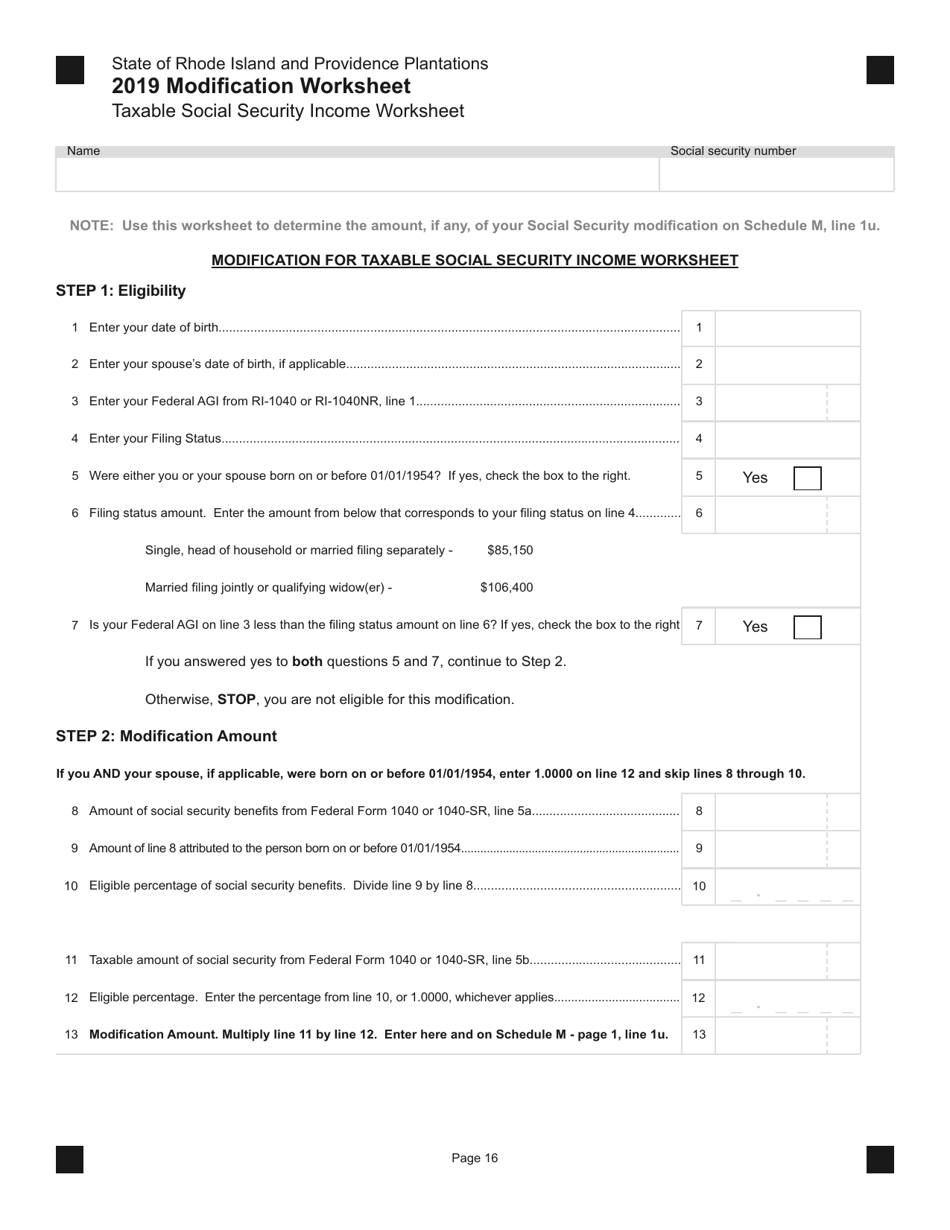

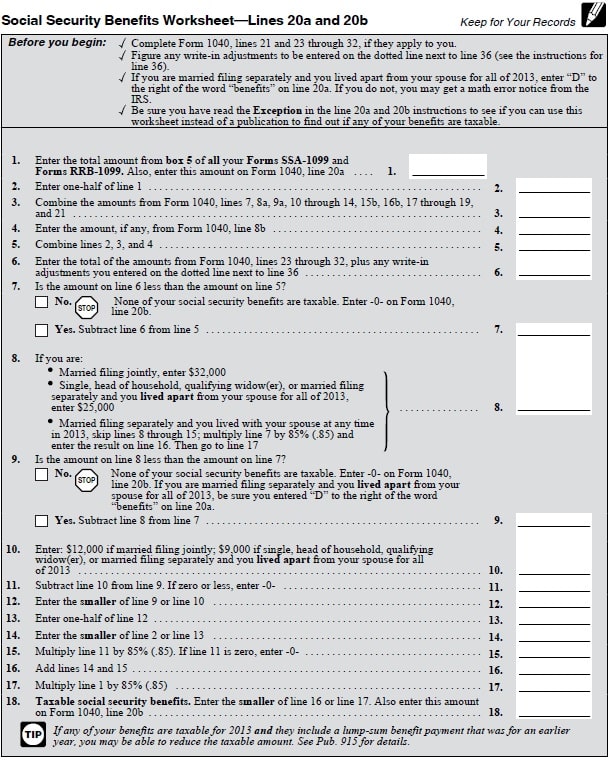

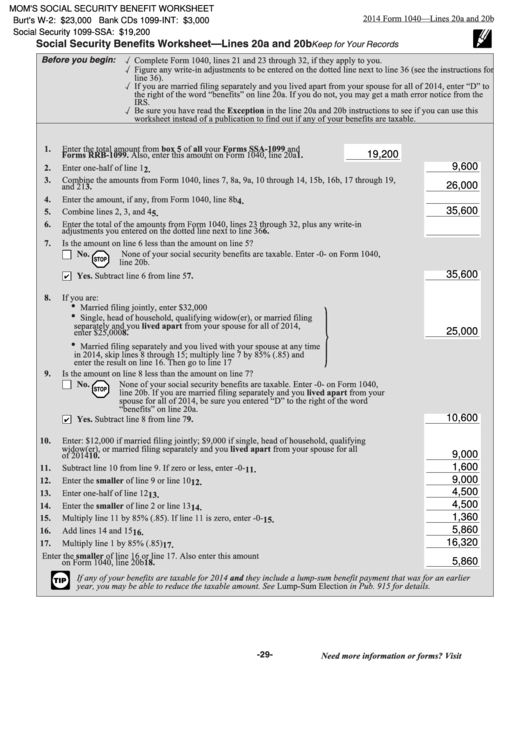

Social Security Taxable Calculation Worksheet - It is prepared through the joint. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. More than $34,000, up to 85. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Compare retirement benefit estimates based on your selected date or age to begin. You can use the money help center calculator to determine how much social. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web my social security retirement estimate. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

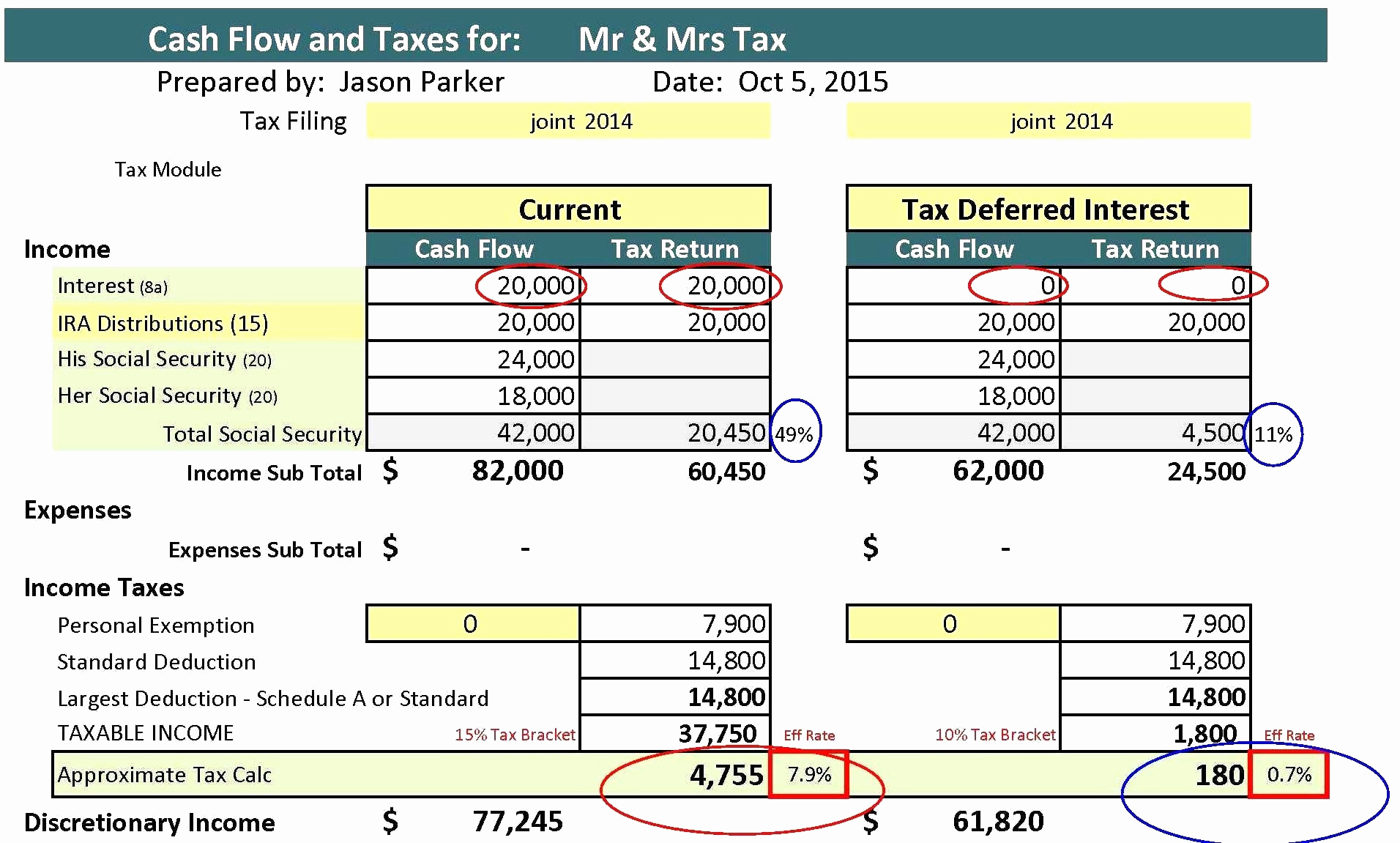

Retirement Cash Flow Spreadsheet in Retirement Calculator Excel

More than $34,000, up to 85. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to.

Will Your Social Security Benefits Be Taxed? Worksheet Template Tips

It is prepared through the joint. Web the current version of the detailed calculator is 2023.2, which we released on may 30, 2023. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability. Get tax form (1099/1042s) update direct deposit. Web as your gross income increases, a higher percentage of.

Taxable Social Security Calculator

Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement benefits. The taxable amount, if any, of a. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Note that not everyone pays. Web as your gross income increases, a higher percentage.

Social Security Worksheet Calculator

Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: This taxable benefit calculator makes it simple for you to show clients how much of their benefit.

Calculate Taxable Portion Of Social Security

Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web worksheet instead of a publication to find out if any of your benefits are taxable. You can use the money help center calculator to determine how much social. Web this publication explains the federal income tax rules for social security benefits and equivalent.

Ssvf Eligibility Calculation Worksheet

Web worksheet instead of a publication to find out if any of your benefits are taxable. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web the current version of the detailed calculator is 2023.2, which we released on may 30, 2023. Web how to calculate my social security.

2021 Social Security Taxable Worksheets

Web this publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement benefits. More than $34,000, up to 85. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web information about notice 703, read this to see if your social security benefits may be taxable, including.

Taxable Social Security Worksheet 2021

Compare retirement benefit estimates based on your selected date or age to begin. Get tax form (1099/1042s) update direct deposit. Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of. More than $34,000, up to 85. This taxable benefit calculator makes it simple for you to show clients how much of.

Fillable Form 1040 Social Security Benefits Worksheet 1040 Form Printable

More than $34,000, up to 85. Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of. You can use the money help center calculator to determine how much social. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: More.

More Nerdy Social Security Stuff I Found With My Spreadsheet Bankers

Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web my social security retirement estimate. It is prepared through the joint. Note that not everyone pays.

The taxable amount, if any, of a. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Web however, the irs helps taxpayers by offering software and a worksheet to calculate social security tax liability. Web if that total is more than $32,000, then part of their social security may be taxable. More than $34,000, up to 85. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: It is prepared through the joint. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Compare retirement benefit estimates based on your selected date or age to begin. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Get tax form (1099/1042s) update direct deposit. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web worksheet instead of a publication to find out if any of your benefits are taxable. Web the current version of the detailed calculator is 2023.2, which we released on may 30, 2023. More than $34,000, up to 85. Web how to calculate my social security benefits. Web my social security retirement estimate. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability.

Web This Publication Explains The Federal Income Tax Rules For Social Security Benefits And Equivalent Tier 1 Railroad Retirement Benefits.

Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability.

Web Enter Your Date Of Birth ( Month / Day / Year Format) / / Enter Earnings In The Current Year:

Web information about notice 703, read this to see if your social security benefits may be taxable, including recent. Note that not everyone pays. Web the current version of the detailed calculator is 2023.2, which we released on may 30, 2023. Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of.

More Than $34,000, Up To 85.

You can use the money help center calculator to determine how much social. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85%. The taxable amount, if any, of a. Compare retirement benefit estimates based on your selected date or age to begin.

Web However, The Irs Helps Taxpayers By Offering Software And A Worksheet To Calculate Social Security Tax Liability.

Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web my social security retirement estimate. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Web if that total is more than $32,000, then part of their social security may be taxable.