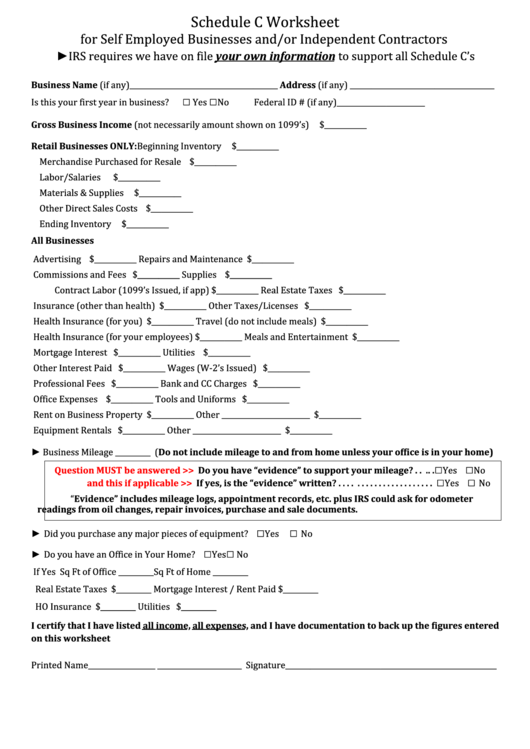

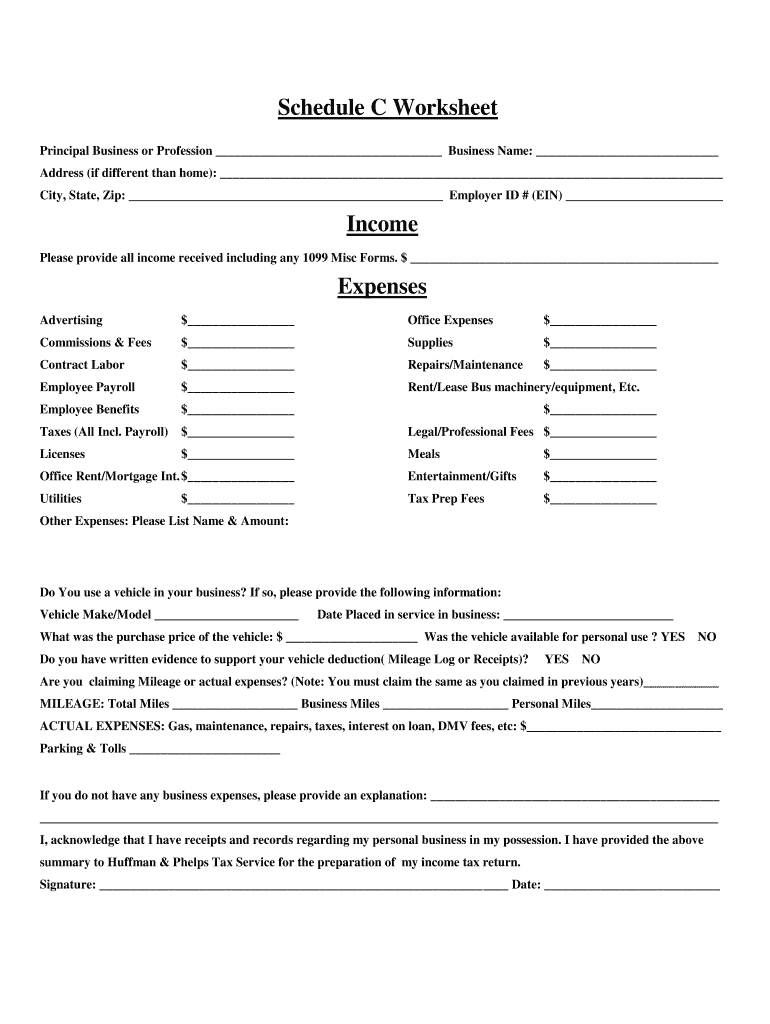

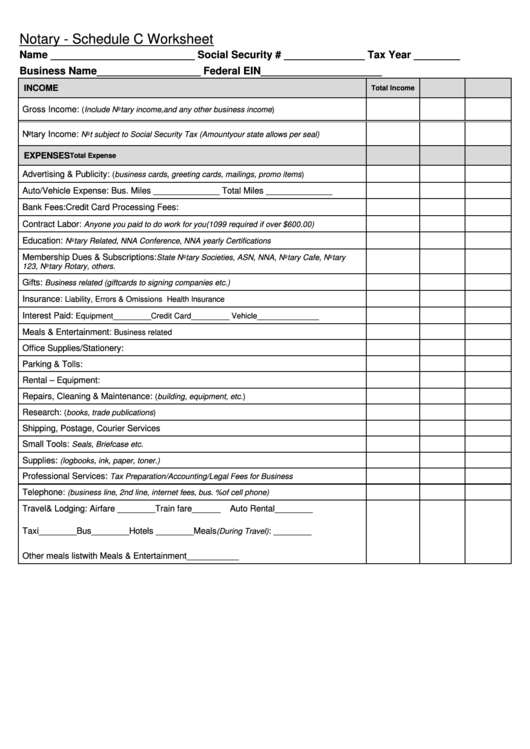

Schedule C Worksheet - Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your. An activity qualifies as a business if: Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Worksheet —

Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web use schedule c (form 1040) to report income or loss.

Schedule C Worksheet Yooob —

Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. An activity qualifies as a business if your. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web department of.

Who's required to fill out a Schedule C IRS form?

An activity qualifies as a business if: Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web department of the.

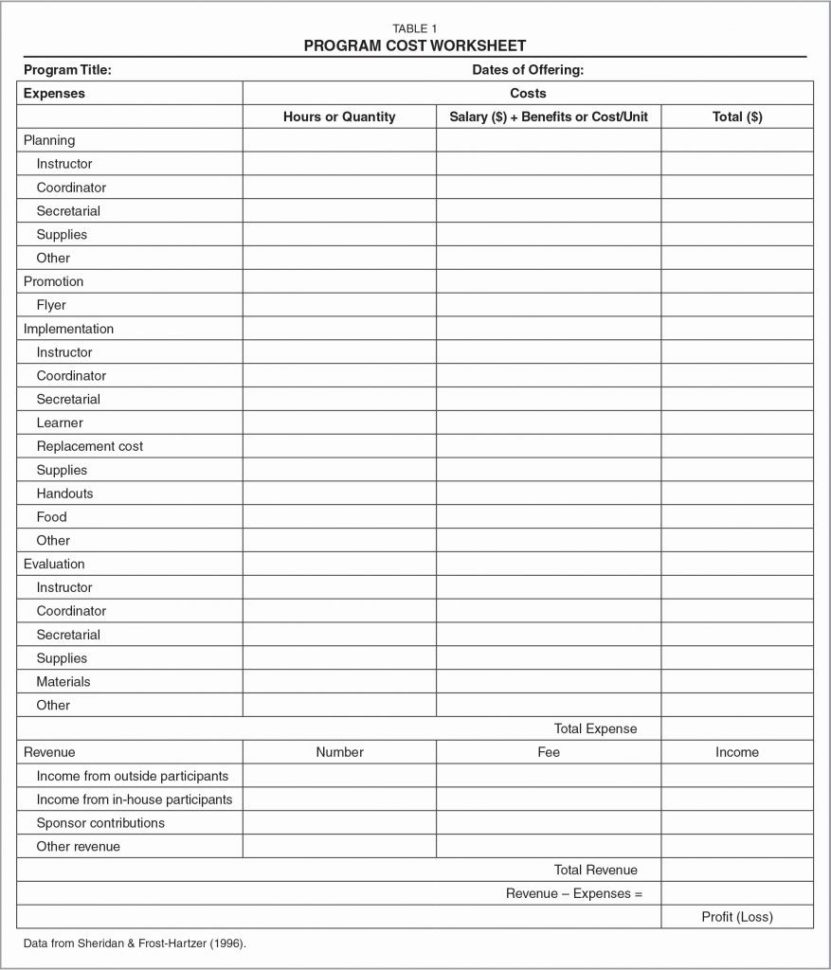

Schedule C Worksheet For Self Employed Businesses printable pdf download

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if your. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web use schedule.

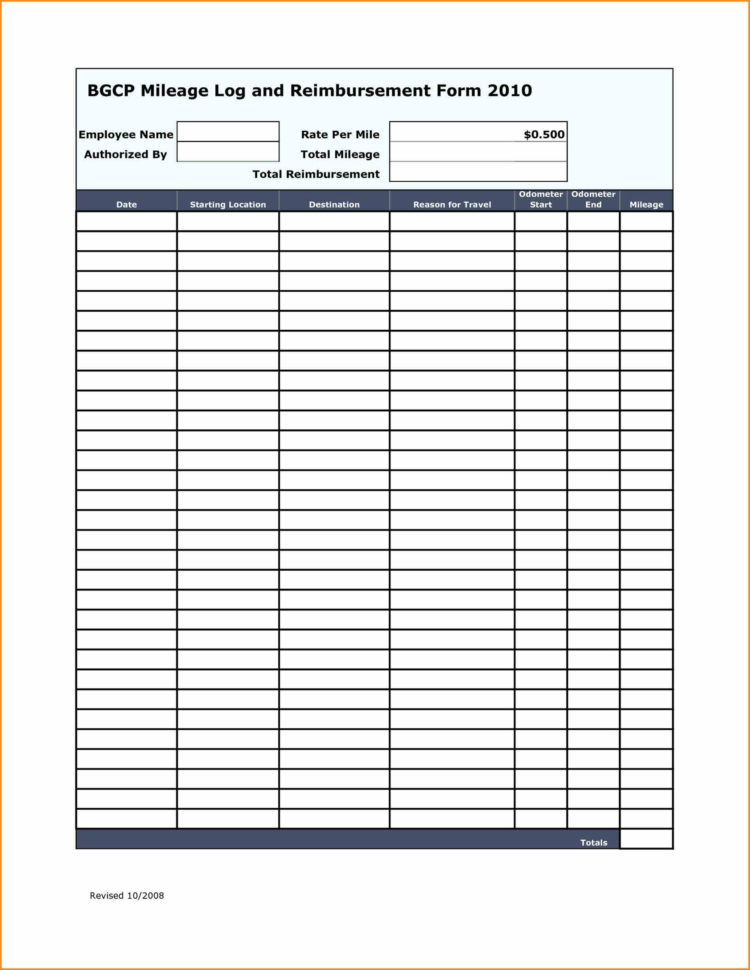

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. An activity qualifies as a business if your. An activity qualifies.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if: An activity qualifies as a business if your. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced.

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. Web use schedule c (form 1040) to report income or loss from.

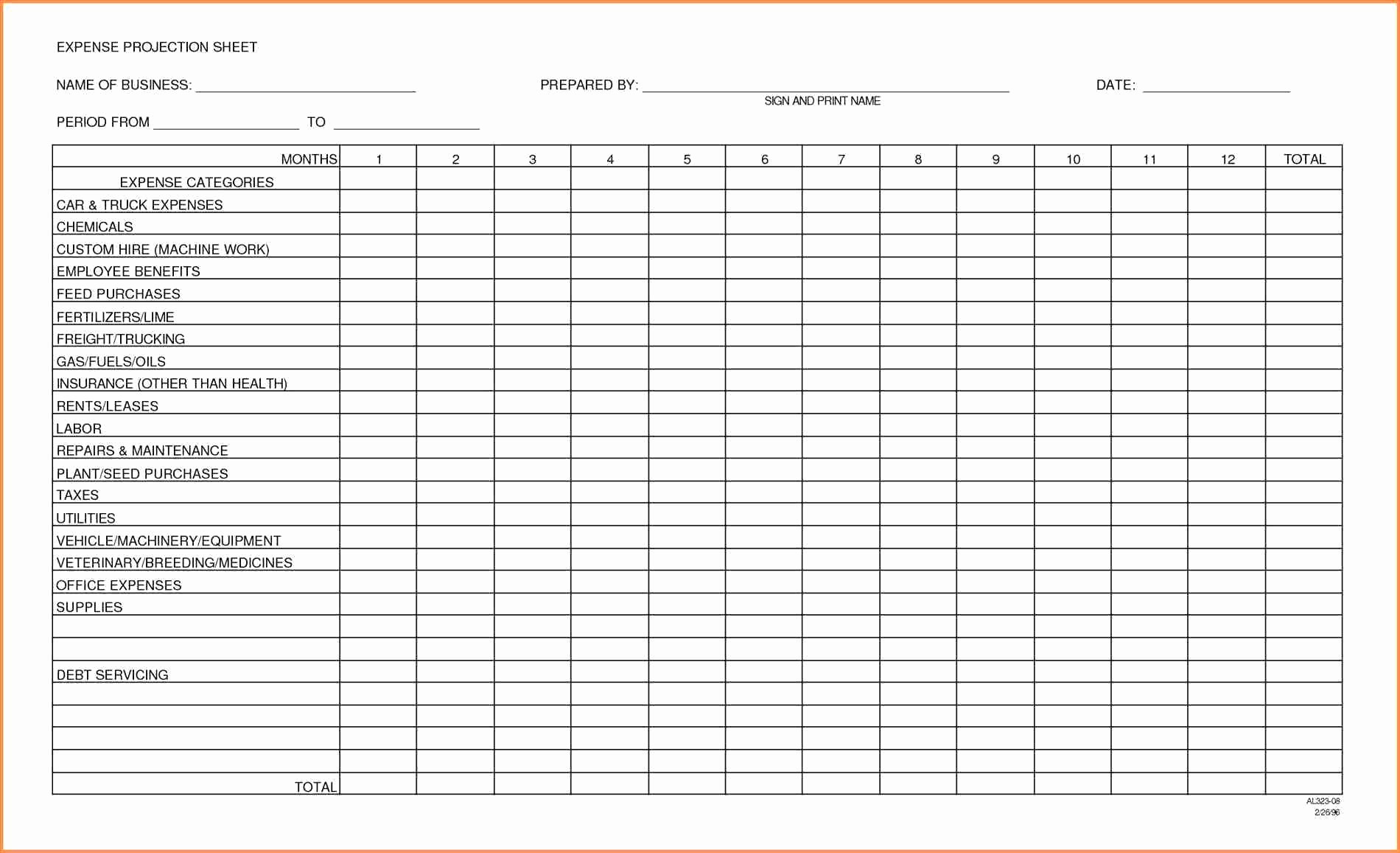

Schedule C Expenses Spreadsheet Download Laobing Kaisuo —

Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. An activity qualifies as a business if your. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as.

Schedule C Worksheet printable pdf download

An activity qualifies as a business if: Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. Web use schedule c (form.

Schedule C Worksheet Misc Exp Other worksSheet list

An activity qualifies as a business if: Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web use schedule c (form.

Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if: Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s.

Web Department Of The Treasury Internal Revenue Service Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own informationto support all schedule c’s. An activity qualifies as a business if: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)