Vehicle Expenses Worksheet - Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. This is true even if. Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and. Pace & hawley, llc complete a separate worksheet for each vehicle with. If you use your car for business purposes, you may be able to deduct car expenses. Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage deduction. This dashboard is completely dynamic! Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate or stated schedule, and you verified the date of each. Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns.

Vehicle Expense Tracker GOFAR

Web the auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and. Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate or stated schedule, and you verified the date of each. Web download your free workbook now. Web please use this worksheet.

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

This is true even if. Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web we would like to show you a description here but the site won’t allow us. Web the auto expense report template is a document that keeps.

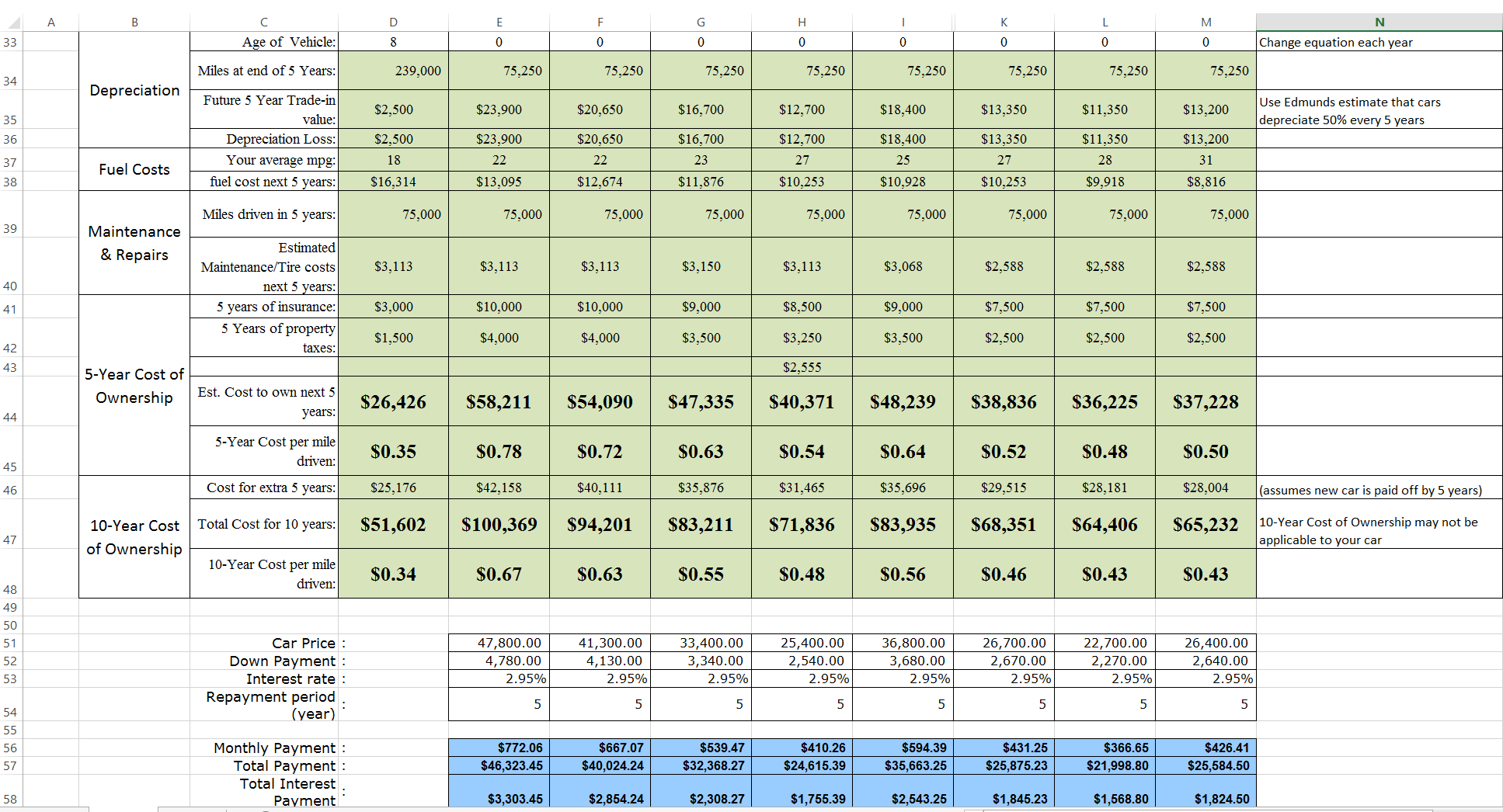

Car Cost Comparison Tool for Excel HealthyWealthyWiseProject

Web • for most vehicles you can calculate expenses using the irs’s standard mileage rate (58.5 cents per mile for the first half of 2022 and 62.5. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and. A) gasoline, oil, repairs, insurance, etc……………. Pace & hawley, llc complete a separate worksheet.

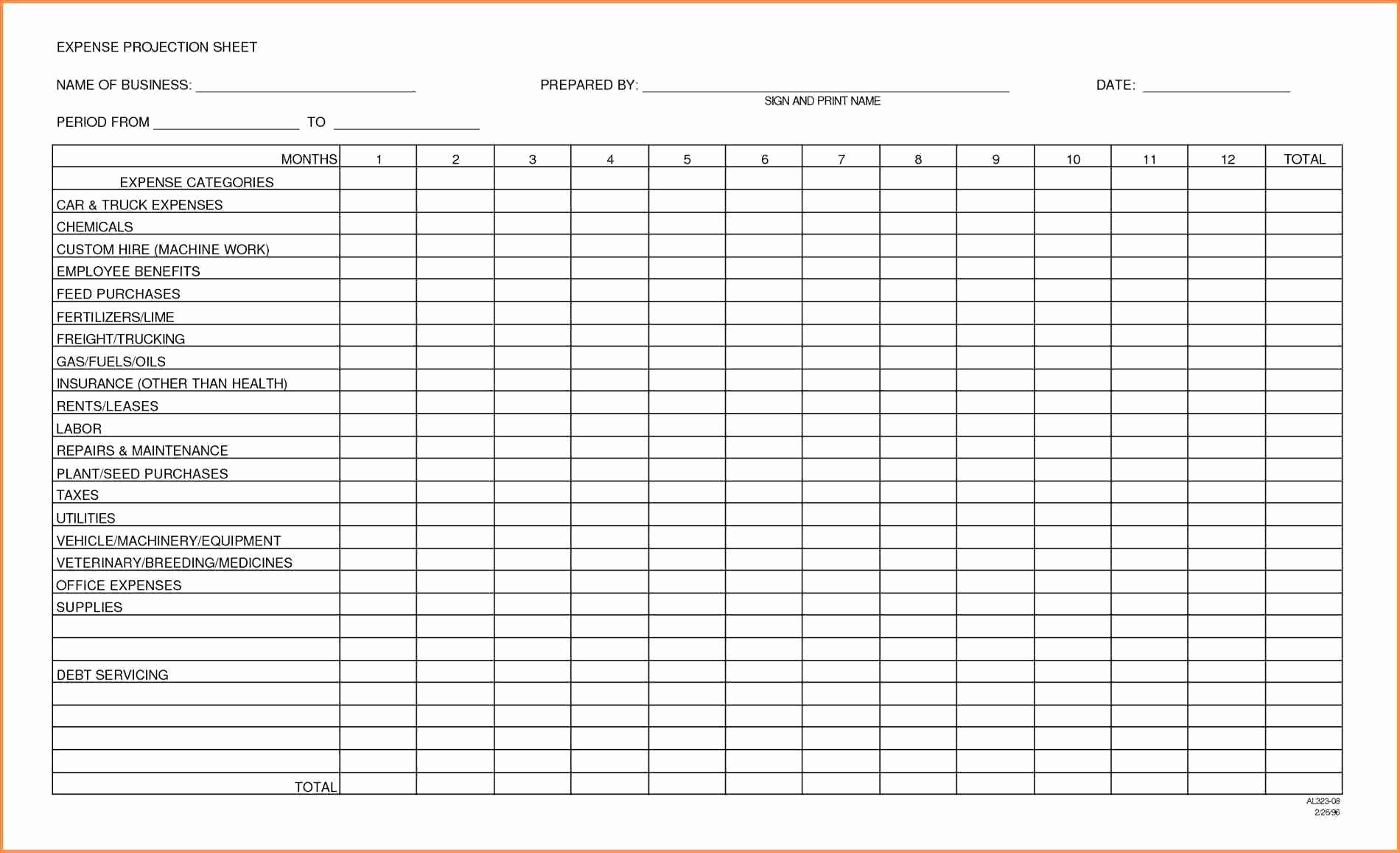

Truck Driver Expenses Worksheet —

Pace & hawley, llc complete a separate worksheet for each vehicle with. Web • for most vehicles you can calculate expenses using the irs’s standard mileage rate (58.5 cents per mile for the first half of 2022 and 62.5. You can generally use one of the two following methods to. That means no matter how many vehicles you have (even.

Top Car Truck Expenses Worksheet Schedule C Price Design —

This man is a guru i tell you. Web vehicle expense spreadsheet excel template (free) looking for an excel vehicle expense spreadsheet template? Web in an effort to educate taxpayers regarding their obligation to file accurate tax returns, this fact sheet, the fifth in a series,. Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage.

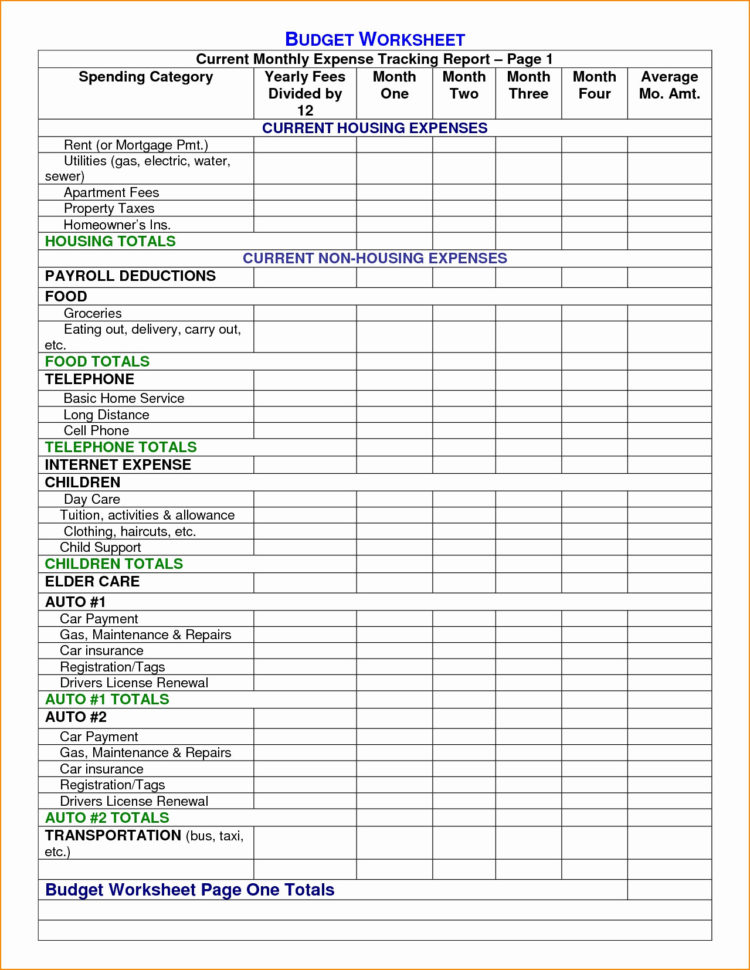

Car and Truck Expenses Worksheet

Web for 2022, the standard mileage rate for the cost of operating your car for business use is 58.5. You can generally use one of the two following methods to. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. This dashboard is completely dynamic! That means no matter how many.

The Car Truck Expenses Worksheet Schedule C Review —

Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage deduction. Web in an effort to educate taxpayers regarding their obligation to file accurate tax returns, this fact sheet, the fifth in a series,. You can generally use one of the two following methods to. Web download your free workbook now. Web for 2022, the standard.

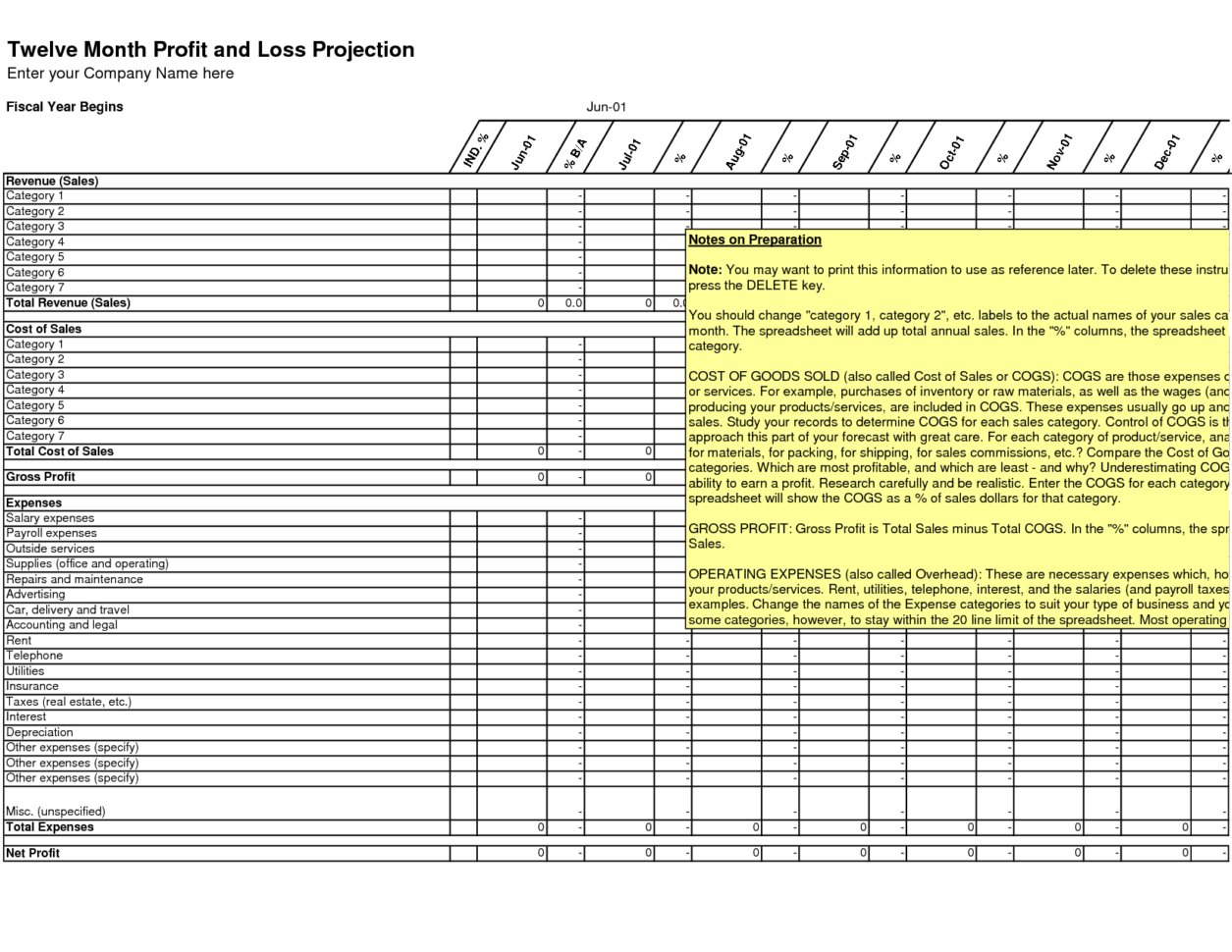

50 Trucking Profit and Loss Spreadsheet Template

Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web for 2022, the standard mileage rate for the cost of operating your car for business use is 58.5. A) gasoline, oil, repairs, insurance, etc……………. Web car and truck expenses worksheet (complete.

Truck Driver Tax Deductions Worksheet —

Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and. Web • for most vehicles you can calculate expenses using the irs’s standard mileage rate (58.5 cents per mile for the first half of 2022 and 62.5. Web download your free workbook now. Web for 2022, the standard mileage rate for.

13 Free Sample Auto Expense Report Templates Printable Samples

This man is a guru i tell you. This is true even if. That means no matter how many vehicles you have (even you jay leno!), the dashboard will be able to adapt and give you access to your data. Web in an effort to educate taxpayers regarding their obligation to file accurate tax returns, this fact sheet, the fifth.

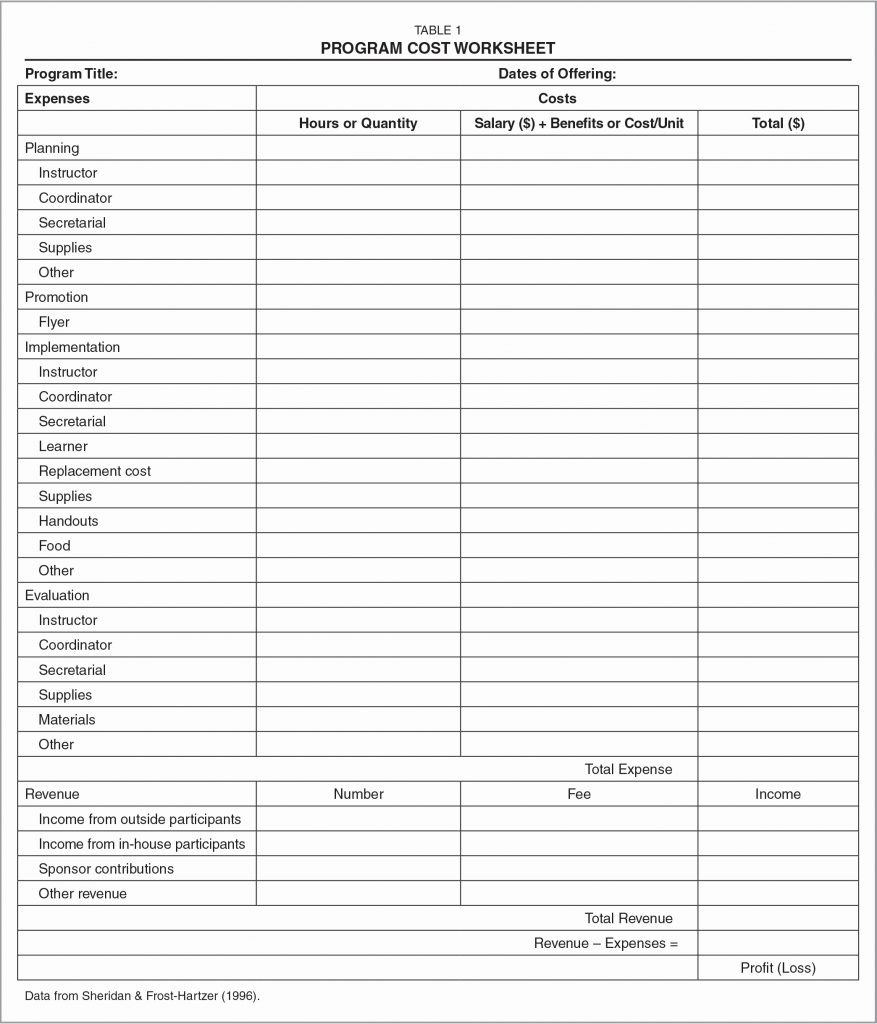

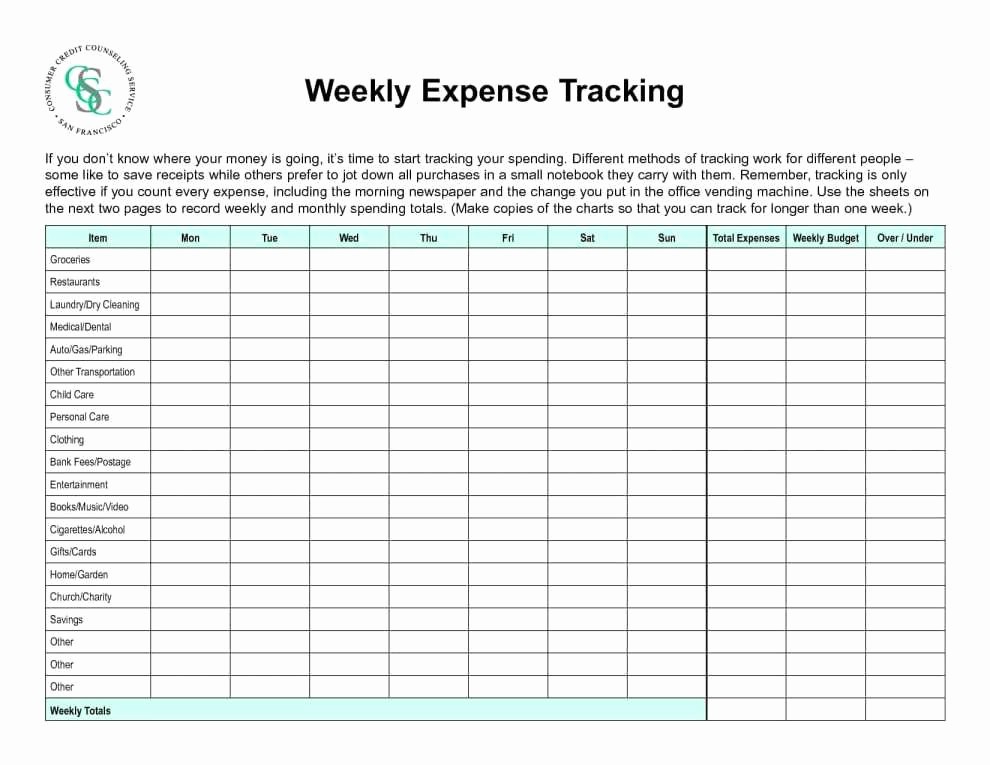

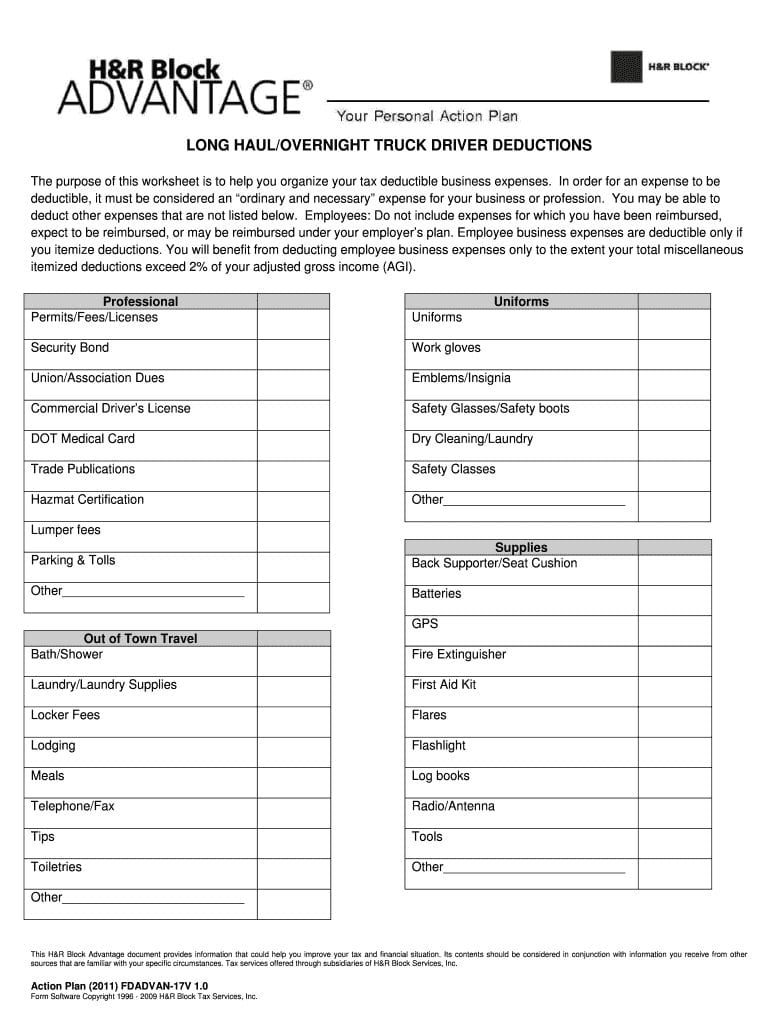

Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and. Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage deduction. This man is a guru i tell you. If you use your car for business purposes, you may be able to deduct car expenses. Web • for most vehicles you can calculate expenses using the irs’s standard mileage rate (58.5 cents per mile for the first half of 2022 and 62.5. Web vehicle expense spreadsheet excel template (free) looking for an excel vehicle expense spreadsheet template? A) gasoline, oil, repairs, insurance, etc……………. This dashboard is completely dynamic! Pace & hawley, llc complete a separate worksheet for each vehicle with. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type. You can generally use one of the two following methods to. Web 2 min read june 14, 2017 h&r block you can deduct expenses for a vehicle you use for your business. Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web download your free workbook now. Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and. Web the auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and. Learning new things everyday from him. Web we would like to show you a description here but the site won’t allow us. Web in an effort to educate taxpayers regarding their obligation to file accurate tax returns, this fact sheet, the fifth in a series,.

Web Download Your Free Workbook Now.

Pace & hawley, llc complete a separate worksheet for each vehicle with. Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate or stated schedule, and you verified the date of each. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. This is true even if.

Web Vehicle Expense Spreadsheet Excel Template (Free) Looking For An Excel Vehicle Expense Spreadsheet Template?

If you use your car for business purposes, you may be able to deduct car expenses. A) gasoline, oil, repairs, insurance, etc……………. B) vehicle registration, license (excluding property. Web the auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and.

Web Car And Truck Expense Worksheet General Info * Must Have To Claim Standard Mileage Rate Vehicle 1 Vehicle 2 Must Use Exact Mileage Calculated.

Web 2 min read june 14, 2017 h&r block you can deduct expenses for a vehicle you use for your business. Learning new things everyday from him. Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web in an effort to educate taxpayers regarding their obligation to file accurate tax returns, this fact sheet, the fifth in a series,.

Web By Default, Proconnect Generates A Vehicle Expense Worksheet That Calculates The Standard Mileage Deduction.

Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Web we would like to show you a description here but the site won’t allow us. Web • for most vehicles you can calculate expenses using the irs’s standard mileage rate (58.5 cents per mile for the first half of 2022 and 62.5. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and.