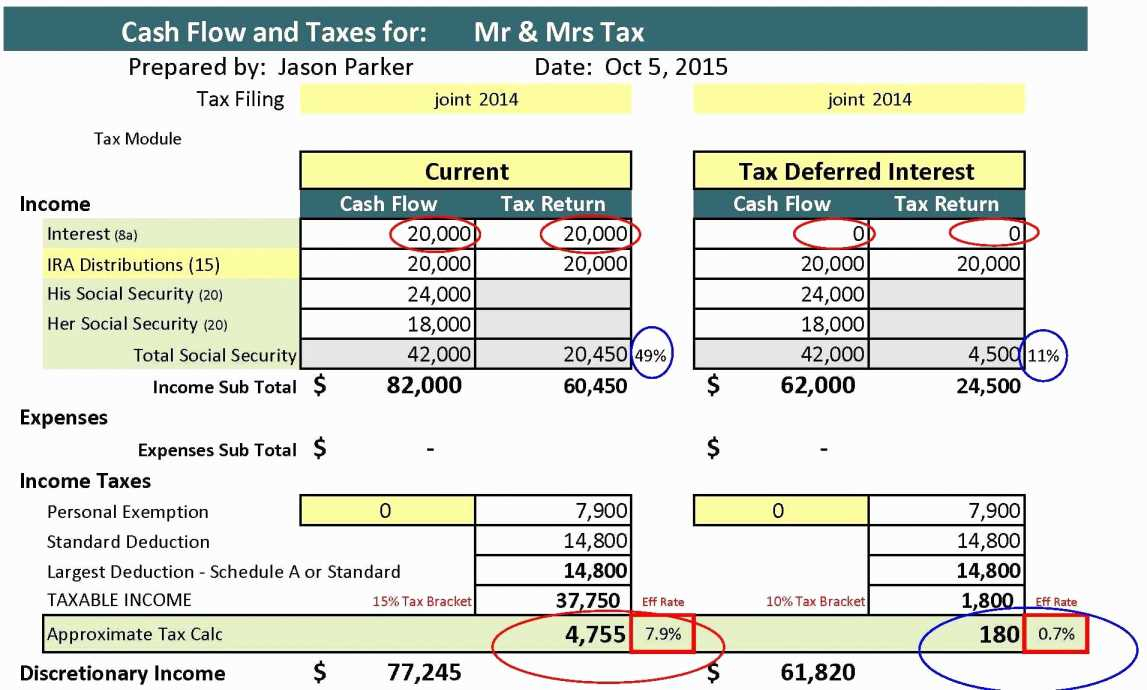

Worksheet To Calculate Taxable Social Security - Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total. You can use the money help center calculator to determine how much social. Note that not everyone pays. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web if that total is more than $32,000, then part of their social security may be taxable. The taxable amount, if any, of a. The irs reminds taxpayers receiving social. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable.

Do You Pay Tax On Social Security Benefits

Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Note that not everyone pays. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue.

Social Security Calculator Spreadsheet 2 Spreadsheet Downloa social

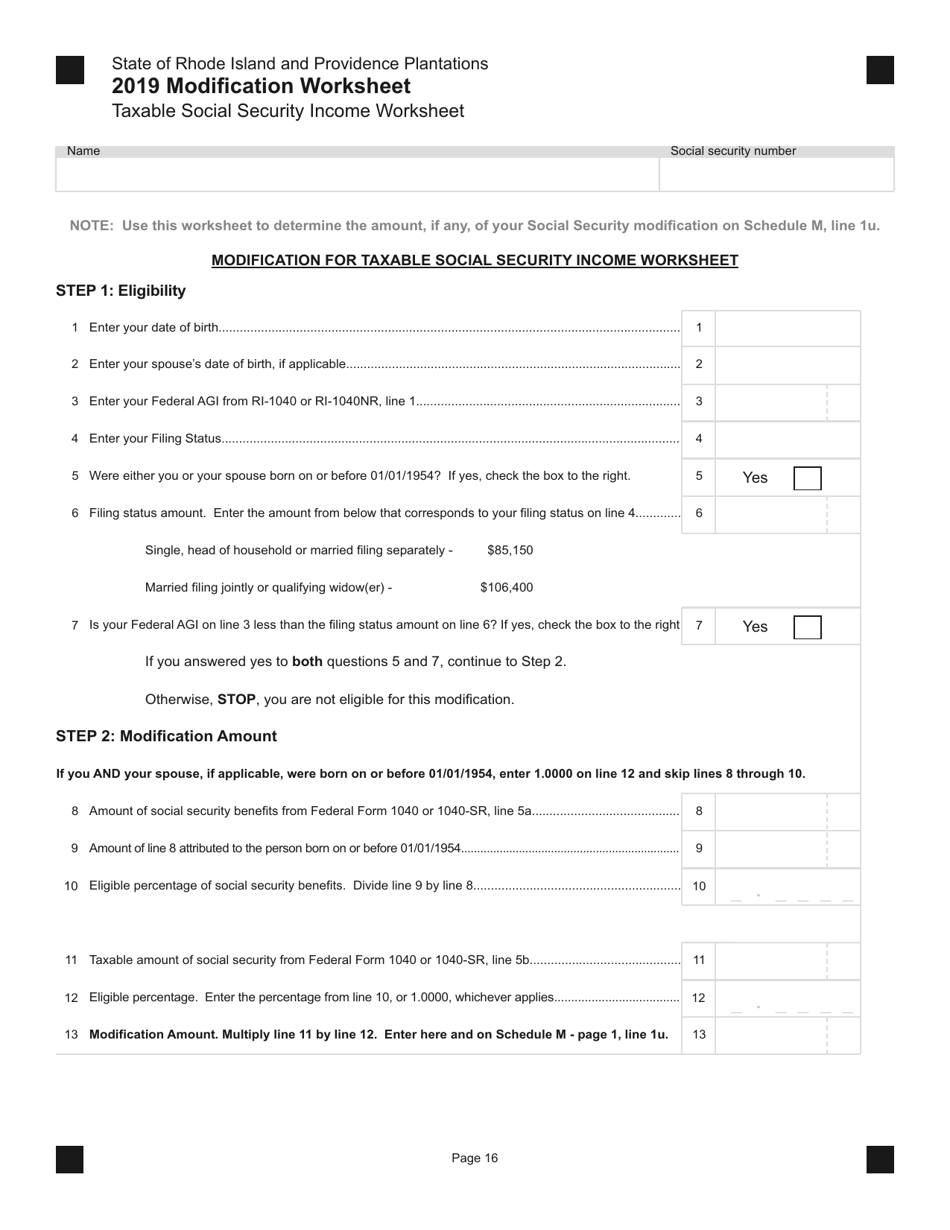

Web where can i find worksheet to calculate taxable amount of social security benefits? Web we developed this worksheet for you to see if your benefits may be taxable for 2022. The irs reminds taxpayers receiving social. Web how to calculate my social security benefits. Web enter your date of birth ( month / day / year format) / /.

Taxable Social Security Worksheet 2021

Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web if that total is more than $32,000, then part of their social security may be taxable. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Web how to.

social security calculation worksheet

The irs reminds taxpayers receiving social. You can use the money help center calculator to determine how much social. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web the taxable amount determined by the projection displays on the social security worksheet (report d16),. Web we developed this.

Calculate Taxable Portion Of Social Security

Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web if that total is more than $32,000, then part of their social security may be taxable. You can use the money help center calculator to determine how much social. If your income is modest, it is likely that.

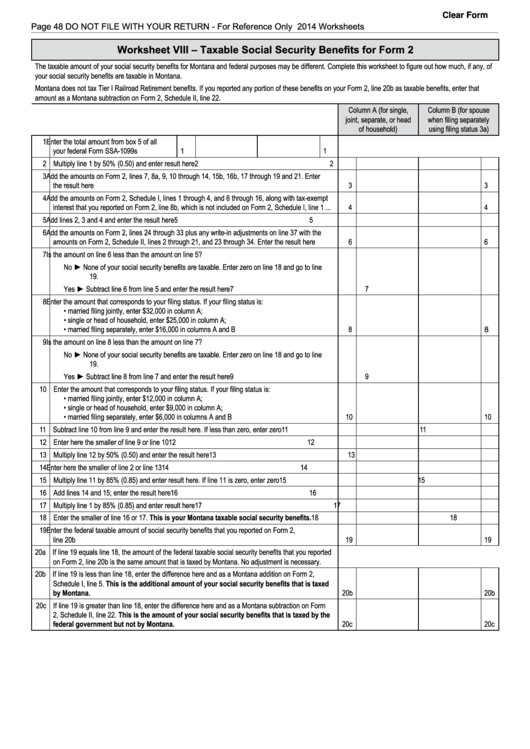

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

If your income is modest, it is likely that none of your social security benefits. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. The irs reminds taxpayers receiving social. Web how to calculate my social security benefits. Web however, the irs helps taxpayers by offering software.

20 New Social Security Calculator Excel Spreadsheet

Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web reminders my social security account. You can use the money help center calculator to determine how.

Irs Social Security Taxable Worksheet

The irs reminds taxpayers receiving social. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Get tax form (1099/1042s) update direct deposit. Web how to calculate my social security benefits.

Ssvf Eligibility Calculation Worksheet

Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. If your income is modest, it is likely that none of your social security benefits. Web if that total is more than $32,000, then part of their social security may be taxable. The irs reminds taxpayers receiving social. Web.

Calculate Taxable Social Security Worksheets

Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. If your income is modest, it is likely that none of your social security benefits. Web the.

The irs reminds taxpayers receiving social. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Get tax form (1099/1042s) update direct deposit. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web the taxable amount determined by the projection displays on the social security worksheet (report d16),. You can use the money help center calculator to determine how much social. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web reminders my social security account. Social security beneficiaries may quickly and easily obtain information from the social security administration's. Web how to calculate my social security benefits. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web where can i find worksheet to calculate taxable amount of social security benefits? Web if that total is more than $32,000, then part of their social security may be taxable. If your income is modest, it is likely that none of your social security benefits. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Note that not everyone pays. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total.

Web You Will Pay Tax On Only 85 Percent Of Your Social Security Benefits, Based On Internal Revenue Service (Irs) Rules.

Web worksheet instead of a publication to find out if any of your benefits are taxable. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total. Get tax form (1099/1042s) update direct deposit. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability.

Web The Taxable Portion Of The Benefits That's Included In Your Income And Used To Calculate Your Income Tax Liability.

This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Web the taxable amount determined by the projection displays on the social security worksheet (report d16),. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%.

Web Reminders My Social Security Account.

Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Social security beneficiaries may quickly and easily obtain information from the social security administration's. You can use the money help center calculator to determine how much social. Web where can i find worksheet to calculate taxable amount of social security benefits?

Web Information About Notice 703, Read This To See If Your Social Security Benefits May Be Taxable, Including Recent.

Note that not everyone pays. The taxable amount, if any, of a. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: