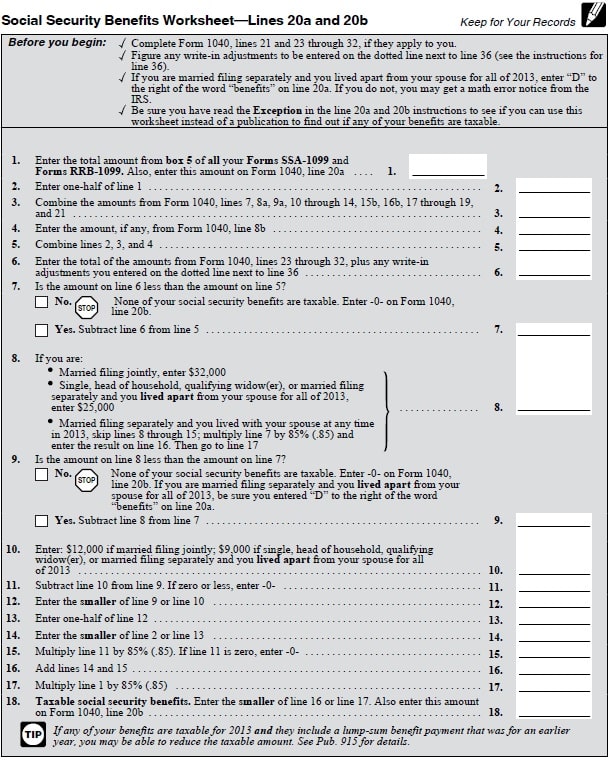

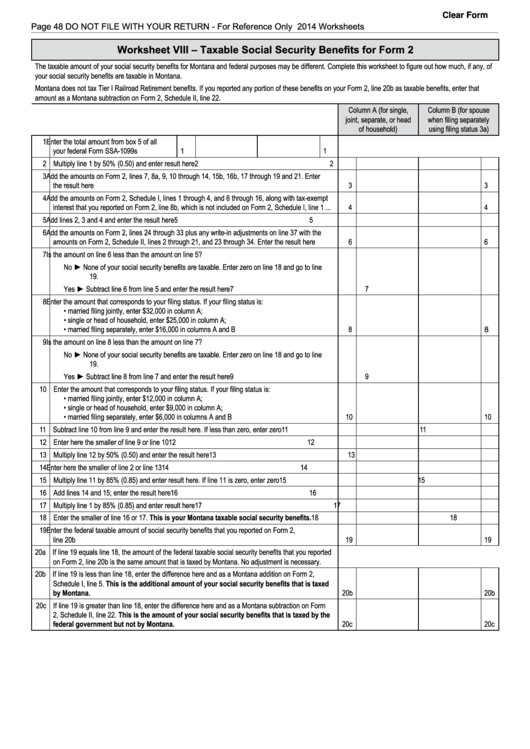

Ssa Taxable Income Worksheet - In many cases, the taxable portion is less. Web irs, the social security administration (ssa), and the u.s. Web worksheet instead of a publication to find out if any of your benefits are taxable. More than $34,000, up to 85. Web benefits are taxable for 2019. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. • form 2555 (foreign earned income) is being filed; Web *can be offset by income tax provisions. More than $34,000, up to 85. With my social security, you can.

worksheet. Irs Social Security Worksheet. Grass Fedjp Worksheet Study Site

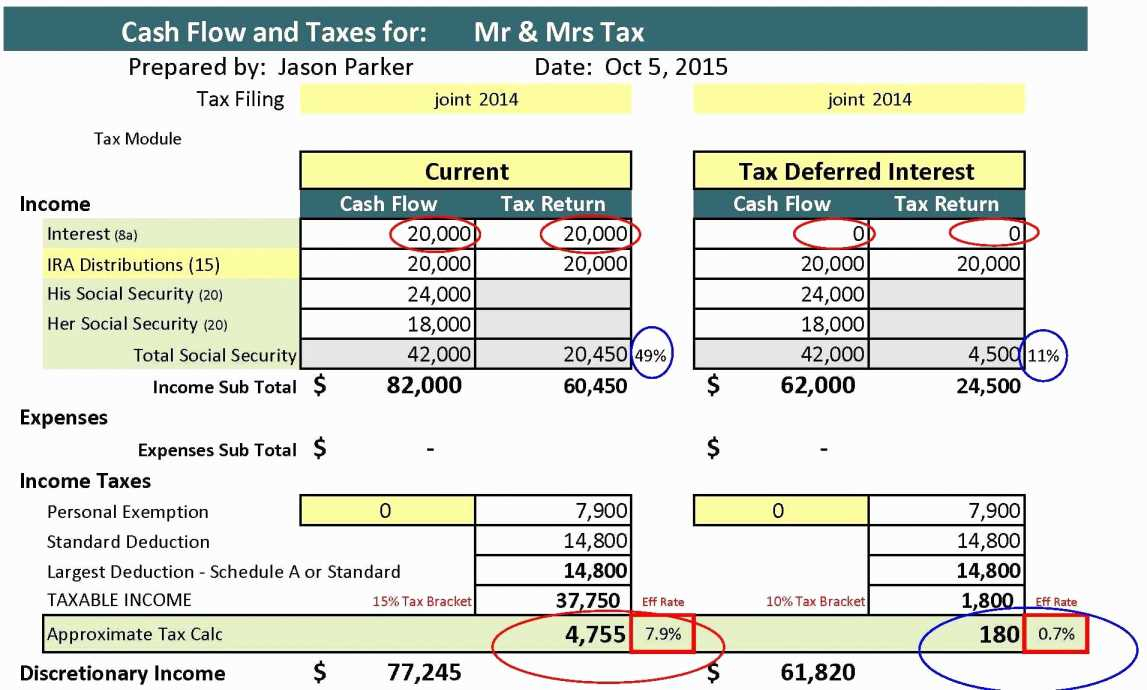

More than $34,000, up to 85. Web instead, use the worksheets in irs pub. It is prepared through the joint. Social security benefits include monthly. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin:

Social Security Calculator Spreadsheet Spreadsheet Download social

Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. From connecticut individual use tax worksheet, section a, column 7. Web social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web fifty percent of a taxpayer's benefits may be taxable if they.

Irs Social Security Tax Worksheet

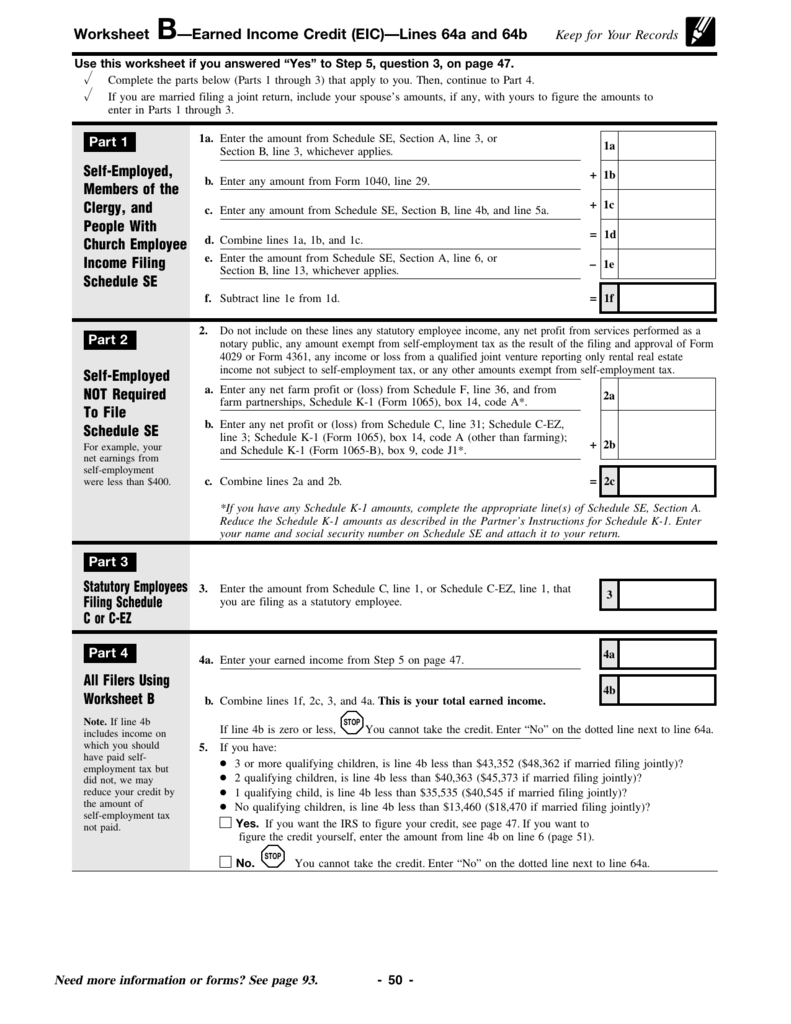

Web worksheet instead of a publication to find out if any of your benefits are taxable. • form 2555 (foreign earned income) is being filed; Web fifty percent of a taxpayer's benefits may be taxable if they are: Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits..

2018 Social Security Taxable Worksheet Master of

In many cases, the taxable portion is less. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. With my social security, you can. Web social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web this publication explains the federal income tax rules.

Printable Form Ssa 1099 Printable Form 2022

Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits. Filing single, head of household or qualifying. Web ssi provides monthly payments to people with disabilities and older adults who have little or no income or resources. Employee/employer (each) 1.45% on all earnings. Total use tax due at.

2021 Social Security Taxable Worksheets

Web ssi provides monthly payments to people with disabilities and older adults who have little or no income or resources. Your social security benefits are taxable based on your filing status and agi. • form 2555 (foreign earned income) is being filed; It is prepared through the joint. Web *can be offset by income tax provisions.

Taxable Social Security Worksheet 2021

With my social security, you can. Web your social security number. It is prepared through the joint. Web benefits are taxable for 2019. 915 if any of the following apply:

Is Social Security Tax Deductible

Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. Web worksheet instead of a publication to find out if any of your benefits.

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web worksheet instead of a publication to find out if any of your benefits are taxable. In many cases, the taxable.

Example Of Non Ssa 1099 Form Form SSA1099 Download Printable PDF or

Web fifty percent of a taxpayer's benefits may be taxable if they are: With my social security, you can. More than $34,000, up to 85. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. In many cases, the taxable portion is less.

In many cases, the taxable portion is less. Filing single, head of household or qualifying. Web social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. Web fifty percent of a taxpayer's benefits may be taxable if they are: Web instead, use the worksheets in irs pub. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web *can be offset by income tax provisions. Employee/employer (each) 1.45% on all earnings. Your social security benefits are taxable based on your filing status and agi. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web irs, the social security administration (ssa), and the u.s. It is prepared through the joint. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. From connecticut individual use tax worksheet, section a, column 7. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. More than $34,000, up to 85. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Total use tax due at 1%: Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

Total Use Tax Due At 1%:

Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. If your income is modest, it is likely that none of your social security benefits. With my social security, you can.

Employee/Employer (Each) 1.45% On All Earnings.

915 if any of the following apply: Filing single, head of household or qualifying. It is prepared through the joint. Web ssi provides monthly payments to people with disabilities and older adults who have little or no income or resources.

Web Worksheet Instead Of A Publication To Find Out If Any Of Your Benefits Are Taxable.

Web instead, use the worksheets in irs pub. Married filers with an agi. From connecticut individual use tax worksheet, section a, column 7. Your social security benefits are taxable based on your filing status and agi.

Web 2020 Social Security Taxable Benefits Worksheet Keep For Your Records Publication 915 Before You Begin:

3) use the worksheet in irs pub. Web social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web benefits are taxable for 2019. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent.