Truck Driver Tax Deductions Worksheet - In order for an expense to be. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. For example, did you know that you can deduct the cost of truck and trailer repairs? Edit your tax deduction worksheet for truck drivers online type text, add images, blackout confidential details, add. Non cash contribution deduction $ nurses & medical professionals; Web get the 2020 truck driver tax deductions worksheet accomplished. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web most truck driver pay about $550 dollar for heavy highway use tax. How much can a truck driver claim on taxes, what is the difference between an.

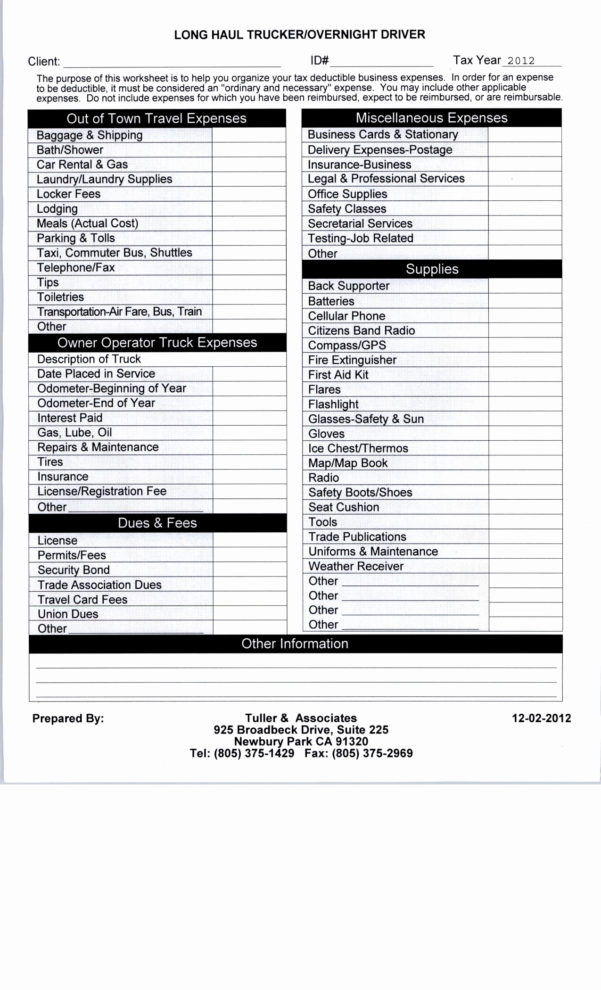

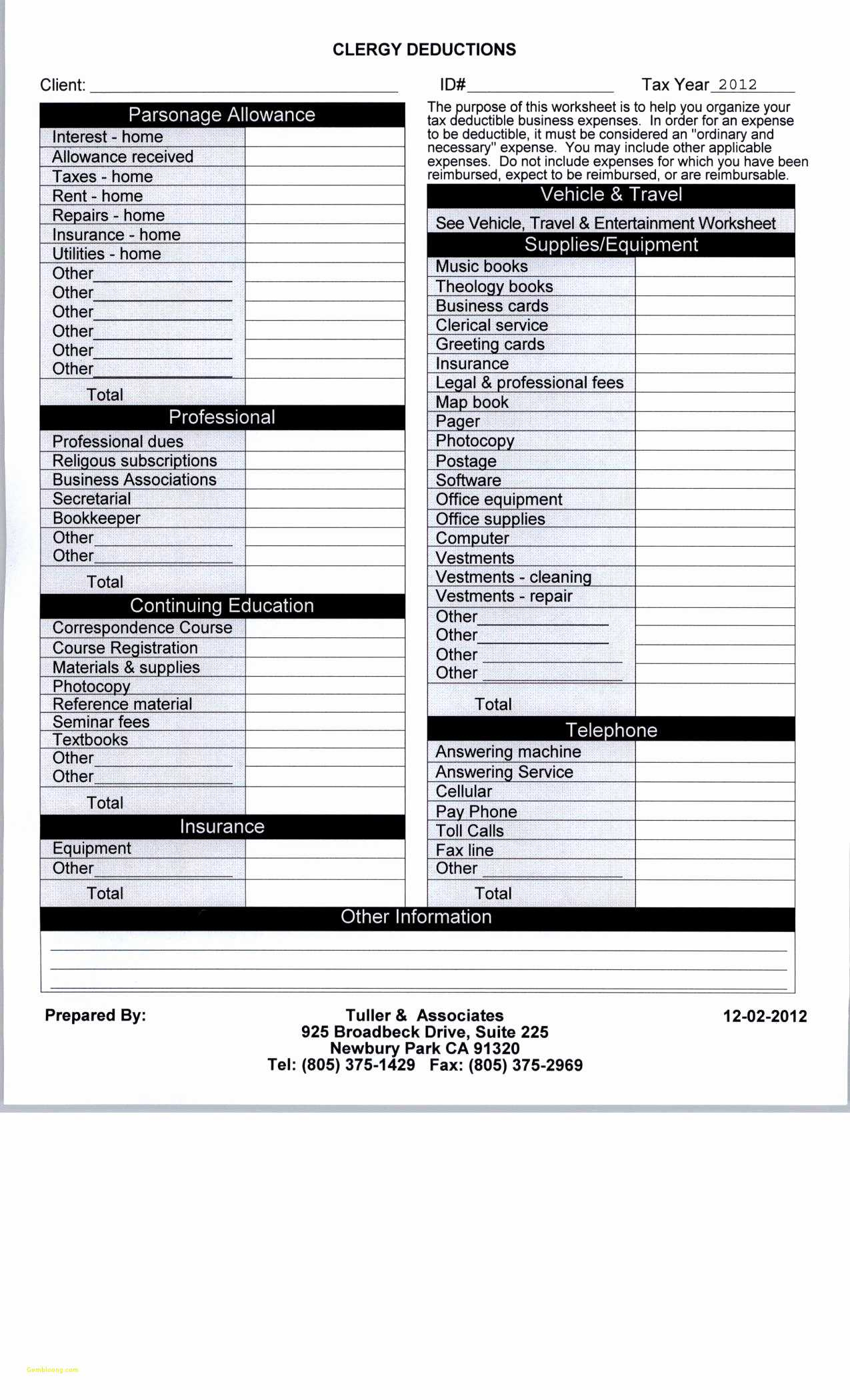

Anchor Tax Service Truck driver deductions

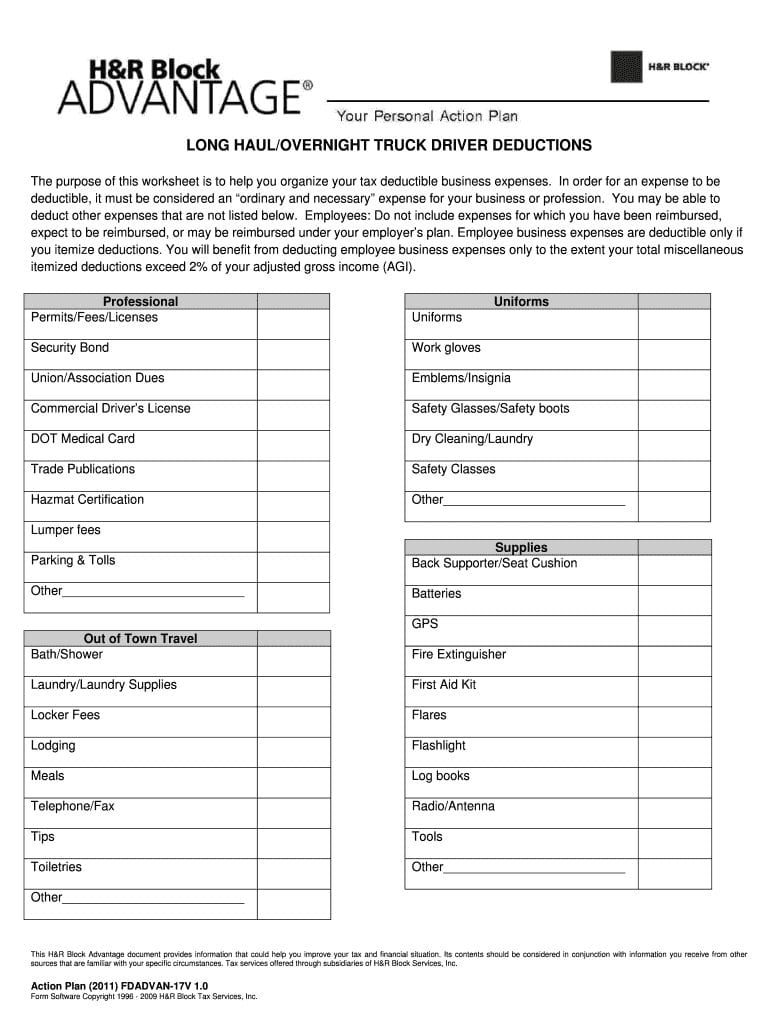

Web 19 truck driver tax deductions that will save you money. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Truck driver tax deductions reduce your tax burden in two ways: Download your adjusted document, export it to the cloud,. Truck drivers can deduct business expenses that are.

Driver Schedule Spreadsheet Spreadsheet Downloa driver schedule

In order for an expense to be. Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Web most truck driver pay about $550 dollar for heavy highway use tax. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a..

20 Unique Truck Driver Tax Deductions Worksheet

Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Web there is a limit on the total section 179 deduction, special depreciation allowance, and depreciation deduction for cars, trucks, and vans that may reduce. Web common truck driver tax deductions. Web get form download the form how to edit the truck.

Truck Driver Tax Deductions Worksheet

Non cash contribution deduction $ nurses & medical professionals; Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you. Web get the 2020 truck driver tax deductions worksheet accomplished. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax..

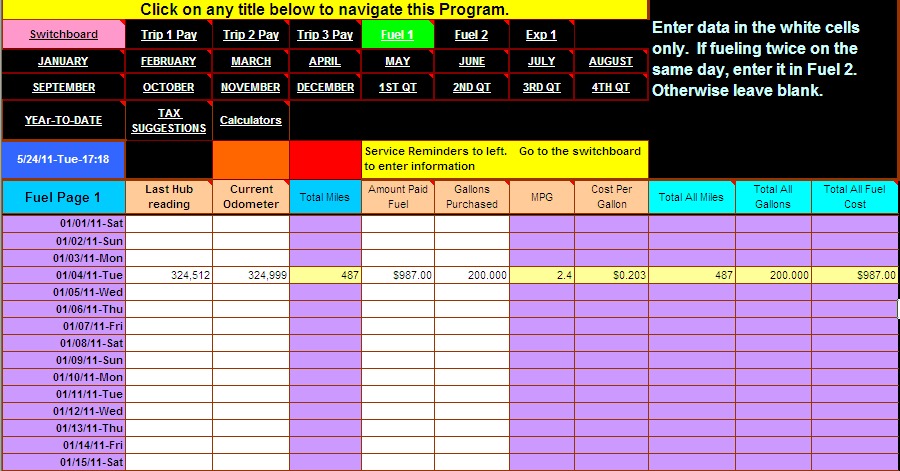

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in. Fuel oil repairs tires washing insurance. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a. How much can a truck driver claim on taxes, what is the difference.

Truck Driver Tax Deductions Worksheet —

This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Truck driver tax deductions reduce your tax burden in two ways: Web common truck driver tax deductions. Web 3.10 sleeping expenses tax breaks.

Truck driver accounting software spreadsheet program from Dieselboss, 2021

Download your adjusted document, export it to the cloud,. Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Here’s a look at common deductions and business. Web truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax. Web common truck driver.

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

How much can a truck driver claim on taxes, what is the difference between an. Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Web common truck driver tax deductions. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how.

Trucker Expense Spreadsheet Beautiful Tax Deduction Worksheet For with

Web common truck driver tax deductions. Web 19 truck driver tax deductions that will save you money. Download your adjusted document, export it to the cloud,. How much can a truck driver claim on taxes, what is the difference between an. Web get form download the form how to edit the truck driver deductions spreadsheet freely online start on editing,.

Anchor Tax Service Home use worksheet

Web get form download the form how to edit the truck driver deductions spreadsheet freely online start on editing, signing and. Fuel oil repairs tires washing insurance. Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in. This is 100% tax deductible and truck driver can deduct the cost of highway.

Download your adjusted document, export it to the cloud,. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Web 19 truck driver tax deductions that will save you money. Web most truck driver pay about $550 dollar for heavy highway use tax. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Truck driver tax deductions reduce your tax burden in two ways: Web get form download the form how to edit the truck driver deductions spreadsheet freely online start on editing, signing and. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck drivers can deduct business expenses that are. Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in. Web in this article we are going to talk about truck driver tax deductions: Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Web there is a limit on the total section 179 deduction, special depreciation allowance, and depreciation deduction for cars, trucks, and vans that may reduce. Here’s a look at common deductions and business. How much can a truck driver claim on taxes, what is the difference between an. Web get the 2020 truck driver tax deductions worksheet accomplished. Web common truck driver tax deductions. Web 3.10 sleeping expenses tax breaks for truck drivers if you’re a truck driver, there are a few tax breaks that you should know about. Edit your tax deduction worksheet for truck drivers online type text, add images, blackout confidential details, add.

Web Get Form Download The Form How To Edit The Truck Driver Deductions Spreadsheet Freely Online Start On Editing, Signing And.

This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Web get the 2020 truck driver tax deductions worksheet accomplished. Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Fuel oil repairs tires washing insurance.

Truck Drivers Can Deduct Business Expenses That Are.

Here’s a look at common deductions and business. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you. Download your adjusted document, export it to the cloud,.

Web There Is A Limit On The Total Section 179 Deduction, Special Depreciation Allowance, And Depreciation Deduction For Cars, Trucks, And Vans That May Reduce.

Web most truck driver pay about $550 dollar for heavy highway use tax. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Web 19 truck driver tax deductions that will save you money. For example, did you know that you can deduct the cost of truck and trailer repairs?

Amounts Of $600.00 Or More Paid To Individuals (Not Corporations) For Rent, Interest, Or Services Rendered To You In.

Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web 3.10 sleeping expenses tax breaks for truck drivers if you’re a truck driver, there are a few tax breaks that you should know about. Non cash contribution deduction $ nurses & medical professionals; Web in this article we are going to talk about truck driver tax deductions: