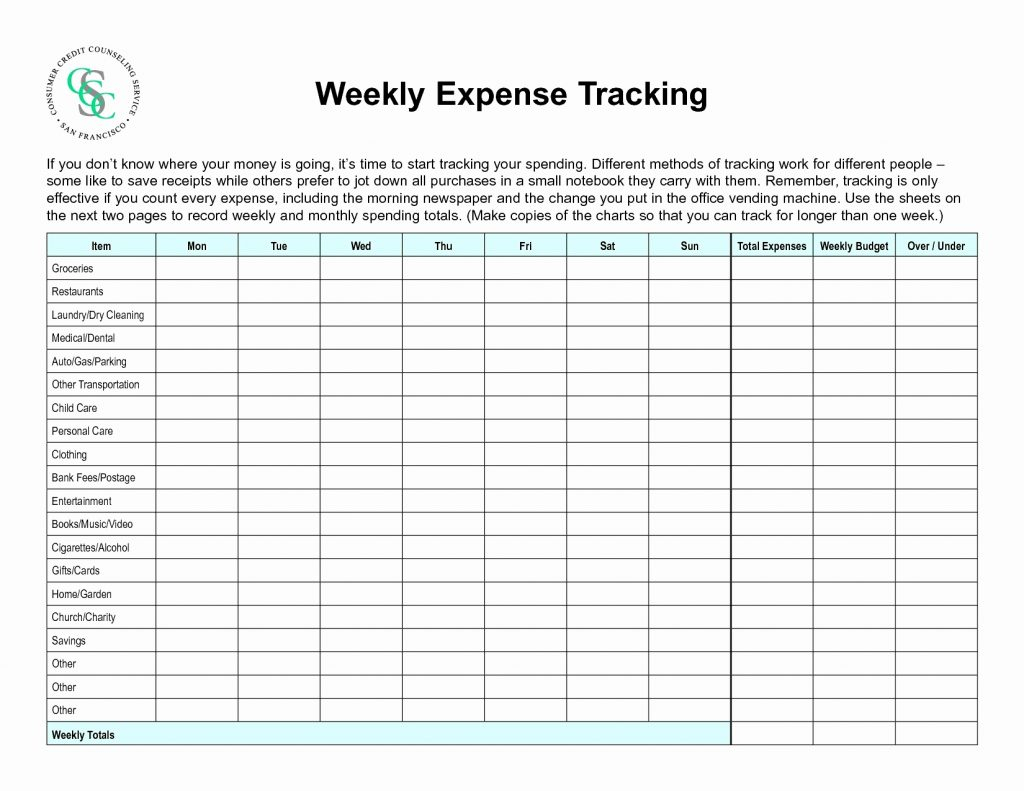

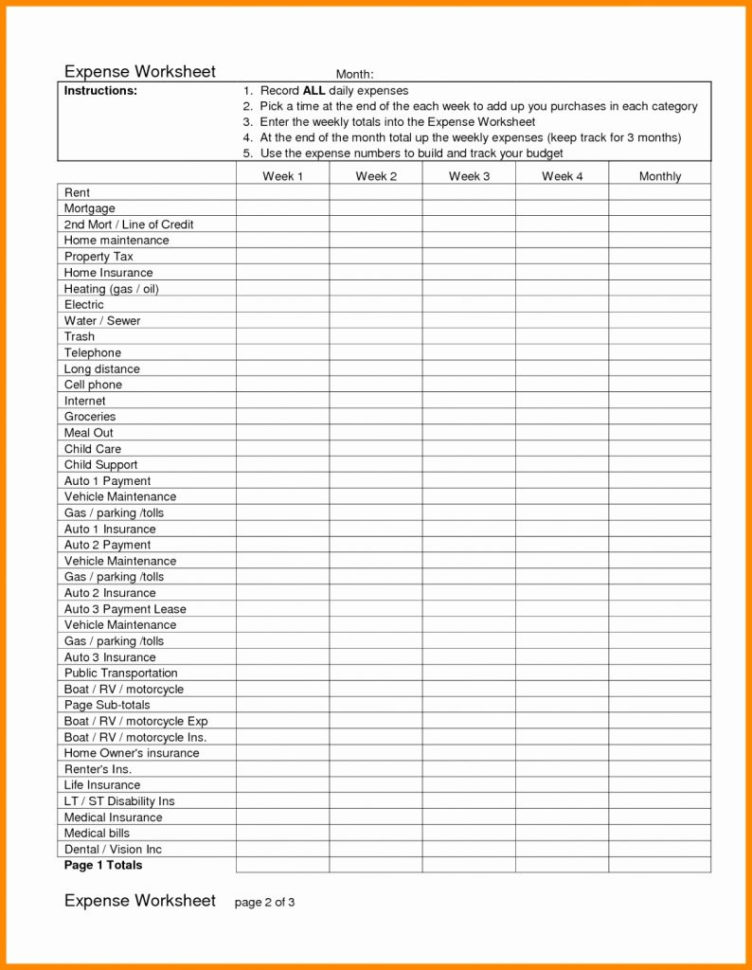

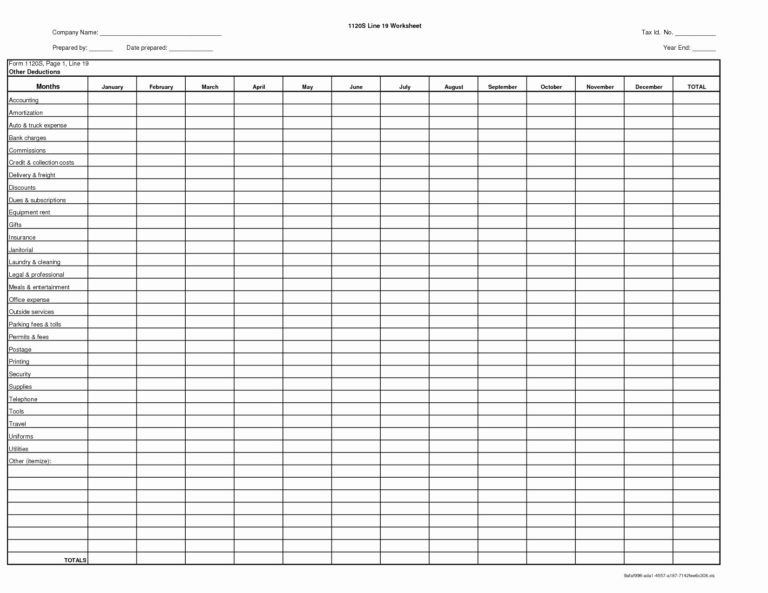

Schedule C Car And Truck Expenses Worksheet - Enter on lines b through f the type and amount of. Web if you’re claiming a deduction for business mileage, you’ll report it using schedule c on form 1040. Web irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Web there are over a dozen categories to help you stay organized, such as advertising, car and truck expenses,. Web expenses count against income. Web average deduction amount: Web instructions for schedule c, parts ii and v. Web average deduction amount: Enter expenses for business use of your home. Cost must be entered. hi everyone, i almost complete my tax.

Schedule C Spreadsheet within Schedule C Expenses Spreadsheet Car And

Enter on lines b through f the type and amount of. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Based on the average amount of deductions/expenses found by turbotax. Web there are over a dozen categories to help you stay organized, such as advertising, car and truck expenses,. Web.

Schedule C Spreadsheet pertaining to Schedule C Expenses Spreadsheet

Web expenses count against income. Web there are over a dozen categories to help you stay organized, such as advertising, car and truck expenses,. Web to entered vehicle expenses in an private return, intuit proseries has a car and truck expense worksheet. Web irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Web if you’re.

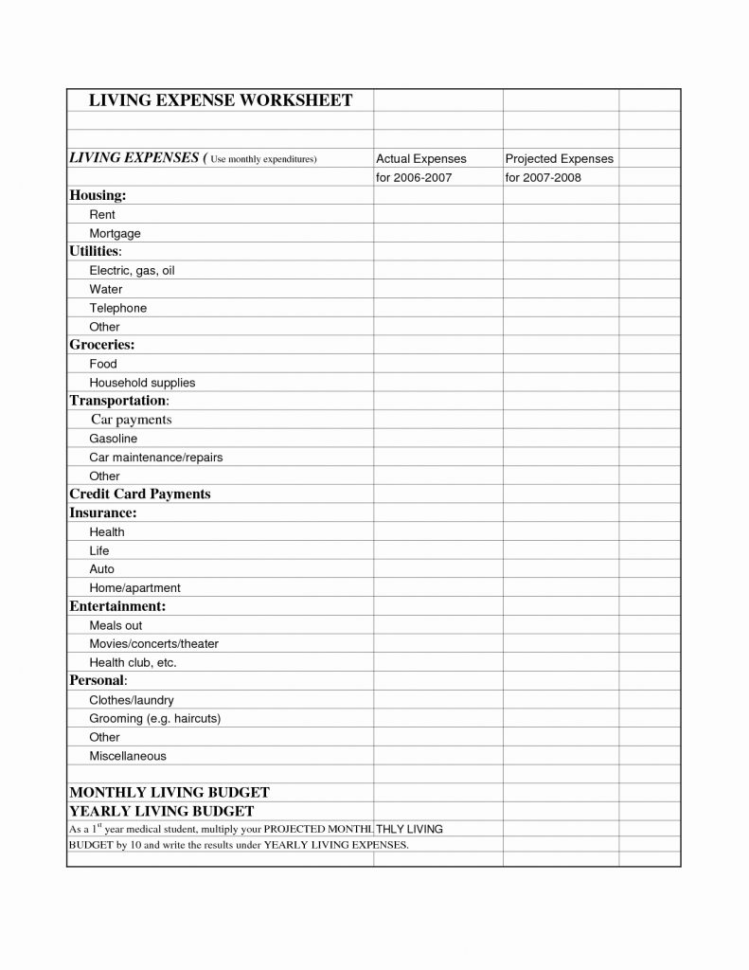

schedule c expenses worksheet

Web instructions for schedule c, parts ii and v. Enter on lines b through f the type and amount of. Web average deduction amount: Based on the average amount of deductions/expenses found by turbotax. List your vehicle information in the assets.

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

Based on the average amount of deductions/expenses found by turbotax. Web irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Web expenses count against income. Enter expenses for business use of your home. Web instructions for schedule c, parts ii and v.

Schedule C Expenses Worksheet

Web average deduction amount: Web on the business income (schedule c) screen, there's an input field for car and truck expenses [adjustment]. List your vehicle information in the assets. Based on the average amount of deductions/expenses found by turbotax. Web to use the actual car expenses, go to the depreciation section of the schedule c.

Chicken Expense Spreadsheet for 50 Best Of Schedule C Car And Truck

Web irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. List your vehicle information in the assets. Based on the average amount of deductions/expenses found by turbotax. Web schedule c worksheet hickman & hickman, pllc. Web average deduction amount:

Schedule C Spreadsheet Google Spreadshee 1040 schedule c spreadsheet

List your vehicle information in the assets. Web to use the actual car expenses, go to the depreciation section of the schedule c. Web on the business income (schedule c) screen, there's an input field for car and truck expenses [adjustment]. Web schedule c worksheet hickman & hickman, pllc. Based on the average amount of deductions/expenses found by turbotax.

Schedule C Expenses Worksheet

Cost must be entered. hi everyone, i almost complete my tax. Based on the average amount of deductions/expenses found by turbotax. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Based on the average amount of deductions/expenses found by turbotax. Federal section>income>profit or loss from a.

Turbotax Car And Truck Expenses Worksheet

Web instructions for schedule c, parts ii and v. Web average deduction amount: Web schedule c worksheet hickman & hickman, pllc. Web to use the actual car expenses, go to the depreciation section of the schedule c. Web irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements.

Schedule C Expenses Worksheet

Web average deduction amount: List your vehicle information in the assets. Web if you’re claiming a deduction for business mileage, you’ll report it using schedule c on form 1040. Web there are over a dozen categories to help you stay organized, such as advertising, car and truck expenses,. Based on the average amount of deductions/expenses found by turbotax.

You can use the optional worksheet below to record your expenses. Enter on lines b through f the type and amount of. Web if you’re claiming a deduction for business mileage, you’ll report it using schedule c on form 1040. Web there are over a dozen categories to help you stay organized, such as advertising, car and truck expenses,. Enter expenses for business use of your home. Web schedule c worksheet hickman & hickman, pllc. Web irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Based on the average amount of deductions/expenses found by turbotax. Web on the business income (schedule c) screen, there's an input field for car and truck expenses [adjustment]. Based on the average amount of deductions/expenses found by turbotax. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Cost must be entered. hi everyone, i almost complete my tax. Web average deduction amount: Federal section>income>profit or loss from a. Web instructions for schedule c, parts ii and v. List your vehicle information in the assets. Web expenses count against income. This is true even if. Web average deduction amount: Web to entered vehicle expenses in an private return, intuit proseries has a car and truck expense worksheet.

Federal Section>Income>Profit Or Loss From A.

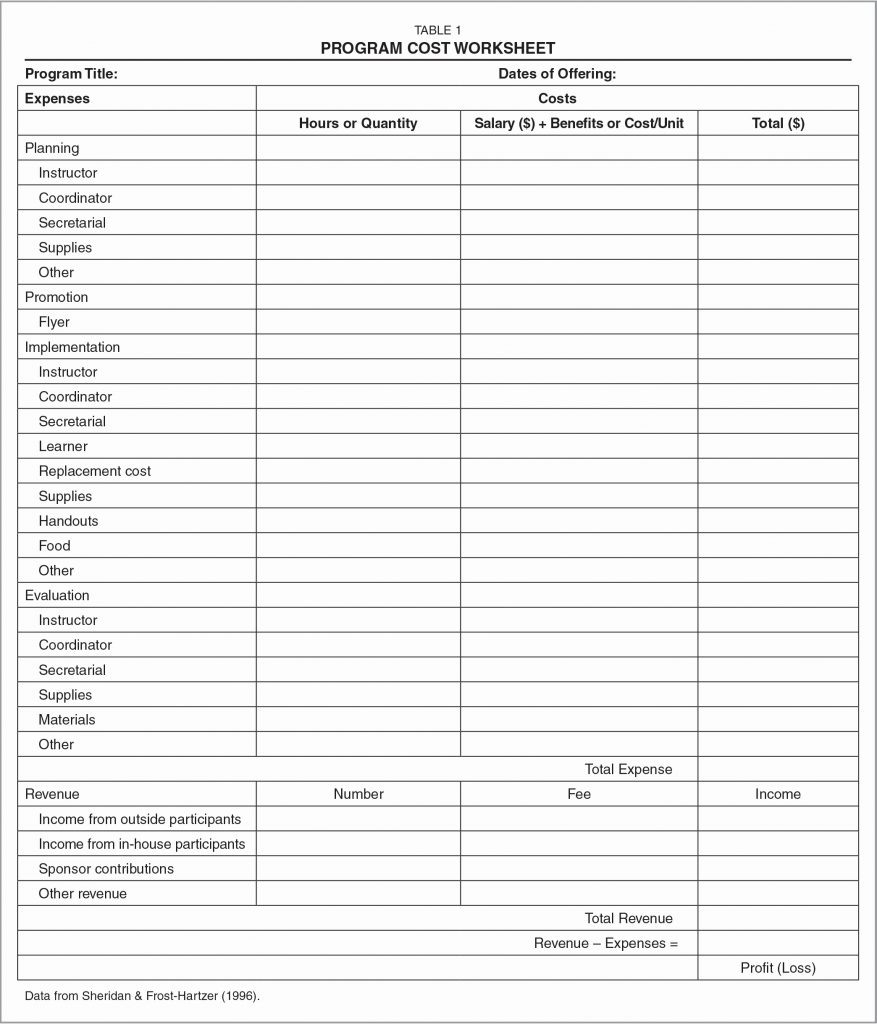

Enter expenses for business use of your home. Web schedule c worksheet hickman & hickman, pllc. Web there are over a dozen categories to help you stay organized, such as advertising, car and truck expenses,. Web instructions for schedule c, parts ii and v.

You Can Use The Optional Worksheet Below To Record Your Expenses.

This is true even if. Cost must be entered. hi everyone, i almost complete my tax. Web expenses count against income. Web to entered vehicle expenses in an private return, intuit proseries has a car and truck expense worksheet.

Web Irs Tax Topic On Deductible Car Expenses Such As Mileage, Depreciation, And Recordkeeping Requirements.

Web on the business income (schedule c) screen, there's an input field for car and truck expenses [adjustment]. Enter on lines b through f the type and amount of. Based on the average amount of deductions/expenses found by turbotax. List your vehicle information in the assets.

Web To Use The Actual Car Expenses, Go To The Depreciation Section Of The Schedule C.

Web if you’re claiming a deduction for business mileage, you’ll report it using schedule c on form 1040. Based on the average amount of deductions/expenses found by turbotax. Web average deduction amount: Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate.