Schedule C Expenses Worksheet - (b) income and deductions of certain qualified joint ventures; Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Advertising $____________ repairs and maintenance $____________ commissions and fees $____________ supplies (not included above). Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;.

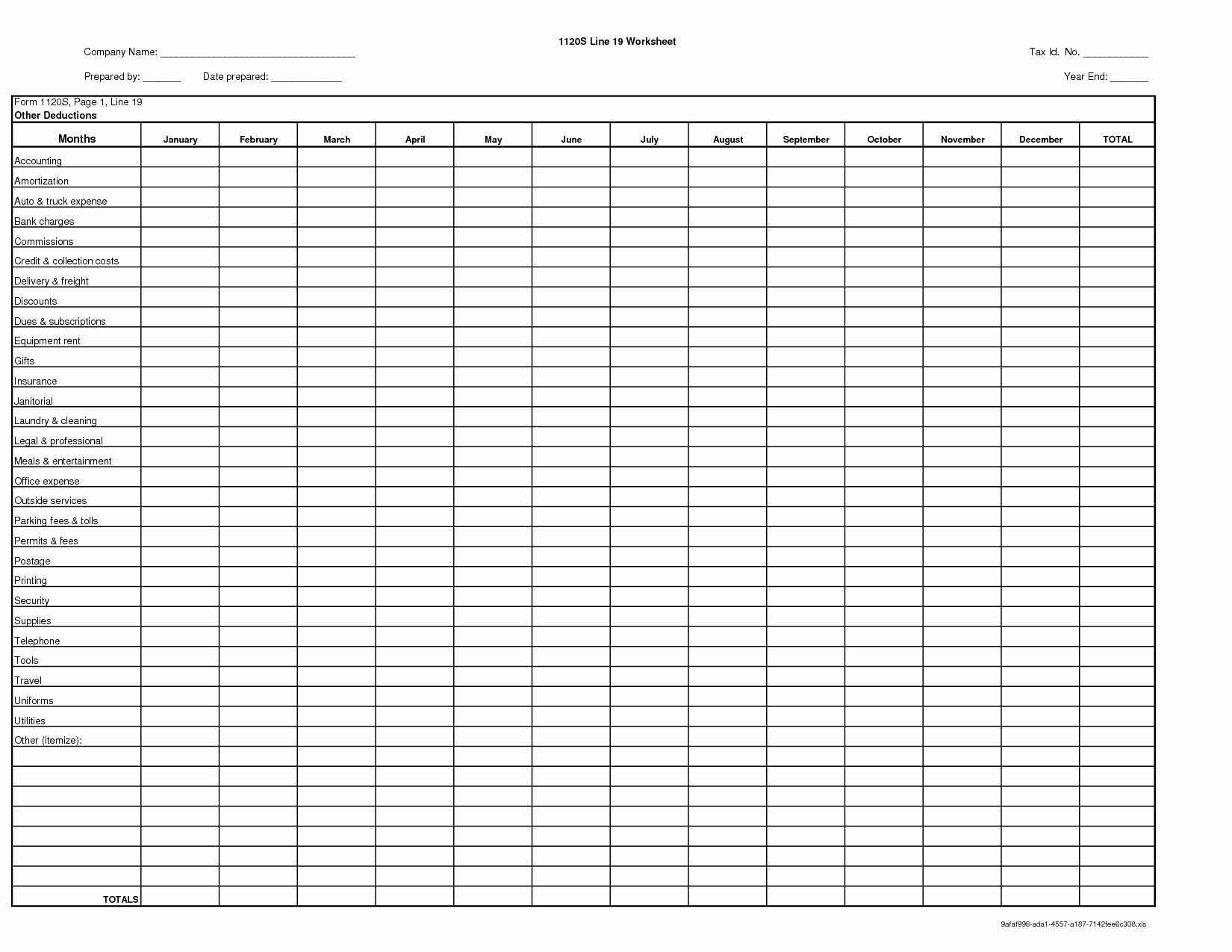

Schedule C Expenses Spreadsheet LAOBING KAISUO

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. (b) income and deductions of certain qualified.

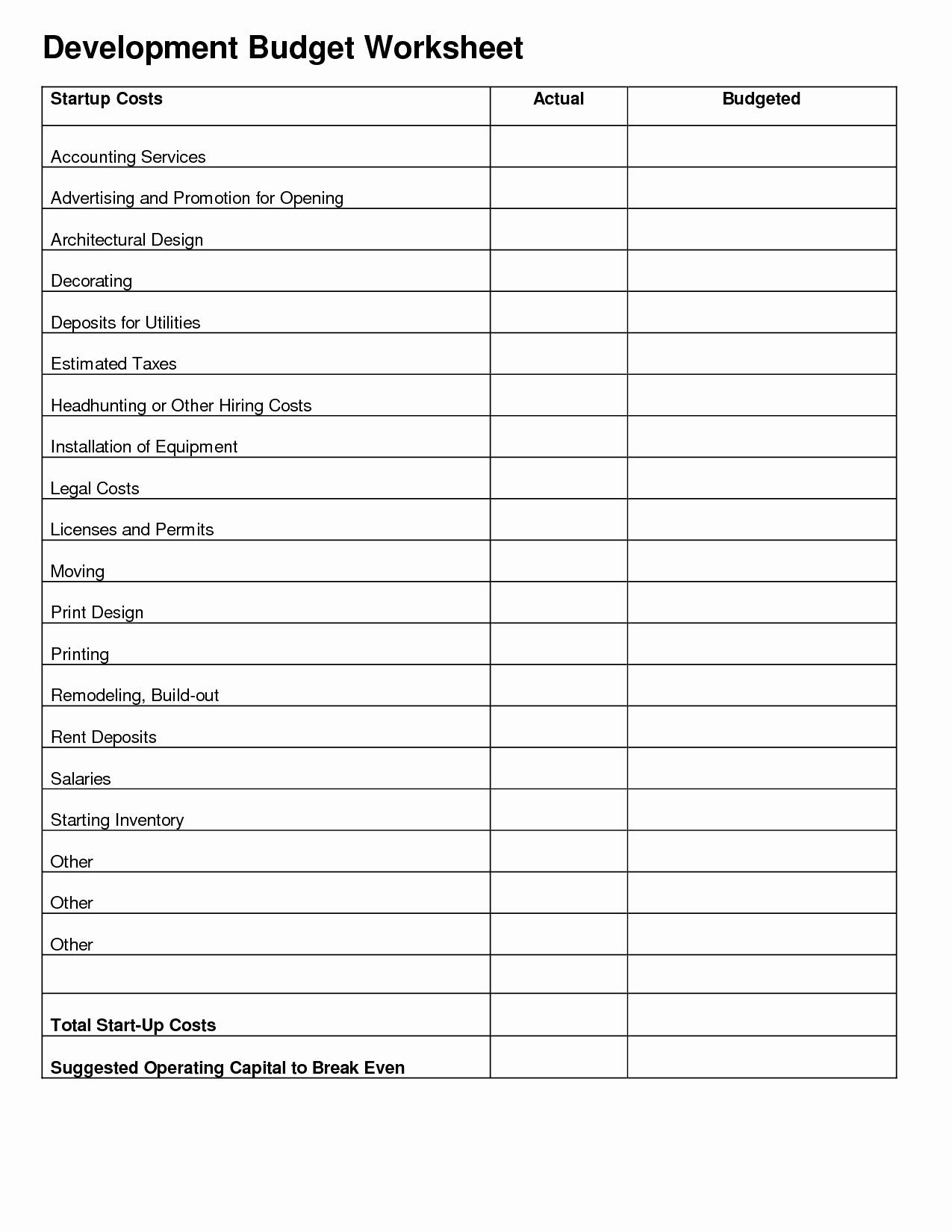

Schedule C Expenses Worksheet —

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. (b) income and deductions of certain qualified joint ventures; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a.

Schedule C Expenses Worksheet

(b) income and deductions of certain qualified joint ventures; Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web department of the treasury.

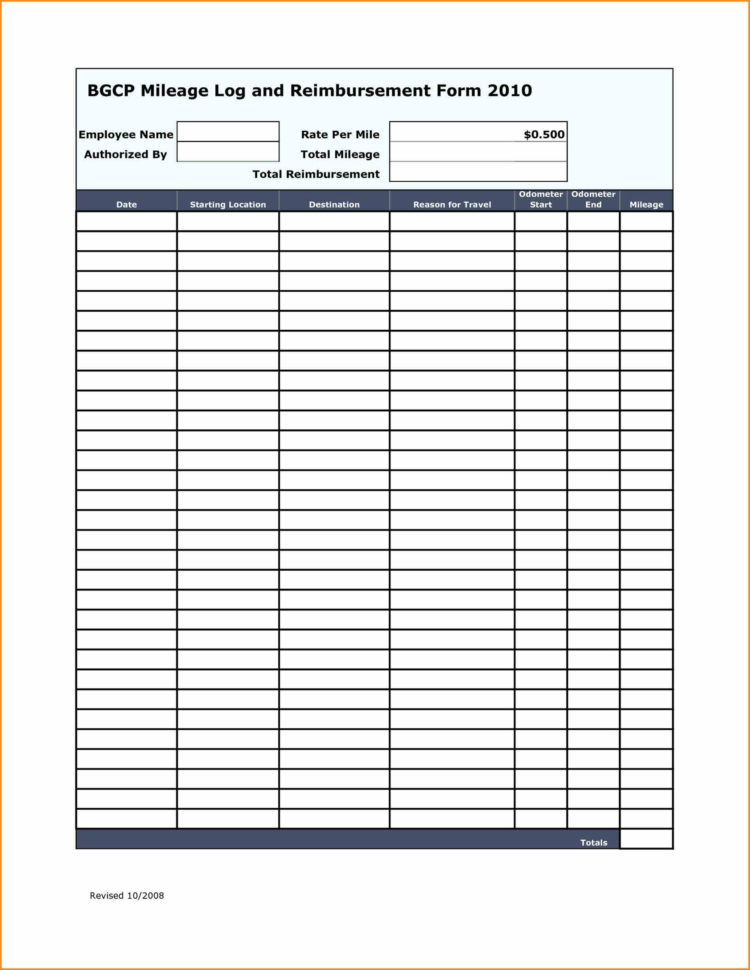

Trucking Expenses Spreadsheet Of Schedule C Car And Truck —

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. (b) income and deductions of certain qualified joint ventures; Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web department of the treasury.

Schedule C Expense Excel Template printable schedule template

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Advertising $____________ repairs and maintenance $____________ commissions and fees $____________ supplies (not included above). Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated.

Schedule C Expenses Spreadsheet —

Advertising $____________ repairs and maintenance $____________ commissions and fees $____________ supplies (not included above). (b) income and deductions of certain qualified joint ventures; Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web information about schedule c (form 1040), profit or loss from business, used.

Schedule C Expenses Spreadsheet Download Laobing Kaisuo —

Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. (b) income and deductions of certain qualified joint ventures; Web department of the treasury.

Schedule C Expenses Worksheet —

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web also, use schedule c to report.

Schedule C Expenses Worksheet

Advertising $____________ repairs and maintenance $____________ commissions and fees $____________ supplies (not included above). Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;..

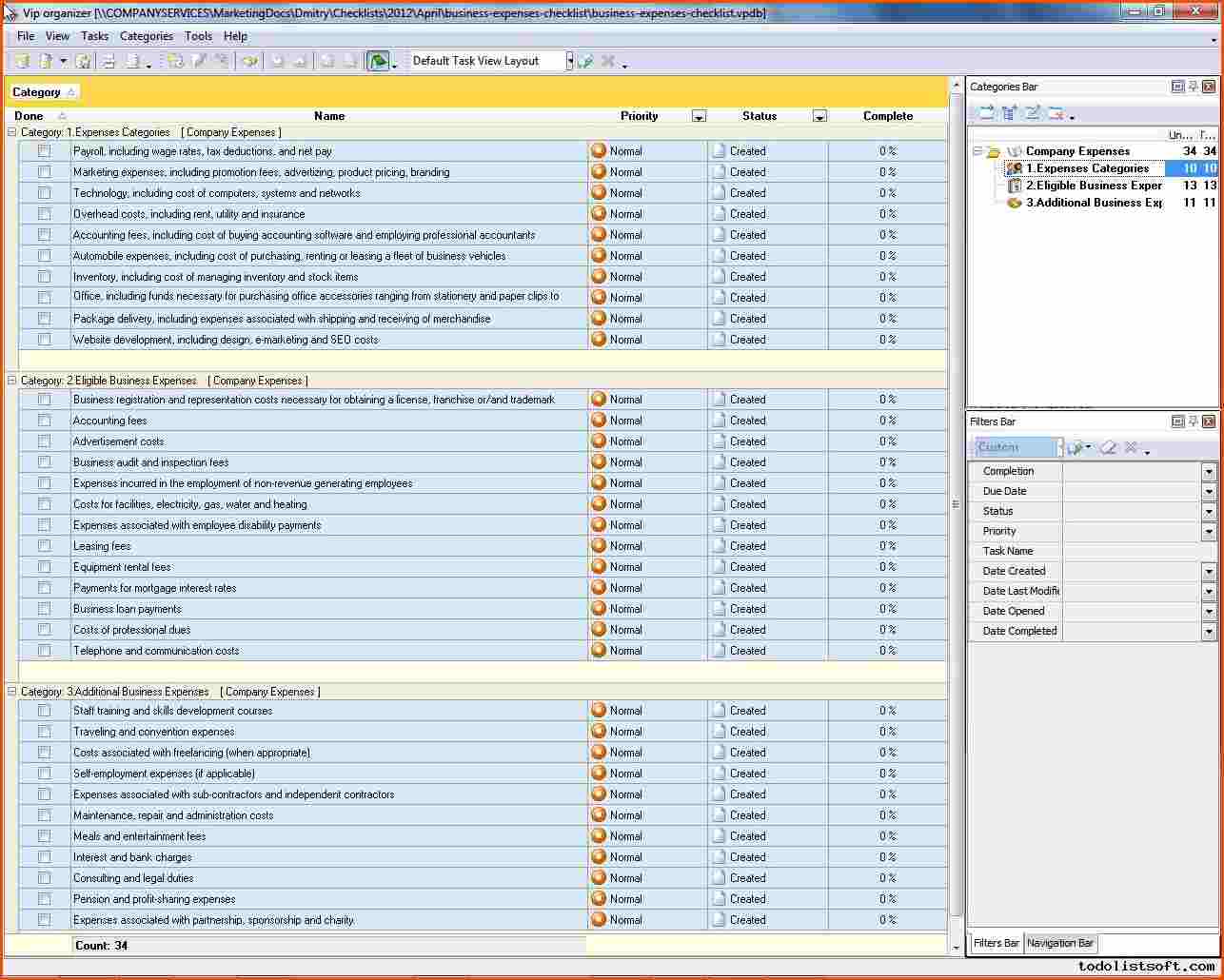

What do the Expense entries on the Schedule C mean? Support

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. (b) income and deductions of certain qualified joint ventures; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a.

(b) income and deductions of certain qualified joint ventures; Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Advertising $____________ repairs and maintenance $____________ commissions and fees $____________ supplies (not included above). Web also, use schedule c to report (a) wages and expenses you had as a statutory employee;

Web Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession Practiced As A Sole Proprietor;.

Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; (b) income and deductions of certain qualified joint ventures; Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Advertising $____________ repairs and maintenance $____________ commissions and fees $____________ supplies (not included above).