State Tax Refund Worksheet Item Q Line 2 - Loans are offered in amounts of $250,. But don’t enter more than the amount of your state and local income taxes shown. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your house and land) item q line 2 is. Web state tax refund item q line 2 is your refund received in 2020 for state or local taxes paid. * social security number 9 numbers, no dashes. It is not your tax refund. Web taxslayer support do i need to complete the state refund worksheet? Then yes, at least part may be taxable. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in. Web if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in.

Tax Payments Worksheet State Id Uncategorized Resume Examples

Loans are offered in amounts of $250,. Numbers in mailing address up to 6. You may be able to get a tax refund if you’ve paid too much tax. Web for line 1 and line 2, the input fields are found on the tax refund, unempl. But don’t enter more than the amount of your state and local income taxes.

State Tax Refund State Tax Refund As

Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Numbers in mailing address up to 6. Web state and local income tax refund worksheet—schedule 1, line 1; Web if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do.

Aarp Overpayment Refund Form Form Resume Examples

Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered. Web for line 1 and line 2, the input fields are found on the tax refund, unempl. Other gains or (losses) line 7. Use this service to check your refund status. For the rest of the.

wordimage Chodorow Law Offices

Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. Or keyword “g” use this worksheet only if the. Web did you use the state sales tax paid as a deduction? Web state and local income tax refund worksheet—schedule 1, line 1; Web check your 2022 refund status.

Tax Refund Tax Refund Worksheet

Web if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in. Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. It is not your tax refund. Do not enter more than the amount of your.

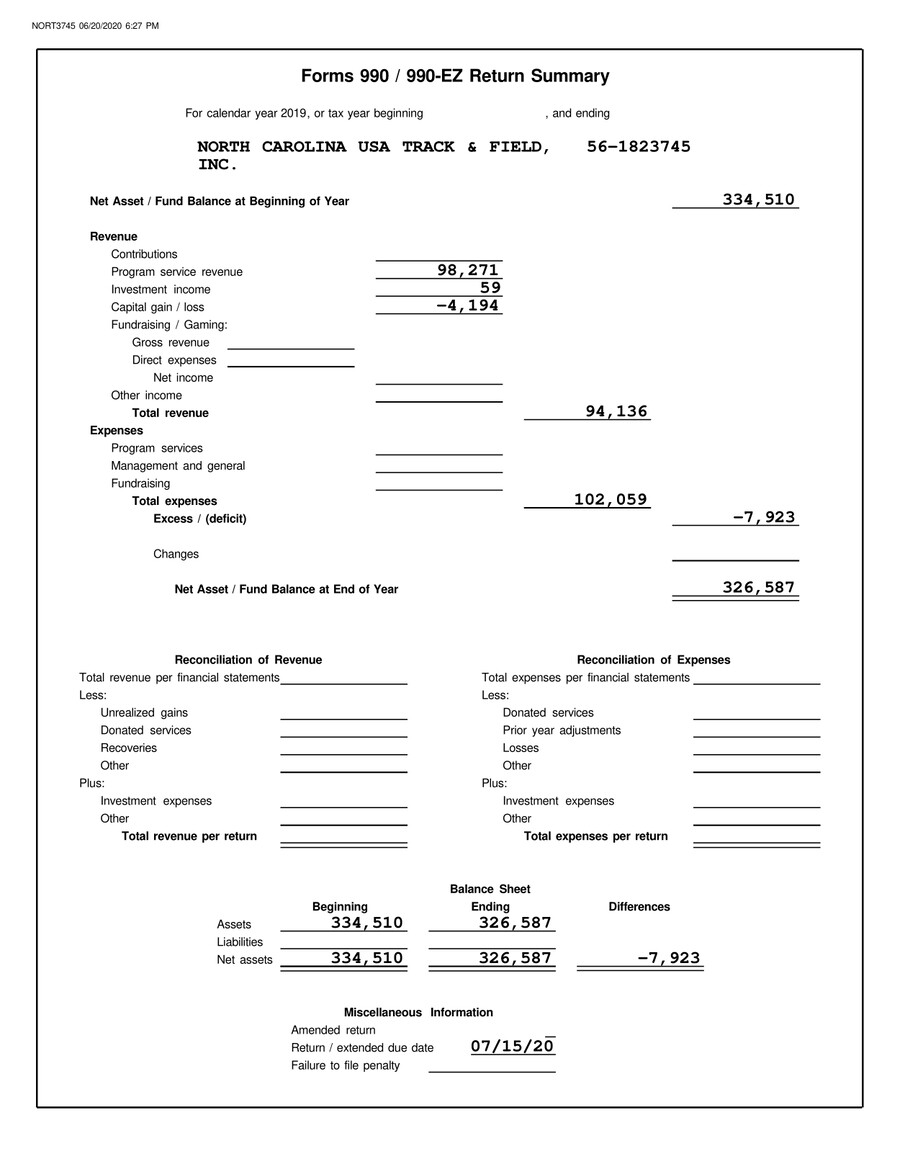

2019 USATF North Carolina Tax Return by USATF Flipsnack

Do not enter more than the amount of your state. It is not your tax refund. Web may 4, 2021 7:59 am running the error report is says state tax refund worksheet item q must be entered. Use this service to check your refund status. Web state tax refund item q line 2 is your refund received in 2020 for.

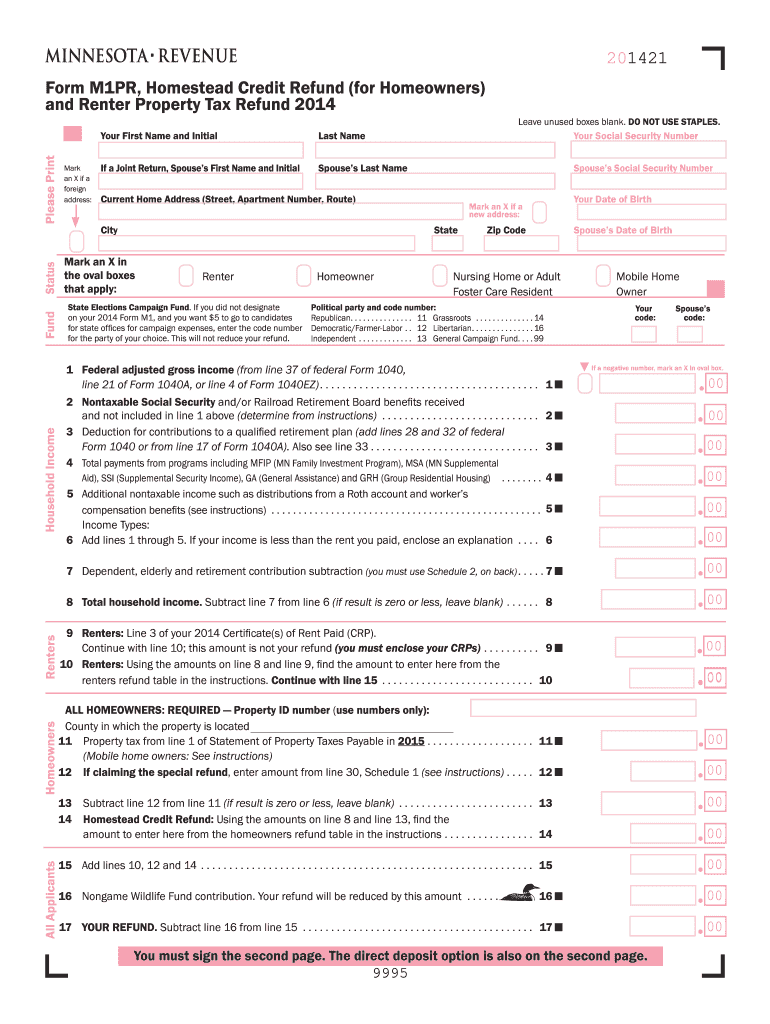

2014 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank PDFfiller

It is not your tax refund. Web did you use the state sales tax paid as a deduction? Web for line 1 and line 2, the input fields are found on the tax refund, unempl. But don’t enter more than the amount of your state and local income taxes shown. Then yes, at least part may be taxable.

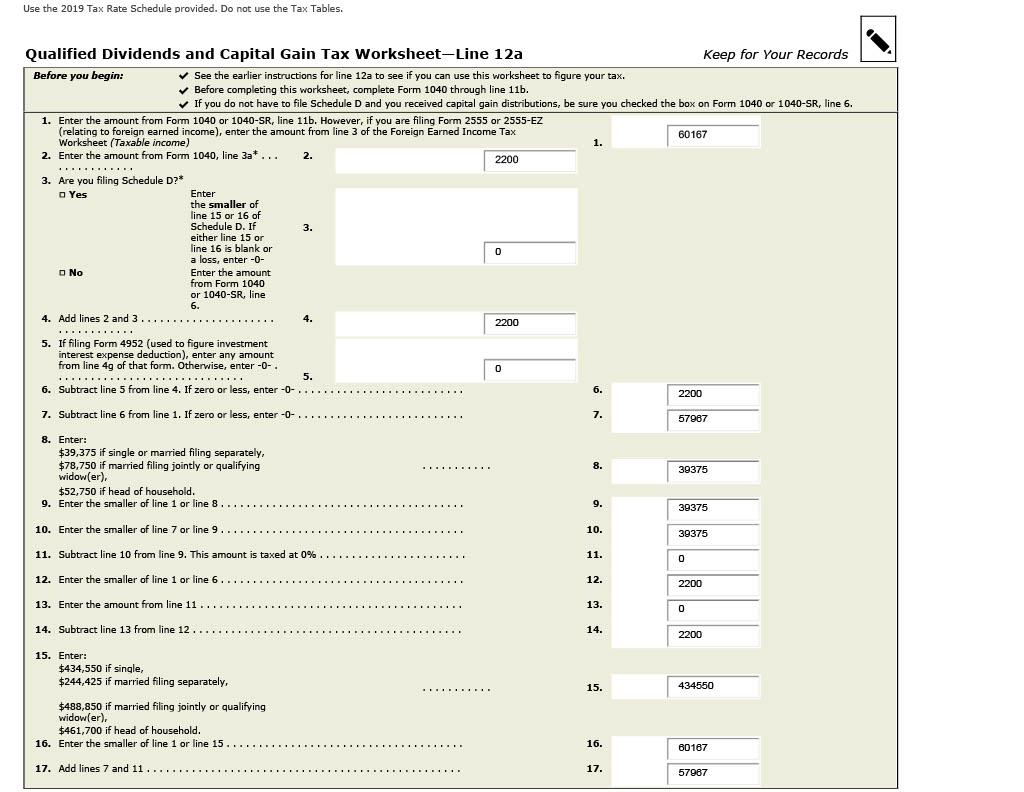

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Web select recovery excl and click ok to open the worksheet. For the rest of the. Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: We help you understand and meet your federal. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate.

State Tax Refund State Tax Refund Line 10

Other gains or (losses) line 7. We help you understand and meet your federal. It is not your tax refund. Or keyword “g” use this worksheet only if the. But don’t enter more than the amount of your state and local income taxes shown.

REV414 (P/S) 2012 PA Nonresident Tax Withholding Worksheet Free Download

Find irs forms and answers to tax questions. Use this service to check your refund status. You may be able to get a tax refund if you’ve paid too much tax. Loans are offered in amounts of $250,. Web state and local income tax refund worksheet—schedule 1, line 1;

Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered. Web if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in. Numbers in mailing address up to 6. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your house and land) item q line 2 is. Web check your 2022 refund status. (box by line 5a ix not. Web for line 1 and line 2, the input fields are found on the tax refund, unempl. Web state and local income tax refund worksheet—schedule 1, line 1; Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Find irs forms and answers to tax questions. For the rest of the. Web taxslayer support do i need to complete the state refund worksheet? Web if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in. You may be able to get a tax refund if you’ve paid too much tax. Web may 4, 2021 7:59 am running the error report is says state tax refund worksheet item q must be entered. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in. Use this service to check your refund status. Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. But don’t enter more than the amount of your state and local income taxes shown. Web did you use the state sales tax paid as a deduction?

Web Taxslayer Support Do I Need To Complete The State Refund Worksheet?

For the rest of the. Or keyword “g” use this worksheet only if the. Web select recovery excl and click ok to open the worksheet. Web if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in.

We Help You Understand And Meet Your Federal.

Web check your refund status. Then yes, at least part may be taxable. Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. Numbers in mailing address up to 6.

You May Be Able To Get A Tax Refund If You’ve Paid Too Much Tax.

* social security number 9 numbers, no dashes. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your house and land) item q line 2 is. Loans are offered in amounts of $250,. Web did you use the state sales tax paid as a deduction?

Web If I Am Being Told To Check This Entry And It Says State Tax Refund Worksheet Item Q Line 2 What Do I Put In.

Web state tax refund item q line 2 is your refund received in 2020 for state or local taxes paid. But don’t enter more than the amount of your state and local income taxes shown. Do not enter more than the amount of your state. Use this service to check your refund status.