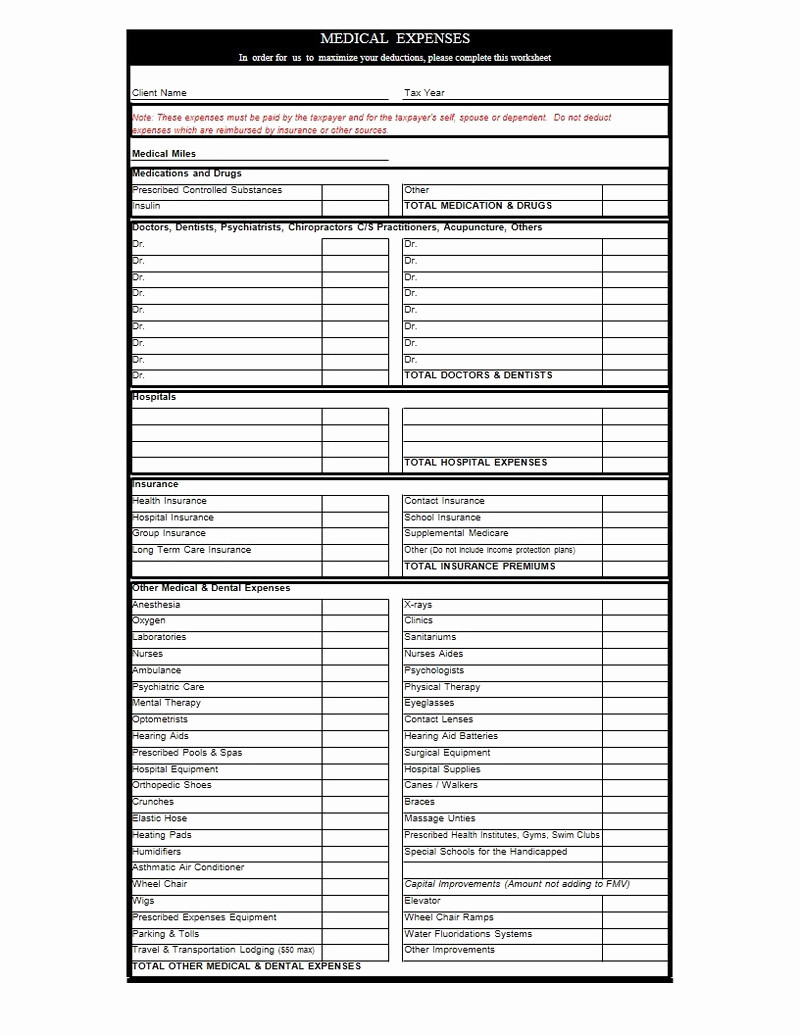

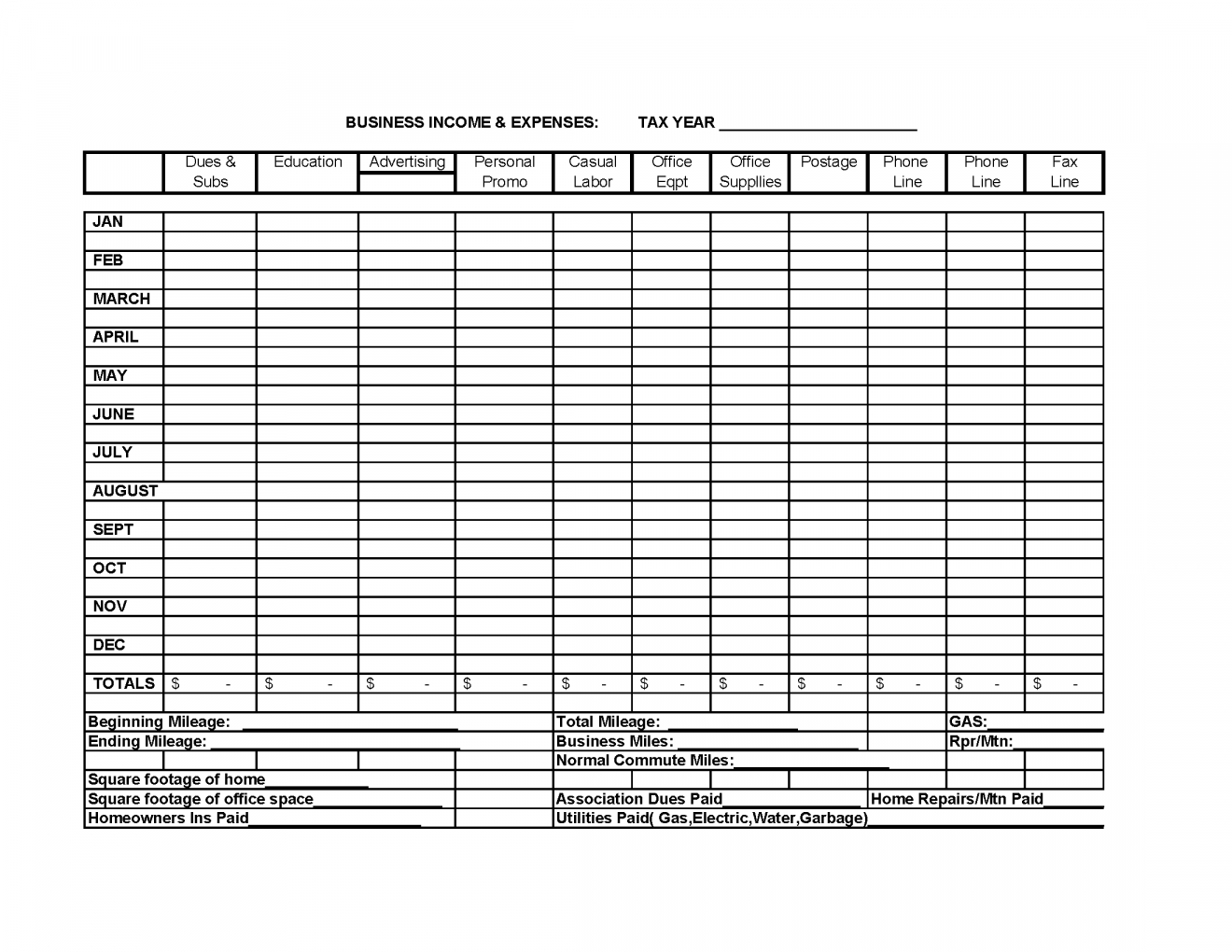

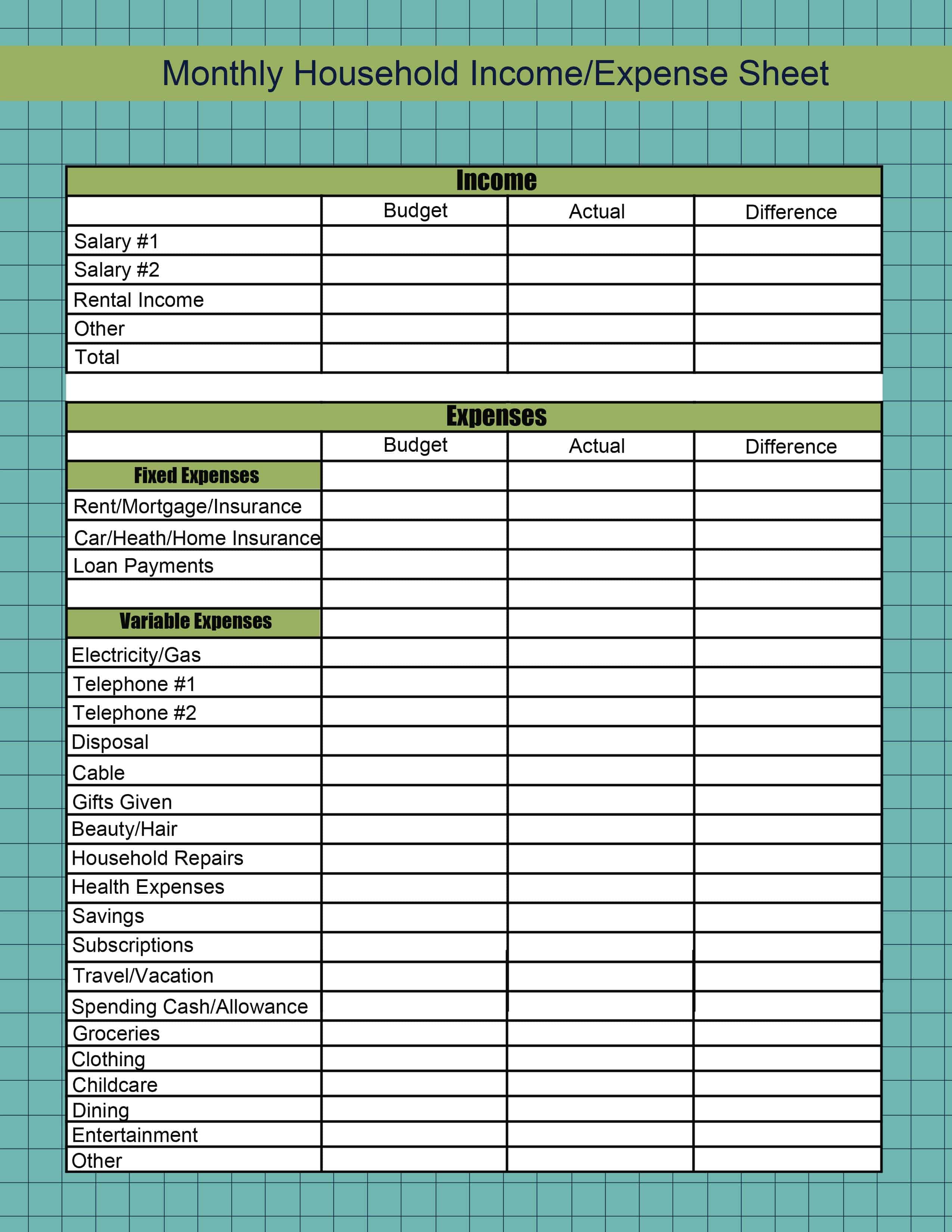

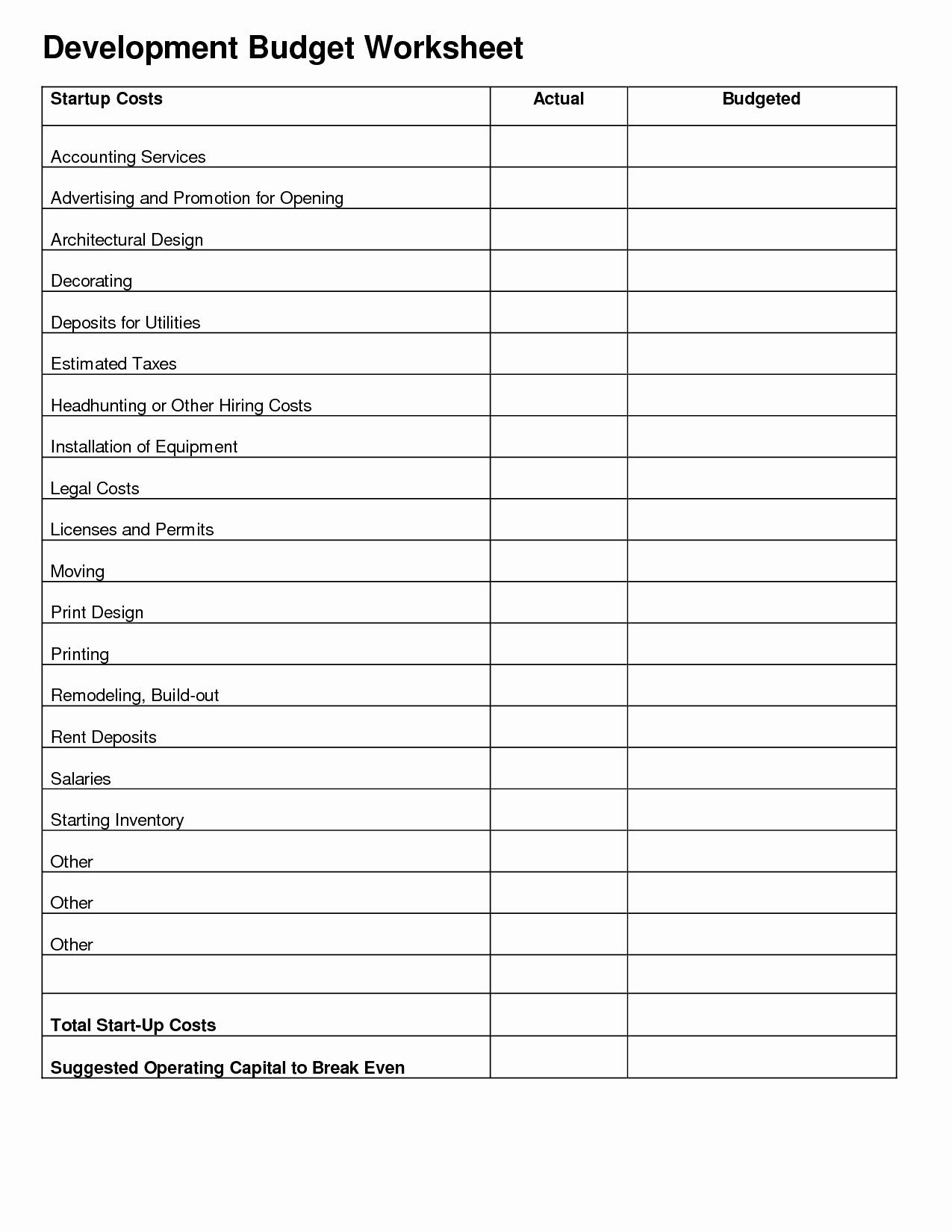

Schedule C Income And Expense Worksheet - Web expenses or collections of receipts to organize or subtotal your expenses for you. (b) income and deductions of certain. Web joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses,. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to. The expense categories used on the. Web statutory employees use schedule c to report their wages and expenses. Schedule c or form 2106 expense report worksheet.pdf. Web worksheets, schedule c, expense report, deductions; (include notary income, and any other business income) notary income: Web in this segment we'll provide an overview of form 1040, schedule c, profit or loss from business, and discuss how to calculate.

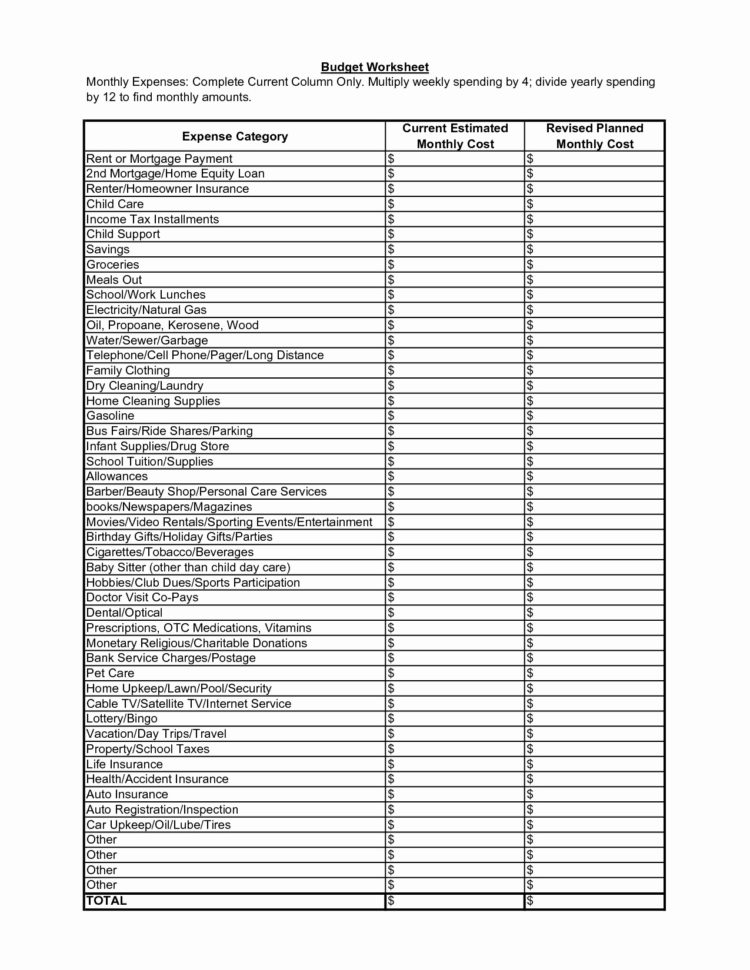

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Total sales, fees or honoraria in exchange for services or goods (please explain if this figure includes amount(s). Web expenses or collections of receipts to organize or subtotal your expenses for you. Web report income and expenses related.

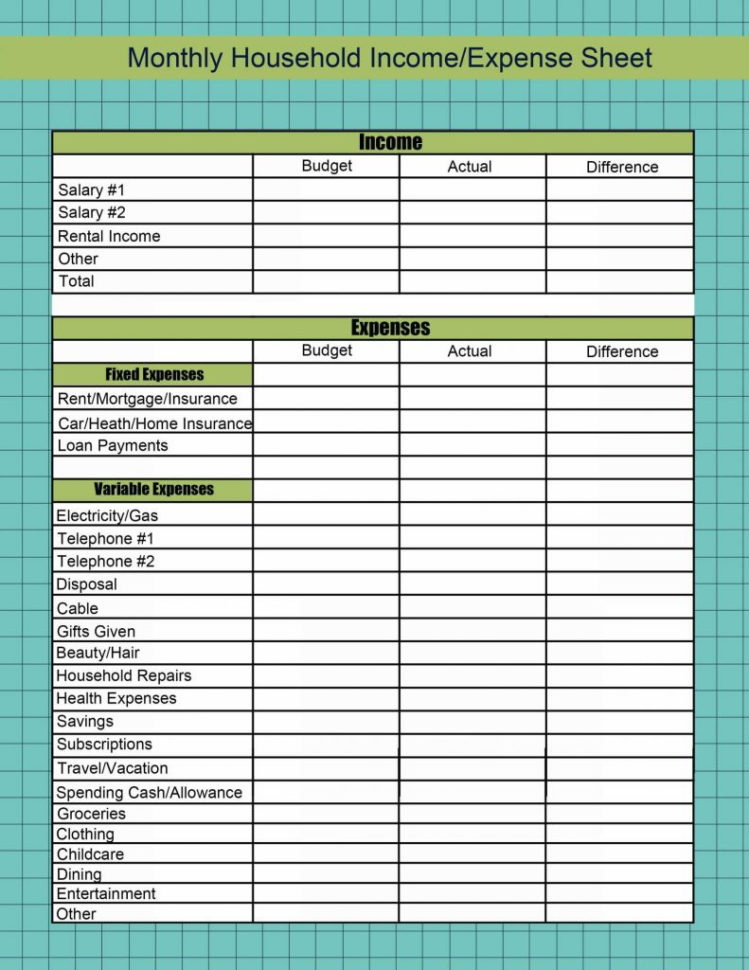

Personal And Expenses Spreadsheet for Business Expense

Total sales, fees or honoraria in exchange for services or goods (please explain if this figure includes amount(s). Schedule c or form 2106 expense report worksheet.pdf. Web schedule c worksheet hickman & hickman, pllc. 2021 schedue c & e worksheets.xlsx author: Web go to www.irs.gov/schedulec for instructions and the latest information.

How to Claim the Home Office Deduction with Form 8829 Ask Gusto

(include notary income, and any other business income) notary income: Total sales, fees or honoraria in exchange for services or goods (please explain if this figure includes amount(s). Web expenses or collections of receipts to organize or subtotal your expenses for you. The expense categories used on the. Web worksheets, schedule c, expense report, deductions;

monthly budget planner DriverLayer Search Engine

Schedule c or form 2106 expense report worksheet.pdf. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to. Web in this segment we'll provide an overview of form 1040, schedule c, profit or loss from business, and discuss how to calculate. Web go to www.irs.gov/schedulec for instructions and the latest.

Schedule C Expenses Worksheet —

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Business owned and operated by spouses Web the income (or loss) from a borrower’s sole proprietorship is calculated on irs form 1040, schedule c, then. Web report income and expenses related to personal property rentals on schedule c.

Schedule C Expenses Worksheet —

Schedule c or form 2106 expense report worksheet.pdf. (b) income and deductions of certain. Web report income and expenses related to personal property rentals on schedule c (form 1040) pdf, if you're in. Web in this segment we'll provide an overview of form 1040, schedule c, profit or loss from business, and discuss how to calculate. Web worksheets, schedule c,.

Schedule C Spreadsheet Google Spreadshee 1040 schedule c spreadsheet

Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax. Web the income (or loss) from a borrower’s sole proprietorship is calculated on irs form 1040, schedule c, then. 2021 schedue c & e worksheets.xlsx author: Web also, use schedule c to report (a) wages and expenses you had as a.

Schedule C Expenses Worksheet

Web worksheets, schedule c, expense report, deductions; 2021 schedue c & e worksheets.xlsx author: Web schedule c worksheet hickman & hickman, pllc. Schedule c or form 2106 expense report worksheet.pdf. Web expenses or collections of receipts to organize or subtotal your expenses for you.

Schedule C Expenses Worksheet —

Business owned and operated by spouses (b) income and deductions of certain. Web worksheets, schedule c, expense report, deductions; Web statutory employees use schedule c to report their wages and expenses. The expense categories used on the.

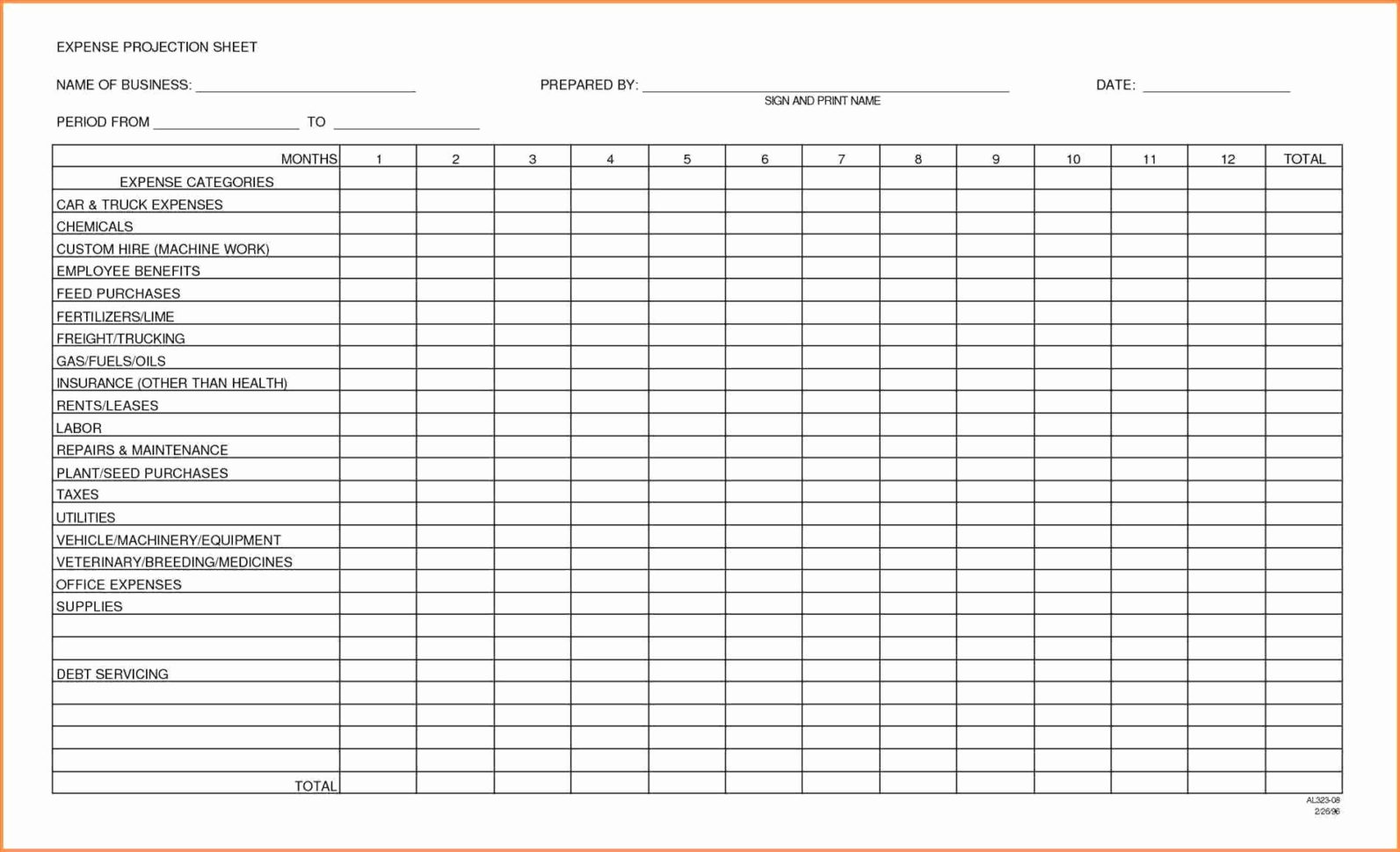

Expense Spreadsheet For Rental Property —

Web in this segment we'll provide an overview of form 1040, schedule c, profit or loss from business, and discuss how to calculate. Web statutory employees use schedule c to report their wages and expenses. Business owned and operated by spouses The expense categories used on the. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires.

Web worksheets, schedule c, expense report, deductions; Web report income and expenses related to personal property rentals on schedule c (form 1040) pdf, if you're in. Schedule c or form 2106 expense report worksheet.pdf. Web go to www.irs.gov/schedulec for instructions and the latest information. Total sales, fees or honoraria in exchange for services or goods (please explain if this figure includes amount(s). Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; 2021 schedue c & e worksheets.xlsx author: The expense categories used on the. Business owned and operated by spouses Web schedule c worksheet hickman & hickman, pllc. (include notary income, and any other business income) notary income: Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Web joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses,. Web department of the treasury internal revenue service (99) profit or loss from business. Web statutory employees use schedule c to report their wages and expenses. (b) income and deductions of certain. Web expenses or collections of receipts to organize or subtotal your expenses for you. Web in this segment we'll provide an overview of form 1040, schedule c, profit or loss from business, and discuss how to calculate. Web the income (or loss) from a borrower’s sole proprietorship is calculated on irs form 1040, schedule c, then.

Web In This Segment We'll Provide An Overview Of Form 1040, Schedule C, Profit Or Loss From Business, And Discuss How To Calculate.

Schedule c or form 2106 expense report worksheet.pdf. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. 2021 schedue c & e worksheets.xlsx author: Web department of the treasury internal revenue service (99) profit or loss from business.

(B) Income And Deductions Of Certain.

Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax. Web schedule c worksheet hickman & hickman, pllc. Web joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses,. Web expenses or collections of receipts to organize or subtotal your expenses for you.

Business Owned And Operated By Spouses

Web report income and expenses related to personal property rentals on schedule c (form 1040) pdf, if you're in. Total sales, fees or honoraria in exchange for services or goods (please explain if this figure includes amount(s). (include notary income, and any other business income) notary income: Web statutory employees use schedule c to report their wages and expenses.

Web Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

The expense categories used on the. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Web the income (or loss) from a borrower’s sole proprietorship is calculated on irs form 1040, schedule c, then. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to.