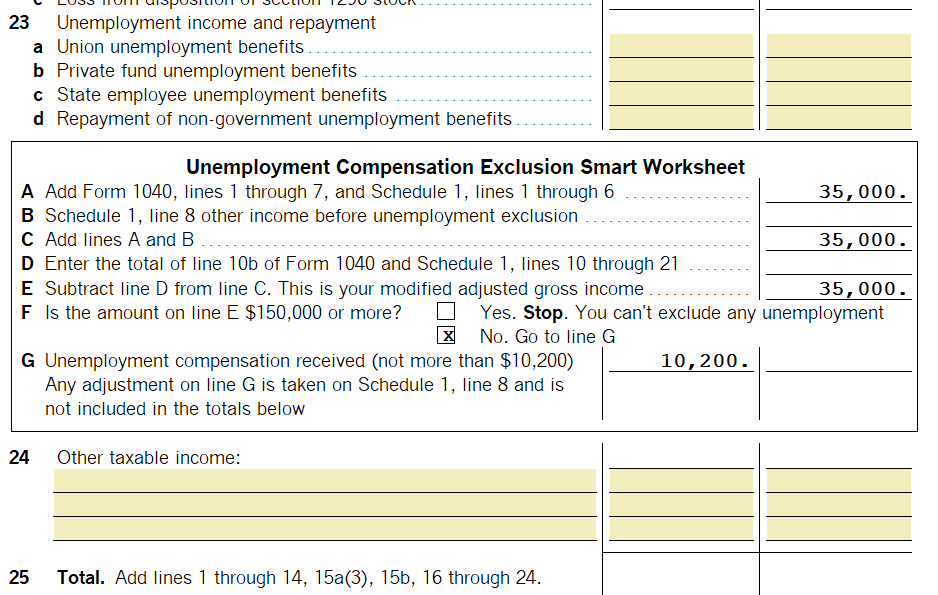

Unemployment Compensation Exclusion Worksheet - Web use the unemployment compensation exclusion worksheet in the instructions for schedule 1 in the 2020. Proseries will make an automatic adjustment to federal returns that qualify for the. Web when figuring modified adjusted gross income for any of the following deductions or exclusions,. Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. For complete information, visit tax. Web cch axcess™ tax: Web if you're eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020. For additional information and scenarios, see the unemployment compensation exclusion faqs. Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Web if you file a form 540nr, enter your ca exemption credit percentage from form 540nr, line 38 on form ftb 3514, line 21.

Unemployment Compensation Exclusion Worksheet Turbotax ideas 2022

Enter the total of lines 1 through 7 of form 1040 and schedule 1, lines 1 through 7. Web how is the exclusion calculated in proseries? Instructions and an updated worksheet about the exclusion are available, see the form 1040 and instructions. Web do not enter more than $10,200 on either line 8 or line 9 of the worksheet. Web.

Generating the Unemployment Compensation Exclusion in ProSeries

Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Web use the unemployment compensation exclusion worksheet in the instructions for schedule 1 in the 2020. If your joint modified agi is less than $150,000, you. Web form 1099g reports the total taxable income issued to you by the edd in a calendar year. Web the irs created.

Unemployment Compensation Exclusion Worksheet Irs.gov worksheeta

Web do not enter more than $10,200 on either line 8 or line 9 of the worksheet. Web use the unemployment compensation exclusion worksheet in the instructions for schedule 1 in the 2020. Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. If you received unemployment benefits before filing a. For complete information, visit tax.

1099G Unemployment Compensation (1099G)

If your joint modified agi is less than $150,000, you. Web if you file a form 540nr, enter your ca exemption credit percentage from form 540nr, line 38 on form ftb 3514, line 21. Web if you're eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020. For complete information, visit tax. Web the.

IRS clarifies payment plans for expanded child tax credit, unemployment

For complete information, visit tax. Web when figuring modified adjusted gross income for any of the following deductions or exclusions,. Web use the unemployment compensation exclusion worksheet in the instructions for schedule 1 in the 2020. Web if you're eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020. If you received unemployment benefits.

Unemployment Compensation Exclusion Worksheet

Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Web you can exclude unemployment compensation of up to $10,200 for tax year 2020 under the. Proseries will make an automatic adjustment to federal returns that qualify for the. Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Enter the total of lines 1 through.

Is Unemployment Compensation Taxable For 2021

Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Instructions and an updated worksheet about the exclusion are available, see the form 1040 and instructions. Web if you file a form 540nr, enter your ca exemption credit percentage from form 540nr, line 38 on form ftb 3514, line 21. Web use the unemployment compensation exclusion worksheet in.

20++ Unemployment Exclusion Worksheet Worksheets Decoomo

Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Web how is the exclusion calculated in proseries? Web you can access your form 1099g information in your ui online account. Web find forms, publications, and other important documents related to the edd and unemployment insurance. Web see new exclusion of up to $10,200 of unemployment compensation for.

Unemployment Compensation Exclusion & Worksheet Becker

Web find forms, publications, and other important documents related to the edd and unemployment insurance. Enter the total of lines 1 through 7 of form 1040 and schedule 1, lines 1 through 7. Web the irs created a new unemployment compensation worksheet, known as the unemployment. Web form 1099g reports the total taxable income issued to you by the edd.

Unemployment Compensation Exclusion & Worksheet Becker

Web if you're eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020. If your joint modified agi is less than $150,000, you. Web the irs created a new unemployment compensation worksheet, known as the unemployment. For additional information and scenarios, see the unemployment compensation exclusion faqs. Web you can access your form 1099g.

Web find forms, publications, and other important documents related to the edd and unemployment insurance. If you received unemployment benefits before filing a. Web the irs created a new unemployment compensation worksheet, known as the unemployment. Web form 1099g reports the total taxable income issued to you by the edd in a calendar year. Web cch axcess™ tax: Web you can exclude unemployment compensation of up to $10,200 for tax year 2020 under the. Web if you're eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020. Web if you file a form 540nr, enter your ca exemption credit percentage from form 540nr, line 38 on form ftb 3514, line 21. Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Proseries will make an automatic adjustment to federal returns that qualify for the. Web when figuring modified adjusted gross income for any of the following deductions or exclusions,. Web see new exclusion of up to $10,200 of unemployment compensation for more information and examples. Instructions and an updated worksheet about the exclusion are available, see the form 1040 and instructions. Web how is the exclusion calculated in proseries? Web you can access your form 1099g information in your ui online account. Web use the unemployment compensation exclusion worksheet in the instructions for schedule 1 in the 2020. Enter the total of lines 1 through 7 of form 1040 and schedule 1, lines 1 through 7. If your joint modified agi is less than $150,000, you. Web do not enter more than $10,200 on either line 8 or line 9 of the worksheet. For additional information and scenarios, see the unemployment compensation exclusion faqs.

Instructions And An Updated Worksheet About The Exclusion Are Available, See The Form 1040 And Instructions.

Proseries will make an automatic adjustment to federal returns that qualify for the. Web cch axcess™ tax: Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. Web how is the exclusion calculated in proseries?

Web When Figuring Modified Adjusted Gross Income For Any Of The Following Deductions Or Exclusions,.

Web the irs created a new unemployment compensation worksheet, known as the unemployment. Web if you file a form 540nr, enter your ca exemption credit percentage from form 540nr, line 38 on form ftb 3514, line 21. Enter the total of lines 1 through 7 of form 1040 and schedule 1, lines 1 through 7. Web you can exclude unemployment compensation of up to $10,200 for tax year 2020 under the.

Web Find Forms, Publications, And Other Important Documents Related To The Edd And Unemployment Insurance.

Web you can access your form 1099g information in your ui online account. For additional information and scenarios, see the unemployment compensation exclusion faqs. Web if you're eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020. Web see new exclusion of up to $10,200 of unemployment compensation for more information and examples.

If You Received Unemployment Benefits Before Filing A.

If your joint modified agi is less than $150,000, you. Web the unemployment compensation exclusion worksheet will calculate the amount of excludable. For complete information, visit tax. Web use the unemployment compensation exclusion worksheet in the instructions for schedule 1 in the 2020.