Small Business Tax Deductions Worksheet - Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Use separate schedules a, b, c, and/or d, as appropriate,. Web business supplies and equipment. Learn how to do your. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to. Everyone’s favorite day of the year is right around the corner: Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web you should be informed that the deductible mileage rate for 2021 is 56 cents per mile, down from 57.5 cents for. Web small business worksheet client:

18 Best Images of Itemized Deductions Worksheet Printable Itemized

Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Everyone’s favorite day of the year is right around the corner: Web you should be informed that the deductible mileage rate for 2021 is 56 cents per mile, down from 57.5 cents for. Web business supplies and equipment..

Beautiful Business Tax Worksheet Background Small Letter Worksheet

You can deduct gross wages, salary, commission bonuses, or other compensation paid to. Web use this form to figure your qualified business income deduction. Learn how to do your. Web if you take a section 179 deduction (explained in chapter 8 under depreciation) for an asset and before the end of the. Web under current tax law, many business owners.

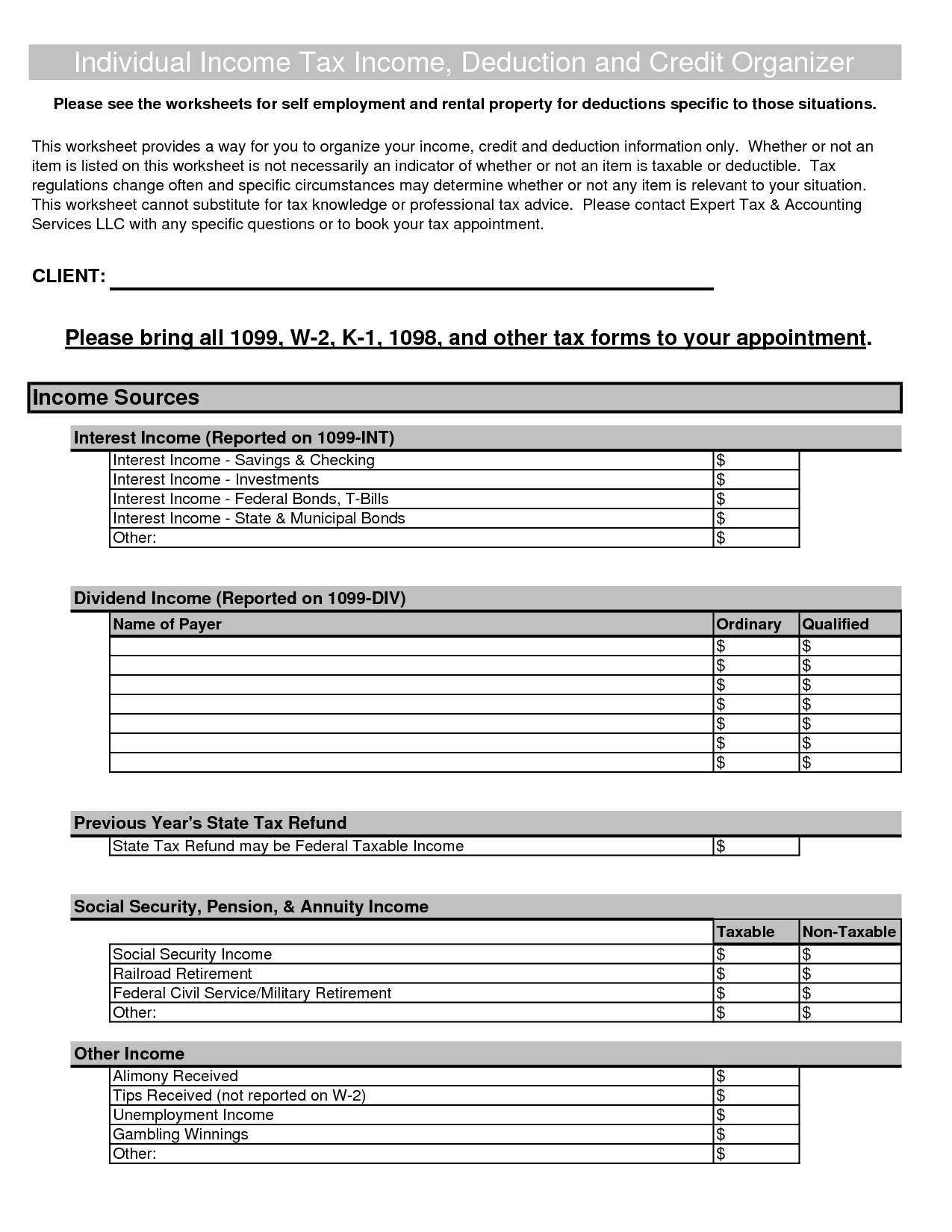

8 Best Images of Tax Preparation Organizer Worksheet Individual

Web you should be informed that the deductible mileage rate for 2021 is 56 cents per mile, down from 57.5 cents for. Web the top 17 small business tax deductions. Web business supplies and equipment. Accountant and attorney fees related to the business. Web use this form to figure your qualified business income deduction.

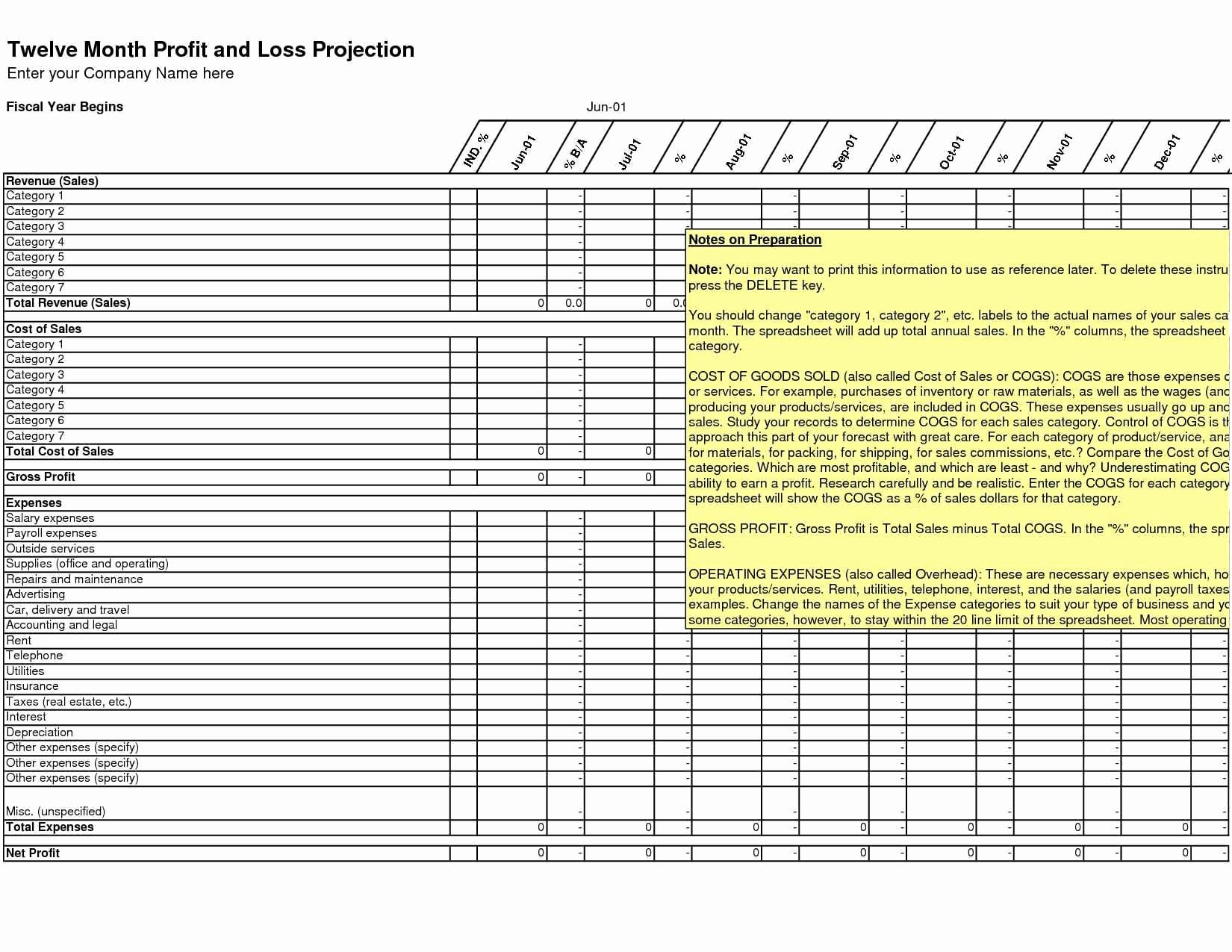

Small Business Tax Spreadsheet Excel Deductions Worksheet —

Each of these expenses are tax deductible. Learn how to do your. Web if you take a section 179 deduction (explained in chapter 8 under depreciation) for an asset and before the end of the. You can deduct gross wages, salary, commission bonuses, or other compensation paid to. Web get our free printable small business tax deduction worksheet at casey.

Small Business Tax Deductions Worksheets

20 top small business expense tax deductions;. Web under current tax law, many business owners can claim a 20% deduction of their qualified business income. Web use this form to figure your qualified business income deduction. Id # tax year ordinary suppliesthe purpose of. Everyone’s favorite day of the year is right around the corner:

Small Business Tax Deductions Worksheet (Part 2) The Neat Company

You can deduct gross wages, salary, commission bonuses, or other compensation paid to. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Web under current tax law, many business owners can claim a 20% deduction of their qualified business income. Web get our free printable small business tax deduction worksheet at casey.

17 Big Tax Deductions (Write Offs) for Businesses Bench Accounting

Learn how to do your. Each of these expenses are tax deductible. Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Accountant and attorney fees related to the business. Use separate schedules a, b, c, and/or d, as appropriate,.

Small Business Tax Preparation Spreadsheet throughout Small Business

Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web business supplies and equipment. You can deduct gross wages, salary, commission bonuses, or other compensation paid to. Each of these expenses are tax deductible. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax.

Small Business Tax Deductions Worksheet —

Web small business worksheet client: Web the top 17 small business tax deductions. Web if you take a section 179 deduction (explained in chapter 8 under depreciation) for an asset and before the end of the. You can deduct gross wages, salary, commission bonuses, or other compensation paid to. Web tax year 2022 small business checklist section a identification client(s).

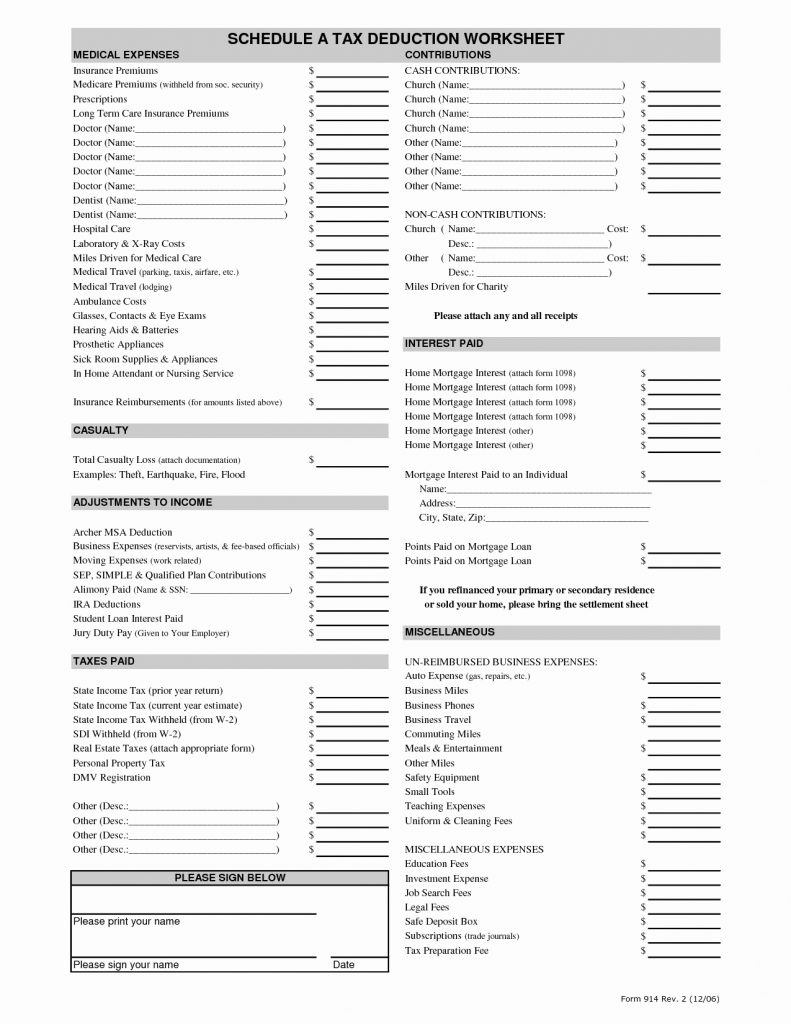

Itemized Deductions Worksheet

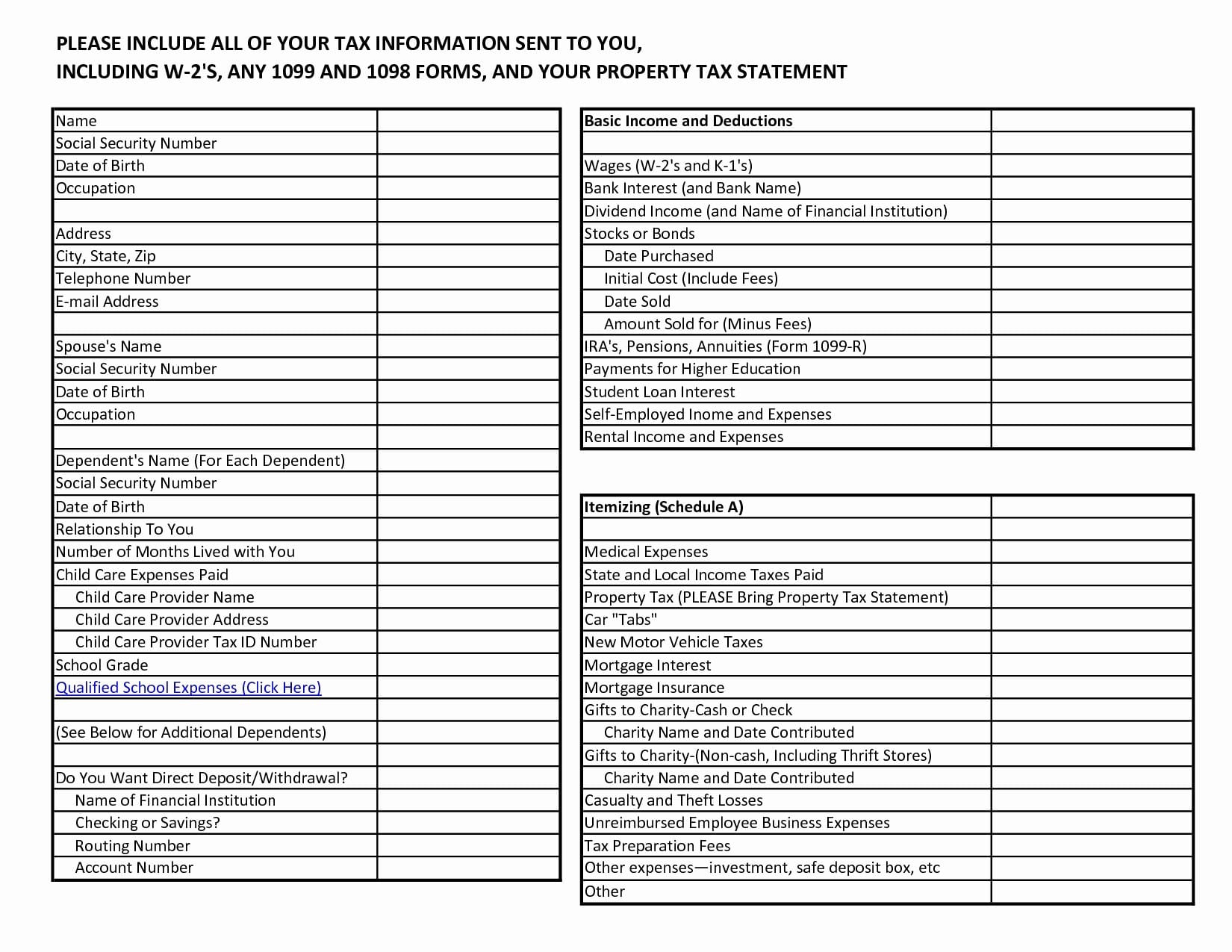

Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Web organize your finances for your small business with this free small business tax spreadsheet in excel. Accountant and attorney fees related to the business. Web use this form to figure your qualified business income deduction. Web the qualified business.

Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Everyone’s favorite day of the year is right around the corner: Web small business worksheet client: Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web if you take a section 179 deduction (explained in chapter 8 under depreciation) for an asset and before the end of the. Id # tax year ordinary suppliesthe purpose of. Consider this a checklist of small business tax write. Web you should be informed that the deductible mileage rate for 2021 is 56 cents per mile, down from 57.5 cents for. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to. Each of these expenses are tax deductible. Learn how to do your. You can deduct gross wages, salary, commission bonuses, or other compensation paid to. Use separate schedules a, b, c, and/or d, as appropriate,. Accountant and attorney fees related to the business. Web under current tax law, many business owners can claim a 20% deduction of their qualified business income. Web the top 17 small business tax deductions.

Consider This A Checklist Of Small Business Tax Write.

Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Learn how to do your. 20 top small business expense tax deductions;. Use separate schedules a, b, c, and/or d, as appropriate,.

Web Under Current Tax Law, Many Business Owners Can Claim A 20% Deduction Of Their Qualified Business Income.

Web if you take a section 179 deduction (explained in chapter 8 under depreciation) for an asset and before the end of the. Web you should be informed that the deductible mileage rate for 2021 is 56 cents per mile, down from 57.5 cents for. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Web small business worksheet client:

Web Use This Form To Figure Your Qualified Business Income Deduction.

Web the top 17 small business tax deductions. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Accountant and attorney fees related to the business.

Web Get Our Free Printable Small Business Tax Deduction Worksheet At Casey Moss Tax, We Have A Free Spreadsheet Template That You Can Use To.

Id # tax year ordinary suppliesthe purpose of. Everyone’s favorite day of the year is right around the corner: Each of these expenses are tax deductible. You can deduct gross wages, salary, commission bonuses, or other compensation paid to.