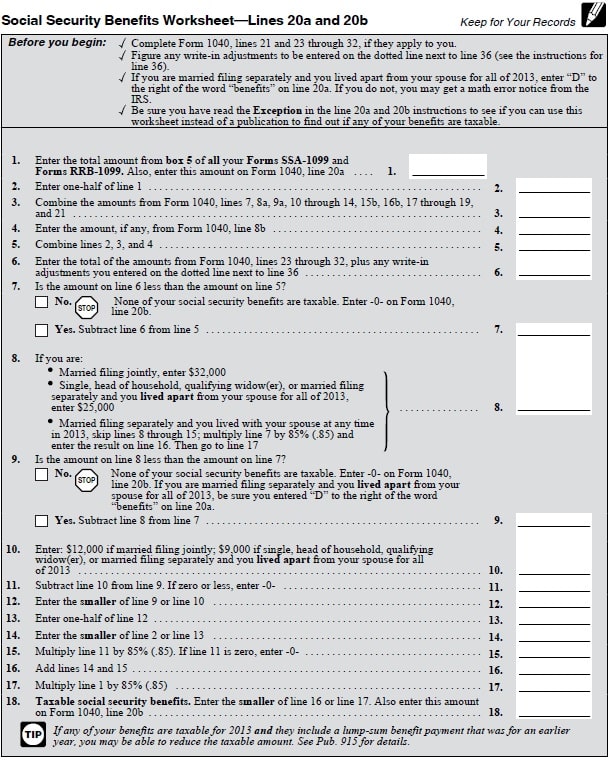

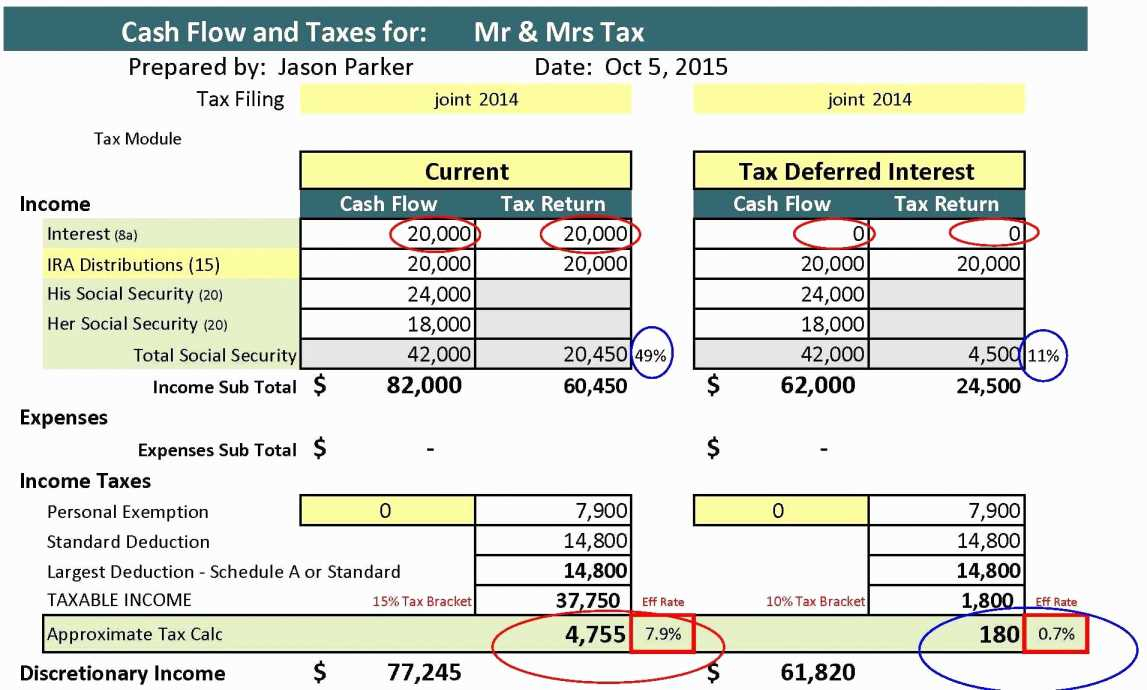

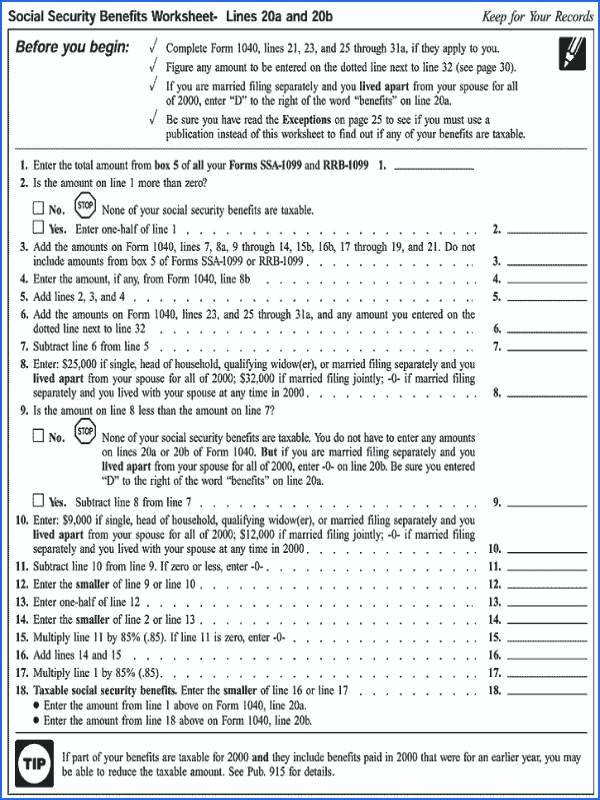

Social Security Taxable Worksheet - Filing single, head of household or qualifying. Married filers with an agi. Do not use this worksheet if any of the following apply. Your social security benefits are taxable based on your filing status and agi. Web social security benefits include monthly retirement, survivor and disability benefits. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. In many cases, the taxable portion is less. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Bill figures his taxable benefits by.

Is Social Security Tax Deductible

Bill figures his taxable benefits by. You can earn a maximum of four credits each year. Web fifty percent of a taxpayer's benefits may be taxable if they are: Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. Web to view the.

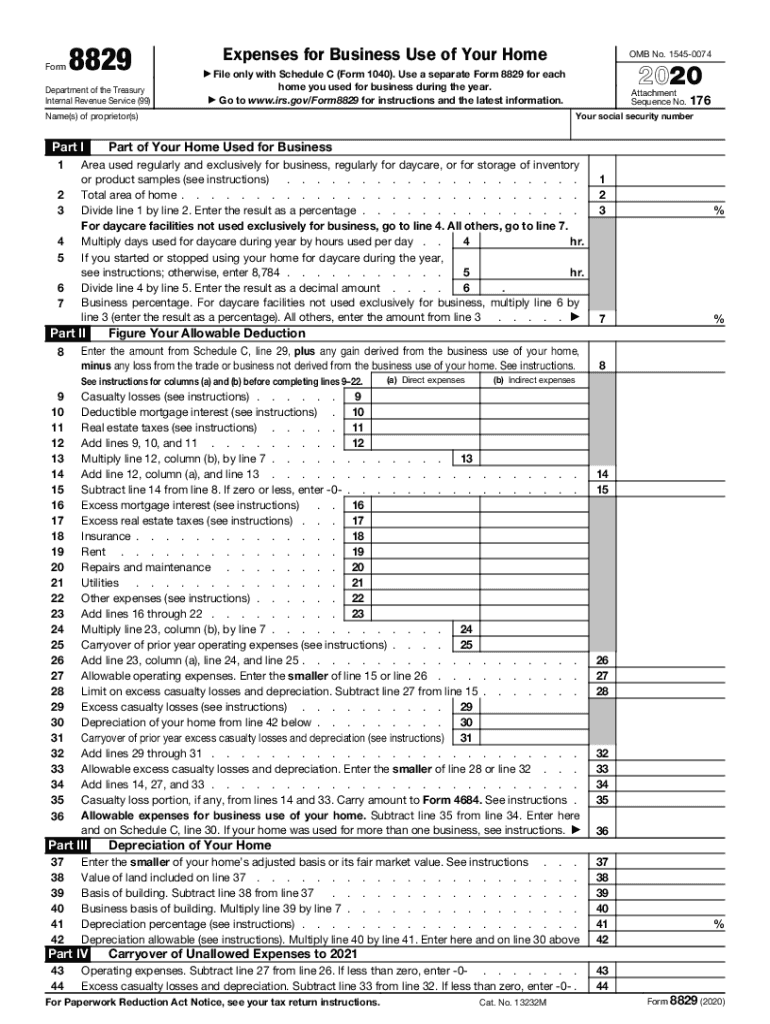

Form 8829 Expenses For Business Use Of Your Home Fill Out and Sign

Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Your social security benefits are taxable based on your filing status and agi. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Web social security benefits depends on your age and the.

Will Your Social Security Benefits Be Taxed? Worksheet Template Tips

Web social security benefits include monthly retirement, survivor and disability benefits. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Web 2021 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Bill figures his taxable benefits by. 1) if the taxpayer made a.

Social Security Calculator Spreadsheet 2 Spreadsheet Downloa social

Generally, each employer for whom you work during the tax year must withhold social security tax up to the. Filing single, head of household or qualifying. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever.

Social Security Worksheet Calculator

Filing single, head of household or qualifying. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Married filers with an agi. Web we developed this worksheet for you to.

2018 Form 1040 Social Security Fillable Worksheet 1040 Form Printable

Filing single, head of household or qualifying. Do not use this worksheet if any of the following apply. Web eligibility for your children. Web social security benefits include monthly retirement, survivor and disability benefits. Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income.

Social Security Benefits Worksheet 2022 Lines 6A And 6B

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web fifty percent of a taxpayer's benefits may be taxable if they are: Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Web social security income is.

Taxable Social Security Worksheets 2020

Web instead, use the worksheets in irs pub. Web social security benefits worksheet (2019) caution: Web up to 50% of your social security benefits are taxable if: Web social security benefits include monthly retirement, survivor and disability benefits. You can earn a maximum of four credits each year.

Fill Free fillable Social Security Taxable Worksheet (2020

From within your taxact online return,. Do not use this worksheet if any of the following apply. In many cases, the taxable portion is less. You file a federal tax return as an individual and. Web instead, use the worksheets in irs pub.

Social Security Benefits Worksheet For 2019 Taxes worksSheet list

Your children may be eligible for a monthly benefit because of your work if they are: Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Married filers with an agi. Do not use this worksheet if any of the following apply. You file a federal tax return as an.

Web 2021 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Web social security benefits worksheet (2019) caution: Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web social security benefits include monthly retirement, survivor and disability benefits. Web social security benefits depends on your age and the type of benefit for which you are applying. Generally, each employer for whom you work during the tax year must withhold social security tax up to the. Do not use this worksheet if any of the following apply. Web up to 50% of your social security benefits are taxable if: Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web to view the social security benefits worksheet: Your social security benefits are taxable based on your filing status and agi. You can earn a maximum of four credits each year. Web instead, use the worksheets in irs pub. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: In many cases, the taxable portion is less. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. You file a federal tax return as an individual and. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Filing single, head of household or qualifying.

Web Social Security Benefits Include Monthly Retirement, Survivor And Disability Benefits.

Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Web to view the social security benefits worksheet: Web information about notice 703, read this to see if your social security benefits may be taxable, including recent.

Your Social Security Benefits Are Taxable Based On Your Filing Status And Agi.

Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. Web social security benefits depends on your age and the type of benefit for which you are applying. You file a federal tax return as an individual and. Web instead, use the worksheets in irs pub.

Web Social Security Benefits Worksheet (2019) Caution:

Web fifty percent of a taxpayer's benefits may be taxable if they are: Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. 1) if the taxpayer made a 2019 traditional ira contribution.

Do Not Use This Worksheet If Any Of The Following Apply.

From within your taxact online return,. Filing single, head of household or qualifying. Your children may be eligible for a monthly benefit because of your work if they are: More than $34,000, up to 85.