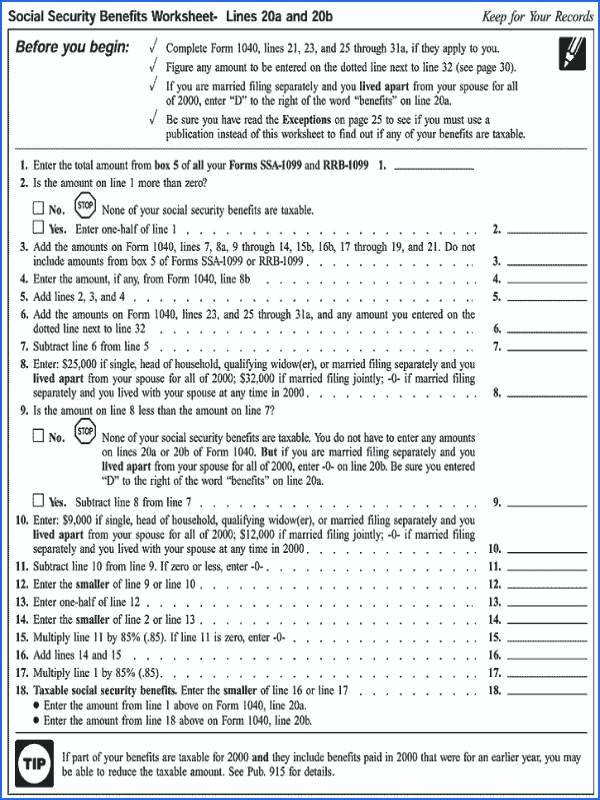

Worksheet 1 Figuring Your Taxable Benefits - Enter the total amount from. Web part of your social security benefits may be taxable if, for 2022, item 1, 2, or 3 below applies to you. Web to figure his taxable benefits, george completes worksheet 1, shown below. Before filling out this worksheet:. Web taxact® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent railroad. Web the taxact ® program supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and. Web social security taxable benefits worksheet (2022) worksheet 1. Web to report on your tax return. Web use the worksheets in appendix b to figure your ira deduction, your nondeductible contribution, and the taxable portion, if any, of your social. Web taxact ® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent.

2018 Form 1040 Social Security Fillable Worksheet 1040 Form Printable

On line 20a of his form 1040, george enters his net benefits of $5,980. If you are married filing separately and you. Web to figure his taxable benefits, george completes worksheet 1, shown below. If your income is modest, it is likely that none of your social security benefits. Enter the total amount from.

Publication 590 Individual Retirement Arrangements (IRAs); How Much

Web the taxact ® program supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and. Web taxact® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent railroad. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web social security taxable benefits worksheet (2022).

Social Security Benefits Worksheet For 2021 Taxes

Web part of your social security benefits may be taxable if, for 2022, item 1, 2, or 3 below applies to you. Web use this worksheet to calculate your taxable social security benefits for 2016. 919 especially if you used the two earner/two job worksheet and your earnings exceed $150,000 (single) or. Web the taxact ® program supports worksheet 1.

Publication 721, Tax Guide to U.S. Civil Service Retirement Benefits

Enter the total amount from. If you are married filing separately and you. Before filling out this worksheet:. On line 20a of his form 1040, george enters his net benefits of $5,980. None of your benefits are taxable.

How To File Taxes With Ssi Benefits

Web worksheet instead of a publication to find out if any of your benefits are taxable. If you are married filing separately and you. None of your benefits are taxable. If you are married filing separately and you. 919 especially if you used the two earner/two job worksheet and your earnings exceed $150,000 (single) or.

Social Security Benefits Formula 2021

Before filling out this worksheet:. More money now or refund later? Web to figure his taxable benefits, george completes worksheet 1, shown below. On line 6a of his form 1040, george. Web use this worksheet to calculate your taxable social security benefits for 2016.

Worksheet 1. Figuring Your Taxable Benefits Keep For Your Records

Web your estimated total annual tax. Web taxact ® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent. 919 especially if you used the two earner/two job worksheet and your earnings exceed $150,000 (single) or. If you are married filing separately and you. Web information about notice 703, read this to see if your.

Coaching our kids with Aspergers Math Worksheet Calculating Tax

Web to figure his taxable benefits, george completes worksheet 1, shown below. Web your estimated total annual tax. If you are married filing separately and you. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web to figure his taxable benefits, george completes worksheet 1, shown below.

DevikaAaiva

Before filling out this worksheet:. Web part of your social security benefits may be taxable if, for 2022, item 1, 2, or 3 below applies to you. If you are married filing separately and you. If your income is modest, it is likely that none of your social security benefits. Web the taxact ® program supports worksheet 1 figuring your.

Worksheet 1 Social Security Benefits Studying Worksheets

Web to report on your tax return. Web part of your social security benefits may be taxable if, for 2022, item 1, 2, or 3 below applies to you. Web use the worksheets in appendix b to figure your ira deduction, your nondeductible contribution, and the taxable portion, if any, of your social. Web taxact® supports worksheet 1 figuring your.

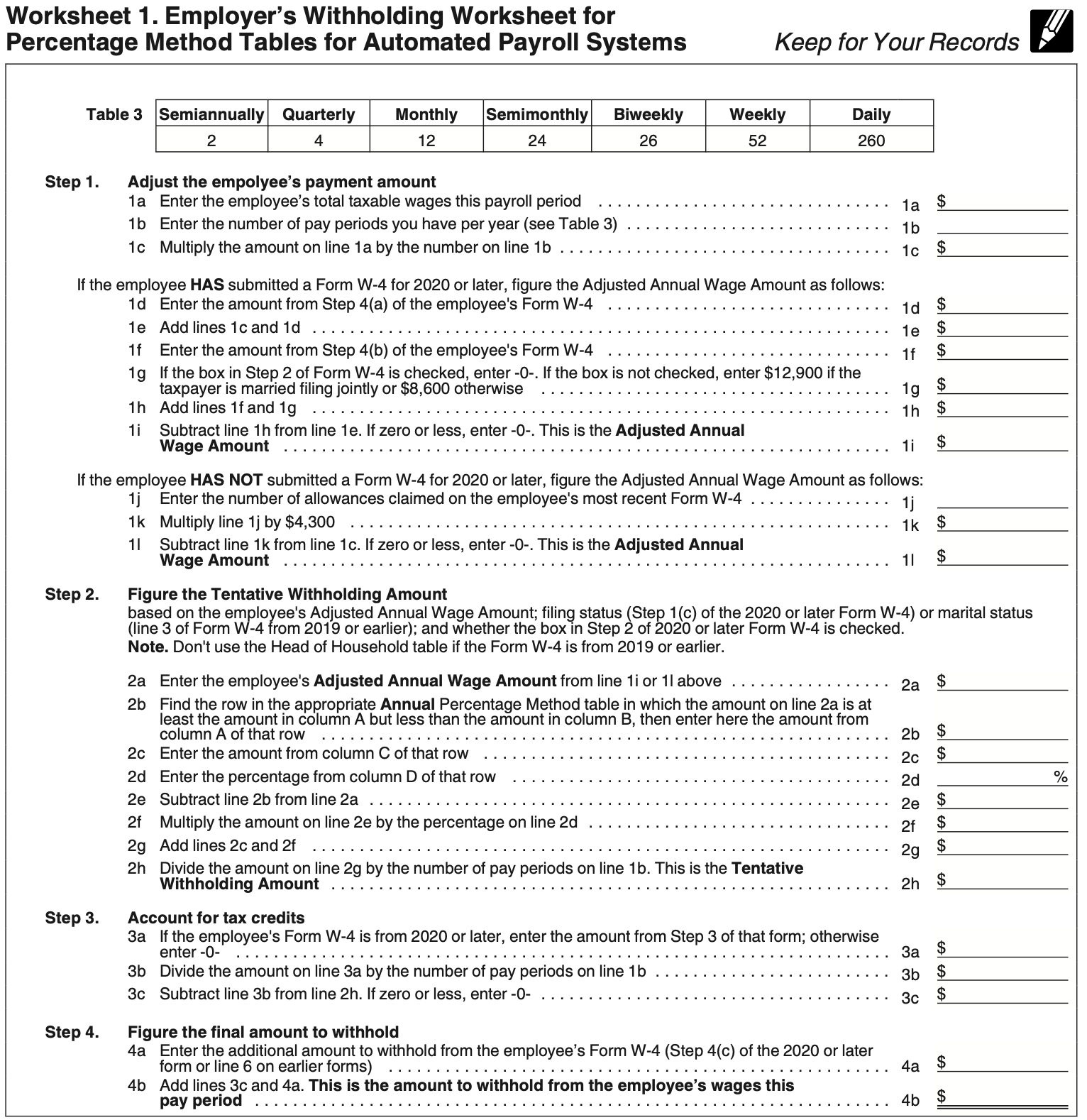

If you are married filing separately and you. Web to figure his taxable benefits, george completes worksheet 1, shown below. Web use this worksheet to calculate your taxable social security benefits for 2016. Web worksheet instead of a publication to find out if any of your benefits are taxable. More money now or refund later? Web taxact® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent railroad. Web part of your social security benefits may be taxable if, for 2022, item 1, 2, or 3 below applies to you. Enter the total amount from. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Web taxact ® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent. Web to figure his taxable benefits, george completes worksheet 1, shown below. Web social security taxable benefits worksheet (2022) worksheet 1. On line 6a of his form 1040, george. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. If you are married filing separately and you. 919 especially if you used the two earner/two job worksheet and your earnings exceed $150,000 (single) or. On line 20a of his form 1040, george enters his net benefits of $5,980. Web the taxact ® program supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and. Web to report on your tax return. Web learn how to report and pay taxes on your social security benefits and equivalent tier 1 railroad retirement benefits in 2022.

Web To Figure His Taxable Benefits, George Completes Worksheet 1, Shown Below.

On line 20a of his form 1040, george enters his net benefits of $5,980. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web part of your social security benefits may be taxable if, for 2022, item 1, 2, or 3 below applies to you. Web use this worksheet to calculate your taxable social security benefits for 2016.

If Your Income Is Modest, It Is Likely That None Of Your Social Security Benefits.

Web taxact® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent railroad. If you are married filing separately and you. Web to figure his taxable benefits, george completes worksheet 1, shown below. Web learn how to report and pay taxes on your social security benefits and equivalent tier 1 railroad retirement benefits in 2022.

On Line 6A Of His Form 1040, George.

If your income will be $200,000 or less ($400,000 or less if married filing jointly): Web taxact ® supports worksheet 1 figuring your taxable benefits from irs publication 915 social security and equivalent. Web your estimated total annual tax. Enter the total amount from.

Web The Taxact ® Program Supports Worksheet 1 Figuring Your Taxable Benefits From Irs Publication 915 Social Security And.

If you are married filing separately and you. Web to report on your tax return. More money now or refund later? None of your benefits are taxable.