Truck Expenses Worksheet - Web method worksheet in the instructions to figure the amount to enter on line 30. Web cost for operating a truck fall under two general categories; Web this truck driver expenses worksheet form can help make the process a little easier. Web deductible car and truck expenses ordinarily, expenses related to use of a car, van, pickup or panel truck for business can. Make & model of vehicle. With this form, you can track your mileage, fuel costs, and other. Web 2020 tax year car and truck expense worksheet. An ordinary expense is one that is. Web what does this mean? Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type.

Truck Driver Expense Spreadsheet Tagua

Web 2020 tax year car and truck expense worksheet. An ordinary expense is one that is. Car & truck expenses worksheet (ford fusion): Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs. Web method worksheet in the instructions to figure the amount to enter on line 30.

Truck Driver Expense Spreadsheet Free —

Web this truck driver expenses worksheet form can help make the process a little easier. Financial projections template for a trucking company; Web cost for operating a truck fall under two general categories; Postage, stationery, office supplies, bank charges, pens, faxes, etc. Make & model of vehicle.

Car And Truck Expenses Worksheet —

Web what does this mean? Web last updated february 12, 2023. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type. With this form, you can track your mileage, fuel costs, and other. Trucker’s income & expense worksheet;

Truck Driver Expense Spreadsheet Free Trucking Spreadsheet Templates to

Web method worksheet in the instructions to figure the amount to enter on line 30. Car & truck expenses worksheet (ford fusion): Financial projections template for a trucking company; An ordinary expense is one that is. Web 20212021 tax year car and truck expense worksheet.

Truck Driver Expense Spreadsheet —

Financial projections template for a trucking company; Postage, stationery, office supplies, bank charges, pens, faxes, etc. Web cost for operating a truck fall under two general categories; Web deductible car and truck expenses ordinarily, expenses related to use of a car, van, pickup or panel truck for business can. An ordinary expense is one that is.

Trucking Accounting Spreadsheet —

An ordinary expense is one that is. Web 20212021 tax year car and truck expense worksheet. Web last updated february 12, 2023. Postage, stationery, office supplies, bank charges, pens, faxes, etc. Web what does this mean?

Truck Driver Expenses Worksheet —

Make & model of vehicle. Trucker’s income & expense worksheet; This article will show you everything you should include in a trucking expenses. Web deductible car and truck expenses ordinarily, expenses related to use of a car, van, pickup or panel truck for business can. Web the depreciation limitations for passenger automobiles placed in service during calendar year 2022 for.

Trucking Accounting Spreadsheet —

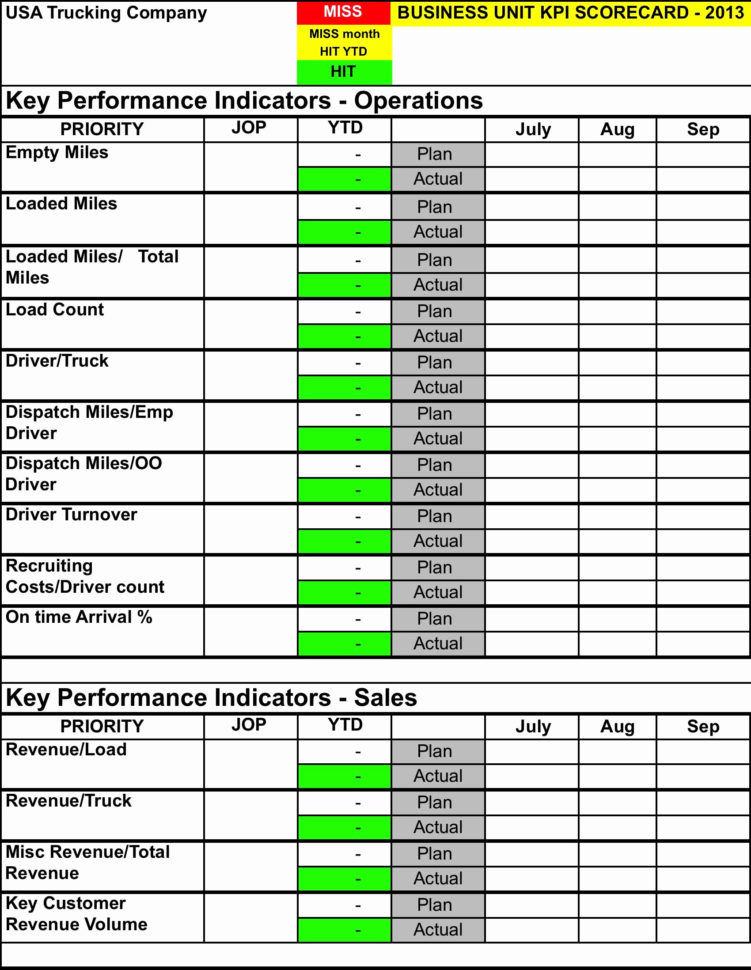

Financial projections template for a trucking company; Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in. This article will show you everything you should include in a trucking expenses. Vehicle information vehicle 1 vehicle 2 vehicle 3 (complete. Web deductible car and truck expenses ordinarily, expenses related to use of.

Car and Truck Expenses Worksheet

Vehicle information vehicle 1 vehicle 2 vehicle 3 (complete. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type. Web this truck driver expenses worksheet form can help make the process a little easier. Financial projections template for a trucking company; Web the depreciation limitations for passenger.

Truck Driver Expense Blank Forms Fill Online Printable —

Web method worksheet in the instructions to figure the amount to enter on line 30. Web 20212021 tax year car and truck expense worksheet. Web cost for operating a truck fall under two general categories; Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs. An ordinary expense is one.

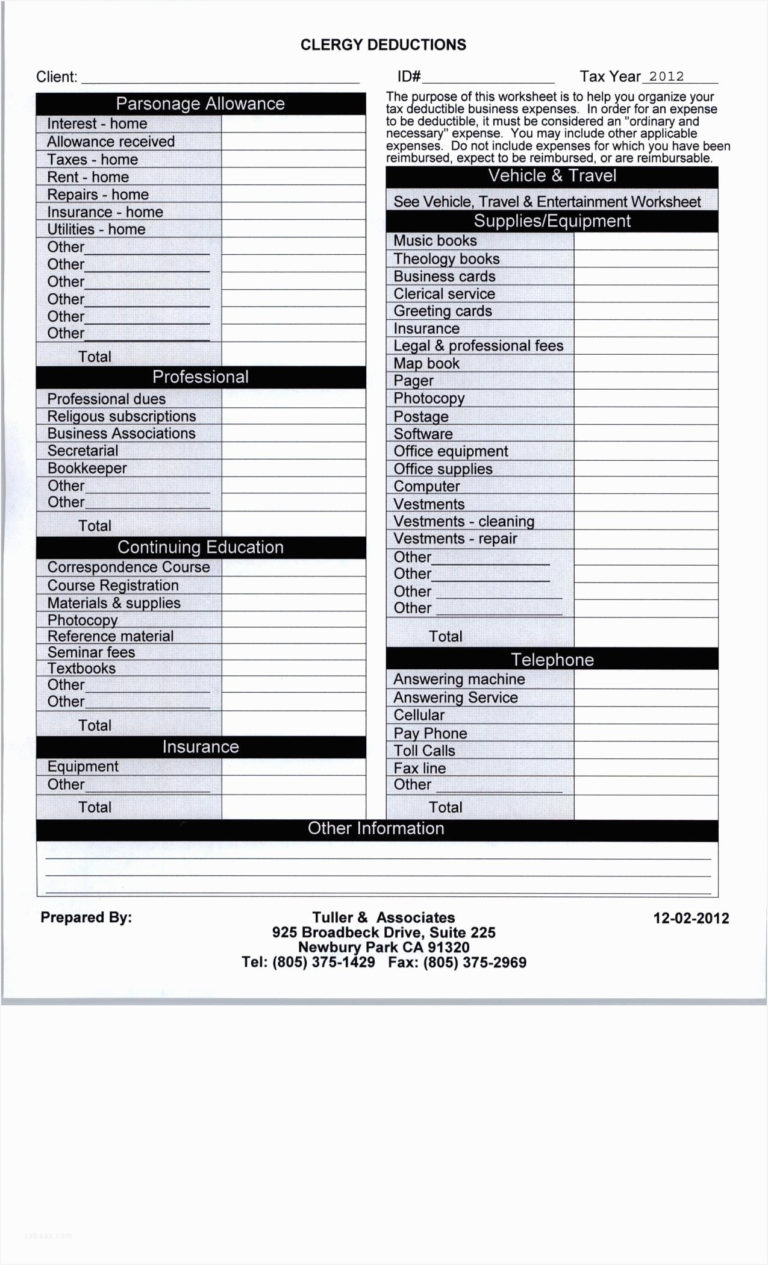

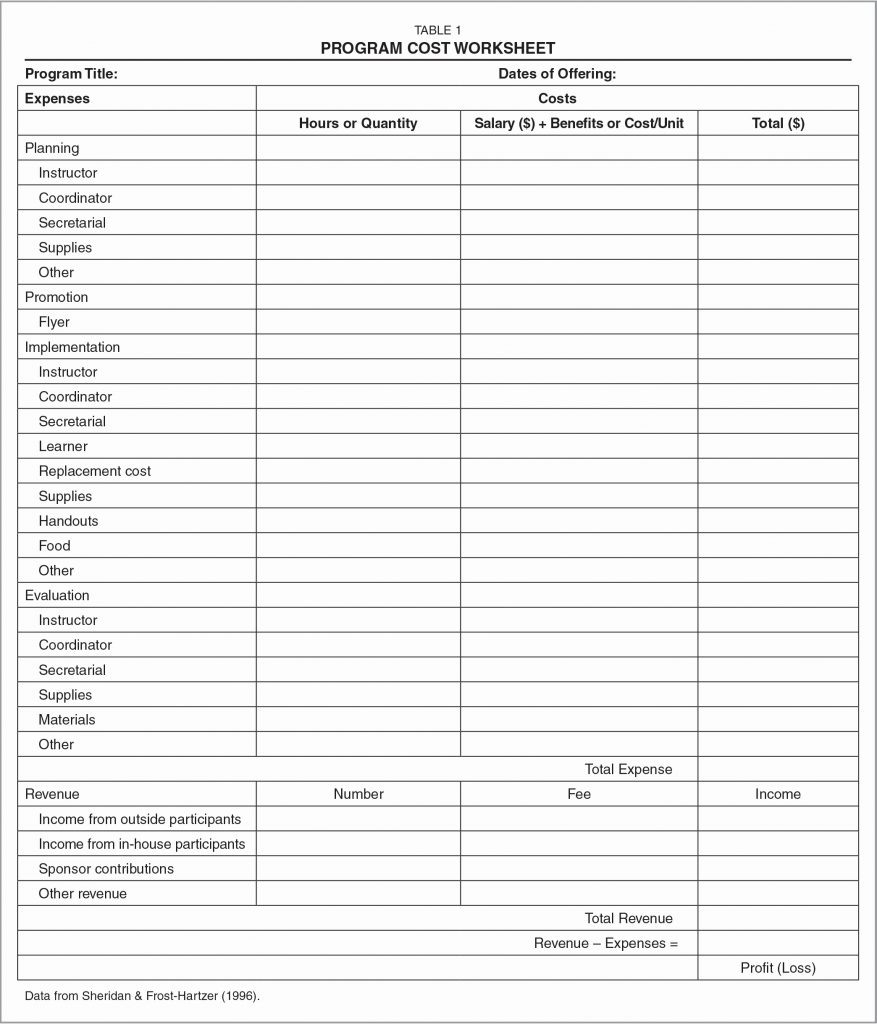

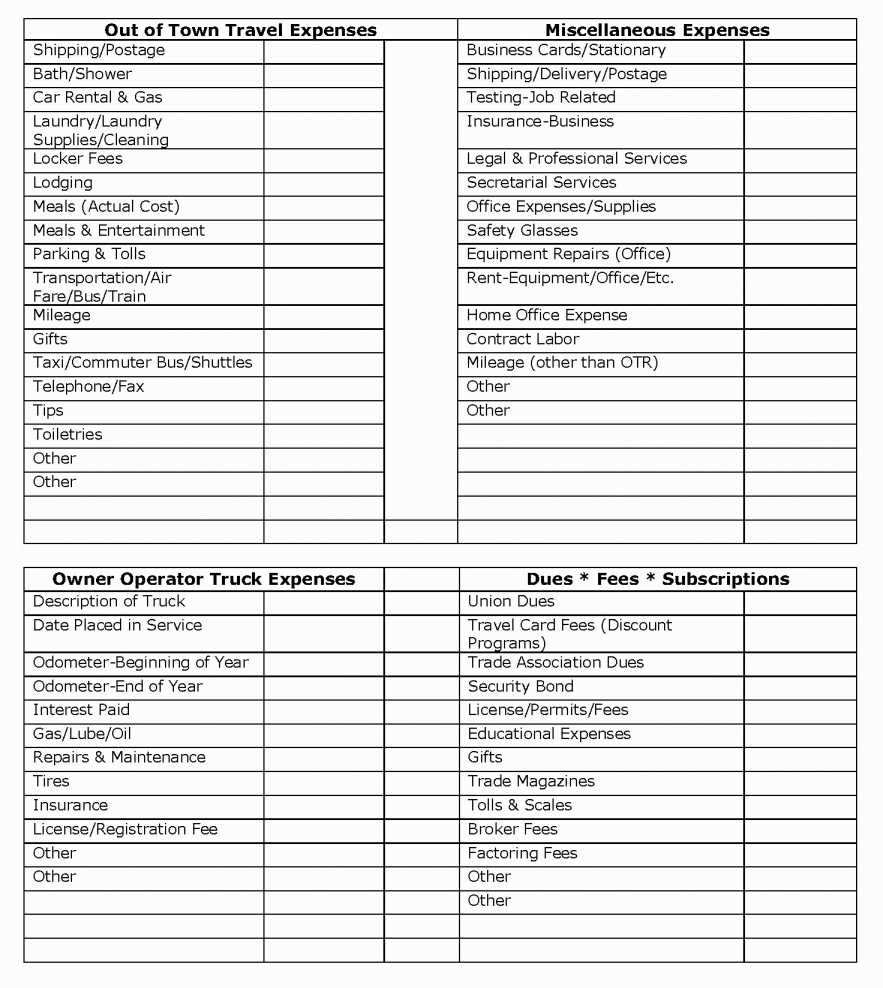

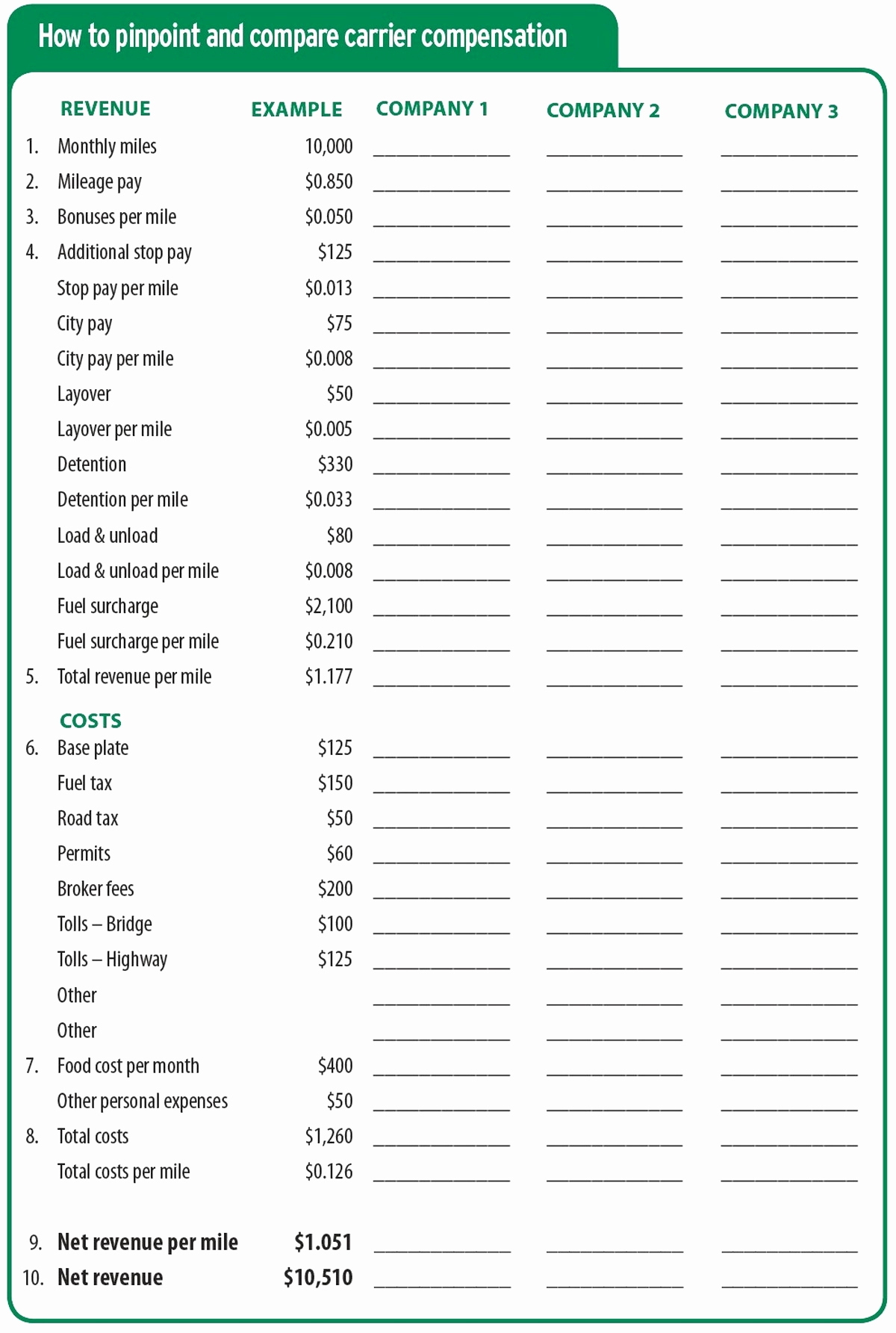

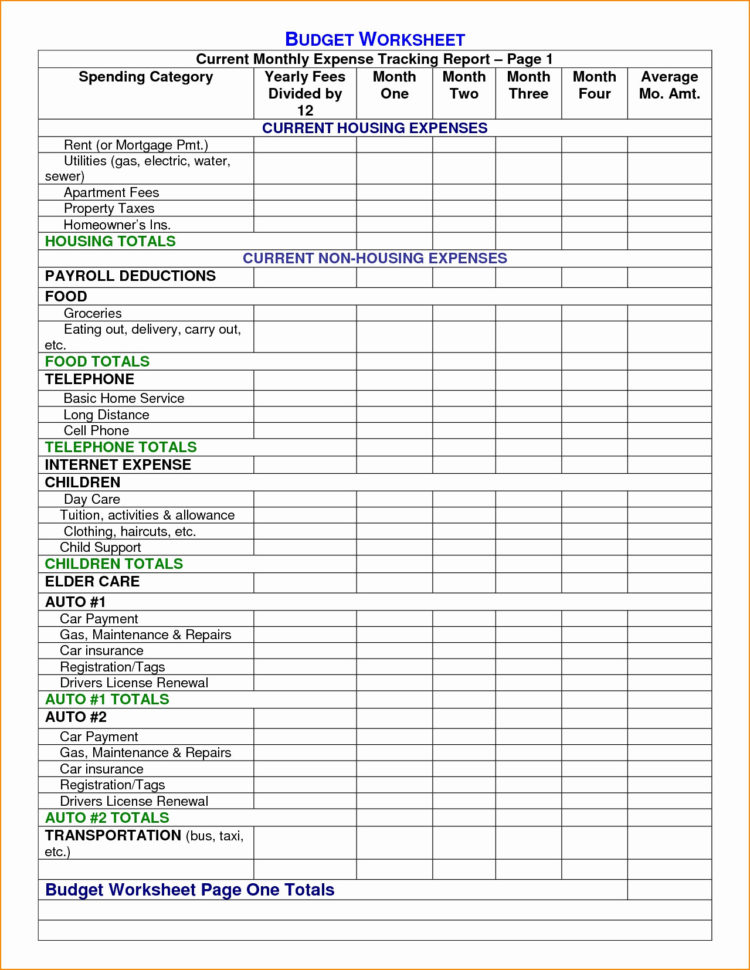

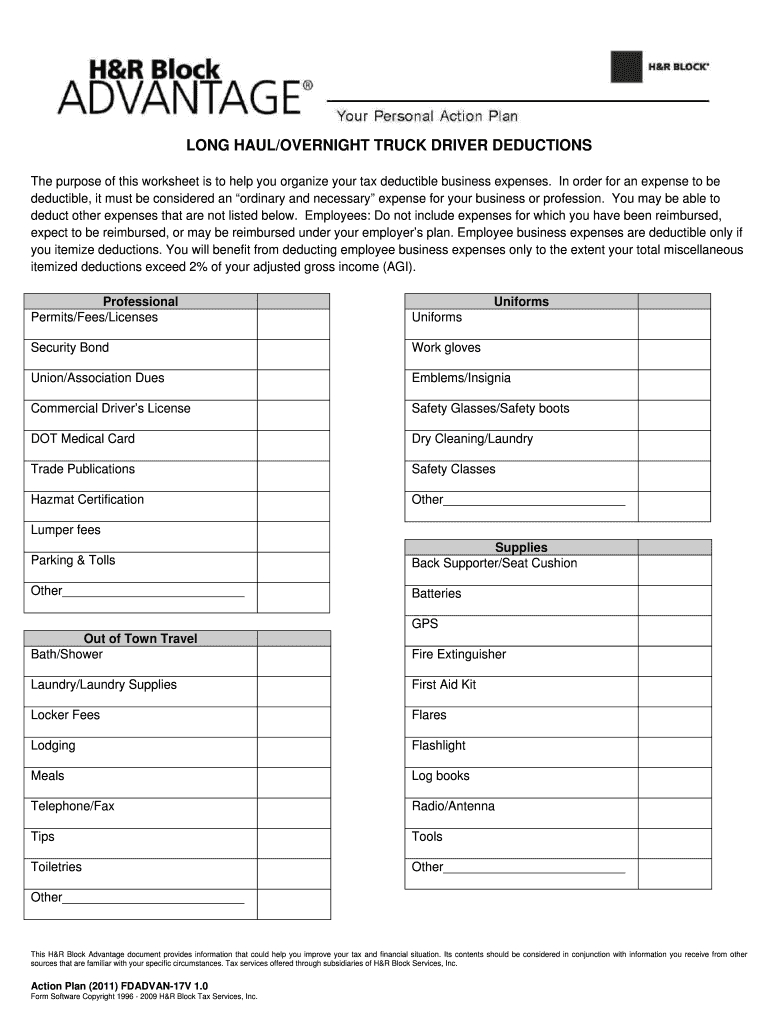

An ordinary expense is one that is. Web method worksheet in the instructions to figure the amount to enter on line 30. Web cost for operating a truck fall under two general categories; Web what does this mean? Make & model of vehicle. Web this truck driver expenses worksheet form can help make the process a little easier. Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in. Postage, stationery, office supplies, bank charges, pens, faxes, etc. Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs. Trucker’s income & expense worksheet; Financial projections template for a trucking company; Vehicle information vehicle 1 vehicle 2 vehicle 3 (complete. With this form, you can track your mileage, fuel costs, and other. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type. Web the depreciation limitations for passenger automobiles placed in service during calendar year 2022 for which no section 168 (k) additional first year depreciation. This article will show you everything you should include in a trucking expenses. Web deductible car and truck expenses ordinarily, expenses related to use of a car, van, pickup or panel truck for business can. Web last updated february 12, 2023. Web 20212021 tax year car and truck expense worksheet. Web 2020 tax year car and truck expense worksheet.

Web Method Worksheet In The Instructions To Figure The Amount To Enter On Line 30.

Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type. Trucker’s income & expense worksheet; Postage, stationery, office supplies, bank charges, pens, faxes, etc. Web this truck driver expenses worksheet form can help make the process a little easier.

Vehicle Information Vehicle 1 Vehicle 2 Vehicle 3 (Complete.

Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs. Web what does this mean? Car & truck expenses worksheet (ford fusion): Web 2020 tax year car and truck expense worksheet.

Web 20212021 Tax Year Car And Truck Expense Worksheet.

Make & model of vehicle. Financial projections template for a trucking company; Web last updated february 12, 2023. Web the depreciation limitations for passenger automobiles placed in service during calendar year 2022 for which no section 168 (k) additional first year depreciation.

This Article Will Show You Everything You Should Include In A Trucking Expenses.

Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in. An ordinary expense is one that is. Web deductible car and truck expenses ordinarily, expenses related to use of a car, van, pickup or panel truck for business can. With this form, you can track your mileage, fuel costs, and other.