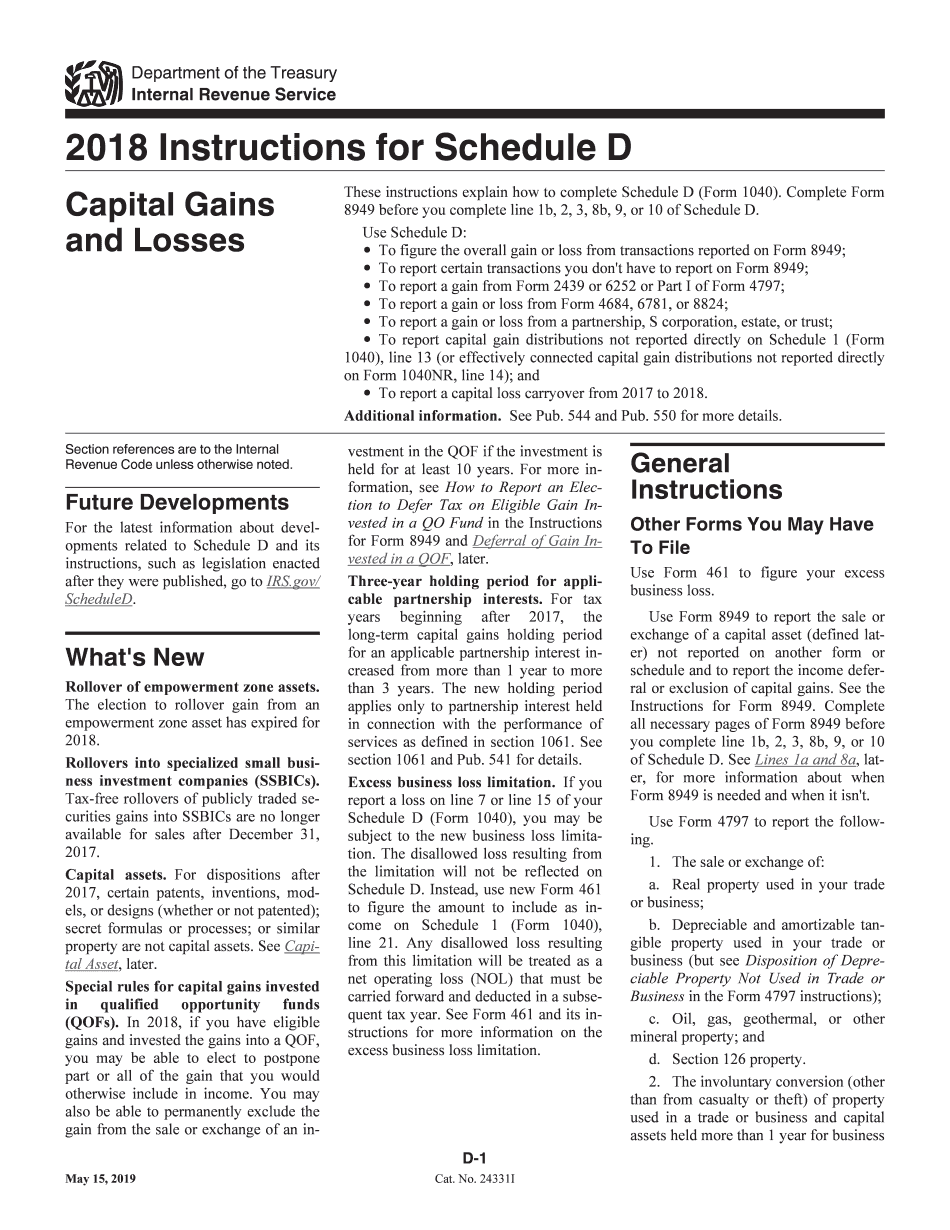

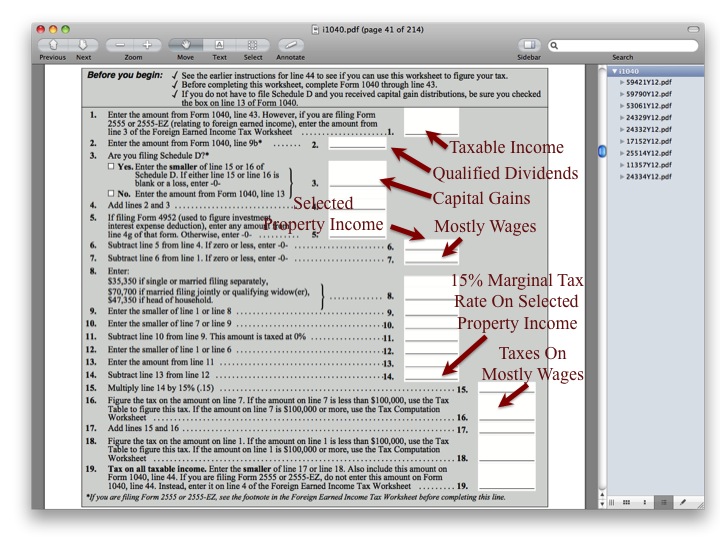

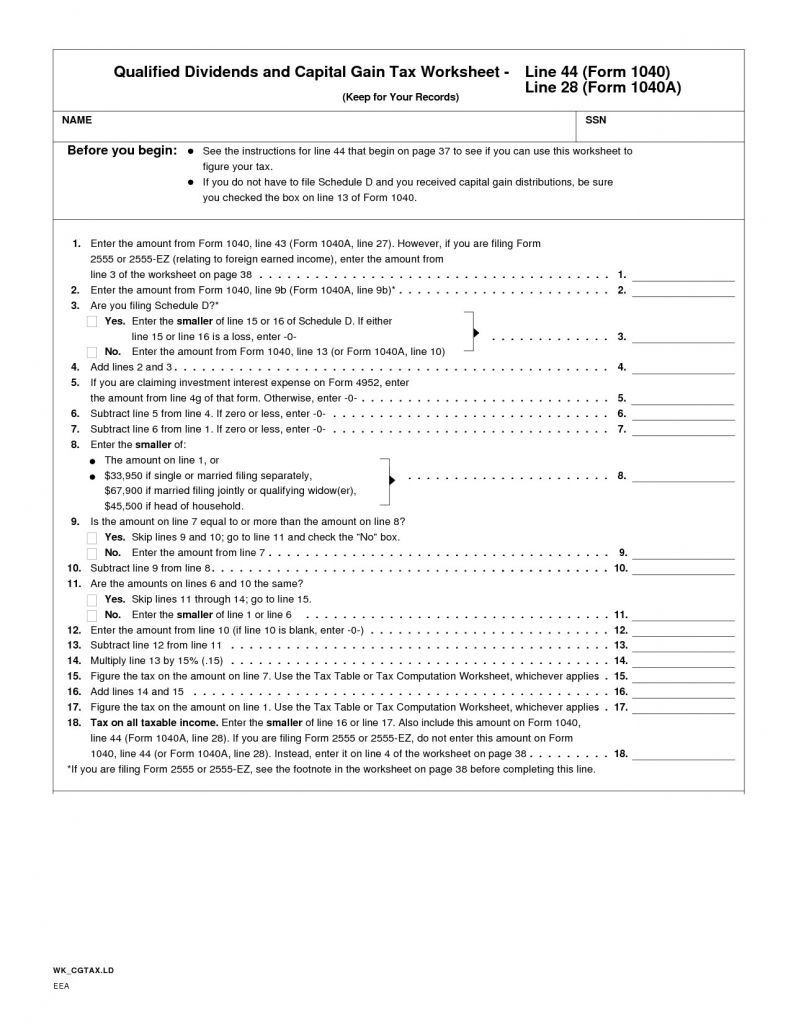

The Qualified Dividends And Capital Gain Tax Worksheet - Foreign earned income tax worksheet. Use the qualified dividends and capital gain tax worksheet to figure your. Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the. Qualified dividends and capital gain tax worksheet. Web what is the qualified dividend and capital gain tax worksheet? To see this select forms view, then the dtaxwrk folder, then the. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web how can i find the qualified dividends and capital gain tax worksheet. turbotax deluxe windows posted june 7,. It is for a single taxpayer, but.

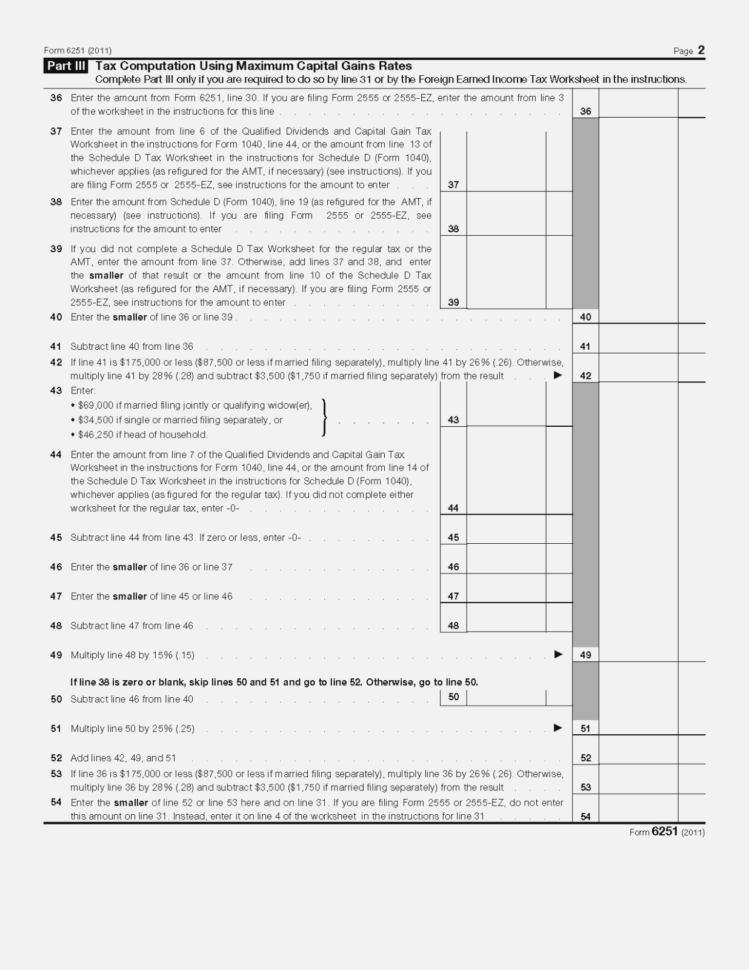

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Qualified dividends and capital gain tax worksheet. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web qualified dividends and capital gain tax worksheet. Web qualified dividend and capital gain tax worksheet.

qualified dividends and capital gain tax worksheet 2019 Fill Online

Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Qualified dividends and capital gain tax worksheet. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Figuring out the tax on your qualified dividends can be. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. It is for a single taxpayer, but. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if.

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Figuring out the tax on your qualified dividends can be. To see this select forms view, then the dtaxwrk folder, then the. Web qualified dividends and capital gain tax worksheet (2020).

Qualified Dividends and Capital Gain Tax Worksheet 2019

Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Qualified dividends and capital gain tax worksheet line 44. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web qualified dividend and capital gain tax worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Our publications provide fast answers to tax questions for. It is for a single taxpayer, but. Web on the turbotax form 1040/sr wks.

Thoughts On Economics The State Is "The Executive Committee Of The

Use the qualified dividends and capital gain tax worksheet to figure your. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web qualified dividends and capital gain tax worksheet. Web on the turbotax form 1040/sr wks , between lines 15 and 16 “ tax smart worksheet” item 3:.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Web how can i find the qualified dividends and capital gain tax worksheet. turbotax deluxe windows posted june 7,..

Understanding The Qualified Dividends And Capital Gains Worksheet 2020

Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Use the qualified dividends and capital gain tax worksheet to figure your. Web schedule d tax worksheet. Qualified dividends and capital gain tax worksheet. To see this select forms view, then the dtaxwrk folder, then the.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Our publications provide fast answers to tax questions for. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Qualified dividends and capital gain tax worksheet line 44. It is for a single taxpayer, but. Web this flowchart is designed to.

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web what is the qualified dividend and capital gain tax worksheet? Our publications provide fast answers to tax questions for. Use the qualified dividends and capital gain tax worksheet to figure your. Qualified dividends and capital gain tax worksheet line 44. Web how can i find the qualified dividends and capital gain tax worksheet. turbotax deluxe windows posted june 7,. It is for a single taxpayer, but. Web qualified dividend and capital gain tax worksheet. Web schedule d tax worksheet. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Web on the turbotax form 1040/sr wks , between lines 15 and 16 “ tax smart worksheet” item 3: To see this select forms view, then the dtaxwrk folder, then the. Figuring out the tax on your qualified dividends can be. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Foreign earned income tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the.

Web Qualified Dividends And Capital Gain Tax Worksheet—Line 11A Keep For Your Records Before.

Web qualified dividend and capital gain tax worksheet. Qualified dividends and capital gain tax worksheet line 44. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a.

Web Qualified Dividends And Capital Gain Tax Worksheet.

Figuring out the tax on your qualified dividends can be. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Use the qualified dividends and capital gain tax worksheet to figure your. Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the.

Web If Line 8 Includes Any Net Capital Gain Or Qualified Dividends, Use The Qualified Dividends And Capital Gain Tax Worksheet.

Foreign earned income tax worksheet. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. It is for a single taxpayer, but. To see this select forms view, then the dtaxwrk folder, then the.

Web Qualified Dividends And Capital Gain Tax Worksheet (2020) • See Form 1040 Instructions For Line 16 To See If The.

Qualified dividends and capital gain tax worksheet. Our publications provide fast answers to tax questions for. Web schedule d tax worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or.