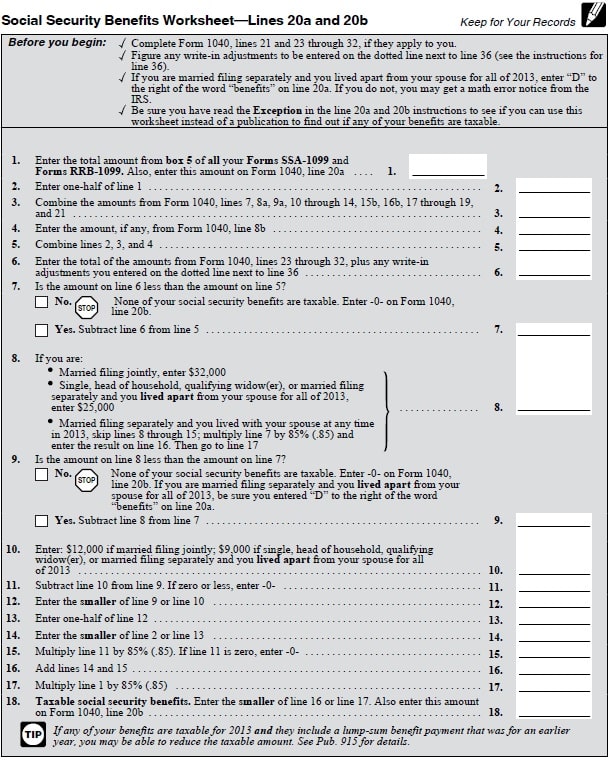

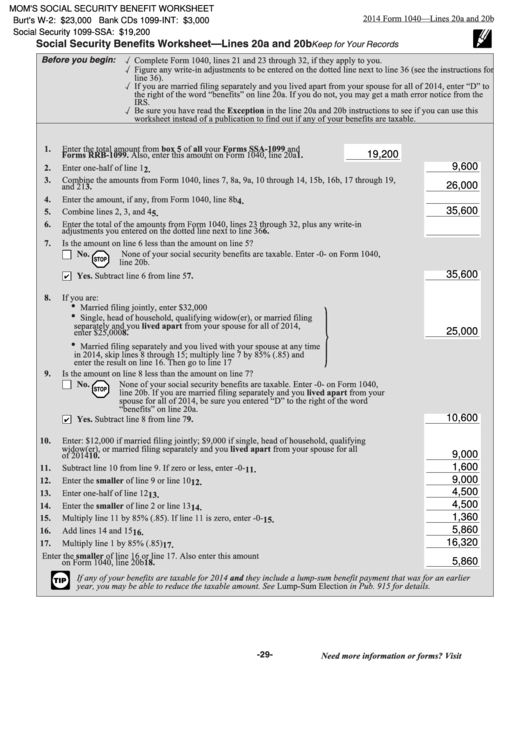

Ss Taxable Income Worksheet - Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web the taxact ® program will automatically calculate the taxable amount of your social security income (if any). Get tax form (1099/1042s) update direct deposit. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web you can see the worksheet in forms mode. Web ray and alice have two savings accounts with a total of $250 in taxable interest income. As your total income goes up, you’ll pay. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

Form 1040 U.S. Individual Tax Return Definition

You file a federal tax return as an individual and. As your total income goes up, you’ll pay. Web for clients with provisional income over $44,000 (joint) a) the portion of income between $32,000 and $44,000 is. Get tax form (1099/1042s) update direct deposit. Web so benefit estimates made by the quick calculator are rough.

Taxable Social Security Worksheet 2021

Web your social security number. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web the taxact ® program will automatically calculate the taxable amount of your social security income (if.

Social Security Taxable Benefits Worksheet 2021

Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: Web up to 50% of your social security benefits are taxable if: Web are social security survivor benefits for children considered taxable income? Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web between $25,000 and $34,000,.

Taxable Social Security Benefits Worksheet 2018 Master

More than $34,000, up to 85. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web your social security number. As your total income goes up, you’ll pay. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin:

Taxable Social Security Benefits calculation, Inclusion of SS benefit

Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web your social security number. Total use tax due at 1%: Web social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web so benefit estimates made by the quick calculator.

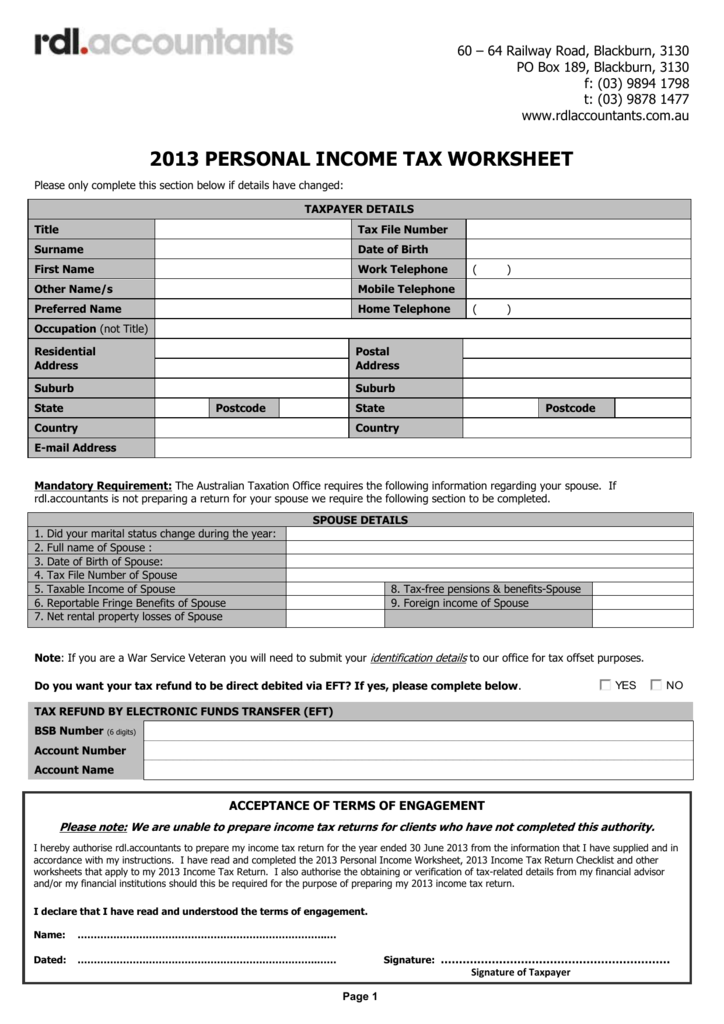

personal tax worksheet

Web your social security number. From within your taxact online return,. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web the taxact ® program will automatically calculate the taxable amount of your social security income (if any). Web ray and alice have two savings accounts with.

Amount Of Social Security Taxable

Select forms in the upper right hand corner of your open return. Web up to 50% of your social security benefits are taxable if: Although the quick calculator makes an initial. Web the taxact ® program will automatically calculate the taxable amount of your social security income (if any). From within your taxact online return,.

Fillable Form 1040 Social Security Benefits Worksheet 1040 Form Printable

Web you can see the worksheet in forms mode. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: From within your taxact online return,. Web to view the social security benefits worksheet: Web the taxact ® program will automatically calculate the taxable amount of your social security income (if any).

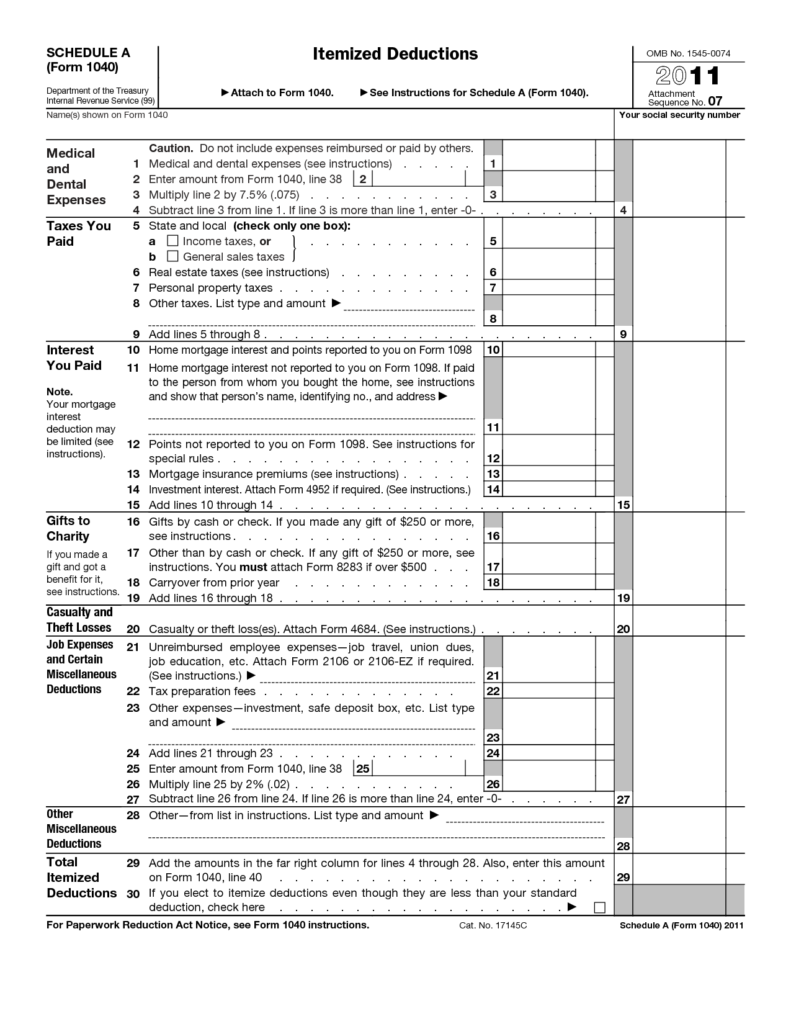

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

From within your taxact online return,. Web up to 50% of your social security benefits are taxable if: Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web so benefit estimates made by the quick calculator are rough. You file a federal tax return as an individual and.

Federal Tax Worksheet —

2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. They complete worksheet 1, shown below, entering. Web up to 50% of your social security benefits are taxable if: From connecticut individual.

Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web you can see the worksheet in forms mode. From within your taxact online return,. Although the quick calculator makes an initial. They complete worksheet 1, shown below, entering. As your total income goes up, you’ll pay. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web social security taxable benefits worksheet 2021 by jerry m how to file social security income on your. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web so benefit estimates made by the quick calculator are rough. Select forms in the upper right hand corner of your open return. Web the taxact ® program will automatically calculate the taxable amount of your social security income (if any). Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. Web up to 50% of your social security benefits are taxable if: 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total. More than $34,000, up to 85.

Web To View The Social Security Benefits Worksheet:

Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Web you can see the worksheet in forms mode. Web up to 50% of your social security benefits are taxable if: They complete worksheet 1, shown below, entering.

Web Between $25,000 And $34,000, You May Have To Pay Income Tax On Up To 50 Percent Of Your Benefits.

From connecticut individual use tax worksheet, section a, column 7. Web for clients with provisional income over $44,000 (joint) a) the portion of income between $32,000 and $44,000 is. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: Web are social security survivor benefits for children considered taxable income?

Web Taxpayers Receiving Social Security Benefits May Have To Pay Federal Income Tax On A Portion Of Those Benefits.

Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Total use tax due at 1%: As your total income goes up, you’ll pay. Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level.

Get Tax Form (1099/1042S) Update Direct Deposit.

Web so benefit estimates made by the quick calculator are rough. Web the taxact ® program will automatically calculate the taxable amount of your social security income (if any). More than $34,000, up to 85. Although the quick calculator makes an initial.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)