Erc Worksheet Excel - Please read the following notes on the erc spreadsheet: Adjusted credit for qualified sick and family leave wages for leave taken before april 1, 2021. Web therefore, you must complete worksheet 1, which you will find in the instructions for form 941, and then claim the erc directly. Web employee retention credit worksheet calculation. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified. Web this worksheet is to be used when reviewing payroll tax returns for the 2020 and 2021 calendar years. Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients. Web the ey erc calculator:

Qualifying for Employee Retention Credit (ERC) Gusto

10k+ visitors in the past month Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Each cwa client will need to determine if and at what level they..

Employee Retention Credit (ERC) Calculator Gusto

Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Web the ey erc calculator: Please read the following notes on the erc spreadsheet: Web employee retention credit.

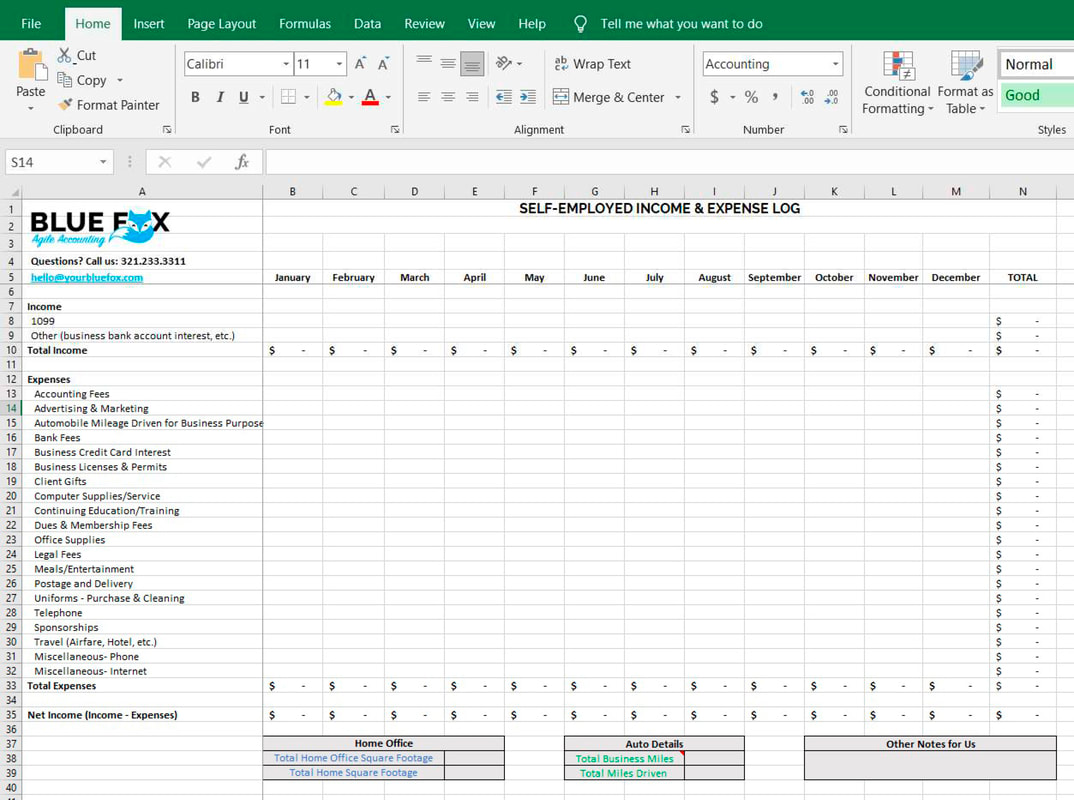

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]

Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified. Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc). Web therefore, you must complete worksheet 1, which you will find in the instructions for form 941, and then claim the erc directly..

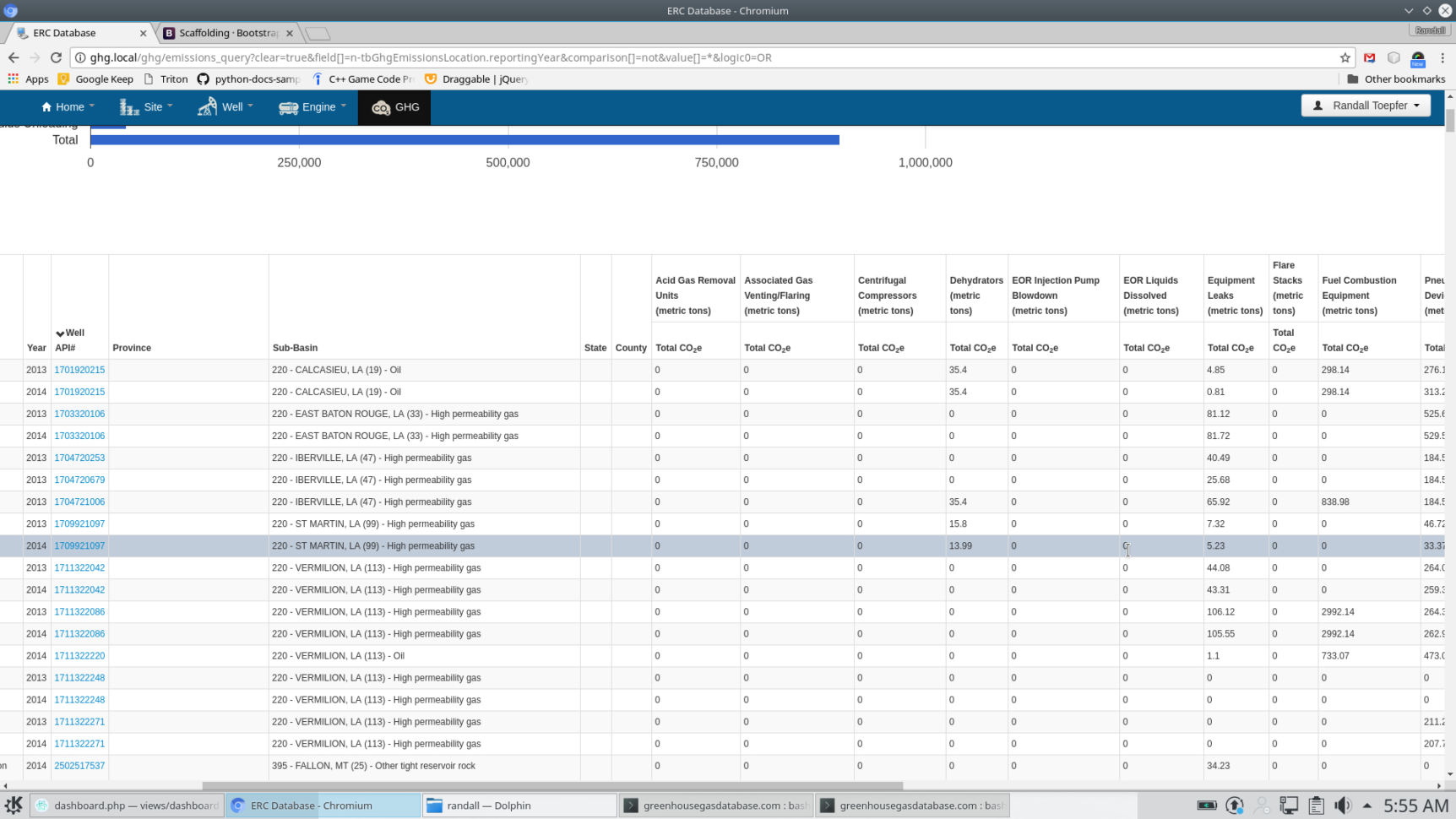

Epa Tanks Spreadsheet pertaining to Erc Database —

Use worksheet 3 to figure the credit for leave taken after. Web so for the 1q21 941 form, the max for each employee for the ertc refund should be $7000. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified. Web employee retention credit spreadsheet brown schultz sheridan & fritz.

Worksheet 1 941x

Web therefore, you must complete worksheet 1, which you will find in the instructions for form 941, and then claim the erc directly. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business.

Ertc Calculation Worksheet

Each cwa client will need to determine if and at what level they. Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc). Use worksheet 3 to figure the credit for leave taken after. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april.

Ertc Worksheet Excel

Web process & worksheet for maximizing ppp1 and erc please note: Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Web employee retention credit spreadsheet brown schultz sheridan & fritz 63 subscribers subscribe 19 share 7.6k. Answers to employee retention credit (erc) questions from the latest irs.

erc form download romanholidayvannuys

Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their. Please read the following notes on the erc spreadsheet: Web process & worksheet for maximizing ppp1 and erc please note: Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc). A simple, guided tool.

Employee Retention Credit (ERC) Calculator Gusto

Web employee retention credit worksheet calculation. Web so for the 1q21 941 form, the max for each employee for the ertc refund should be $7000. Now you have your own version of the calculator. Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients. A simple, guided tool to help.

erc form download romanholidayvannuys

Please read the following notes on the erc spreadsheet: Click file > make a copy at the top right hand of your screen. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified. Web so for the 1q21 941 form, the max for each employee for the ertc refund should.

Web employee retention credit spreadsheet brown schultz sheridan & fritz 63 subscribers subscribe 19 share 7.6k. Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients. Web process & worksheet for maximizing ppp1 and erc please note: 10k+ visitors in the past month A simple, guided tool to help businesses calculate their potential erc. Web the ey erc calculator: Please read the following notes on the erc spreadsheet: Use worksheet 3 to figure the credit for leave taken after. Now you have your own version of the calculator. Web the employee retention credit (erc) is a refundable tax credit for businesses that continued to pay employees while either. Web therefore, you must complete worksheet 1, which you will find in the instructions for form 941, and then claim the erc directly. Web so for the 1q21 941 form, the max for each employee for the ertc refund should be $7000. Each cwa client will need to determine if and at what level they. Click file > make a copy at the top right hand of your screen. Web employee retention credit worksheet calculation. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc). 10k+ visitors in the past month

Answers To Employee Retention Credit (Erc) Questions From The Latest Irs Guidance To Employee Retention Credit (Erc).

Web so for the 1q21 941 form, the max for each employee for the ertc refund should be $7000. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. 10k+ visitors in the past month Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified.

Adjusted Credit For Qualified Sick And Family Leave Wages For Leave Taken Before April 1, 2021.

Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients. Web process & worksheet for maximizing ppp1 and erc please note: Web this worksheet is to be used when reviewing payroll tax returns for the 2020 and 2021 calendar years. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their.

Web Employee Retention Credit Worksheet Calculation.

Now you have your own version of the calculator. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and. Each cwa client will need to determine if and at what level they. Web therefore, you must complete worksheet 1, which you will find in the instructions for form 941, and then claim the erc directly.

A Simple, Guided Tool To Help Businesses Calculate Their Potential Erc.

Web the ey erc calculator: Please read the following notes on the erc spreadsheet: Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021.

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)