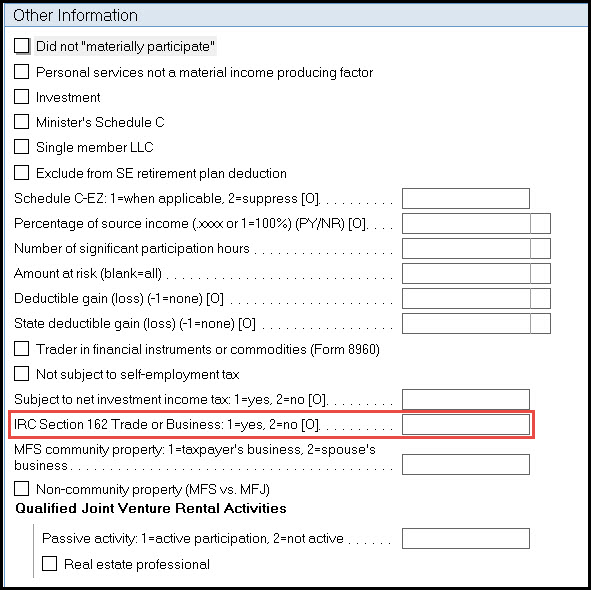

Section 199A Information Worksheet - Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web section 199a income. Web section 199a defines specified service businesses to professional fields like law, financial services,. You may mark more than one unit of screen. Web their full impact is realized when taxable income exceeds an upper income threshold ($464,200 for joint filers. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. Web section 199a is a qualified business income (qbi) deduction. With this deduction, select types of domestic.

Iso Business Worksheet

Web section 199a information worksheet. This is the net ordinary income or, generally, the net rental income produced by the entity. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,. With this deduction, select types of domestic. 199a allows taxpayers other than corporations a deduction of 20% of.

Lacerte QBI Section 199A Partnership and SCorporate Details

Web their full impact is realized when taxable income exceeds an upper income threshold ($464,200 for joint filers. Web partnership’s section 199a information worksheet. With this deduction, select types of domestic. Web purposes of §199a if at least 250 hours of service are performed each year, including • services performed by owners,. 199a allows taxpayers other than corporations a deduction.

Section 199a Information Worksheet

Web partnership’s section 199a information worksheet. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Generally, you may be allowed a deduction of up to 20% of your net. Web the section 199a information worksheet includes columns for multiple activities. Web many owners of sole proprietorships, partnerships, s corporations and some.

Section 199a Information Worksheet

Web partnership’s section 199a information worksheet. Web section 199a information worksheet. You may mark more than one unit of screen. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web qualified business income includes profits from a sole proprietorship, rental income (if your real estate investing rises to the level.

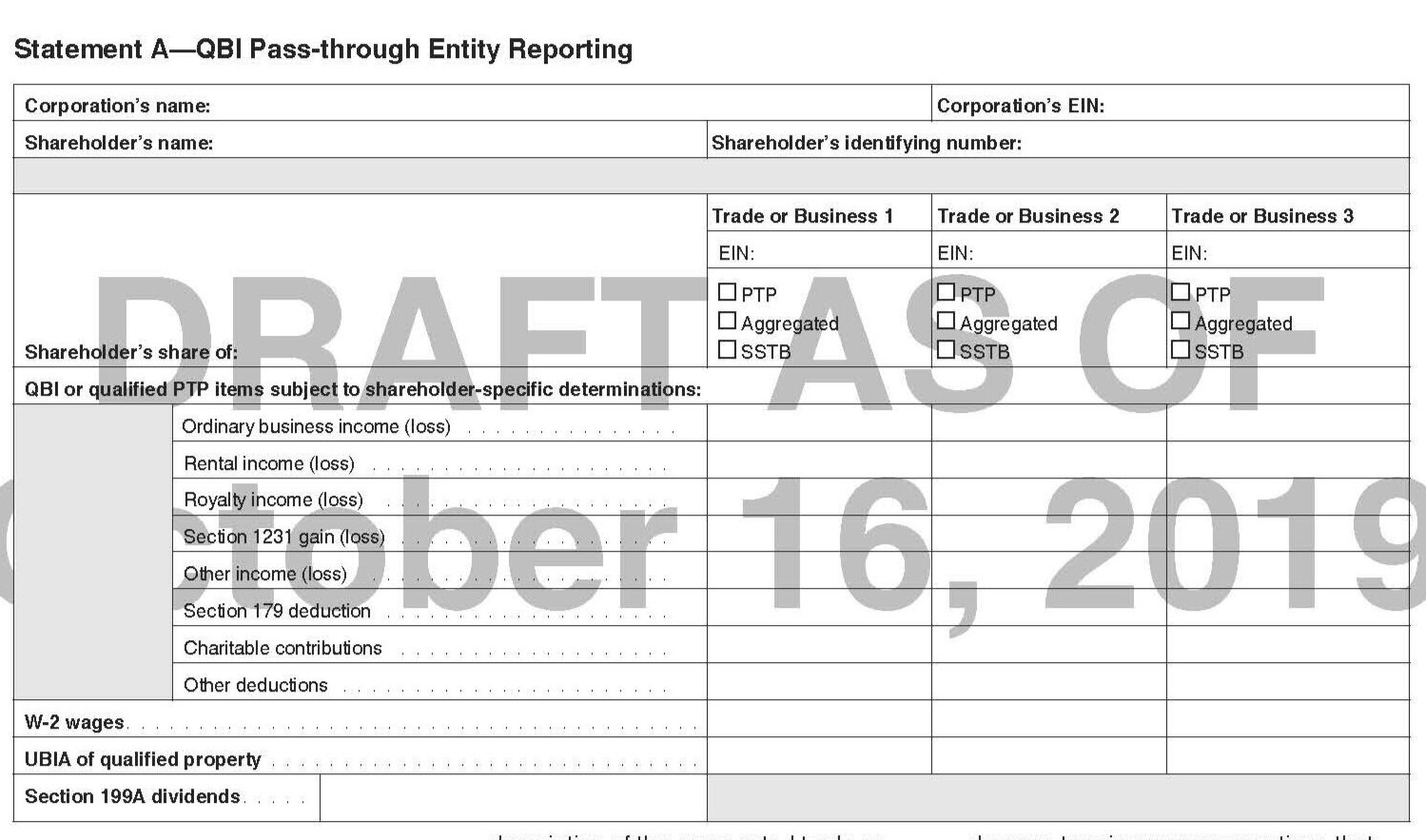

Heartwarming Section 199a Statement A Irs Form 413

Web section 199a is a qualified business income (qbi) deduction. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,. Qbi or qualified ptp items subject to shareholder. Web the section 199a information worksheet includes columns for multiple activities. Web at the top of the schedule c or f.

New IRS Regulations & Guidance for the Section 199A Deduction C

Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. This is the net ordinary income or, generally, the net rental income produced by the entity. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web.

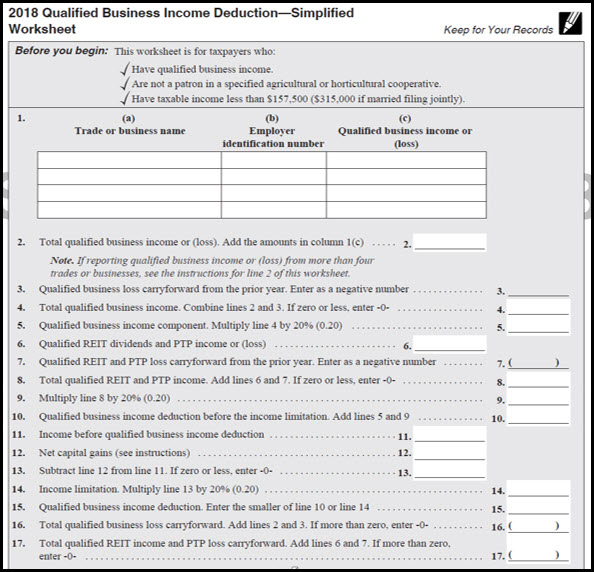

Lacerte Simplified Worksheet Section 199A Qualified Business I

Web partnership’s section 199a information worksheet. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified. You may mark more than one unit of screen. Web section 199a income.

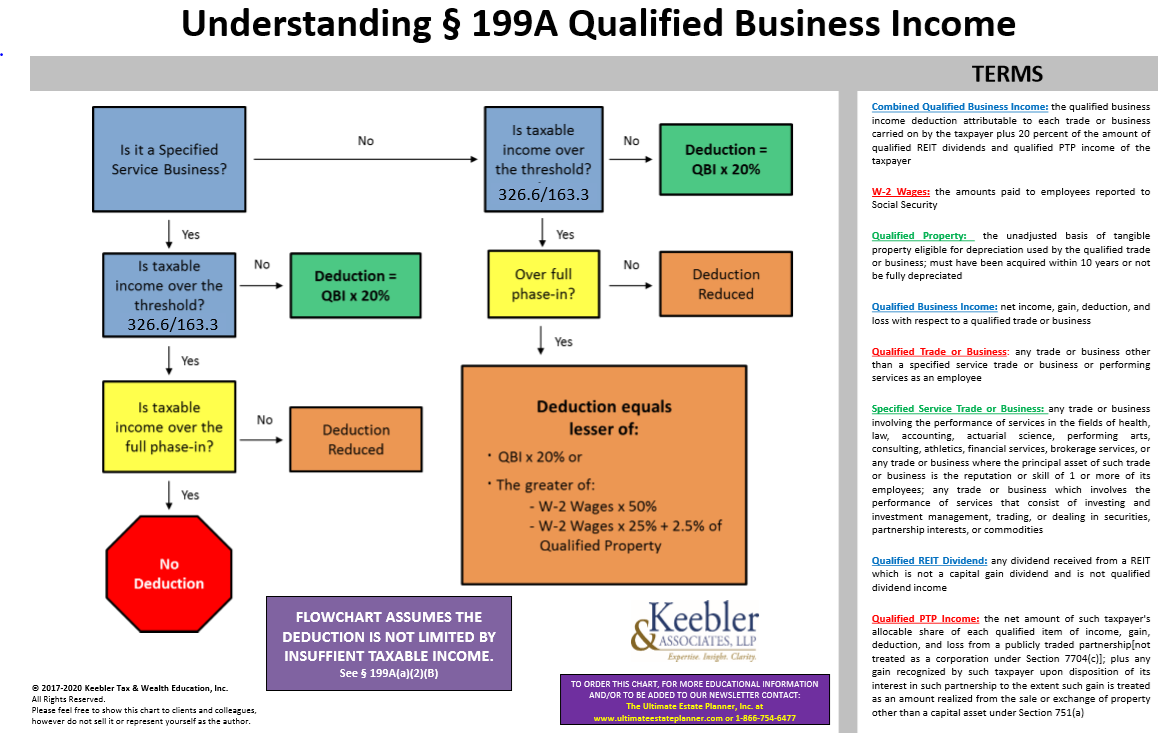

2022 Section 199A Chart Ultimate Estate Planner

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web qualified business income includes profits from a sole proprietorship, rental income (if your real estate investing rises to the level. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,..

Section 199a Information Worksheet

Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. 199a allows taxpayers other than corporations a deduction of 20% of qualified business income earned in a qualified trade or. Web qualified business income includes profits from a sole proprietorship, rental income (if your real estate investing rises to the level..

Section 199a Information Worksheet

Generally, you may be allowed a deduction of up to 20% of your net. Web their full impact is realized when taxable income exceeds an upper income threshold ($464,200 for joint filers. Qbi or qualified ptp items subject to shareholder. Web purposes of §199a if at least 250 hours of service are performed each year, including • services performed by.

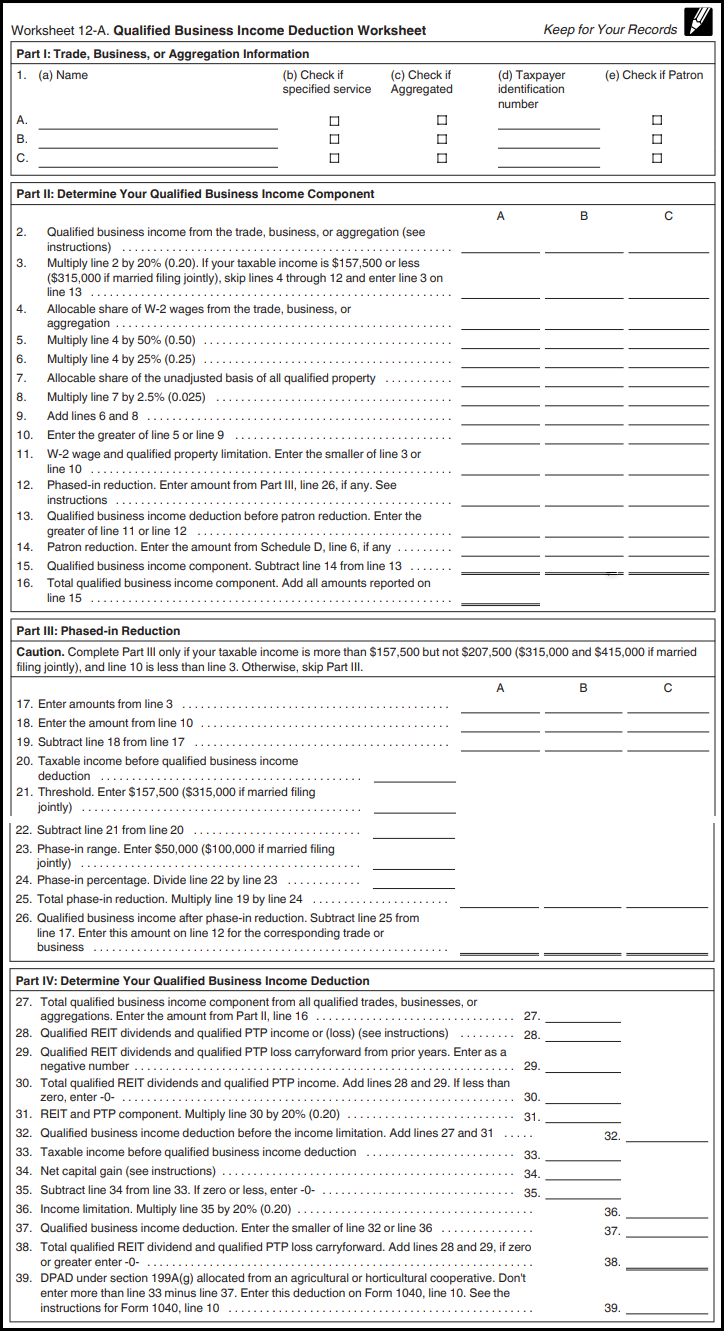

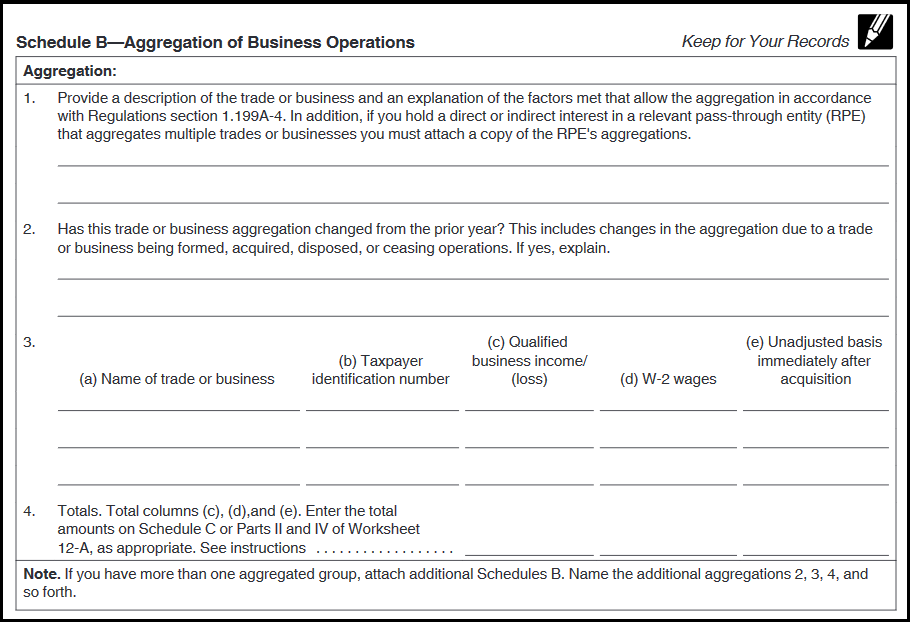

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a defines specified service businesses to professional fields like law, financial services,. Web their full impact is realized when taxable income exceeds an upper income threshold ($464,200 for joint filers. This is the net ordinary income or, generally, the net rental income produced by the entity. Generally, you may be allowed a deduction of up to 20% of your net. You may mark more than one unit of screen. Web section 199a income. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,. Web section 199a information worksheet. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. 199a allows taxpayers other than corporations a deduction of 20% of qualified business income earned in a qualified trade or. Qbi or qualified ptp items subject to shareholder. With this deduction, select types of domestic. Web qualified business income includes profits from a sole proprietorship, rental income (if your real estate investing rises to the level. Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified. Web partnership’s section 199a information worksheet. Web the section 199a information worksheet includes columns for multiple activities.

Web Many Owners Of Sole Proprietorships, Partnerships, S Corporations And Some Trusts And Estates May Be Eligible For A Qualified.

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a defines specified service businesses to professional fields like law, financial services,. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. 199a allows taxpayers other than corporations a deduction of 20% of qualified business income earned in a qualified trade or.

Web This Worksheet Is Designed For Tax Professionals To Evaluate The Type Of Legal Entity A Business Should Consider,.

Web partnership’s section 199a information worksheet. Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web section 199a income.

Web Section 199A Is A Qualified Business Income (Qbi) Deduction.

Web the section 199a information worksheet includes columns for multiple activities. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,. With this deduction, select types of domestic. Web qualified business income includes profits from a sole proprietorship, rental income (if your real estate investing rises to the level.

This Is The Net Ordinary Income Or, Generally, The Net Rental Income Produced By The Entity.

You may mark more than one unit of screen. Web their full impact is realized when taxable income exceeds an upper income threshold ($464,200 for joint filers. Web purposes of §199a if at least 250 hours of service are performed each year, including • services performed by owners,. Web section 199a information worksheet.