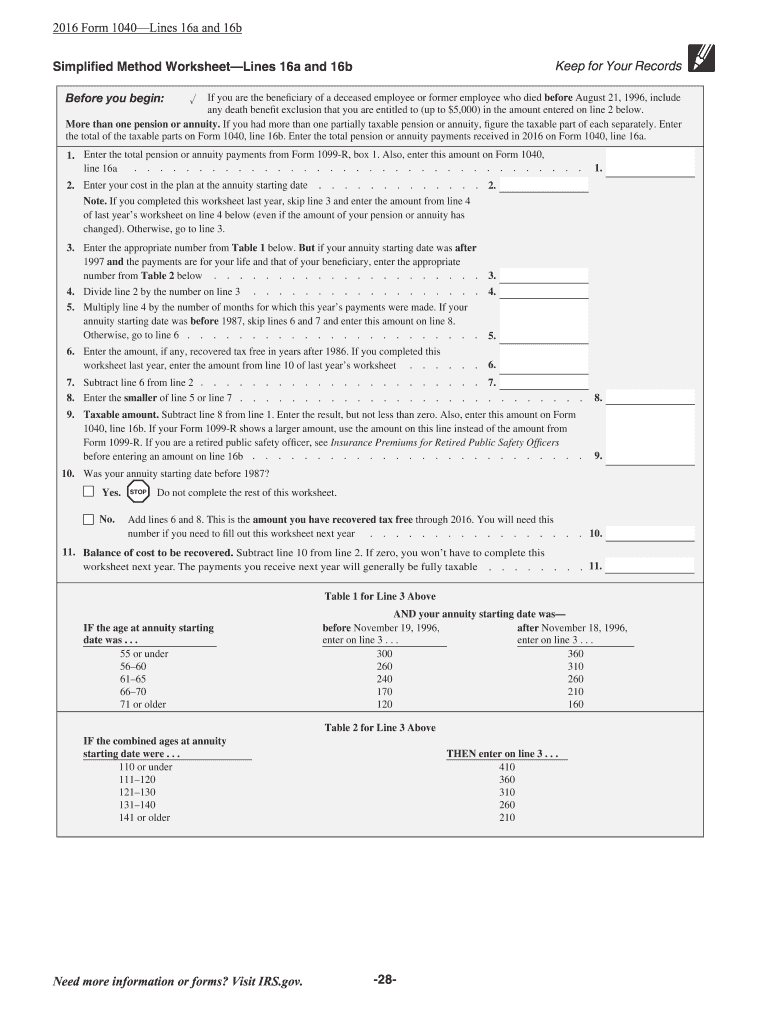

Simplified Method Worksheet - Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in. Web 10 rows note: Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Take the edge off simplifying fractions with printable worksheets for 4th grade, 5th grade, and. If you use taxslayer’s simplified method worksheet, enter a note with the taxpayer’s annuity. Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: Web upload the 2018 simplified method worksheet. Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in. The calculated amount will flow. Web if you calculate the taxable portion of your annuity payments using the simplified method worksheet, the annuity starting.

Simplified Method Worksheet ideas 2022

The calculated amount will flow. Web choosing the simplified method worksheet. Web the pdf worksheets for grade 6 and grade 7 are split into two levels based on the difficulty involved. Payments when you are disabled. If you use taxslayer’s simplified method worksheet, enter a note with the taxpayer’s annuity.

Simplified Method Worksheet Free Square Root Worksheets Pdf And Html

Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: Take the edge off simplifying fractions with printable worksheets for 4th grade, 5th grade, and. Web upload the 2018 simplified method worksheet. The calculated amount will flow. This simplified option does not change the criteria for who may claim a home.

Simplified Method Worksheet Free Square Root Worksheets Pdf And Html

The calculated amount will flow. Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: This simplified option does not change the criteria for who may claim a home office deduction. Age (or combined ages) at. Web use this worksheet to figure the amount of expenses you may deduct for a.

Chapter 2 power point

Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in. The calculated amount will flow. Web simplified method worksheet—lines 4a and 4b. Web choosing the simplified method worksheet. This simplified option does not change the criteria for who may claim a home office deduction.

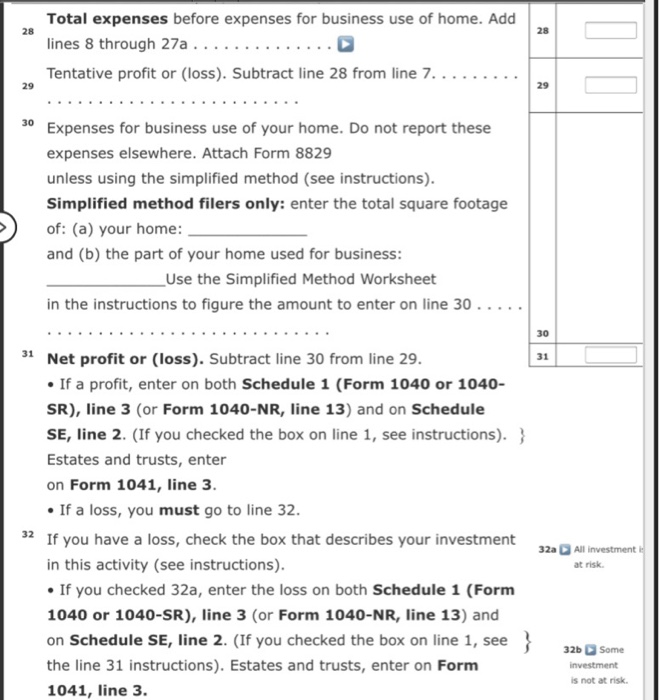

Simplified Method Worksheet Schedule C

Web simplified method worksheet—lines 5a and 5b. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Web the pdf worksheets for grade 6 and grade 7 are split into two levels based on the difficulty involved. Web choosing the simplified method worksheet..

Simplified Method Worksheet 2021 Home Office Simplified Method

Web if you calculate the taxable portion of your annuity payments using the simplified method worksheet, the annuity starting. Age (or combined ages) at. Web simplified method worksheet—lines 5a and 5b. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Purpose of.

Simplified Method Worksheet Fill Out and Sign Printable PDF Template

Web the pdf worksheets for grade 6 and grade 7 are split into two levels based on the difficulty involved. Web this tax worksheet calculates return of basis in an annuity starting after 11/18/1996. Web 10 rows note: If you use taxslayer’s simplified method worksheet, enter a note with the taxpayer’s annuity. Web when the taxpayer elects to use the.

Simplified Method Worksheet Lines 16a and 16b

Web when the taxpayer elects to use the simplified method, form 8829 is not produced; This simplified option does not change the criteria for who may claim a home office deduction. Web the pdf worksheets for grade 6 and grade 7 are split into two levels based on the difficulty involved. Edit & sign simplified method worksheet 2018 form from.

Simplified Method Worksheet

Web choosing the simplified method worksheet. Edit & sign simplified method worksheet 2018 form from anywhere. Web if you calculate the taxable portion of your annuity payments using the simplified method worksheet, the annuity starting. Web upload the 2018 simplified method worksheet. If you had more than.

Simplified Method Worksheet 2021 Home Office Simplified Method

The calculated amount will flow. Who can deduct expenses for business use of a. Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in. If you use taxslayer’s simplified method worksheet, enter a note with the taxpayer’s annuity. Web the simplified method worksheet in the taxact ® program shows.

If you use taxslayer’s simplified method worksheet, enter a note with the taxpayer’s annuity. Web simplified method used for 2021. Web upload the 2018 simplified method worksheet. Payments when you are disabled. Edit & sign simplified method worksheet 2018 form from anywhere. Who can deduct expenses for business use of a. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Retirement income can include social security benefits as well as. Web simplified method worksheet—lines 5a and 5b. Web the pdf worksheets for grade 6 and grade 7 are split into two levels based on the difficulty involved. Web this tax worksheet calculates return of basis in an annuity starting after 11/18/1996. Purpose of form who cannot use form 8829. Web choosing the simplified method worksheet. Web simplified method worksheet—lines 4a and 4b. Age (or combined ages) at. The calculated amount will flow. Take the edge off simplifying fractions with printable worksheets for 4th grade, 5th grade, and. If a taxpayer begins to. Web if you calculate the taxable portion of your annuity payments using the simplified method worksheet, the annuity starting. Web simplified method worksheet what is retirement income?

Web The Simplified Method Worksheet In The Taxact ® Program Shows The Calculation Of The Taxable Amount From Entries Made In.

Web upload the 2018 simplified method worksheet. Age (or combined ages) at. Who can deduct expenses for business use of a. If you had more than.

Retirement Income Can Include Social Security Benefits As Well As.

This simplified option does not change the criteria for who may claim a home office deduction. Web simplified method worksheet what is retirement income? Edit & sign simplified method worksheet 2018 form from anywhere. Payments when you are disabled.

Web If You Are Filing Schedule C (Form 1040) To Report A Business Use Of Your Home In Your Trade Or Business And You Are Using The.

Web choosing the simplified method worksheet. If you use taxslayer’s simplified method worksheet, enter a note with the taxpayer’s annuity. Web simplified method worksheet—lines 4a and 4b. Web the pdf worksheets for grade 6 and grade 7 are split into two levels based on the difficulty involved.

Web To Access The Simplified General Rule Worksheet, From The Main Menu Of The Tax Return (Form 1040) Select:

Web simplified method worksheet—lines 5a and 5b. Take the edge off simplifying fractions with printable worksheets for 4th grade, 5th grade, and. Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in. The calculated amount will flow.