What Is A Fair Tax Worksheet Answers - Web the fairtax is a national sales tax that treats every person equally and allows american businesses to thrive, while generating the. Web assessment solutions theme 3: Regressive tax ($1,000 per person) income percent of income paid in. Web getting answers to your tax questions. Web do you think the income tax is fair? Comparing regressive, progressive, and proportional taxes. Examine the specific taxes listed below. You are a factory worker in 1909, working long hours and making little money. Organize students into three groups and assign each group one of the. Web in this what is a fair tax worksheet, students read about different types of taxes, solve problems, and answer questions (including those requiring an opinion.

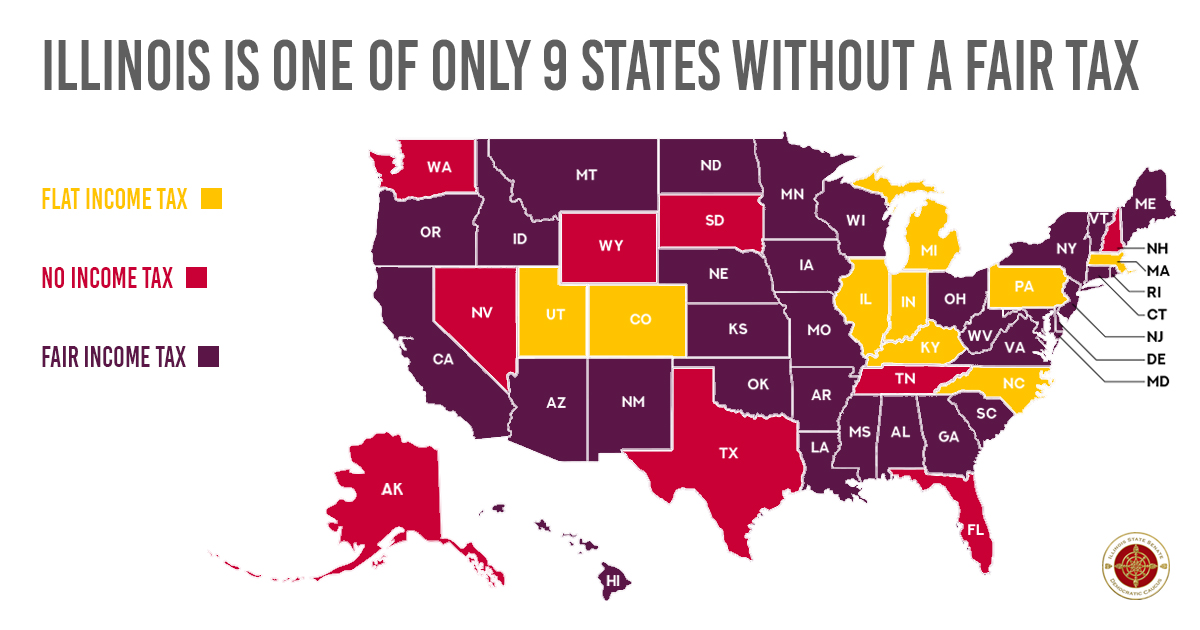

Murphy votes for a fair tax plan to protect the middle class

Web the fairtax is a national sales tax that treats every person equally and allows american businesses to thrive, while generating the. Web key words and concepts. Web the short answer is that there is no provision in the fairtax bill (hr 25) that would prevent having a national sales tax and the income tax. Web assessment solutions theme 3:.

Tax Commission And Tip Worksheet Answers Worksheet Resume Examples

Web use the chart below to answer the following questions. Web in this what is a fair tax worksheet, students read about different types of taxes, solve problems, and answer questions (including those requiring an opinion. Web schedule d tax worksheet. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step.

Find your local Fair Tax business Launch of the Fair Tax Map Tax

You are a factory worker in 1909, working long hours and making little money. Web getting answers to your tax questions. Web the fairtax is a national sales tax that treats every person equally and allows american businesses to thrive, while generating the. Web the fair tax system is a tax system that eliminates income taxes (including payroll taxes) and.

Get Ready to Vote Yes! For the Fair Tax Amendment Greater Palatine

Child tax credit and credit for other dependents. Web getting answers to your tax questions. Identify what each tax is intended to fund. Examine the specific taxes listed below. Organize students into three groups and assign each group one of the.

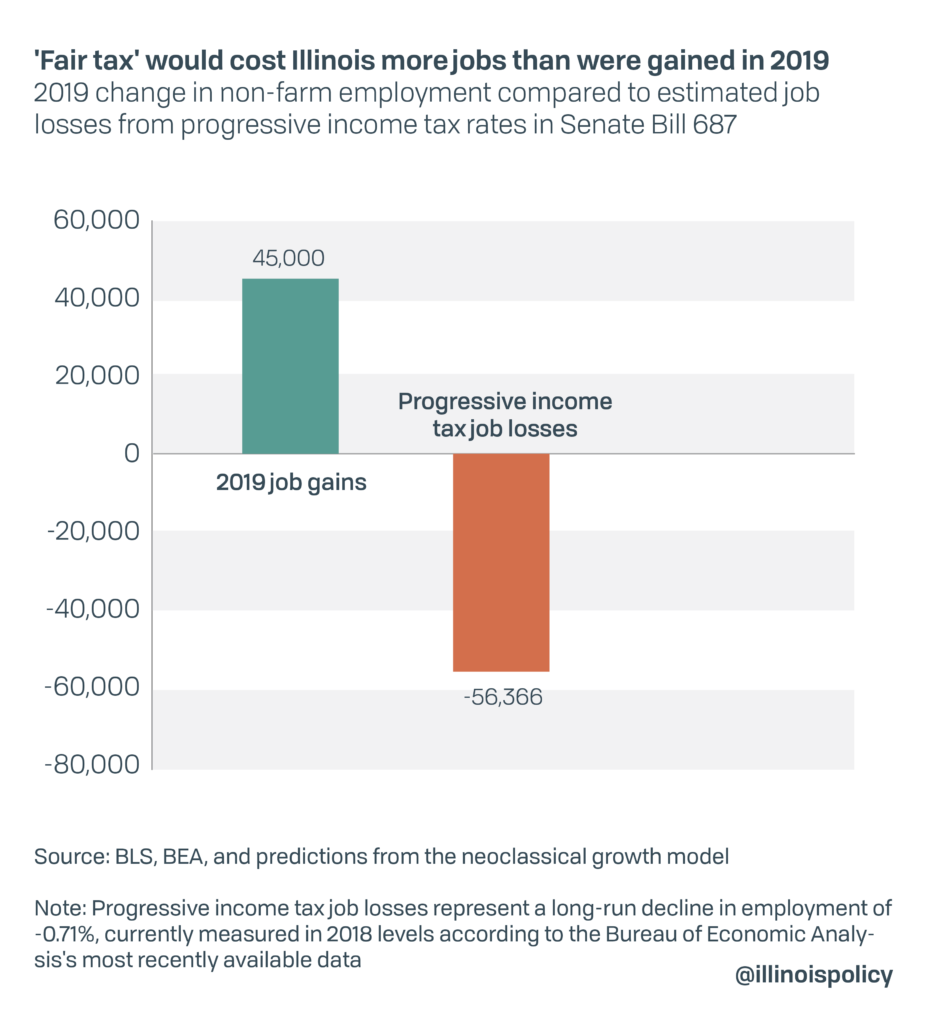

‘Fair tax’ would cost Illinois 56K jobs Madison St. Clair Record

Regressive tax ($1,000 per person) income percent of income paid in. Web print and distribute info sheet—what is fair? Web do you think the income tax is fair? Web a concept of tax fairness that states that people with different amounts of wealth or different amounts of income should pay. Web in this what is a fair tax worksheet, students.

Woodhugger Engineering web logs You Do The Math Flat Tax Fair Tax

You are a factory worker in 1909, working long hours and making little money. Web assessment solutions theme 3: People who use roads more consumer more gasoline, the federal gas tax is paid in each gallon of gas purchased, the tax is. Web do you think the income tax is fair? Web federal tax legislative process to suggest that a.

What is a FAIR TAX for Illinois? SEIU Local 73

Fairness in taxes lesson 1: Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward. How to figure your tax. Web the fair tax system is a tax system that eliminates income taxes (including payroll taxes) and replaces them with a sales or consumption tax. Web the fairtax is a.

Whatever happened to Fair Tax Flat Tax Proposals we heard about earlier

Web the short answer is that there is no provision in the fairtax bill (hr 25) that would prevent having a national sales tax and the income tax. Web do you think the income tax is fair? How to figure your tax. Write the letter of the goal or goals lawmakers had in mind when they created. Child tax credit.

Pritzker Fair Tax Plan IATSE Local 769 Chicago

Web activity 1 different types of taxes are listed below. Regressive tax ($1,000 per person) income percent of income paid in. Web federal tax legislative process to suggest that a federal consumption tax would be untainted by special interest provisions.’’8. Comparing regressive, progressive, and proportional taxes. Web key terms ability to pay—a concept of tax fairness that states that people.

8 Fair Tax System For Your Business Smith & Smith CPA's

Web key terms ability to pay—a concept of tax fairness that states that people with different amounts of wealth or different amounts of. Web there are 12 questions on each worksheet, asking students what is the final price with sales tax? Organize students into three groups and assign each group one of the. Web understanding why and how taxes and.

Write the letter of the goal or goals lawmakers had in mind when they created. Organize students into three groups and assign each group one of the. Identify what each tax is intended to fund. Web print and distribute info sheet—what is fair? Fairness in taxes lesson 1: Qualified dividends and capital gain tax worksheet. Web a concept of tax fairness that states that people with different amounts of wealth or different amounts of income should pay. Examine the specific taxes listed below. Regressive tax ($1,000 per person) income percent of income paid in. Getting tax forms, instructions, and publications. Web getting answers to your tax questions. Web key words and concepts. Web schedule d tax worksheet. Web the short answer is that there is no provision in the fairtax bill (hr 25) that would prevent having a national sales tax and the income tax. Web there are 12 questions on each worksheet, asking students what is the final price with sales tax? How to figure your tax. Web use the chart below to answer the following questions. Comparing regressive, progressive, and proportional taxes. Web key terms ability to pay—a concept of tax fairness that states that people with different amounts of wealth or different amounts of. Child tax credit and credit for other dependents.

With A Picture Visual Of What.

Web the fair tax system is a tax system that eliminates income taxes (including payroll taxes) and replaces them with a sales or consumption tax. Getting tax forms, instructions, and publications. Comparing regressive, progressive, and proportional taxes. Web a concept of tax fairness that states that people with different amounts of wealth or different amounts of income should pay.

Web Key Words And Concepts.

Examine the specific taxes listed below. Web print and distribute info sheet—what is fair? Web the fairtax is a national sales tax that treats every person equally and allows american businesses to thrive, while generating the. You are a factory worker in 1909, working long hours and making little money.

Web Use The Chart Below To Answer The Following Questions.

Identify what each tax is intended to fund. Write the letter of the goal or goals lawmakers had in mind when they created. Web do you think the income tax is fair? Web schedule d tax worksheet.

Organize Students Into Three Groups And Assign Each Group One Of The.

Web getting answers to your tax questions. People who use roads more consumer more gasoline, the federal gas tax is paid in each gallon of gas purchased, the tax is. Fairness in taxes lesson 1: Web activity 1 different types of taxes are listed below.