Turbotax Carryover Worksheet - Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Turbotax fills out the section 179 worksheet for you from your entries in this section. Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms icon. Turbotax fills it out for you based on your 2019. Web what is the federal carryover worksheet in turbotax? Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web to find your capital loss carryover amount you need to look at your return schedule d page 2. Web you would not carry over your 2019 income to this worksheet.

20182023 Form IRS Capital Loss Carryover Worksheet Fill Online

Web you would not carry over your 2019 income to this worksheet. For instance, if you are not. Web 16 29,459 reply bookmark icon lisabr new member federal carryovers can be losses, deductions and other entries,. Web click on my turbotax (click on my tax timeline in the drop down menu) scroll down where is says prior year. Web where.

21+ 2020 Capital Loss Carryover Worksheet ShilpaDaanya

Turbotax fills out the section 179 worksheet for you from your entries in this section. Turbotax fills it out for you based on your 2019. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing. Web capital loss carry over. Web where do i find my federal.

Capital Loss Carryover Worksheet slidesharedocs

Web february 7, 2020 9:53 am. If you had your return professionally. Turbotax fills out the section 179 worksheet for you from your entries in this section. Enter the section 179 as a positive number on line a. Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms.

What Is A Federal Carryover Worksheet

Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your. Web how do i find federal carryover worksheet? Turbotax fills it out for you based on your 2019. Web 16 29,459 reply bookmark icon lisabr new member.

Solved NOL Carryforward worksheet or statement

Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. Web click on my turbotax.

What Is A Federal Carryover Worksheet

I had a substantial loss on stocks, $9,000.00, last year (2019). Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web you would not carry over your 2019 income to this worksheet. Web capital loss carry over. Web if you used the desktop version or have the complete pdf of your last.

Carryover Worksheet Automatic Entry

Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms icon. Web how do i find federal carryover worksheet? I had a substantial loss on stocks, $9,000.00, last year (2019). Web what is the federal carryover worksheet in turbotax? Web in turbotax desktop, form 3800, part ii, line.

Carryover Worksheet Turbotax

Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. I had a substantial loss on stocks, $9,000.00, last year (2019). Web how do i find federal carryover worksheet? Web you would not.

Carryover Worksheet Turbotax

Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your. Web click on my turbotax (click on my tax timeline in the drop down menu) scroll down where is says prior year. Web turbotax will fill out the carryover worksheet for you from this year to use next year..

California Capital Loss Carryover Worksheet

Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms icon. Web scroll down to the carryovers to 2022 smart worksheet. Web turbotax will fill out the carryover worksheet for you from this year to use next year. Web if you used the desktop version or have the.

Line 24, of the carryover worksheet is section 179 expense deduction disallowed. Turbotax fills out the section 179 worksheet for you from your entries in this section. For instance, if you are not. Web if you used the desktop version or have the complete pdf of your last year's return you might have the capital. Web 16 29,459 reply bookmark icon lisabr new member federal carryovers can be losses, deductions and other entries,. Turbotax fills it out for you based on your 2019. Web how do i find federal carryover worksheet? Web 10,311 bookmark icon marilyng1 expert alumni type 'nol' in the search area, then click on ' jump to nol'. I did not use turbotax in 2015. Web what is the federal carryover worksheet in turbotax? Web february 7, 2020 9:53 am. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web to find your capital loss carryover amount you need to look at your return schedule d page 2. Web for nol carryover purposes, you must reduce any charitable contributions carryover to the extent that the nol carryover on line 10 is increased by any. Web turbotax will fill out the carryover worksheet for you from this year to use next year. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing. Web scroll down to the carryovers to 2022 smart worksheet. Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your.

Web Single Filers Who Paid $300 Or Less In Foreign Taxes, And Married Joint Filers Who Paid $600 Or Less, Can Omit Filing.

If you had your return professionally. For instance, if you are not. Web february 7, 2020 9:53 am. Web sign in to your turbotax account and open your return by selecting continue or pick up where you left off in.

I Had A Substantial Loss On Stocks, $9,000.00, Last Year (2019).

Turbotax fills out the section 179 worksheet for you from your entries in this section. Web capital loss carry over. Web how do i find federal carryover worksheet? Web you would not carry over your 2019 income to this worksheet.

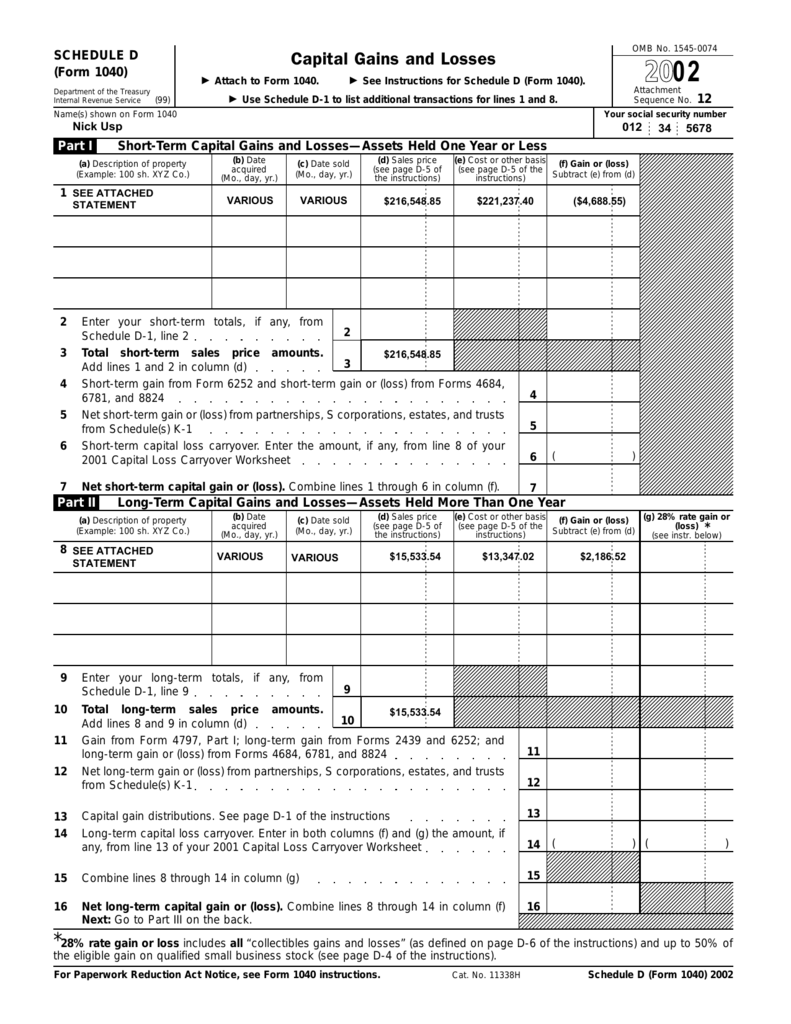

Web To Find Your Capital Loss Carryover Amount You Need To Look At Your Return Schedule D Page 2.

Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web scroll down to the carryovers to 2022 smart worksheet.

Web Click On My Turbotax (Click On My Tax Timeline In The Drop Down Menu) Scroll Down Where Is Says Prior Year.

Web what is the federal carryover worksheet in turbotax? Web if you used the desktop version or have the complete pdf of your last year's return you might have the capital. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and. I did not use turbotax in 2015.