State Tax Refund Worksheet Item Q Line 1 - Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered. Numbers in mailing address up to 6. Web understanding the state refund worksheet: Use a copy of the. You must report them on schedule a of form 1040, if you claimed a deduction for state and local taxes the year before. @reneevyne the state tax refund worksheet, item q, line 1, is for property. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in. Vendor's report of beer shipments. Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be.

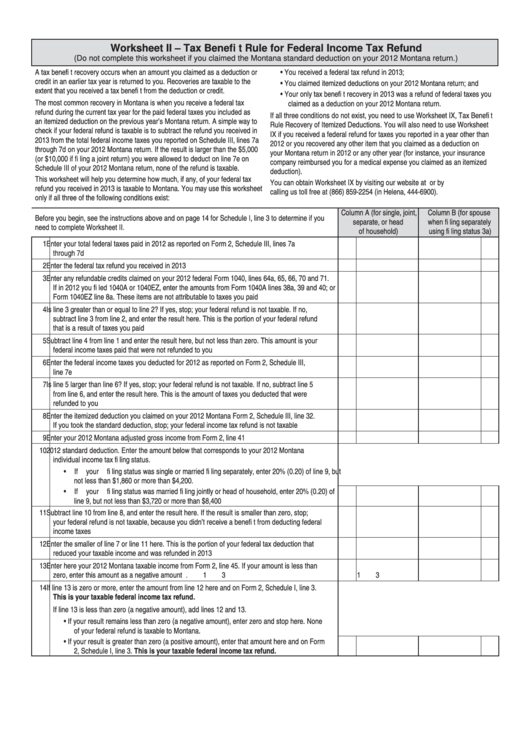

Fillable Form 2 Worksheet Ii Tax Benefit Rule For Federal

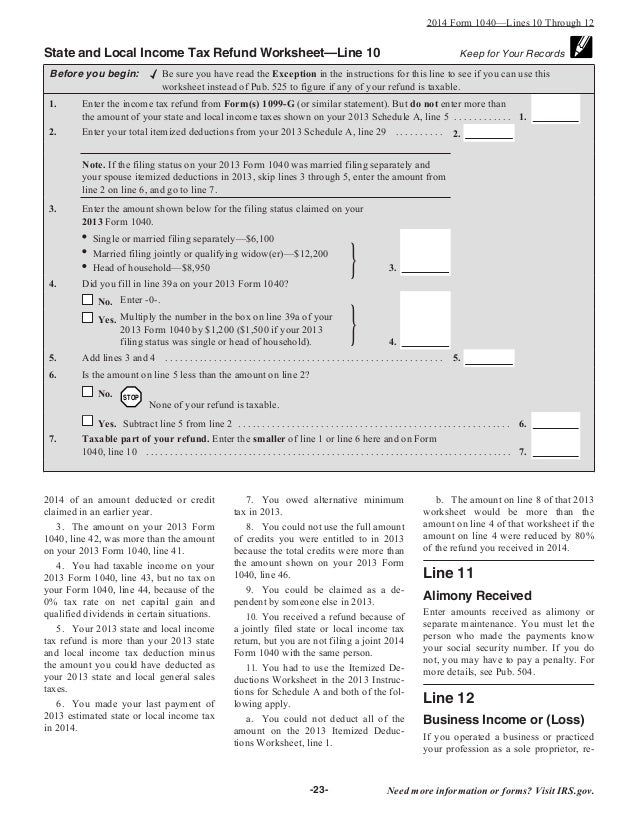

Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Web state and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this line to see if you can use this. State and local income tax refunds (prior year) income tax.

6 Social Security Worksheet

Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in. Web check your refund status. * social security number 9 numbers, no dashes. Use a copy of the. Web understanding the state refund worksheet:

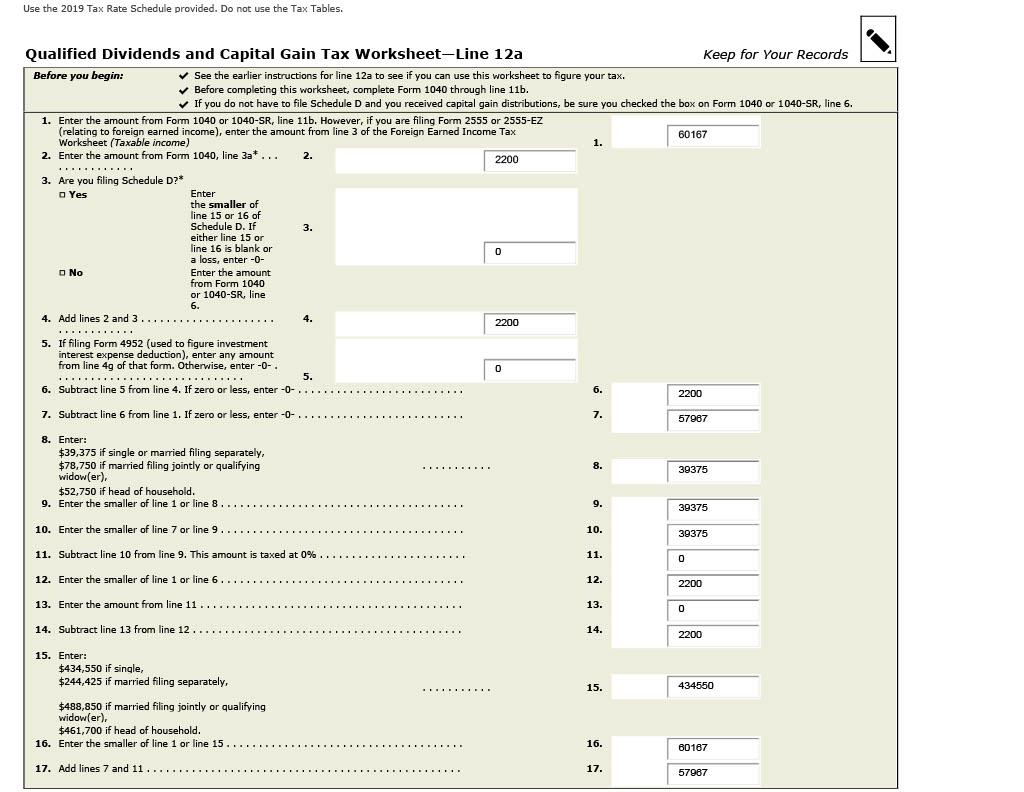

Solved Please help me with this 2019 tax return. All

Web item q amounts on the state tax refund worksheet are numbers from schedule a of your 2019 income tax. Web state and local income tax refund worksheet—schedule 1, line 1; State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web the balance / hilary allison state income tax refunds can sometimes be.

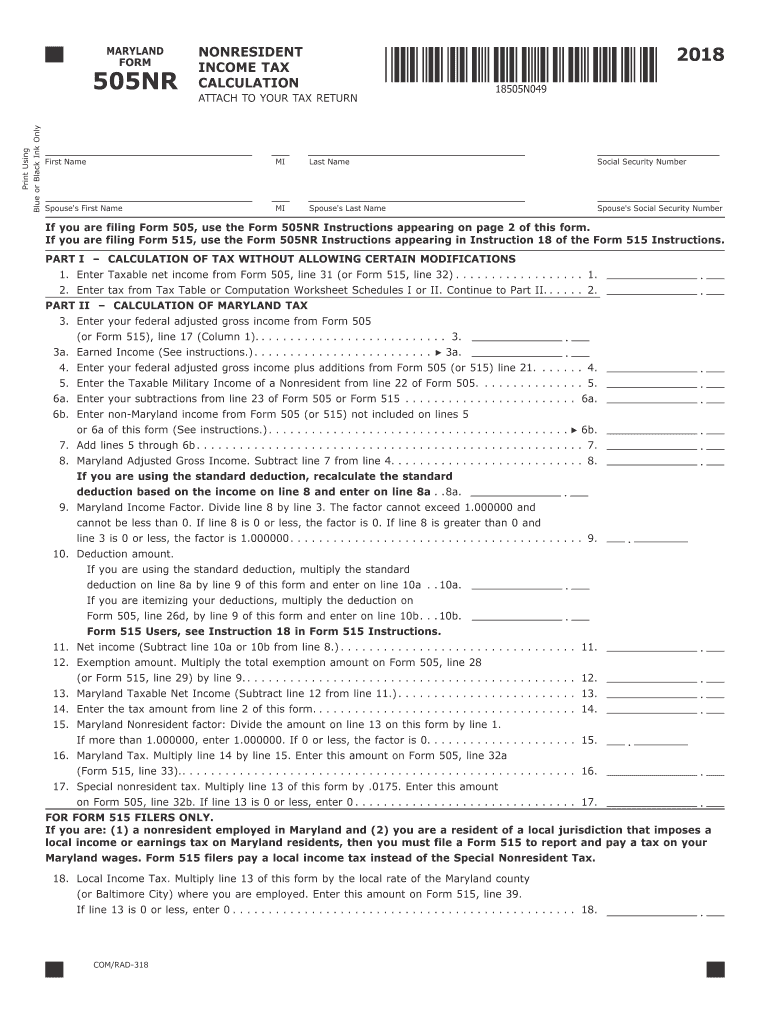

Form 505nr Fill Out and Sign Printable PDF Template signNow

Web do i need to complete the state refund worksheet? Web file a california fiduciary income tax return (form 541) for estates and trusts: Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in. Check the amended tax return box. Web check your 2022 refund status.

2018 Tax Computation Worksheet

Web get your refund status. Use this service to check your refund status. Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. Web do i need to complete the state refund worksheet? Numbers in mailing address up to 6.

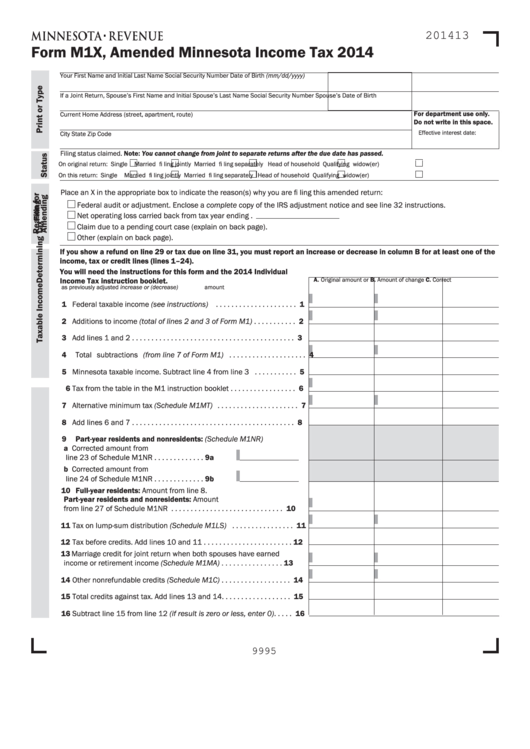

Minnesota State Fillable Tax Forms Printable Forms Free Online

Other gains or (losses) line 7. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web get your refund status. You must report them on schedule a of form 1040, if you claimed a deduction for state and local taxes the year before. State and local income tax refunds (prior year) income tax.

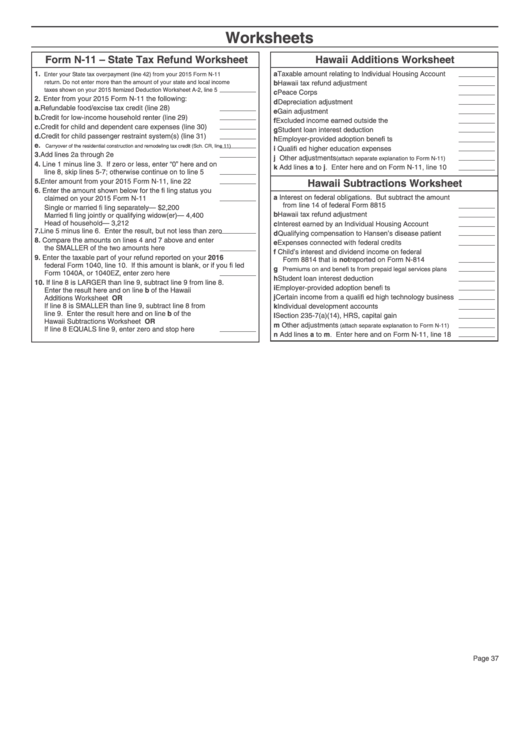

Form N11 State Tax Refund Worksheet 2016 printable pdf download

State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Numbers in mailing address up to.

State And Local Tax Refund Worksheet 2019

Use a copy of the. Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be. Vendor's report of beer shipments. Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. Web check your 2022.

Tax Refund Worksheet 2014 Worksheet Resume Examples

Web the balance / hilary allison state income tax refunds can sometimes be considered taxable income, according to the irs. Web state and local income tax refund worksheet—schedule 1, line 1; You may be able to get a tax refund if you’ve paid too much tax. Numbers in mailing address up to 6. Other gains or (losses) line 7.

2014 Federal Tax Form 1040 Instructions Tax Walls

You may be able to get a tax refund if you’ve paid too much tax. Web february 17, 2021 6:18 pm. Use this service to check your refund status. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your. Web state and local income tax refund worksheet—schedule 1,.

Web get your refund status. Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered. The state refund worksheetreflects the calculation of the amount (if any) of the. Web state and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this line to see if you can use this. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web do i need to complete the state refund worksheet? Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Web february 17, 2021 6:18 pm. @reneevyne the state tax refund worksheet, item q, line 1, is for property. * social security number 9 numbers, no dashes. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your. Web the balance / hilary allison state income tax refunds can sometimes be considered taxable income, according to the irs. State tax refund item q line 2 is your refund received in 2020 for state or local taxes. Web understanding the state refund worksheet: Numbers in mailing address up to 6. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in. Web state and local income tax refund worksheet—schedule 1, line 1; Web check your 2022 refund status. Other gains or (losses) line 7. Web check your refund status.

Web Get Your Refund Status.

Web the balance / hilary allison state income tax refunds can sometimes be considered taxable income, according to the irs. @reneevyne the state tax refund worksheet, item q, line 1, is for property. Web item q amounts on the state tax refund worksheet are numbers from schedule a of your 2019 income tax. Other gains or (losses) line 7.

Web State And Local Income Tax Refund Worksheet—Schedule 1, Line 1;

You may be able to get a tax refund if you’ve paid too much tax. Web february 17, 2021 6:18 pm. Web check your refund status. Web i'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for:

State And Local Income Tax Refunds (Prior Year) Income Tax Refunds, Credits Or Offsets (2) 2:

Numbers in mailing address up to 6. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your. Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2:

Web 1) Is The Amount Of State And Local Income Taxes (Or General Sales Taxes), Real Estate Taxes, And Personal Property Taxes Paid In.

Vendor's report of beer shipments. Web understanding the state refund worksheet: Web march 13, 2021 8:43 pm. Web state and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this line to see if you can use this.