Section 105 Plan Template - Business owners can participate in their business’s section 105 plan. Web section 105 plans require specific documents to comply with irs and labor department regulations. While your employer can’t pay your medicare. Web updated on march 17, 2023. Web last updated march 31, 2021. The hra plan can designate the number of hours for an employee to be eligible to participate in. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums. Web section 105 of the internal revenue service (irs) regulations allows for reimbursement of medical expenses under an employer. Web insurance for purposes of § 105. The purpose of the plan is complete and full medical care for the employees of (name of business).

Revenue Integrity Rn Auditor REVNEUS

Web section 105 of the internal revenue service (irs) regulations allows for reimbursement of medical expenses under an employer. Web section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. The purpose of the plan is complete and full medical care for the employees of (name of business). The hra plan can.

Free Business Plan Template (Each Section Explained)

Web updated on march 17, 2023. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums. The hra plan can designate the number of hours for an employee to be eligible to participate in. Web section 105 plans require specific documents to comply with irs and labor department regulations. While.

Section 105 Plan vs Section 125 Cafeteria Plan What's the Doc

Web because you file your taxes as a sole proprietor on schedule c of your form 1040, the section 105 plan coverage of your. Web section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. Web the short answer is yes. Web section 105 of the internal revenue service (irs) regulations allows.

What is a Section 105 Plan? Prime Corporate Services

Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse. Web section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. Business owners can participate in their business’s section 105 plan. Web the plan is designed and intended to qualify as an accident and health plan.

A Guide to Section 105 Plans PeopleKeep

Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). Web the short answer is yes. Web because you file your taxes as a sole proprietor on schedule c of your form 1040, the section 105 plan coverage of your. The purpose of the plan is complete and full medical.

Section 105 plans for dummies

Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse. Web section 105 of the internal revenue service (irs) regulations allows for reimbursement of medical expenses under an employer. The purpose of the plan is complete and full medical care for the employees of (name of business). Web updated on march 17, 2023. Web.

Section 105 Plan vs Section 125 Cafeteria Plan What’s the Difference

Web last updated march 31, 2021. While your employer can’t pay your medicare. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of. Web because you file your taxes as a sole proprietor on schedule c of your form 1040, the section 105 plan coverage of your. Implement a section 105.

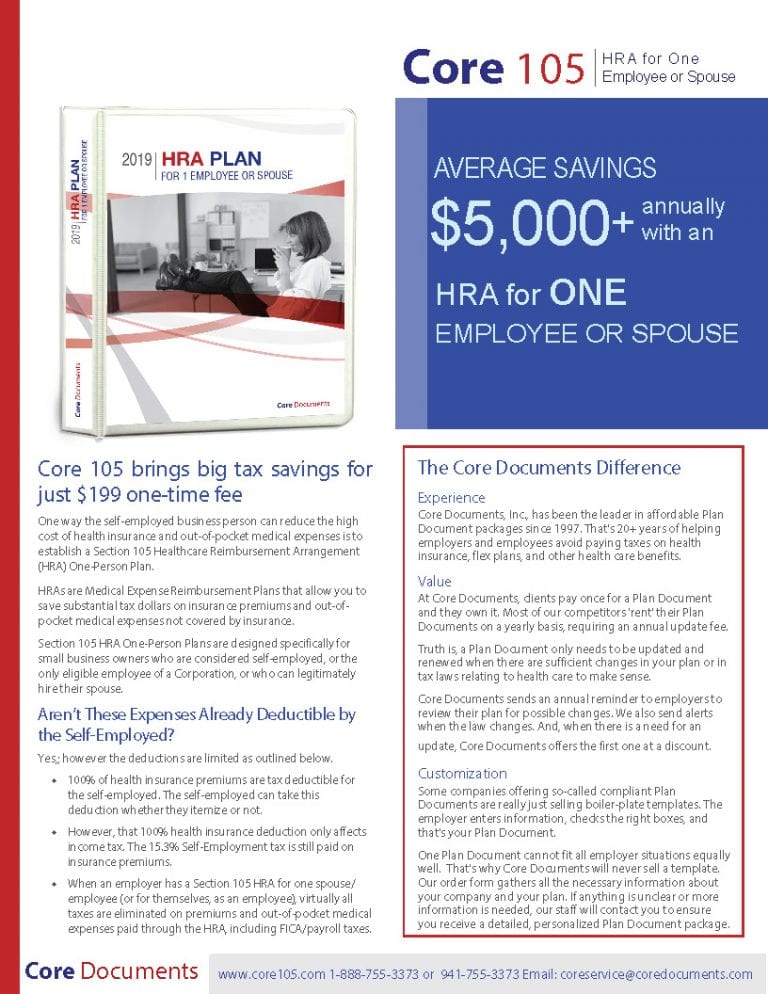

Section 105 OnePerson HRA from 199 fee Core Documents

Web section 105 plans require specific documents to comply with irs and labor department regulations. The hra plan can designate the number of hours for an employee to be eligible to participate in. Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). Web the section 105 plan allows the.

20 C Section Birth Plan Template Simple Template Design

Web a section 105 health reimbursement arrangement is limited to a maximum reimbursement amount set by. The hra plan can designate the number of hours for an employee to be eligible to participate in. Web section 105 of the internal revenue service (irs) regulations allows for reimbursement of medical expenses under an employer. But whether or not you are. While.

Save Taxes Using The IRS Section 105 Medical Reimbursement Plan

The hra plan can designate the number of hours for an employee to be eligible to participate in. Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse. The purpose of the plan is complete and full medical care for the employees of (name of business). Web a section 105 health reimbursement arrangement is.

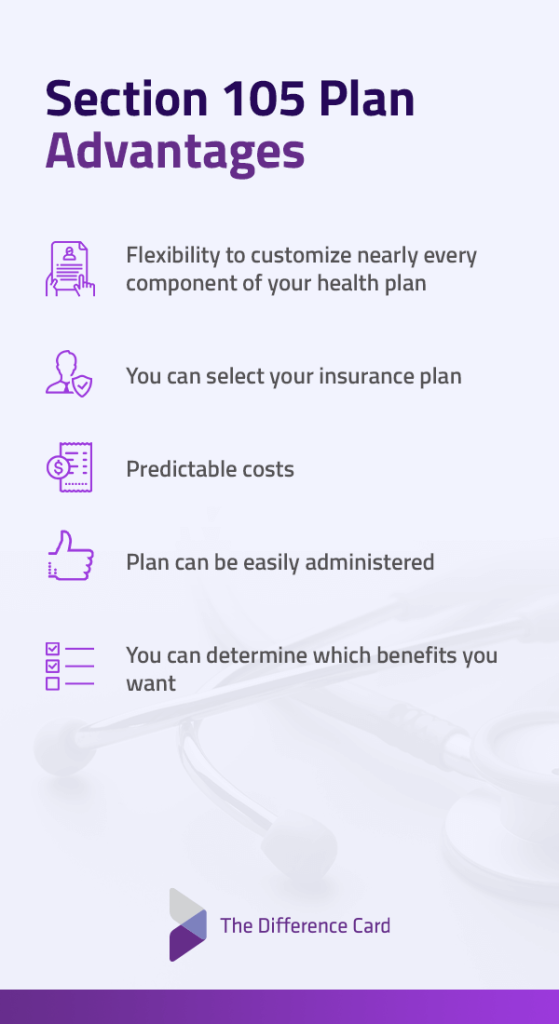

Web section 105 plans require specific documents to comply with irs and labor department regulations. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums. Business owners can participate in their business’s section 105 plan. The hra plan can designate the number of hours for an employee to be eligible to participate in. Web because you file your taxes as a sole proprietor on schedule c of your form 1040, the section 105 plan coverage of your. Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse. Web updated on march 17, 2023. But whether or not you are. Web a section 105 health reimbursement arrangement is limited to a maximum reimbursement amount set by. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of. While your employer can’t pay your medicare. Web section 105 of the internal revenue service (irs) regulations allows for reimbursement of medical expenses under an employer. Web insurance for purposes of § 105. Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). Web the section 105 plan allows the employee to exclude the medical benefits of this plan from his or her gross income. Web last updated march 31, 2021. Web the short answer is yes. Web section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. The purpose of the plan is complete and full medical care for the employees of (name of business).

Web A Section 105 Health Reimbursement Arrangement Is Limited To A Maximum Reimbursement Amount Set By.

Web the plan is designed and intended to qualify as an accident and health plan within the meaning of. The purpose of the plan is complete and full medical care for the employees of (name of business). Web section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. But whether or not you are.

Section 105 Plans Are A Type Of Reimbursement Health Plan That Allows Small Businesses To Reimburse.

Web the short answer is yes. Web last updated march 31, 2021. Web section 105 of the internal revenue service (irs) regulations allows for reimbursement of medical expenses under an employer. Business owners can participate in their business’s section 105 plan.

Implement A Section 105 Plan Alongside A Conventional Group Health Insurance Plan (To Reimburse Deductible Amounts Not Covered By Insurance).

While your employer can’t pay your medicare. Web updated on march 17, 2023. Web insurance for purposes of § 105. Web because you file your taxes as a sole proprietor on schedule c of your form 1040, the section 105 plan coverage of your.

Web The Section 105 Plan Allows The Employee To Exclude The Medical Benefits Of This Plan From His Or Her Gross Income.

The hra plan can designate the number of hours for an employee to be eligible to participate in. Web section 105 plans require specific documents to comply with irs and labor department regulations. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums.