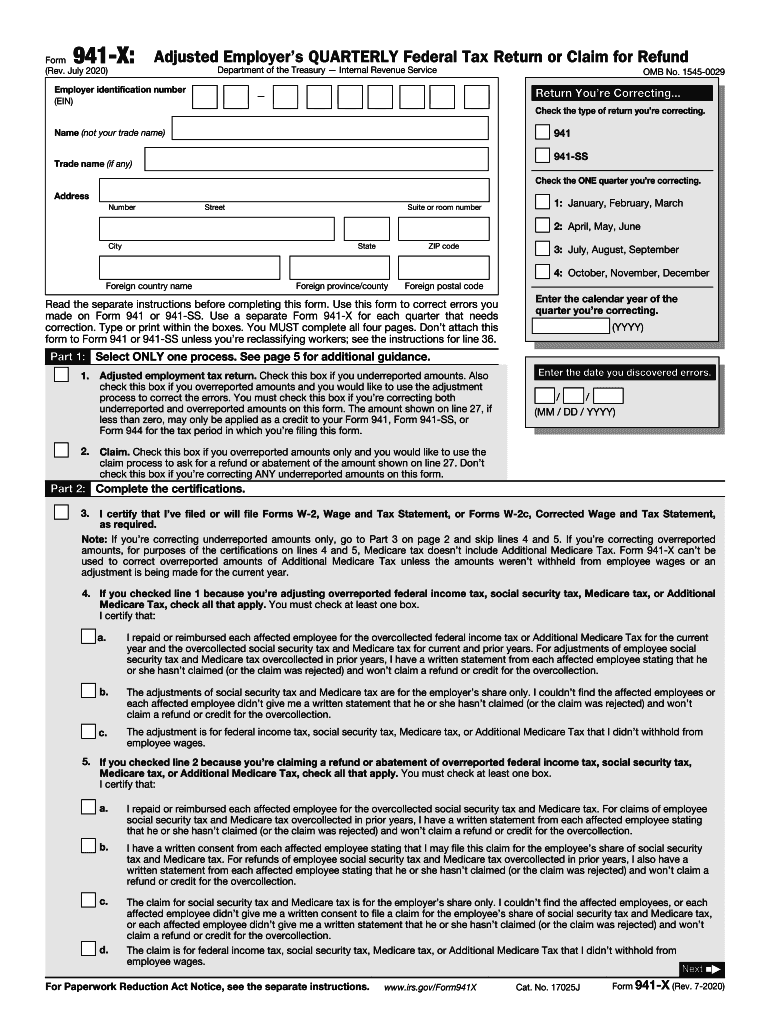

941x Fill out & sign online DocHub

Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Web what's new social security and medicare tax for 2023. Instead of worksheet 1, worksheet 2 needs to be. April, may, june read the separate. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the.

941x Worksheet 1 Excel

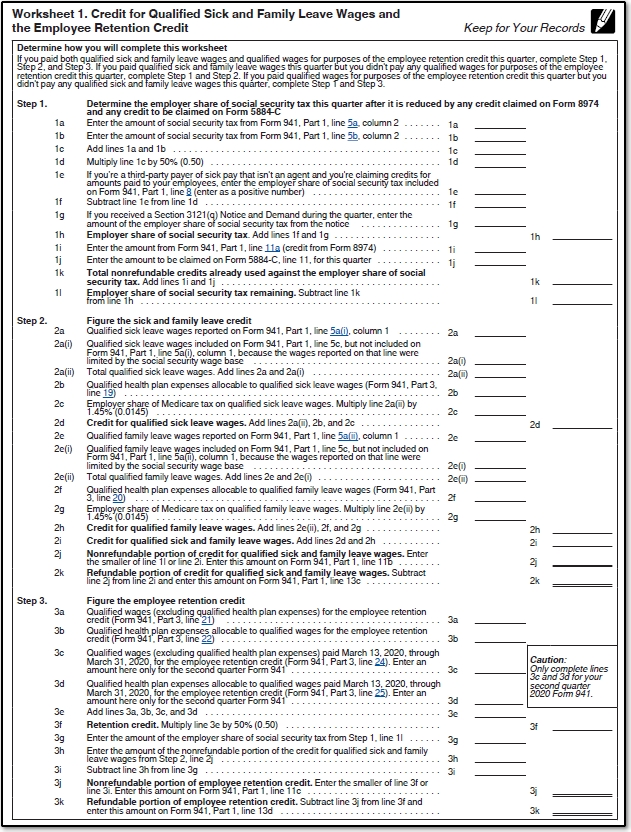

Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. April, may, june read the separate. Web what is the purpose of worksheet 1? Then, multiply the total by. Adjusted credit for qualified sick and family leave wages for leave taken before april 1,.

941x Worksheet 1 Excel

An employer is required to file an irs 941x in the event. Web what's new social security and medicare tax for 2023. Web what is the purpose of worksheet 1? Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before. Worksheet 1 is not an official attachment to form 941,.

941x Worksheet 1 Excel

Web excel formulas can be employed to validate cell values against specific criteria. Instead of worksheet 1, worksheet 2 needs to be. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30,.

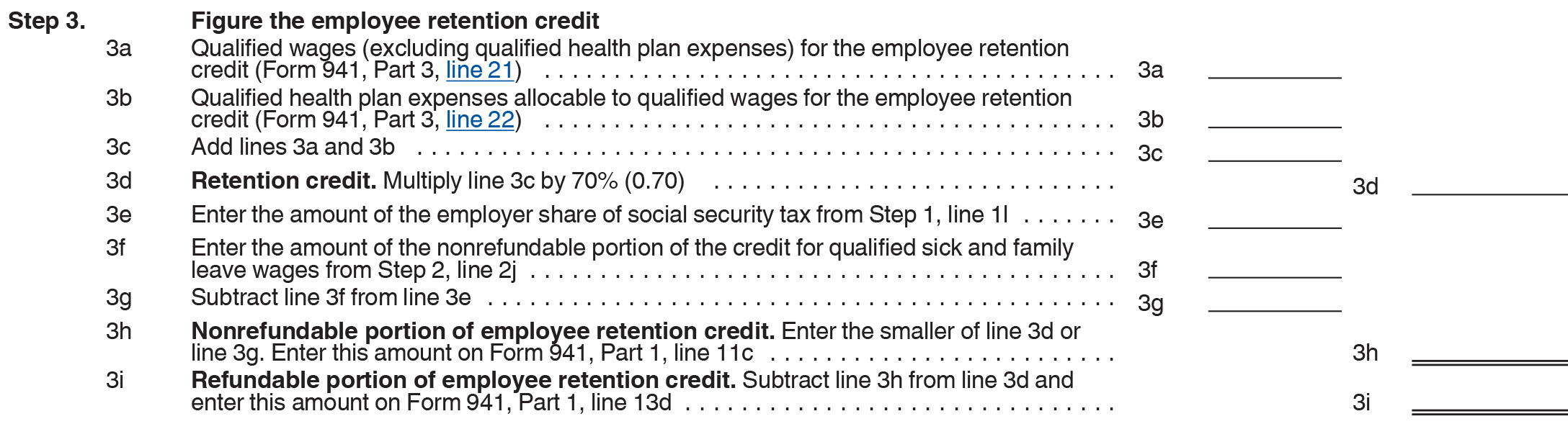

What Is The Nonrefundable Portion Of Employee Retention Credit 2021

Download the excel budget template. Enter your income in your budget template. Web to do so, add form 941, part 1, line 5a, column 2, and form 941, part 1, line 5b, column 2. Then, multiply the total by. Worksheet 1 is not an official attachment to form 941, therefore you won’t.

941x Worksheet 1 Excel

Determine refundable and nonrefundable tax credits. Web form 941 tax credit worksheet updated for 2021 (1) jazlyn williams reporter/editor worksheet 1 was. Enter your income in your budget template. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Then, multiply the total by.

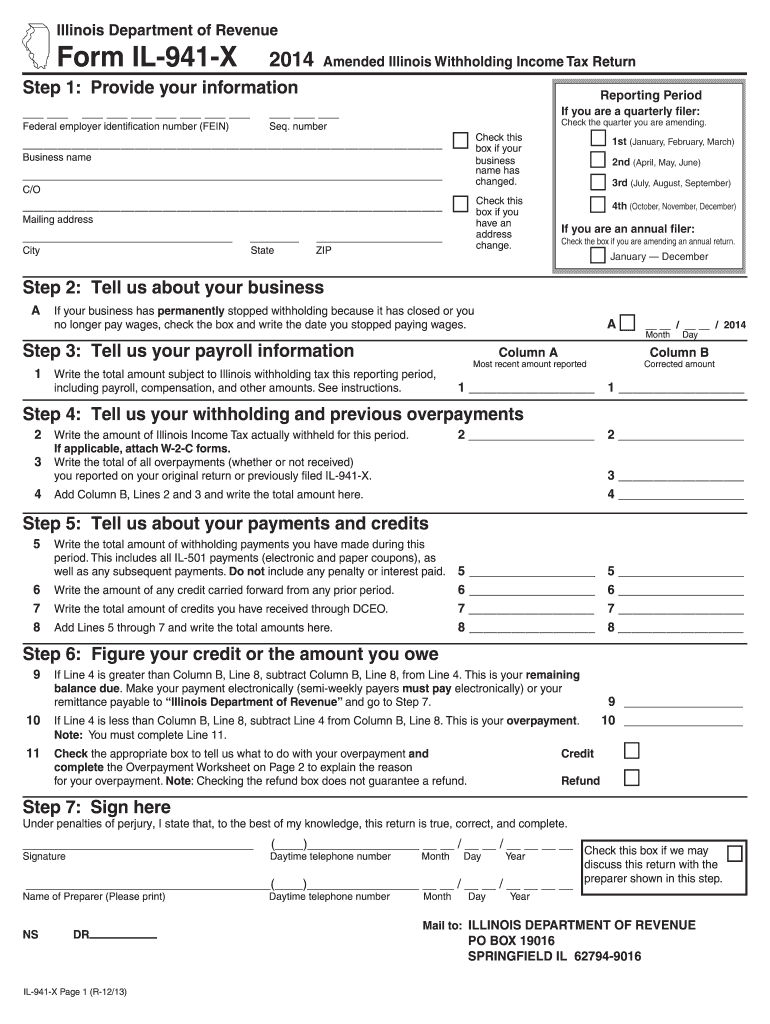

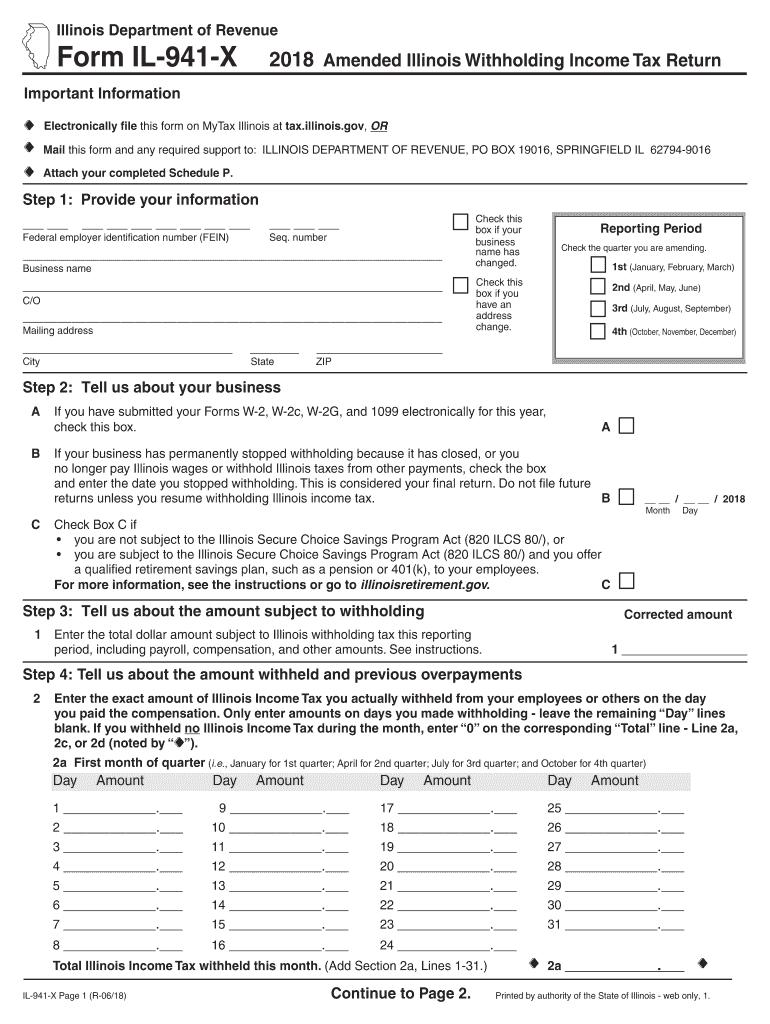

Use get form or simply click on. Web what's new social security and medicare tax for 2023. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and. Web excel formulas can be employed to validate cell values against specific criteria. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Worksheet 1 is not an official attachment to form 941, therefore you won’t. I'm looking for an excel sheet. Adjusted credit for qualified sick and family leave wages for leave taken before april 1,. Web what is the purpose of worksheet 1? Use worksheet 3 to figure the credit for leave taken after. Instead of worksheet 1, worksheet 2 needs to be. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before. An employer is required to file an irs 941x in the event. Download the excel budget template. Determine refundable and nonrefundable tax credits. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified. Enter your income in your budget template. April, may, june read the separate. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Then, multiply the total by.

Web Form 941 Tax Credit Worksheet Updated For 2021 (1) Jazlyn Williams Reporter/Editor Worksheet 1 Was.

Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Determine refundable and nonrefundable tax credits. I do a few small payrolls tax forms. Find the form 941 worksheet 1 fillable you want.

Web To Do So, Add Form 941, Part 1, Line 5A, Column 2, And Form 941, Part 1, Line 5B, Column 2.

Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. Download the excel budget template. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021.

The Rate Of Social Security Tax On Taxable Wages, Including Qualified Sick Leave Wages And Qualified.

Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the irs, you. An employer is required to file an irs 941x in the event. Then, multiply the total by. Enter your income in your budget template.

Use Worksheet 3 To Figure The Credit For Leave Taken After.

Adjusted credit for qualified sick and family leave wages for leave taken before april 1,. April, may, june read the separate. Web excel formulas can be employed to validate cell values against specific criteria. Use get form or simply click on.