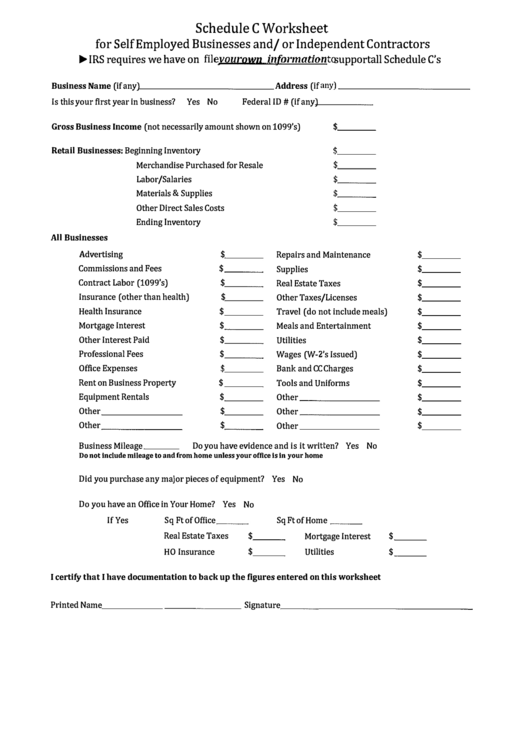

Schedule C Worksheet Fillable - Easily fill out pdf blank, edit, and sign them. Web edit schedule c worksheet. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Edit your schedule c worksheet online type text, add images, blackout confidential details, add comments, highlights and. Web schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Web complete schedule c worksheet online with us legal forms. Web find the schedule c worksheet you want. Open it up using the online editor and start editing. Quickly add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses.

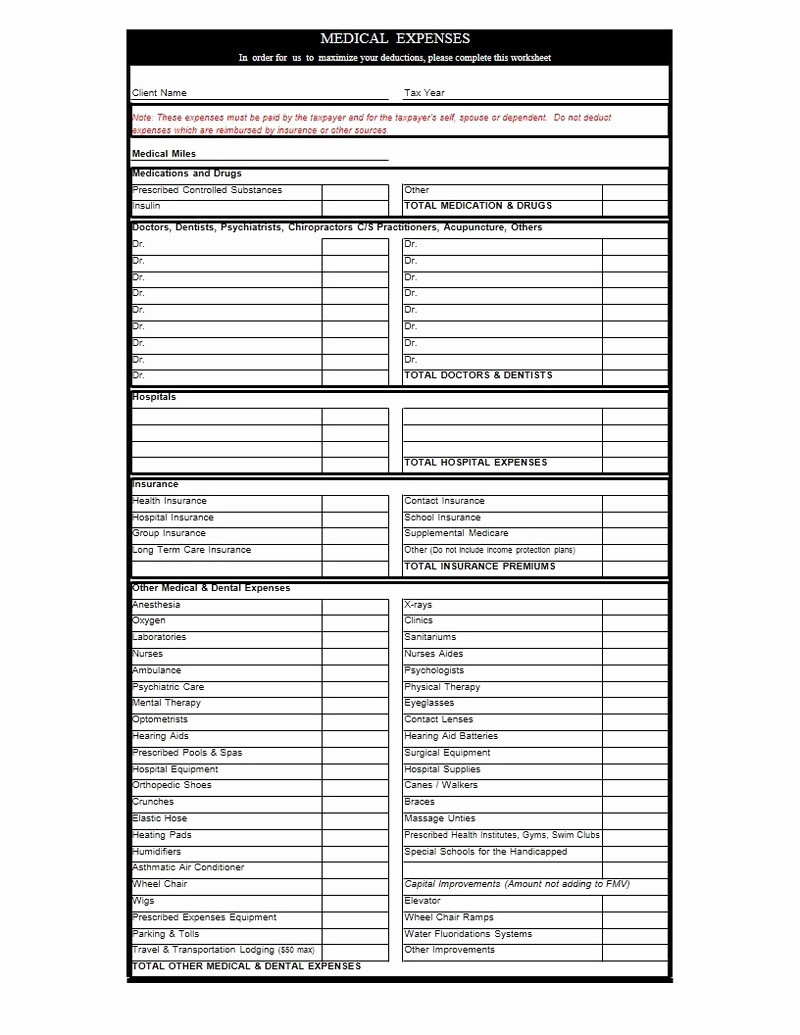

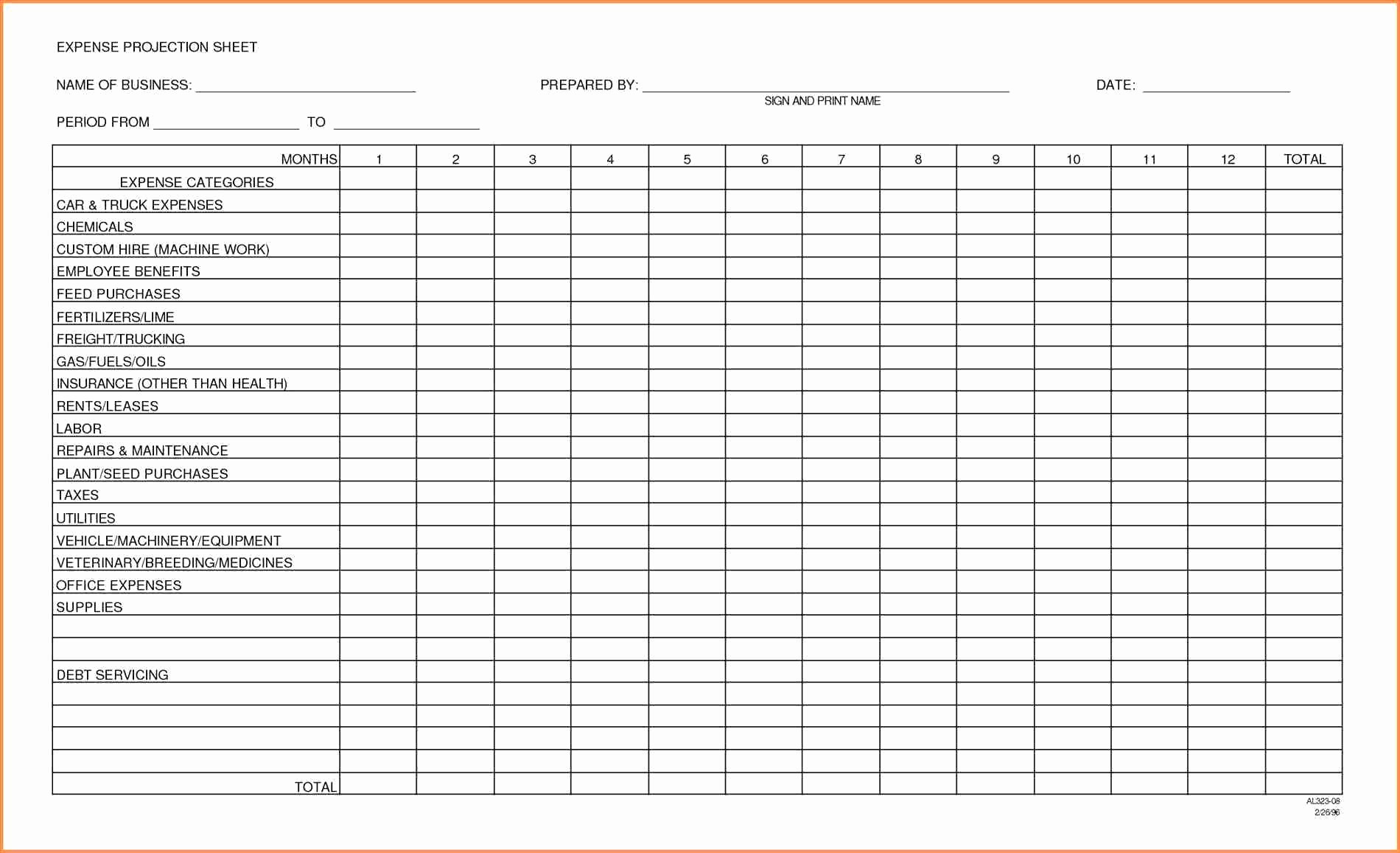

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. For self employed businesses and/or independent contractors. Easily fill out pdf blank, edit, and sign them. Web go to www.irs.gov/schedulec for instructions and the latest information. Web department of the.

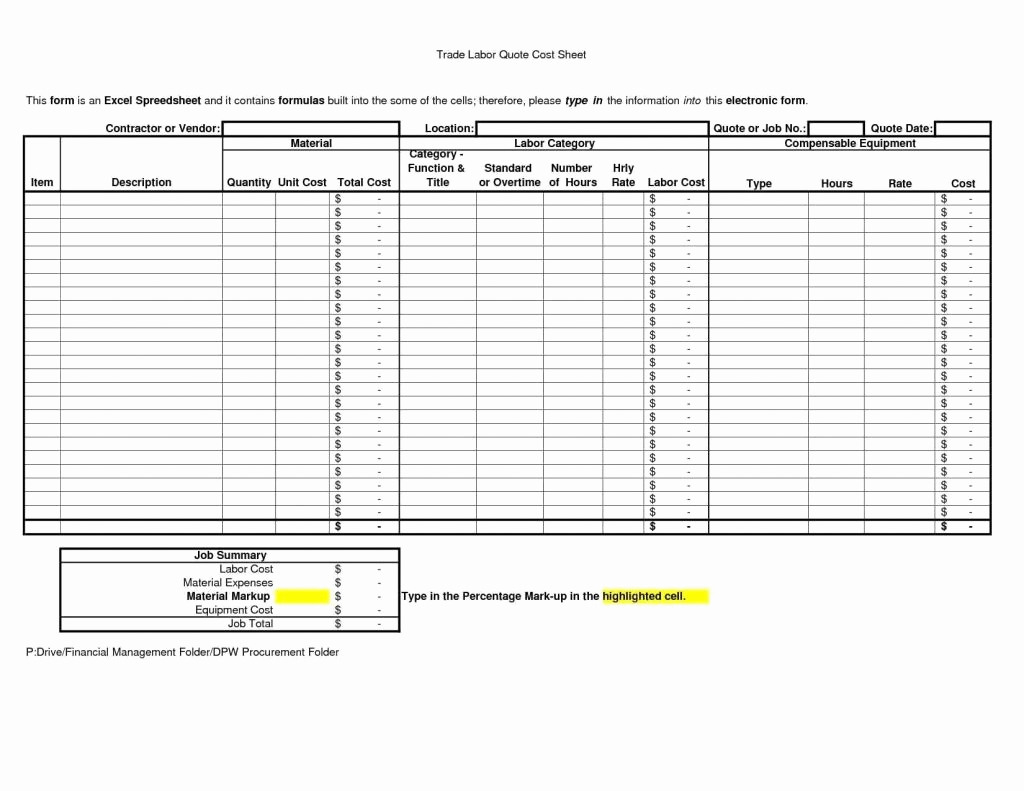

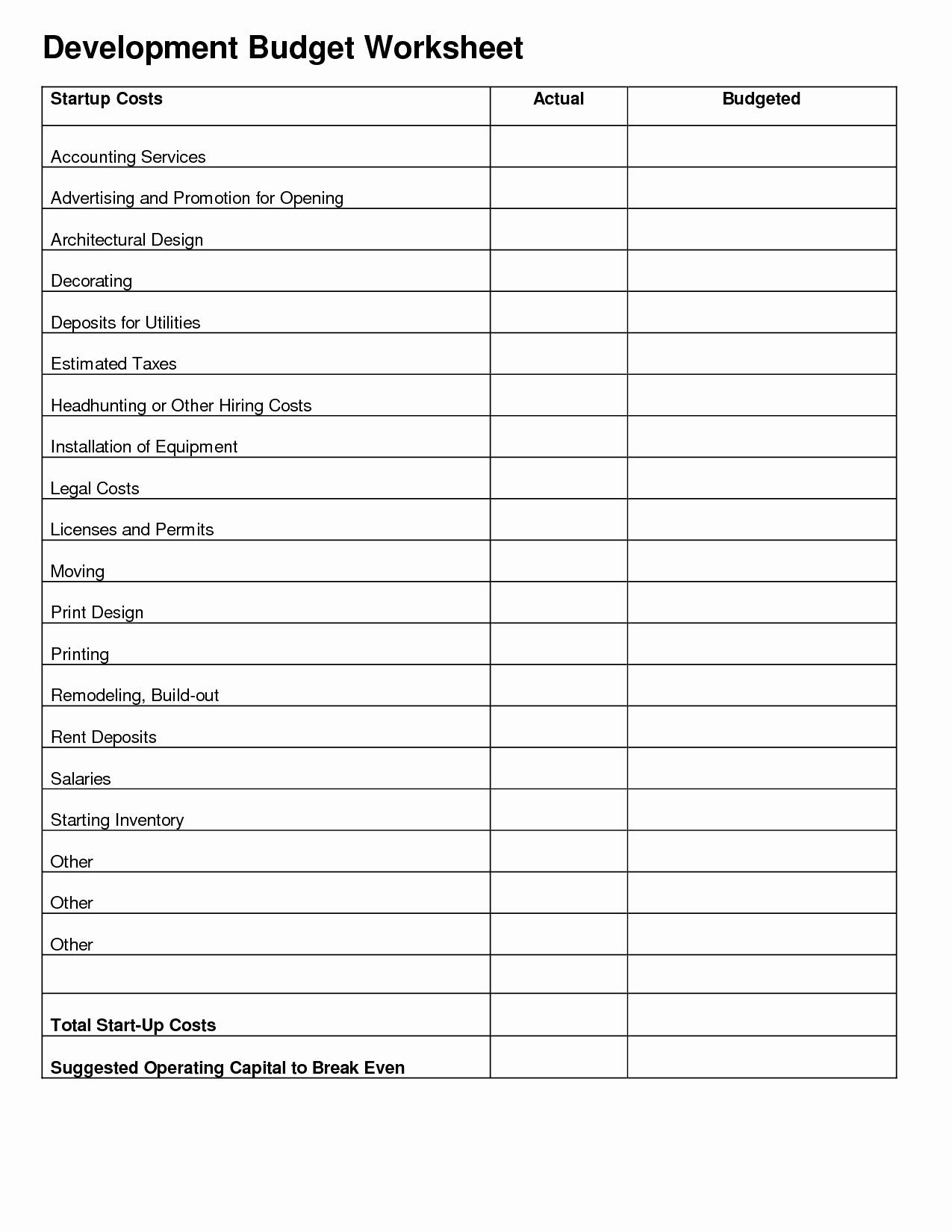

Schedule C Worksheet Excel worksSheet list

Irs requires we have on file your own. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to. Web o fill out the “business use of home” worksheet on page 6 of this checklist if you have relevant business use of home. Easily fill out pdf blank, edit, and sign them. Web information.

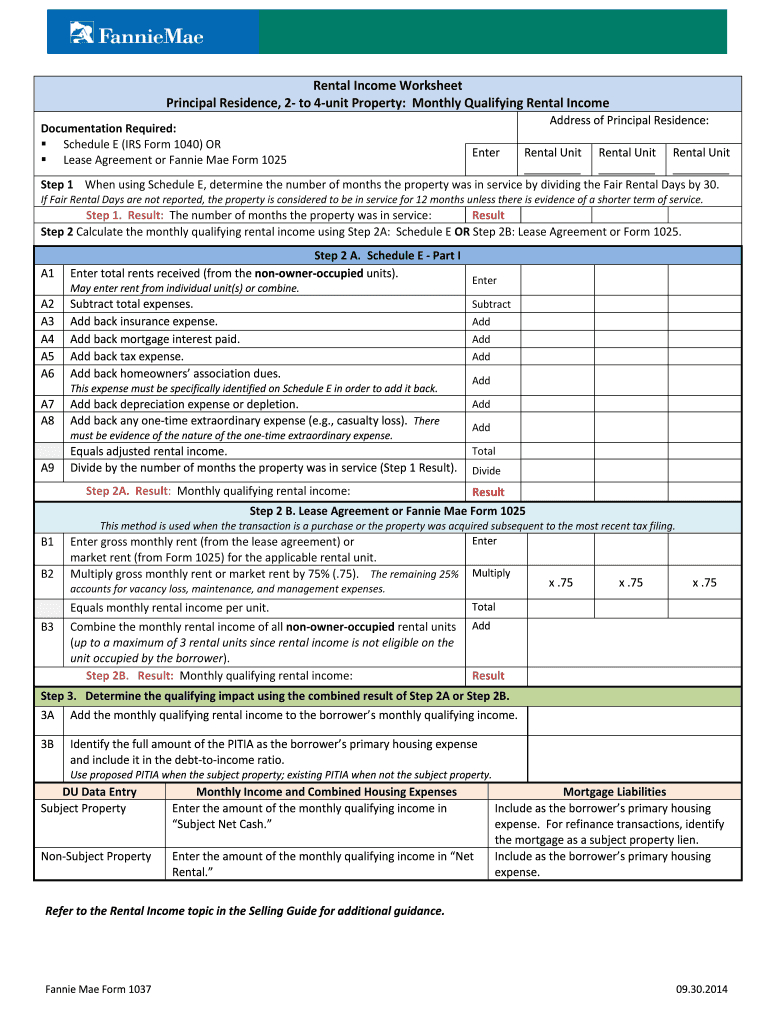

Fannie Mae Self Employed Worksheet —

Easily add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Web complete schedule c worksheet online with us legal forms. Irs requires we have on file your own. Web o fill out the.

Schedule C Form 1040 How to Complete it? The Usual Stuff

Easily add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and. The times of terrifying complicated tax and legal documents are over. Irs requires we have on file your own. Web go to www.irs.gov/schedulec for instructions and the latest information. Web edit schedule c worksheet.

Schedule C Spreadsheet Then Schedule C Car And Truck —

Quickly add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and. Web complete schedule c worksheet online with us legal forms. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Web find the schedule c.

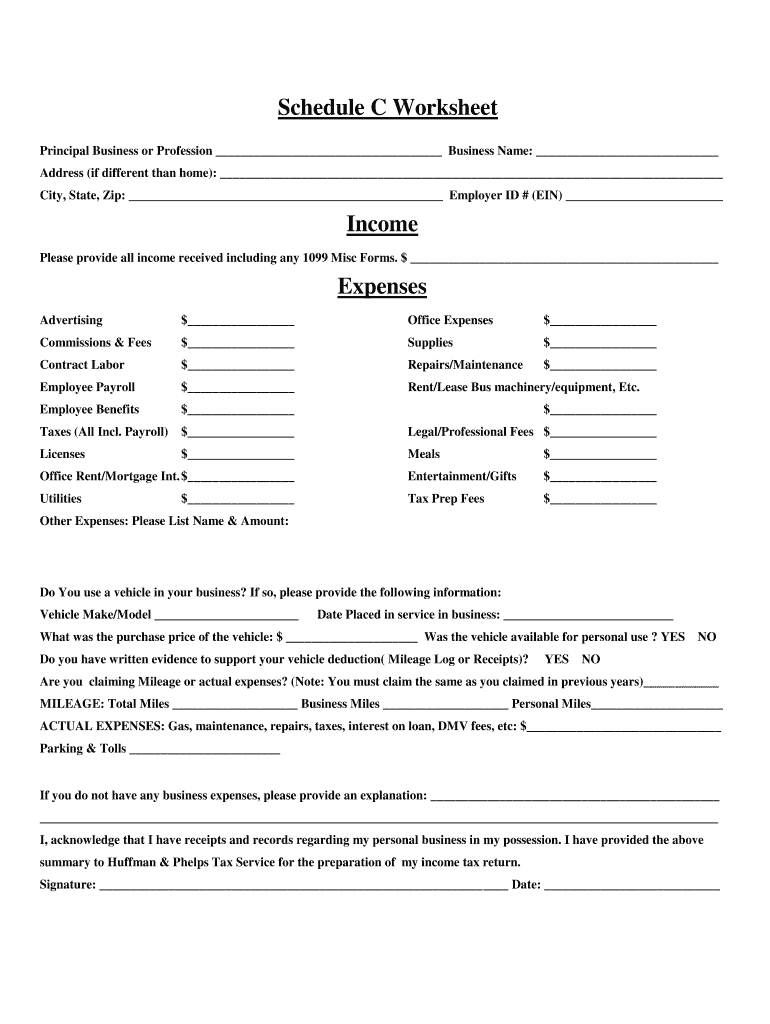

Schedule C Worksheet —

The times of terrifying complicated tax and legal documents are over. Web complete schedule c worksheet online with us legal forms. Edit your schedule c worksheet online type text, add images, blackout confidential details, add comments, highlights and. Web form 1037 or form 1038) to calculate individual rental income (loss) reported on schedule e. Easily fill out pdf blank, edit,.

Fillable Schedule C Worksheet For Self Employed Businesses And/or

Edit your schedule c worksheet online type text, add images, blackout confidential details, add comments, highlights and. Web find the schedule c worksheet you want. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Web information about schedule c.

Schedule C Worksheet Yooob —

Web form 1037 or form 1038) to calculate individual rental income (loss) reported on schedule e. Quickly add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and. For self employed businesses and/or independent contractors. Web complete schedule c worksheet online with us legal forms. Web information about schedule c (form 1040), profit or loss from business,.

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

Web follow the simple instructions below: Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. The times of terrifying complicated tax and legal documents are over. Easily fill out pdf blank, edit, and sign them. Open it up using.

Schedule C Expenses Worksheet —

Web find the schedule c worksheet you want. Edit your schedule c worksheet online type text, add images, blackout confidential details, add comments, highlights and. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Easily fill out pdf blank,.

Web o fill out the “business use of home” worksheet on page 6 of this checklist if you have relevant business use of home. Quickly add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Web edit schedule c worksheet. Web follow the simple instructions below: Web go to www.irs.gov/schedulec for instructions and the latest information. Easily fill out pdf blank, edit, and sign them. Web edit schedule c worksheet. Web complete schedule c worksheet online with us legal forms. Easily add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to. Web schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Irs requires we have on file your own. For self employed businesses and/or independent contractors. Attach to form 1040, 1040. Web go to www.irs.gov/schedulec for instructions and the latest information. The times of terrifying complicated tax and legal documents are over. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Edit your schedule c worksheet online type text, add images, blackout confidential details, add comments, highlights and.

Web Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Irs requires we have on file your own. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Web go to www.irs.gov/schedulec for instructions and the latest information.

Web Complete Schedule C Worksheet Online With Us Legal Forms.

Web key takeaways schedule c is for business owners to report their income for tax purposes. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to. Quickly add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and. The times of terrifying complicated tax and legal documents are over.

Web Schedule C Calculate The Monthly Qualifying Income For A Borrower Who Is A Sole Proprietor.

Edit your schedule c worksheet online type text, add images, blackout confidential details, add comments, highlights and. Web form 1037 or form 1038) to calculate individual rental income (loss) reported on schedule e. For self employed businesses and/or independent contractors. Web o fill out the “business use of home” worksheet on page 6 of this checklist if you have relevant business use of home.

Web Edit Schedule C Worksheet.

Web edit schedule c worksheet. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: Web find the schedule c worksheet you want.