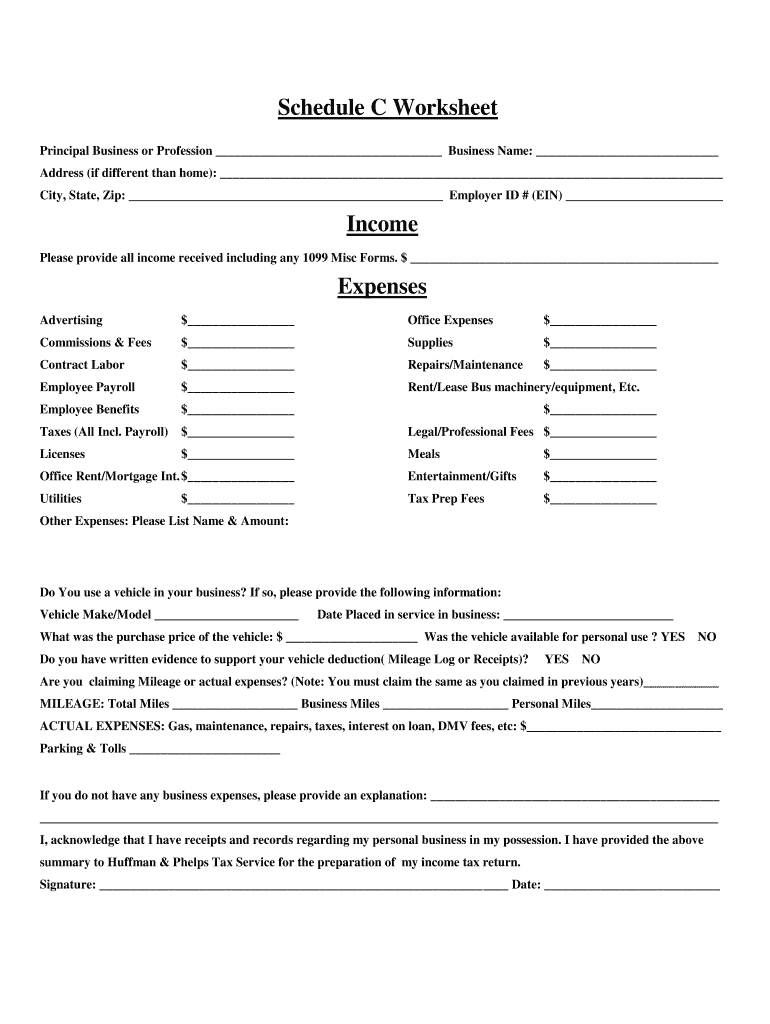

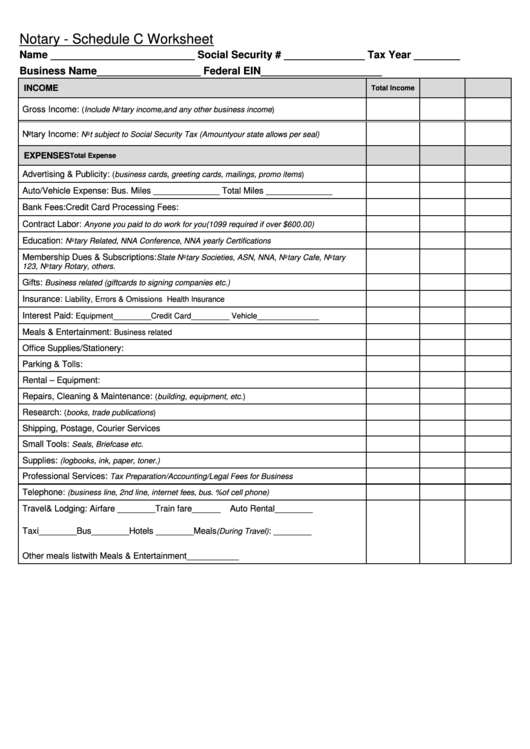

Schedule C Worksheet Excel - Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole. Calculate the monthly qualifying income for a borrower who is a sole proprietor. Web find the schedule c worksheet you want. For self employed businesses and/or independent contractors. I also put together a guide. Web complete every fillable field. Ensure that the details you add to the schedule c worksheet is updated and accurate. Irs requires we have on file your own. Web go to your client's xero organization. Open it up using the online editor and start editing.

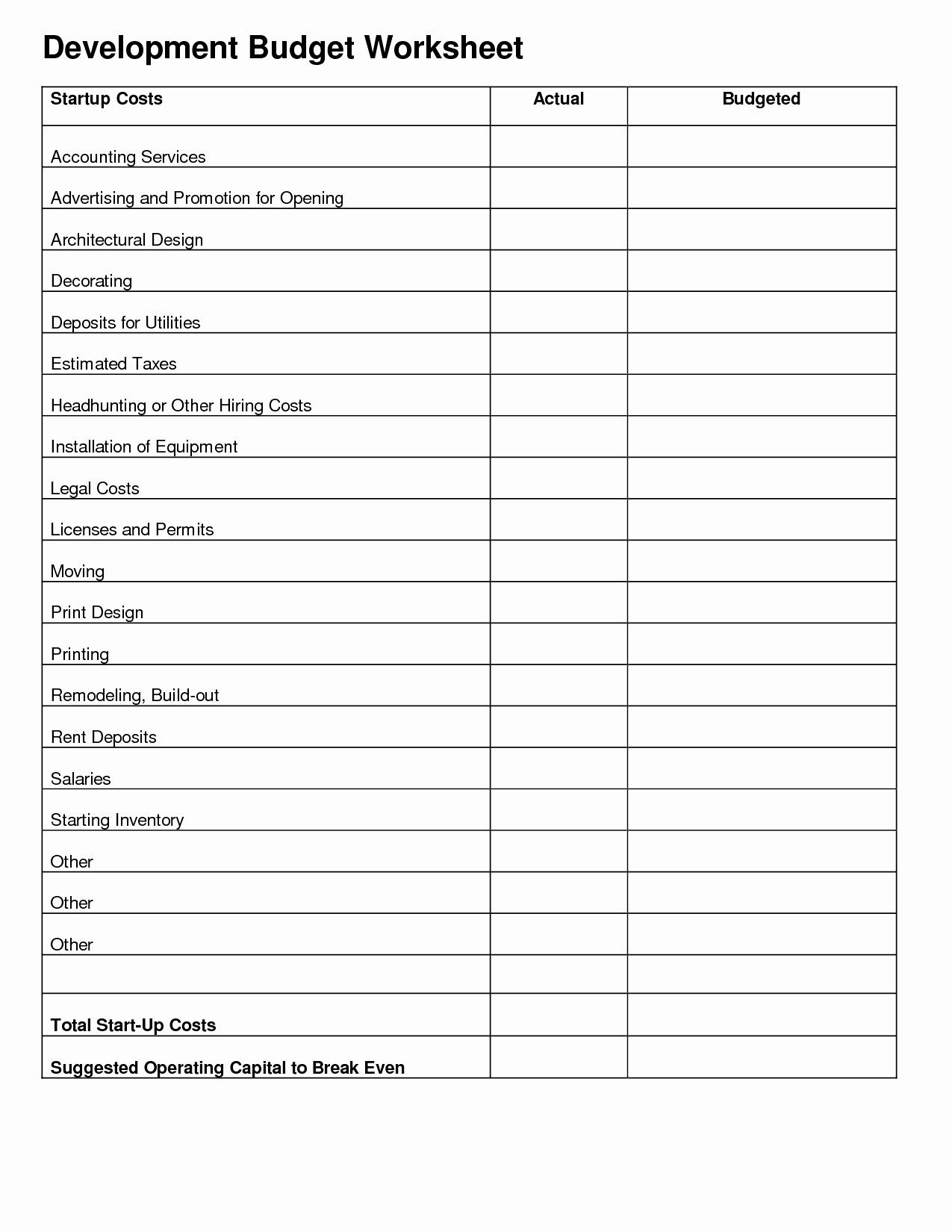

Printable Schedule C Worksheet

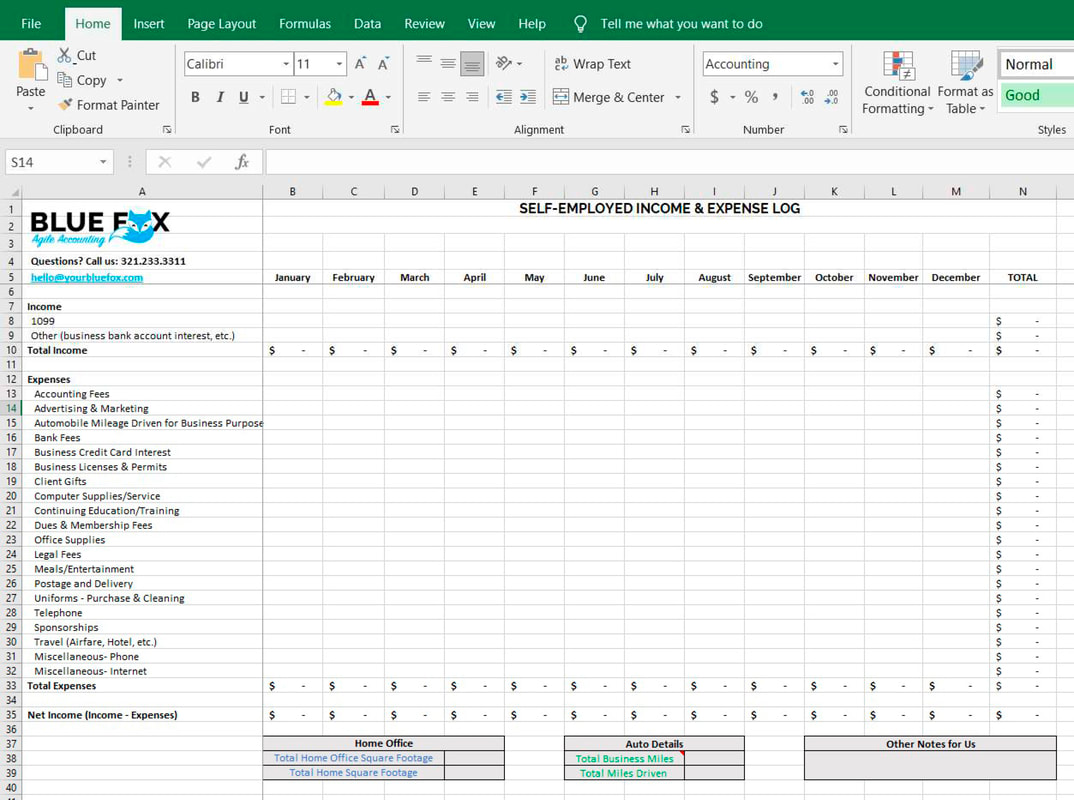

Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Under advisor, click [year] schedule c. Web complete every fillable field. Record the net profit or (loss). In the accounting menu, select reports.

Schedule C Expenses Worksheet —

For self employed businesses and/or independent contractors. Navigate to the templates section and. 31 net profit or (loss). Web method worksheet in the instructions to figure the amount to enter on line 30. Web go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

31 net profit or (loss). Record the net profit or (loss). Web how to fill out schedule c expenses worksheet: Subtract line 30 from line 29. Ensure that the details you add to the schedule c worksheet is updated and accurate.

Schedule C Spreadsheet —

Web method worksheet in the instructions to figure the amount to enter on line 30. 31 net profit or (loss). Calculate the monthly qualifying income for a borrower who is a sole proprietor. • if a profit, enter. Web complete every fillable field.

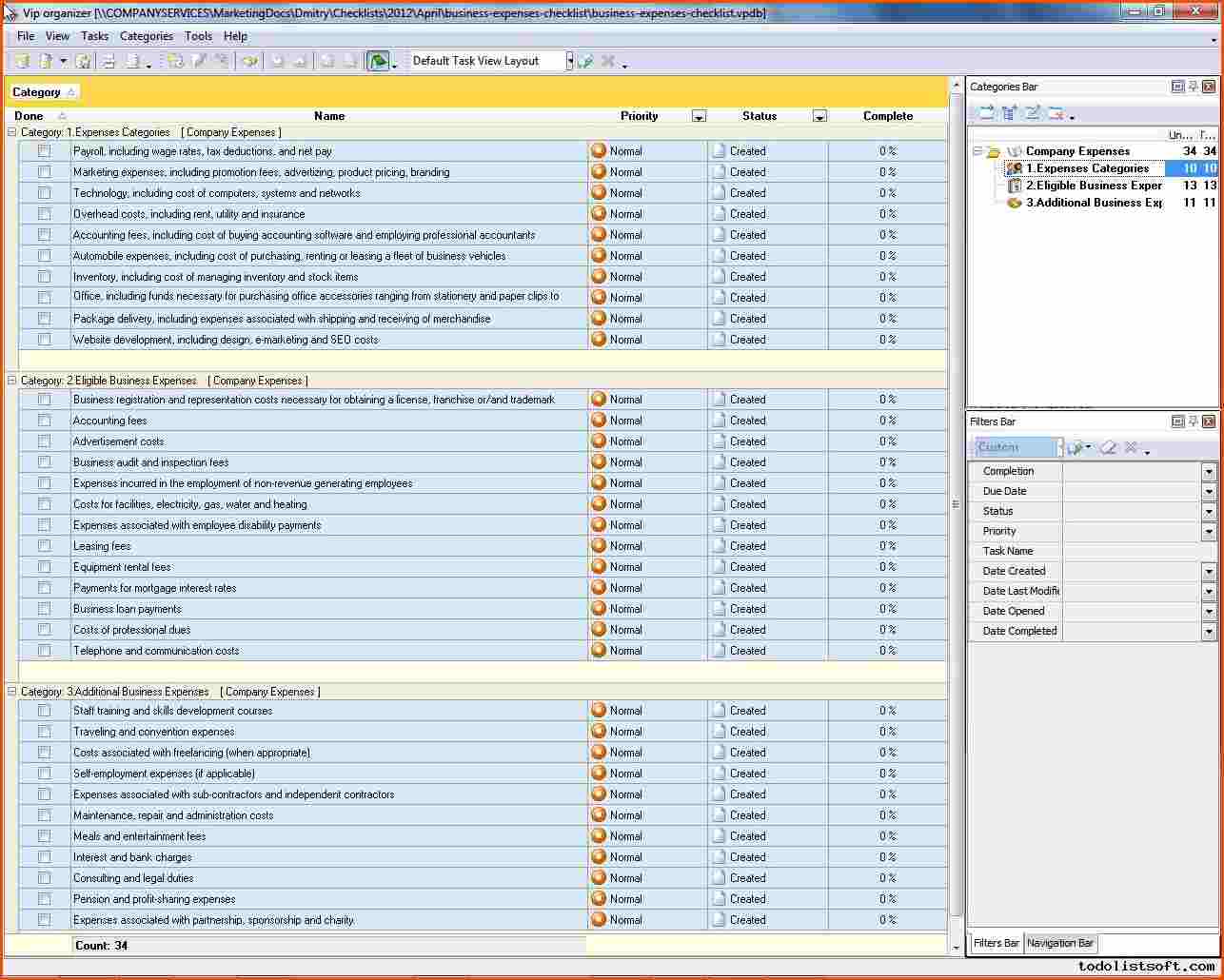

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

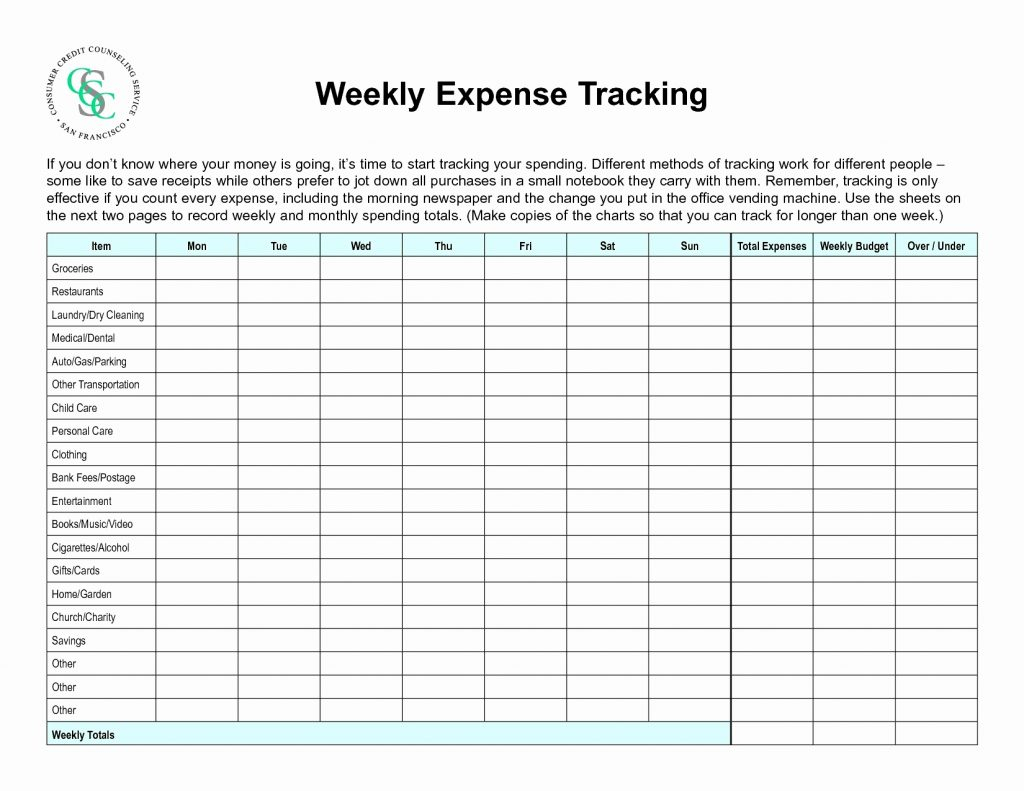

For self employed businesses and/or independent contractors. Web how to fill out schedule c expenses worksheet: Web included on this page, you’ll find a downloadable employee schedule template, weekly work schedule template,. Web design custom schedule templates to help you plan out your year and manage projects for your business. Web go to your client's xero organization.

Schedule C Expense Excel Template printable schedule template

Visit the wps office website or open the wps office application. Calculate the monthly qualifying income for a borrower who is a sole proprietor. Web how to fill out schedule c expenses worksheet: Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Web complete every fillable field.

Schedule C Spreadsheet within Schedule C Expenses Spreadsheet Car And

Web method worksheet in the instructions to figure the amount to enter on line 30. Open it up using the online editor and start editing. Web find the schedule c worksheet you want. Web design custom schedule templates to help you plan out your year and manage projects for your business. Web how to fill out schedule c expenses worksheet:

erc form download romanholidayvannuys

Open it up using the online editor and start editing. Visit the wps office website or open the wps office application. Navigate to the templates section and. I also put together a guide. 31 net profit or (loss).

Schedule C Worksheet printable pdf download

Calculate the monthly qualifying income for a borrower who is a sole proprietor. Under advisor, click [year] schedule c. I also put together a guide. Web design custom schedule templates to help you plan out your year and manage projects for your business. 31 net profit or (loss).

Schedule C Expenses Worksheet —

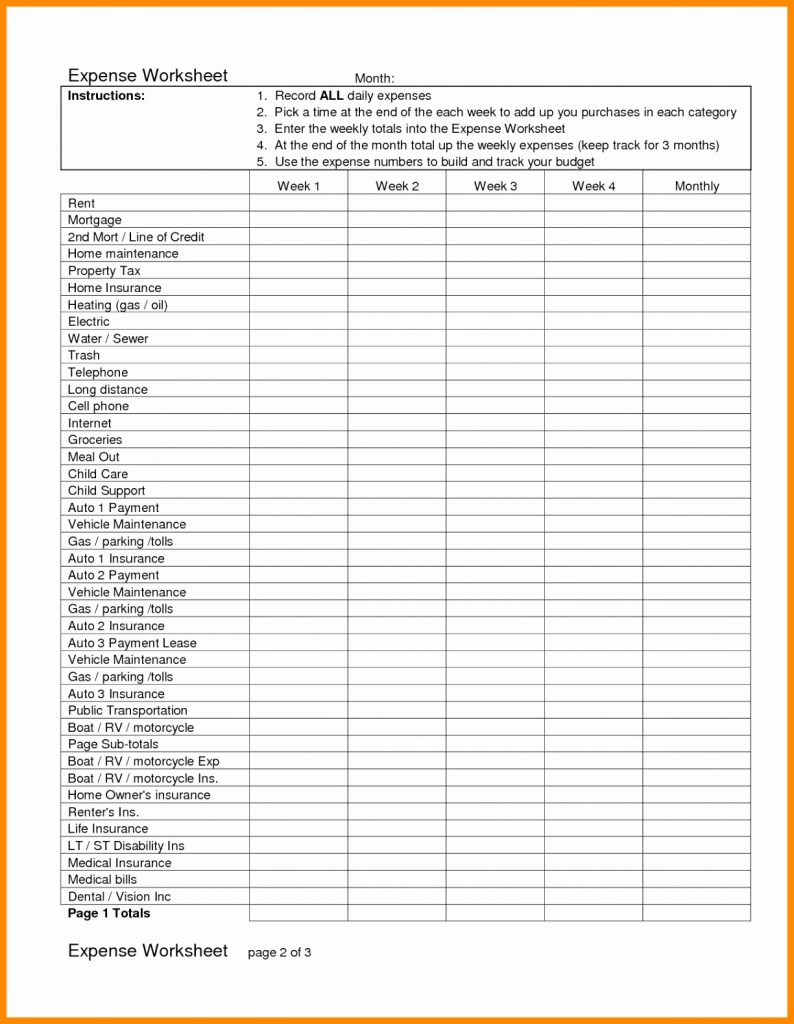

Web go to www.irs.gov/schedulec for instructions and the latest information. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business. Irs requires we have on file your own. Calculate the monthly qualifying income for a borrower who is a sole proprietor. Web included on this page, you’ll find a downloadable employee schedule.

Web design custom schedule templates to help you plan out your year and manage projects for your business. Navigate to the templates section and. I also put together a guide. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole. 31 net profit or (loss). Web included on this page, you’ll find a downloadable employee schedule template, weekly work schedule template,. For self employed businesses and/or independent contractors. • if a profit, enter. Web go to your client's xero organization. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business. Web go to www.irs.gov/schedulec for instructions and the latest information. Open it up using the online editor and start editing. Web method worksheet in the instructions to figure the amount to enter on line 30. Subtract line 30 from line 29. Irs requires we have on file your own. Web find the schedule c worksheet you want. Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Under advisor, click [year] schedule c. Ensure that the details you add to the schedule c worksheet is updated and accurate. Web how to fill out schedule c expenses worksheet:

In The Accounting Menu, Select Reports.

Record the net profit or (loss). Irs requires we have on file your own. I also put together a guide. Web how to fill out schedule c expenses worksheet:

Calculate The Monthly Qualifying Income For A Borrower Who Is A Sole Proprietor.

Web method worksheet in the instructions to figure the amount to enter on line 30. Open it up using the online editor and start editing. Web complete every fillable field. Ensure that the details you add to the schedule c worksheet is updated and accurate.

For Self Employed Businesses And/Or Independent Contractors.

31 net profit or (loss). Web go to your client's xero organization. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business. Web go to www.irs.gov/schedulec for instructions and the latest information.

Subtract Line 30 From Line 29.

Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Visit the wps office website or open the wps office application. Begin by gathering all necessary financial information and. Web design custom schedule templates to help you plan out your year and manage projects for your business.