Schedule C Simplified Method Worksheet - Web schedule c worksheet hickman & hickman, pllc. Page 3 if this vehicle does not take the standard mileage deduction, please list. Who can deduct expenses for business use of a. Web how to complete irs schedule c. If you use the simplified method, you’ll fill out the blanks right on line 30. Web schedule c worksheet hickman & hickman, pllc. Schedule c has six parts — an initial section for providing general information about your. That chosen quantity will surge to the. Web 10 rows highlights of the simplified option: Enter the total square footage of:

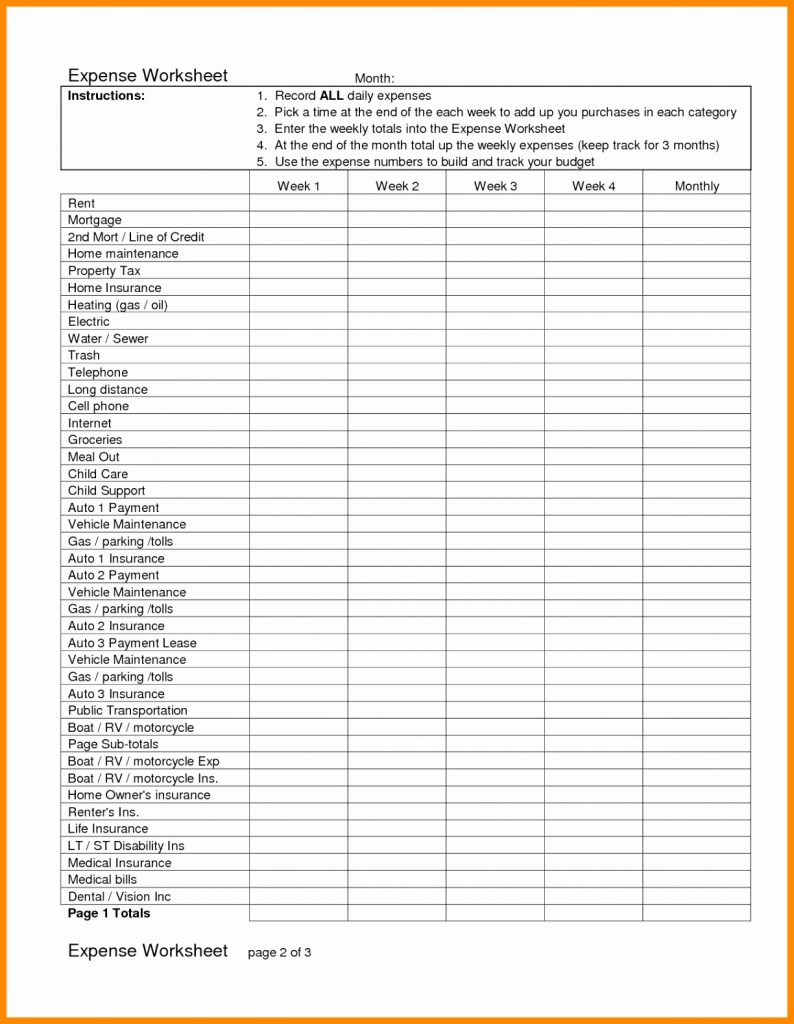

15 Best Images of Monthly Business Expenses Worksheet Printable Free

Enter the total square footage of: The calculated amount will flow. Schedule c has six parts — an initial section for providing general information about your. Web unless using the simplified method. Web use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing.

Simplified Method Worksheet 2021 Home Office Simplified Method

Web simplified method filers only: Web use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing. Standard deduction of $5 per square foot of home used for business. Web if you are filing schedule c (form 1040) to report a business use of your home in.

Working for Yourself? What to Know about IRS Schedule C Credit Karma Tax®

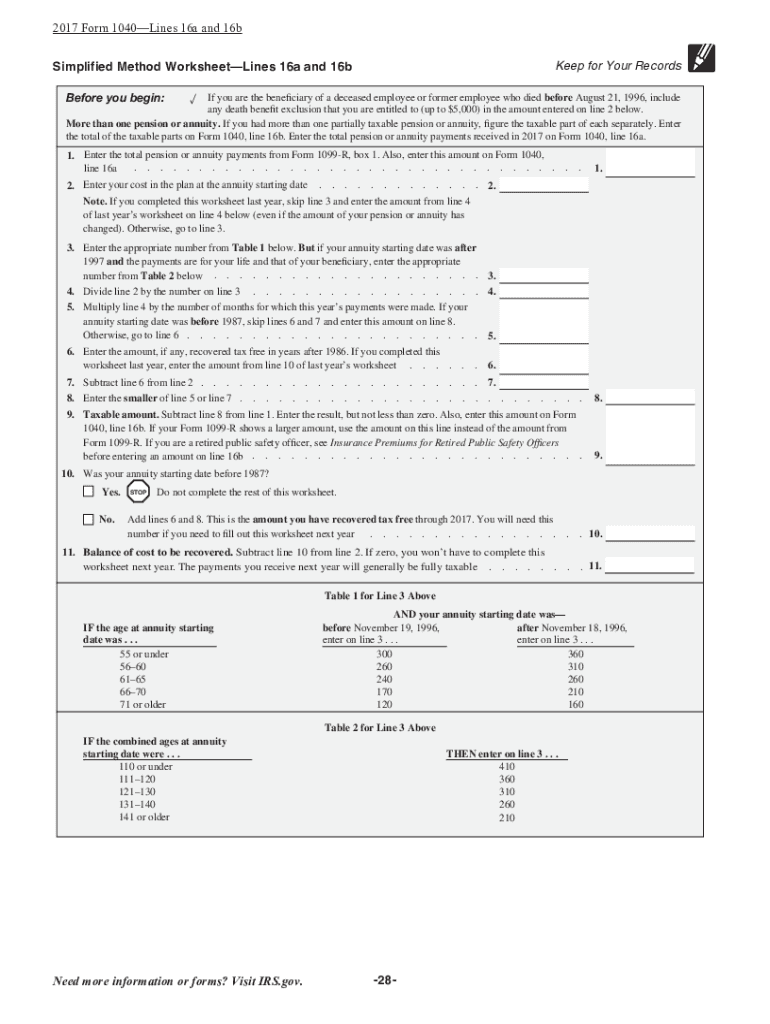

If the taxable amount isn’t calculated in box 2 the simplified method must be used. Payments when you are disabled. Age (or combined ages) at. And (b) the part of your home used for business: Web unless using the simplified method.

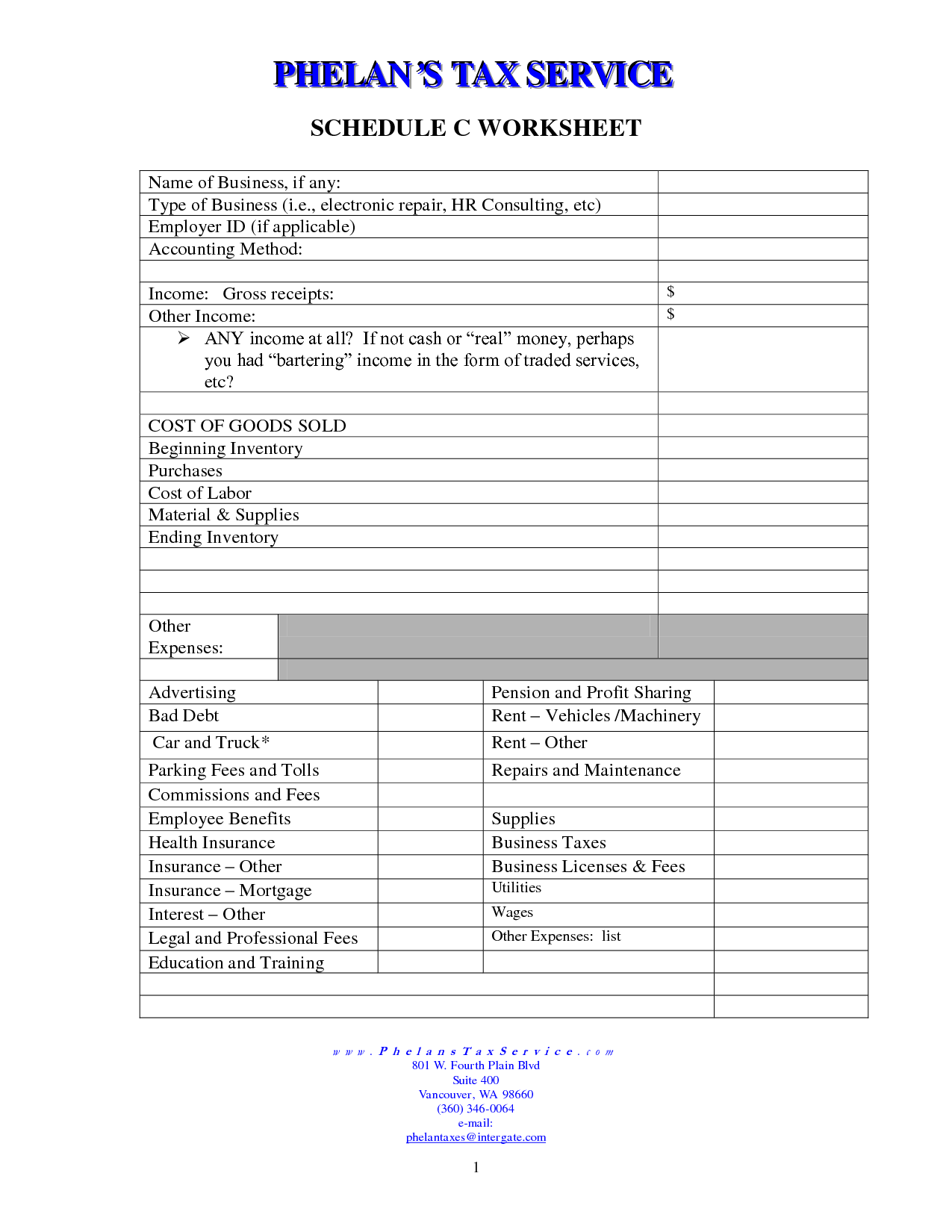

Schedule C Spreadsheet —

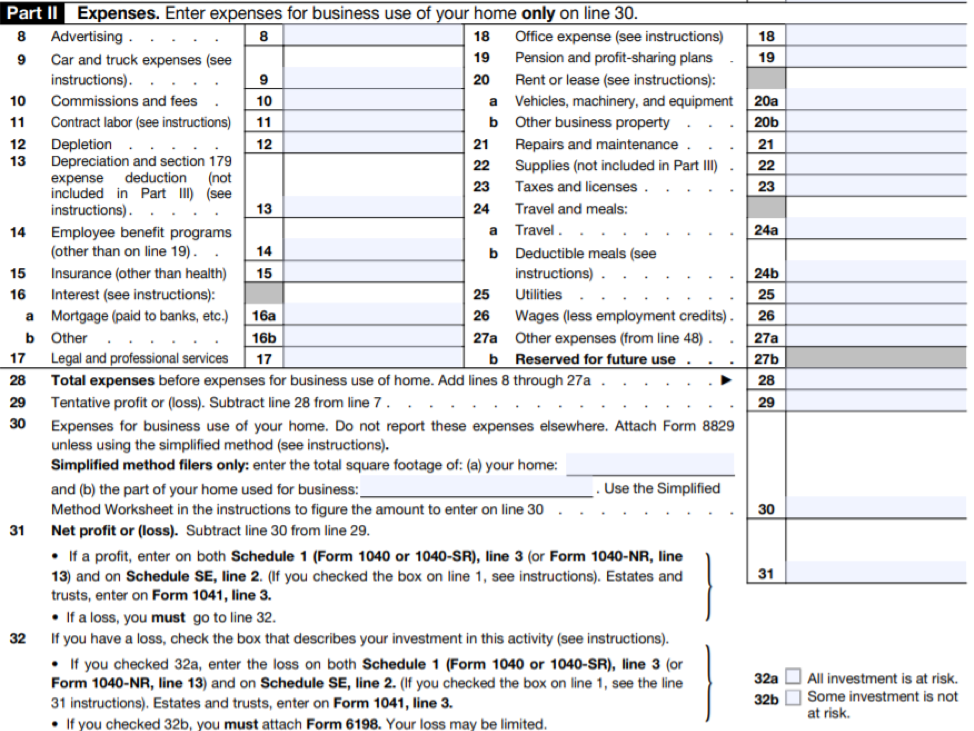

Web and you are filing schedule c (form 1040), you will use either form 8829 or the simplified method worksheet in your instructions for schedule. If you are the bene ciary of a deceased employee or former. Web instructions for the simplified method worksheet use this worksheet to figure the amount of expenses you may deduct for a. Web schedule.

Simplified Method Worksheet Schedule C

Web how to complete irs schedule c. If you use the simplified method, you’ll fill out the blanks right on line 30. Web and you are filing schedule c (form 1040), you will use either form 8829 or the simplified method worksheet in your instructions for schedule. Web schedule c worksheet hickman & hickman, pllc. And (b) the part of.

Simplified Method Worksheet Fill Out and Sign Printable PDF Template

And (b) the part of your home used for business: Web simplified method worksheet—lines 4a and 4b. Purpose of form who cannot use form 8829. Web if the ratepayer voted to use who simple method, create 8829 is no manufactured; Payments when you are disabled.

Schedule C Worksheet printable pdf download

Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Page 3 if this vehicle does not take the standard mileage deduction, please list. Age (or combined ages) at. Web simplified method worksheet—lines 4a and 4b. Web the simplified calculation just multiplies the amount of space by.

Schedule C Simplified Method Worksheets

And (b) the part of your home used for business: Standard deduction of $5 per square foot of home used for business. If you are the bene ciary of a deceased employee or former. Page 3 if this vehicle does not take the standard mileage deduction, please list. Enter the total square footage of:

Editable Schedule C Fill Online, Printable, Fillable, Blank pdfFiller

Web simplified method filers only: Purpose of form who cannot use form 8829. Web schedule c worksheet hickman & hickman, pllc. Web unless using the simplified method. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the simplified method to figure the.

Simplified Method Worksheets Schedule C

Web how to complete irs schedule c. That chosen quantity will surge to the. Web schedule c worksheet hickman & hickman, pllc. Page 3 if this vehicle does not take the standard mileage deduction, please list. Web unless using the simplified method.

If the taxable amount isn’t calculated in box 2 the simplified method must be used. Web use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the simplified method to figure the. Web and you are filing schedule c (form 1040), you will use either form 8829 or the simplified method worksheet in your instructions for schedule. Purpose of form who cannot use form 8829. Age (or combined ages) at. Enter the total square footage of: The calculated amount will flow. Web unless using the simplified method. If you use the simplified method, you’ll fill out the blanks right on line 30. Web 10 rows highlights of the simplified option: Web the simplified calculation just multiplies the amount of space by a specific square foot amount, up to a maximum. Web simplified method filers only: Web how to complete irs schedule c. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Schedule c has six parts — an initial section for providing general information about your. Web schedule c worksheet hickman & hickman, pllc. And (b) the part of your home used for business: Web simplified method used for 2021. Web if the ratepayer voted to use who simple method, create 8829 is no manufactured;

Web Simplified Method Used For 2021.

And (b) the part of your home used for business: Web if the ratepayer voted to use who simple method, create 8829 is no manufactured; If you use the simplified method, you’ll fill out the blanks right on line 30. Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year.

Standard Deduction Of $5 Per Square Foot Of Home Used For Business.

Web schedule c worksheet hickman & hickman, pllc. If you are the bene ciary of a deceased employee or former. If the taxable amount isn’t calculated in box 2 the simplified method must be used. Enter the total square footage of:

Page 3 If This Vehicle Does Not Take The Standard Mileage Deduction, Please List.

Web 10 rows highlights of the simplified option: Purpose of form who cannot use form 8829. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web how to complete irs schedule c.

Web Use This Worksheet To Figure The Amount Of Expenses You May Deduct For A Qualified Business Use Of A Home If You Are Electing.

Enter the total square footage of: Payments when you are disabled. That chosen quantity will surge to the. Web simplified method worksheet—lines 4a and 4b.