Sections 1-1 1-2 Hourly Pay And Overtime Pay Worksheet Answers - Hours worked under the flsa; Some employers pay a set amount for every hour an. Hourly pay rate x 1.5 x overtime hours worked. Web introduction this topic contains information on base pay (salary and hourly), bonus, and overtime income, including:. Overtime required after 40 hours or more than six days in a workweek. Calculating your paycheck weekly time card 1 answers;. She worked the following hours. $22.37 x 12 hours = $268.44. $7.60 per hour x 40 hours =. Web employee's overtime pay rate = $21.75 (the regular rate of pay is $14.50 ($12 hourly wage + $2.50/hour bonus) step 3:.

️Calculating Hourly Wages Worksheet Free Download Goodimg.co

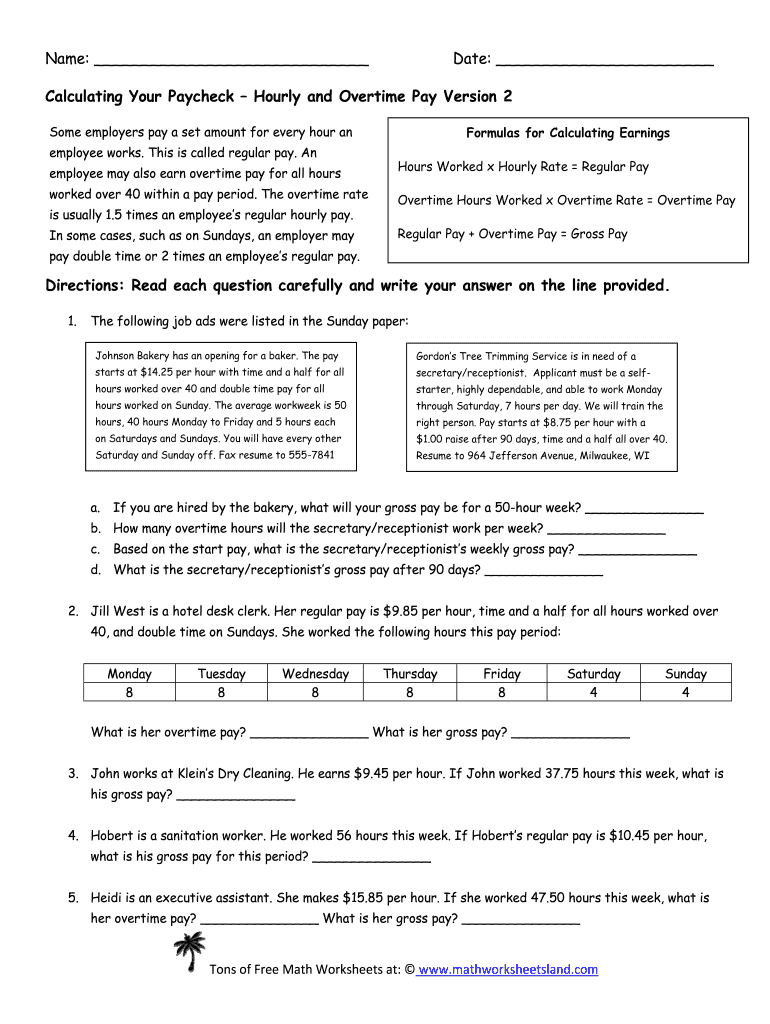

Web jill west is a hotel desk clerk. Web the person's labor cost rate is multiplied by 2.0 to calculate the person's overtime premium labor cost rate. Hourly pay rate x 1.5 x overtime hours worked. Web introduction this topic contains information on base pay (salary and hourly), bonus, and overtime income, including:. Web basic overtime calculation formula =(regular time*rate).

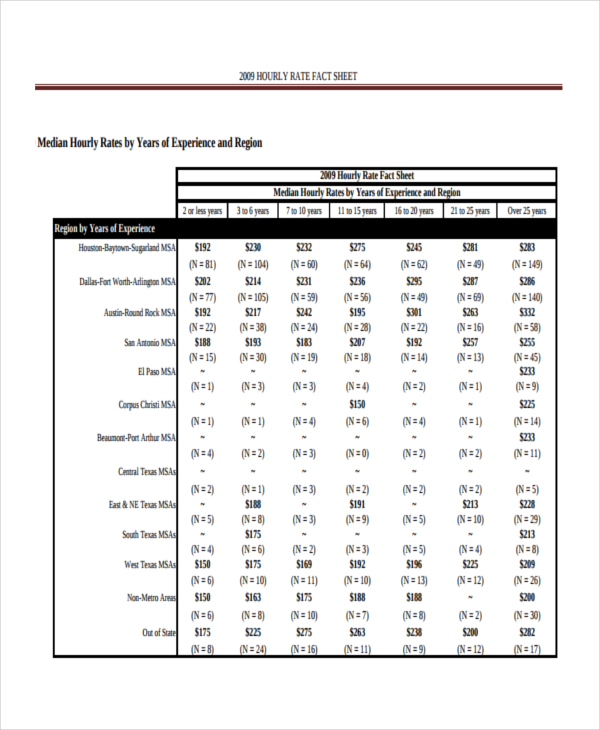

Rate Sheet Template Free Sheet Templates

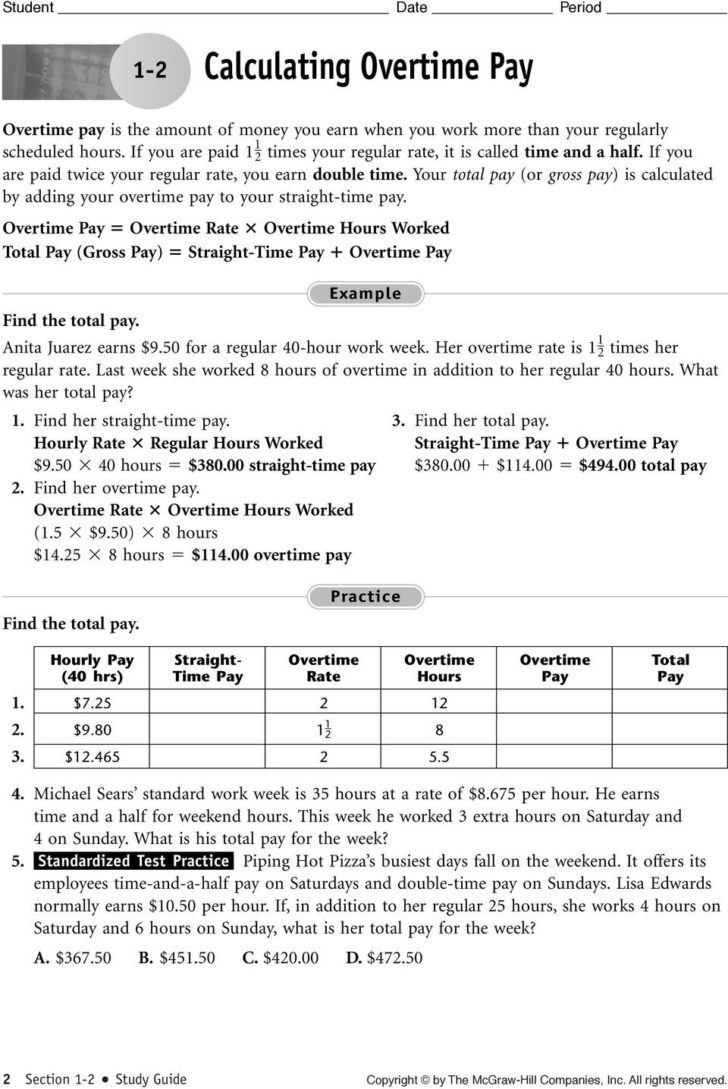

Web the overtime rate overtime hours worked x overtime rate = overtime pay is usually. Hours worked under the flsa; Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime: The trickiest part of payroll administration is calculating overtime. Calculating your paycheck weekly time card 1 answers;.

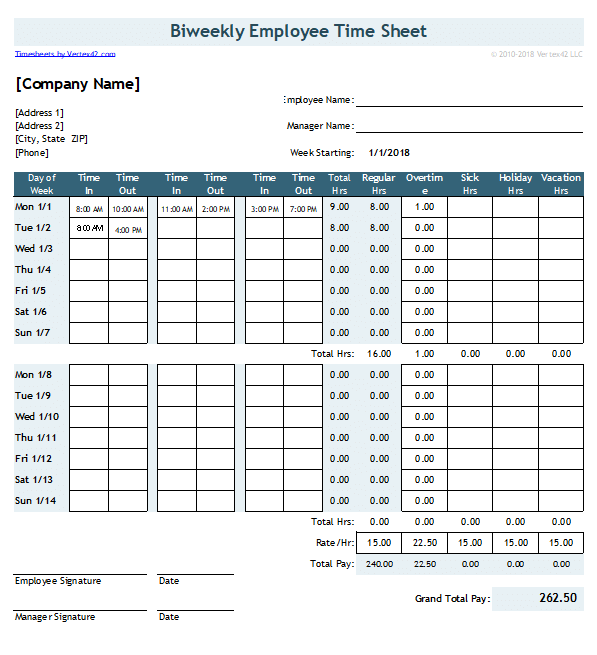

Overtime Spreadsheet Within Overtime Tracking Spreadsheet Excel

Web introduction this topic contains information on base pay (salary and hourly), bonus, and overtime income, including:. Web the overtime rate overtime hours worked x overtime rate = overtime pay is usually. Total amount earned per pay period. In workweek 2 the employee worked 1 overtime hour. She worked the following hours.

Overtime Pay Worksheet Pdf

Overtime wages are a type of increased payment that employees can earn when they work more. $7.60 per hour x 40 hours =. In workweek 2 the employee worked 1 overtime hour. Overtime required after 40 hours or more than six days in a workweek. Calculating your paycheck weekly time card 1 answers;.

Timesheet With Breaks Excel Template

In workweek 2 the employee worked 1 overtime hour. General fact sheets of relevance. Hours worked under the flsa; Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime: Total amount earned per pay period.

Hourly and Overtime Pay Version 2 and Answer following job ads were

Total amount earned per pay period formula: $7.60 per hour x 40 hours =. Calculating your paycheck weekly time card 1 answers;. Overtime required after 40 hours or more than six days in a workweek. Hourly pay rate x 1.5 x overtime hours worked.

Calculating your paycheck hourly and overtime pay version 1 Fill out

General fact sheets of relevance. Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime: Calculating your paycheck weekly time card 1 answers;. Overtime wages are a type of increased payment that employees can earn when they work more. Total amount earned per pay period.

Net Pay, Overtime Rate and Pay worksheet

Some employers pay a set amount for every hour an. Web employee's overtime pay rate = $21.75 (the regular rate of pay is $14.50 ($12 hourly wage + $2.50/hour bonus) step 3:. Web the person's labor cost rate is multiplied by 2.0 to calculate the person's overtime premium labor cost rate. General fact sheets of relevance. Overtime required after 40.

Calculating Overtime Pay Worksheet —

Total amount earned per pay period. Some employers pay a set amount for every hour an. Web the person's labor cost rate is multiplied by 2.0 to calculate the person's overtime premium labor cost rate. Straight time rate of pay x all overtime hours worked. Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime:

Coaching our kids with Aspergers Math annual and hourly salaries

Overtime required after 40 hours or more than six days in a workweek. Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime: $7.60 per hour x 40 hours =. Calculating your paycheck weekly time card 1 answers;. Total amount earned per pay period.

Straight time rate of pay x all overtime hours worked. Hours worked under the flsa; Overtime required after 40 hours or more than six days in a workweek. Web the person's labor cost rate is multiplied by 2.0 to calculate the person's overtime premium labor cost rate. Calculating your paycheck weekly time card 1 answers;. Web employee's overtime pay rate = $21.75 (the regular rate of pay is $14.50 ($12 hourly wage + $2.50/hour bonus) step 3:. Hourly pay rate x 1.5 x overtime hours worked. $22.37 x 12 hours = $268.44. In an emergency, employee may work over. She worked the following hours. In workweek 2 the employee worked 1 overtime hour. $7.60 per hour x 40 hours =. Web introduction this topic contains information on base pay (salary and hourly), bonus, and overtime income, including:. General fact sheets of relevance. Total amount earned per pay period formula: Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime: Some employers pay a set amount for every hour an. Web the overtime rate overtime hours worked x overtime rate = overtime pay is usually. Web jill west is a hotel desk clerk. Overtime wages are a type of increased payment that employees can earn when they work more.

Hourly Pay Rate X 1.5 X Overtime Hours Worked.

Web the person's labor cost rate is multiplied by 2.0 to calculate the person's overtime premium labor cost rate. Overtime wages are a type of increased payment that employees can earn when they work more. $22.37 x 12 hours = $268.44. Total amount earned per pay period formula:

Calculating Your Paycheck Weekly Time Card 1 Answers;.

Total amount earned per pay period. Web jill west is a hotel desk clerk. Web the overtime rate overtime hours worked x overtime rate = overtime pay is usually. She worked the following hours.

Web Employee's Overtime Pay Rate = $21.75 (The Regular Rate Of Pay Is $14.50 ($12 Hourly Wage + $2.50/Hour Bonus) Step 3:.

Straight time rate of pay x all overtime hours worked. Hours worked under the flsa; Web basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) total pay for overtime: In workweek 2 the employee worked 1 overtime hour.

In Workweek 2 The Employee Worked 1 Overtime Hour.

In an emergency, employee may work over. Web introduction this topic contains information on base pay (salary and hourly), bonus, and overtime income, including:. $7.60 per hour x 40 hours =. Some employers pay a set amount for every hour an.