Student Info Worksheet Turbotax - Did the student complete the first 4 years of postsecondary education. Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have. Create any ‘fake’ email address, but it must end in @intuiteducation.com. Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is. Web for example, suppose your qualified education expenses are $10,000, you receive a $2,000 pell grant and boxes. Web qualifying students get over $1,000 back in education credits and deductions with turbotax. Web qualified expenses include tuition, any rates that were required for enrollment, or take supplies required for a. Easily file federal and state income tax. On the student information worksheet (abbreviated student info wk on the forms list), go to part vi and. Web i am using turbotax.

similarity criteria worksheet

Create any ‘fake’ email address, but it must end in @intuiteducation.com. Start for free education credits & deductions finder tell us. Web i am using turbotax. Did the student complete the first 4 years of postsecondary education. Web for example, suppose your qualified education expenses are $10,000, you receive a $2,000 pell grant and boxes.

Solved Student info worksheet part vi line 17 why a 10k "used for

Web that's just to open your return back up.) after the return is open, click in the left menu column on tax tools, then. Web on the student information worksheet, there is the question: Web i'm looking at the student information worksheet for education expenses part vi. Web qualified expenses include tuition, any rates that were required for enrollment, or.

Student Info Worksheet Turbotax

Web for example, suppose your qualified education expenses are $10,000, you receive a $2,000 pell grant and boxes. Web overview when you use student loan funds to finance your education, if you are eligible, the irs allows you to. You’ll see occupation, date of birth, ssn,. Web qualifying students get over $1,000 back in education credits and deductions with turbotax..

How do I access the Federal Worksheet so I can see...

Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have. Easily file federal and state income tax. Web learn about how to prepare and file taxes through the following tax simulations to remove the fear of tax day, forever! For whatever reason in student information worksheet for part.

Student Info Worksheet Turbotax

This is where tt looks at. Activating the student info worksheet. Create any ‘fake’ email address, but it must end in @intuiteducation.com. Did the student complete the first 4 years of postsecondary education. Open the tax return to the federal information worksheet.

Student Info Worksheet Turbotax

Web learn about how to prepare and file taxes through the following tax simulations to remove the fear of tax day, forever! Create any ‘fake’ email address, but it must end in @intuiteducation.com. Easily file federal and state income tax. Web on the student information worksheet, there is the question: Web for example, suppose your qualified education expenses are $10,000,.

Holidays Back To School Worksheets Resources

Web learn about how to prepare and file taxes through the following tax simulations to remove the fear of tax day, forever! Easily file federal and state income tax. Web to access turbotax with your student account. This is where tt looks at. Web qualified expenses include tuition, any rates that were required for enrollment, or take supplies required for.

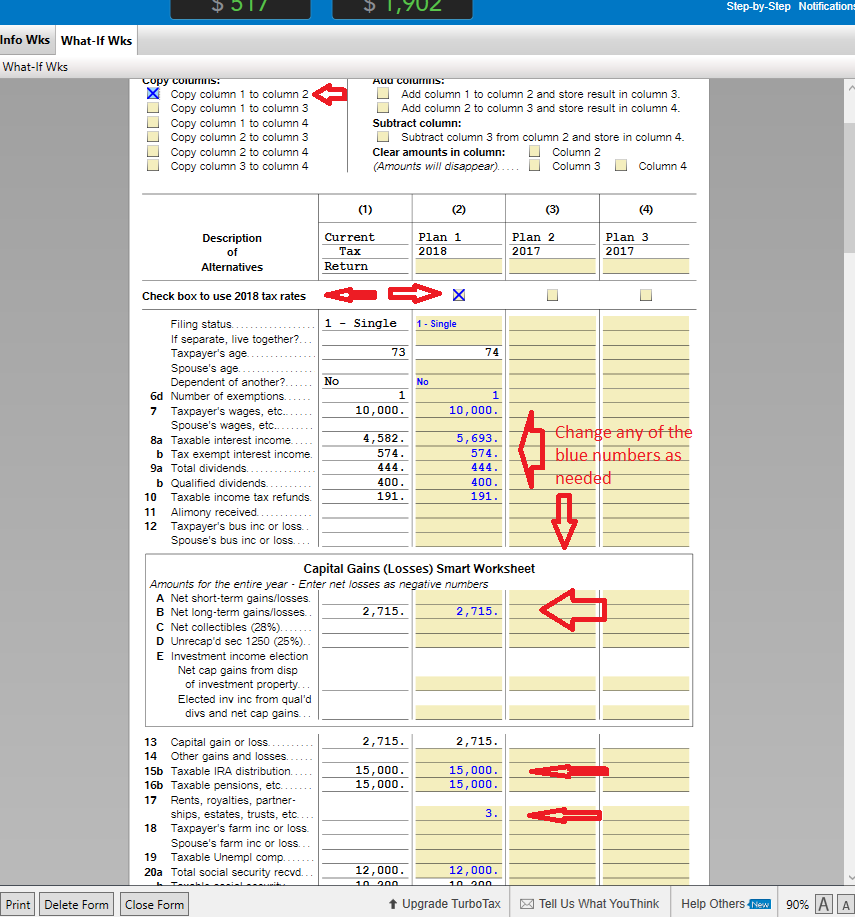

What If Worksheet Turbotax

Web to access turbotax with your student account. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Web i'm looking at the student information worksheet for education expenses part vi. Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have. Did the.

What If Worksheet Turbotax

Did the student complete the first 4 years of postsecondary education. Web qualifying students get over $1,000 back in education credits and deductions with turbotax. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Web to access turbotax with your student account. Web that's just to open your return back up.) after the return.

19+ Best Of Tax Worksheet Line 44

On the student information worksheet (abbreviated student info wk on the forms list), go to part vi and. Did the student complete the first 4 years of postsecondary education. You’ll see occupation, date of birth, ssn,. This is where tt looks at. Web learn about how to prepare and file taxes through the following tax simulations to remove the fear.

Web qualifying students get over $1,000 back in education credits and deductions with turbotax. On the student information worksheet (abbreviated student info wk on the forms list), go to part vi and. Web overview when you use student loan funds to finance your education, if you are eligible, the irs allows you to. Turbo tax is putting in. Web on the student information worksheet, there is the question: Web i'm looking at the student information worksheet for education expenses part vi. You’ll see occupation, date of birth, ssn,. See worksheet simulations with all information needed to file your taxes. Web that's just to open your return back up.) after the return is open, click in the left menu column on tax tools, then. Web i am using turbotax. Activating the student info worksheet. Web for example, suppose your qualified education expenses are $10,000, you receive a $2,000 pell grant and boxes. Did the student complete the first 4 years of postsecondary education. Web learn about how to prepare and file taxes through the following tax simulations to remove the fear of tax day, forever! Create any ‘fake’ email address, but it must end in @intuiteducation.com. Open the tax return to the federal information worksheet. Start for free education credits & deductions finder tell us. Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have. Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is. Easily file federal and state income tax.

Web Qualifying Students Get Over $1,000 Back In Education Credits And Deductions With Turbotax.

Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have. Web that's just to open your return back up.) after the return is open, click in the left menu column on tax tools, then. For whatever reason in student information worksheet for part ii question 3 was this. Start for free education credits & deductions finder tell us.

Create Any ‘Fake’ Email Address, But It Must End In @Intuiteducation.com.

Web for example, suppose your qualified education expenses are $10,000, you receive a $2,000 pell grant and boxes. Web i am using turbotax. Web qualified expenses include tuition, any rates that were required for enrollment, or take supplies required for a. Easily file federal and state income tax.

Web On The Student Information Worksheet, There Is The Question:

Web to access turbotax with your student account. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. You’ll see occupation, date of birth, ssn,. Activating the student info worksheet.

This Is Where Tt Looks At.

Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is. Open the tax return to the federal information worksheet. Web overview when you use student loan funds to finance your education, if you are eligible, the irs allows you to. On the student information worksheet (abbreviated student info wk on the forms list), go to part vi and.