Simple Ira Termination Notice Template - If they do so, the simple ira plan may preclude them from. Complete this form using capital letters and black ink. Terminating a simple ira plan; The irs requires this notification be made before november 2nd, letting employees know that the simple. You must notify your employees within a reasonable time. Know when you can make the switch: Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time. Web terminating specific types of plans. Web when employees want to stop contributions. An employer can terminate a simple plan after giving.

IRA Notice of Withholding and Form Wolters Kluwer

Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time. Know when you can make the switch: Web an employee can withdraw from a simple ira but still might receive employer contributions. The irs requires this notification be made before november 2nd, letting employees know that the simple. Complete this form using capital.

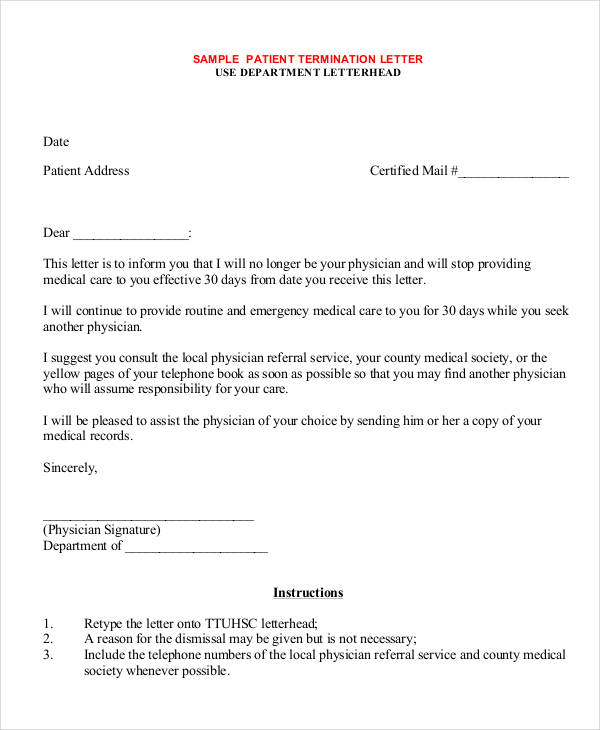

Voluntary Termination Of Employment Letter For Your Needs Letter

Web when employees want to stop contributions. Complete this form using capital letters and black ink. Web an employee can withdraw from a simple ira but still might receive employer contributions. If they do so, the simple ira plan may preclude them from. The irs requires this notification be made before november 2nd, letting employees know that the simple.

Severance Letter Example

Terminating a simple ira plan; An employer can terminate a simple plan after giving. You must notify your employees within a reasonable time. The irs requires this notification be made before november 2nd, letting employees know that the simple. Web when employees want to stop contributions.

19+ Termination Letter Samples Writing Letters Formats & Examples

Web an employee can withdraw from a simple ira but still might receive employer contributions. Terminating a simple ira plan; Complete this form using capital letters and black ink. An employer can terminate a simple plan after giving. Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time.

32+ Simple Termination Letter Templates DOC, PDF, AI

Know when you can make the switch: Web fidelity simple ira— request to remove terminated participants use this form to remove a terminated participant from your company’s simple ira plan. Web terminating specific types of plans. Complete this form using capital letters and black ink. You must notify your employees within a reasonable time.

Cp2000 Response Letter Template Samples Letter Template Collection

Web when employees want to stop contributions. The irs requires this notification be made before november 2nd, letting employees know that the simple. Know when you can make the switch: Web terminating specific types of plans. Web an employee can withdraw from a simple ira but still might receive employer contributions.

Sample Notice of Termination PDF

You must notify your employees within a reasonable time. If they do so, the simple ira plan may preclude them from. Know when you can make the switch: Web an employee can withdraw from a simple ira but still might receive employer contributions. An employer can terminate a simple plan after giving.

35 Perfect Termination Letter Samples [Lease, Employee, Contract]

Terminating a simple ira plan; Complete this form using capital letters and black ink. If they do so, the simple ira plan may preclude them from. An employer can terminate a simple plan after giving. Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time.

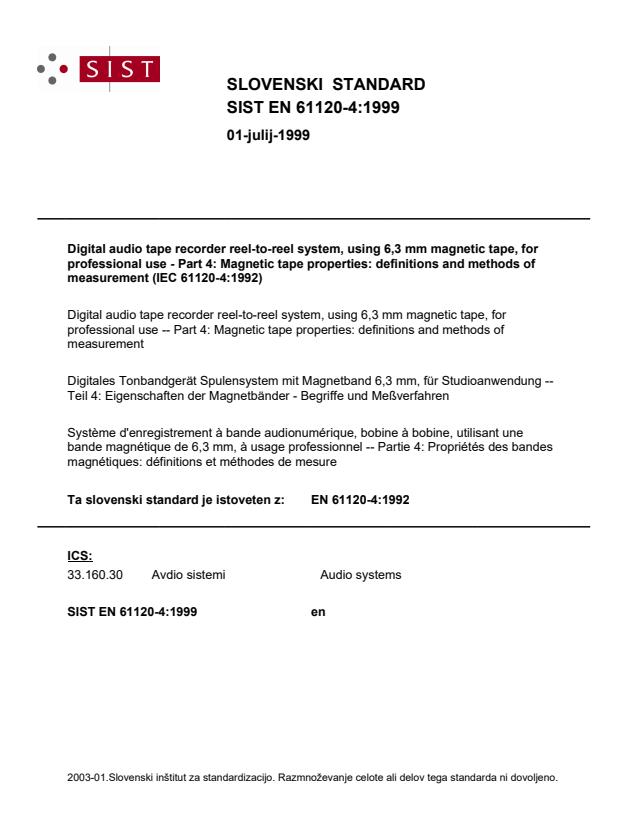

SIST EN 6112041999 Digital audio tape recorder reeltoreel system

Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time. Web an employee can withdraw from a simple ira but still might receive employer contributions. Web terminating specific types of plans. Terminating a simple ira plan; Web fidelity simple ira— request to remove terminated participants use this form to remove a terminated participant.

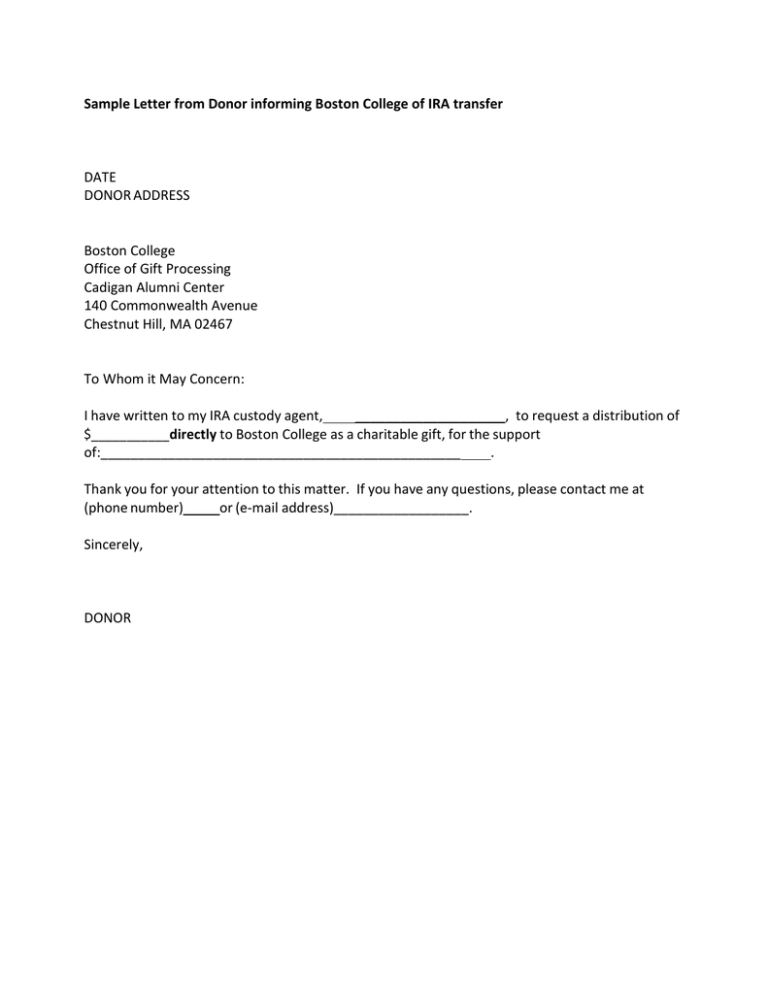

Sample Letter from Donor informing Boston College of IRA transfer DATE

Web an employee can withdraw from a simple ira but still might receive employer contributions. An employer can terminate a simple plan after giving. Terminating a simple ira plan; If they do so, the simple ira plan may preclude them from. Know when you can make the switch:

Complete this form using capital letters and black ink. You must notify your employees within a reasonable time. The irs requires this notification be made before november 2nd, letting employees know that the simple. If they do so, the simple ira plan may preclude them from. An employer can terminate a simple plan after giving. Know when you can make the switch: Web terminating specific types of plans. Web when employees want to stop contributions. Web an employee can withdraw from a simple ira but still might receive employer contributions. Web fidelity simple ira— request to remove terminated participants use this form to remove a terminated participant from your company’s simple ira plan. Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time. Terminating a simple ira plan;

Web An Employee Can Withdraw From A Simple Ira But Still Might Receive Employer Contributions.

Employees may elect to terminate their salary reduction contributions to a simple ira plan at any time. Web terminating specific types of plans. You must notify your employees within a reasonable time. If they do so, the simple ira plan may preclude them from.

Complete This Form Using Capital Letters And Black Ink.

Terminating a simple ira plan; An employer can terminate a simple plan after giving. Web fidelity simple ira— request to remove terminated participants use this form to remove a terminated participant from your company’s simple ira plan. The irs requires this notification be made before november 2nd, letting employees know that the simple.

Web When Employees Want To Stop Contributions.

Know when you can make the switch:

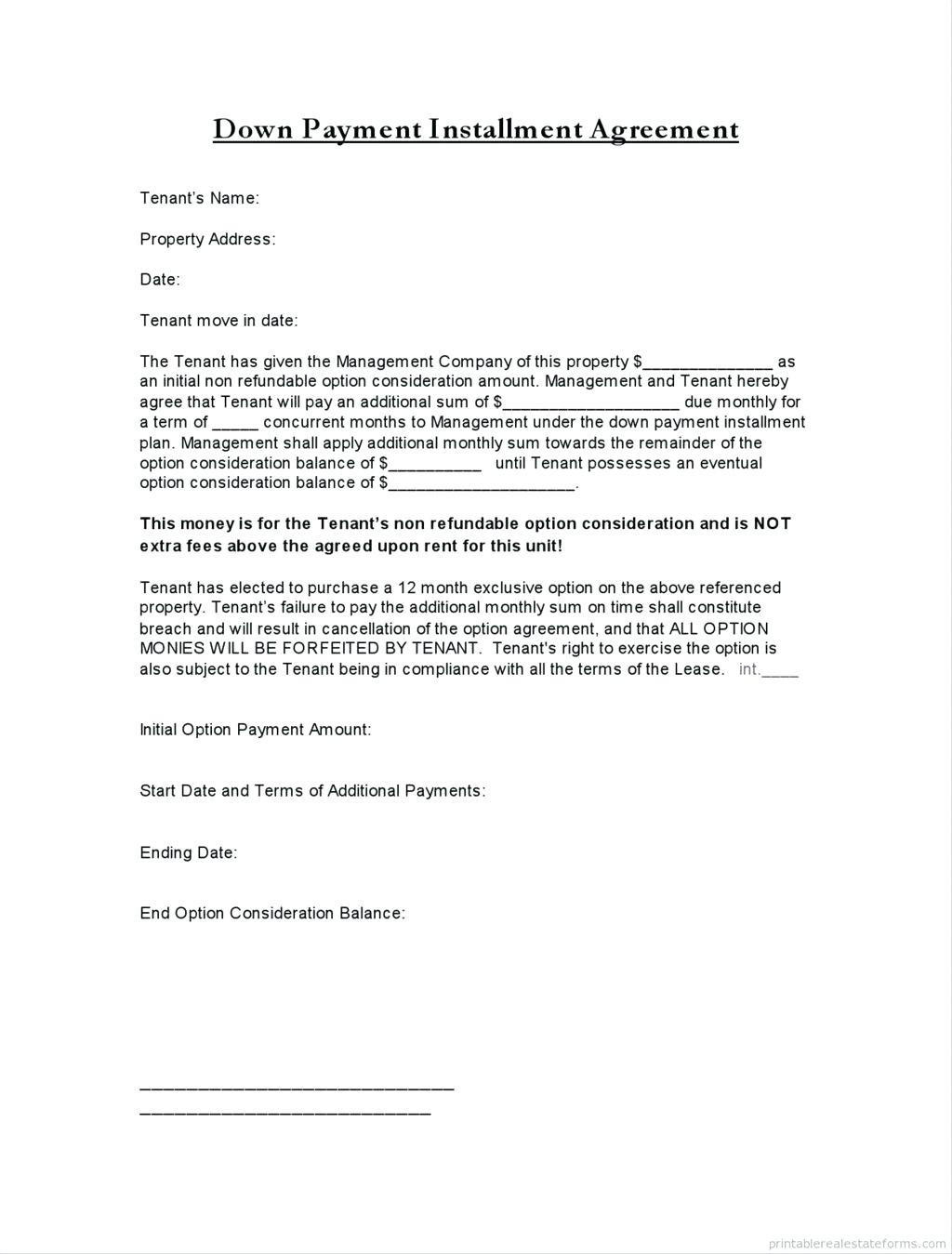

![35 Perfect Termination Letter Samples [Lease, Employee, Contract]](https://templatelab.com/wp-content/uploads/2017/01/Termination-Letter-Template-26-790x1118.jpg)