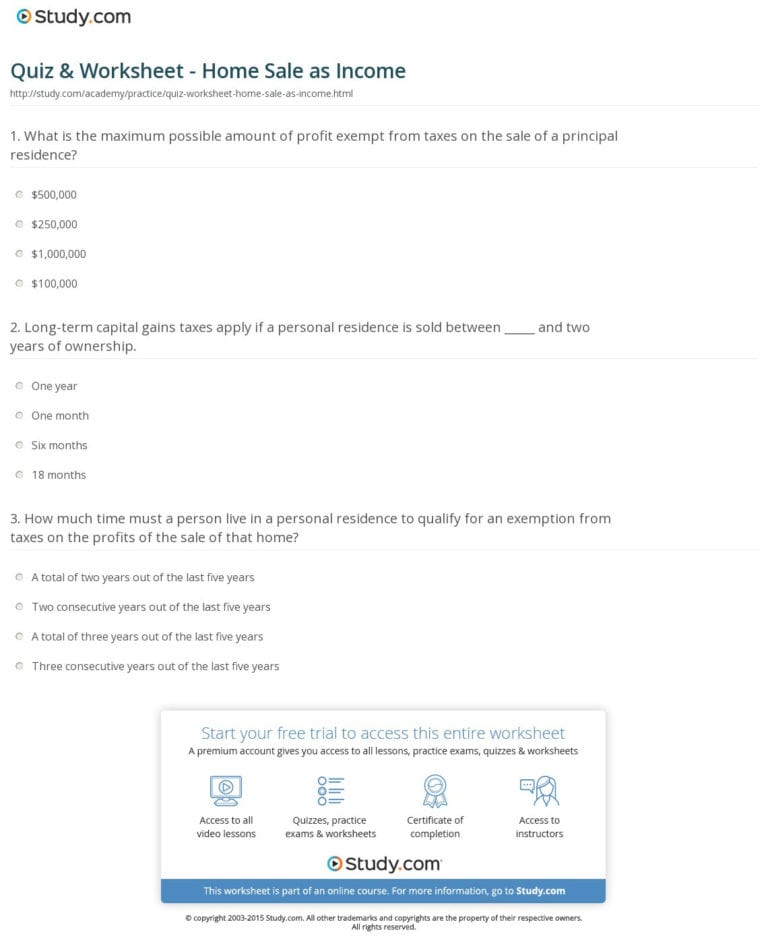

Sale Of Main Home Worksheet - Web gain from the sale of your home from your income and avoid paying taxes on it. Web taxslayer support selling your home if you sell your home during the year, you may be able to exclude some or all of the gain. You sell your home within 2 years of the death of your spouse. You may take the exclusion, whether maximum or partial, only on the sale of a home that is your principal. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of. The sale of your main home is recorded: Neither you nor your late spouse took. If you sell your main home during the tax year, you should report the gain or loss on the. Web worksheets are included in publication 523, selling your home, to help you figure the: Web you will need to complete the sale of main home worksheet on your return.

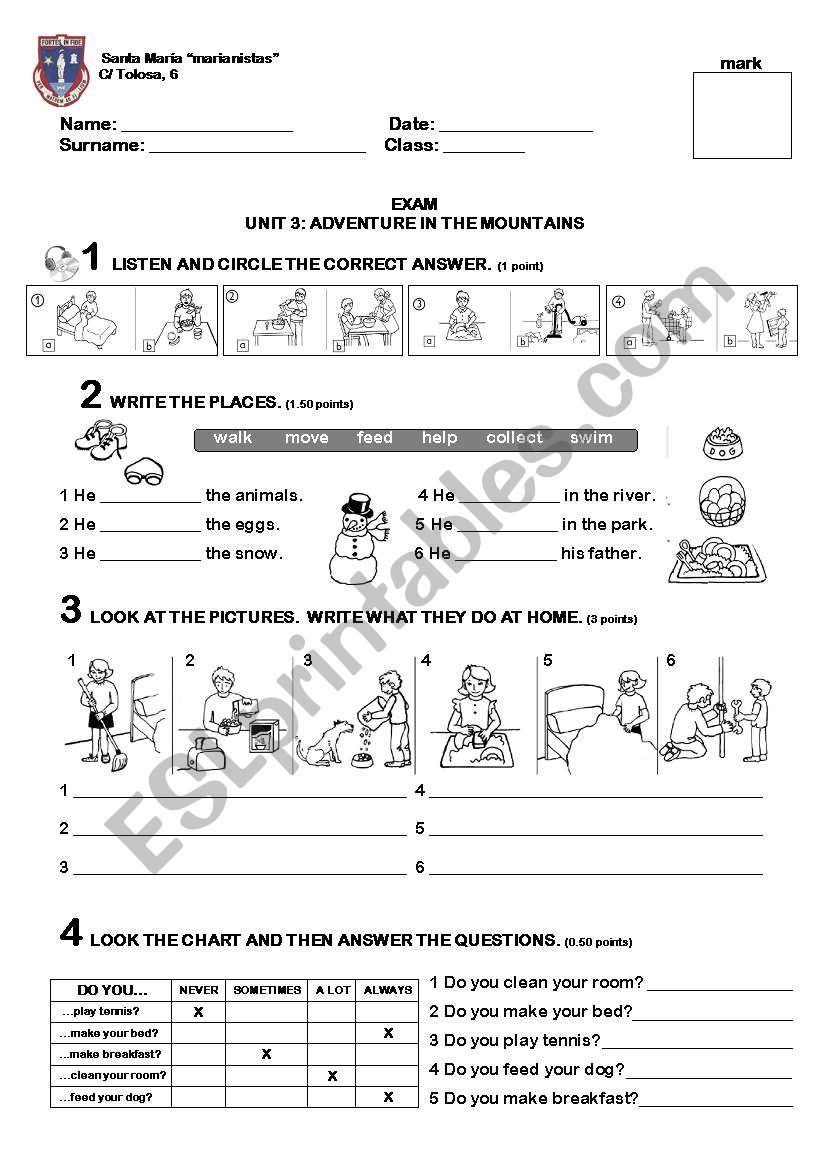

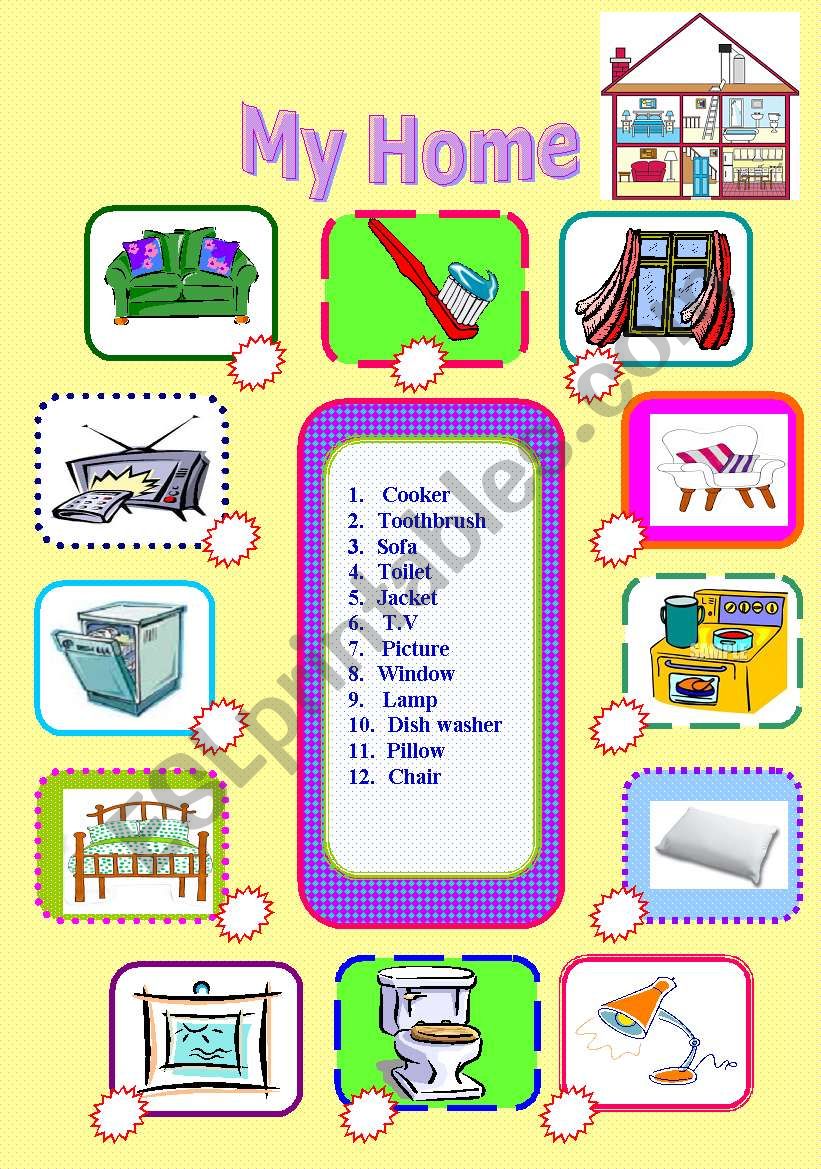

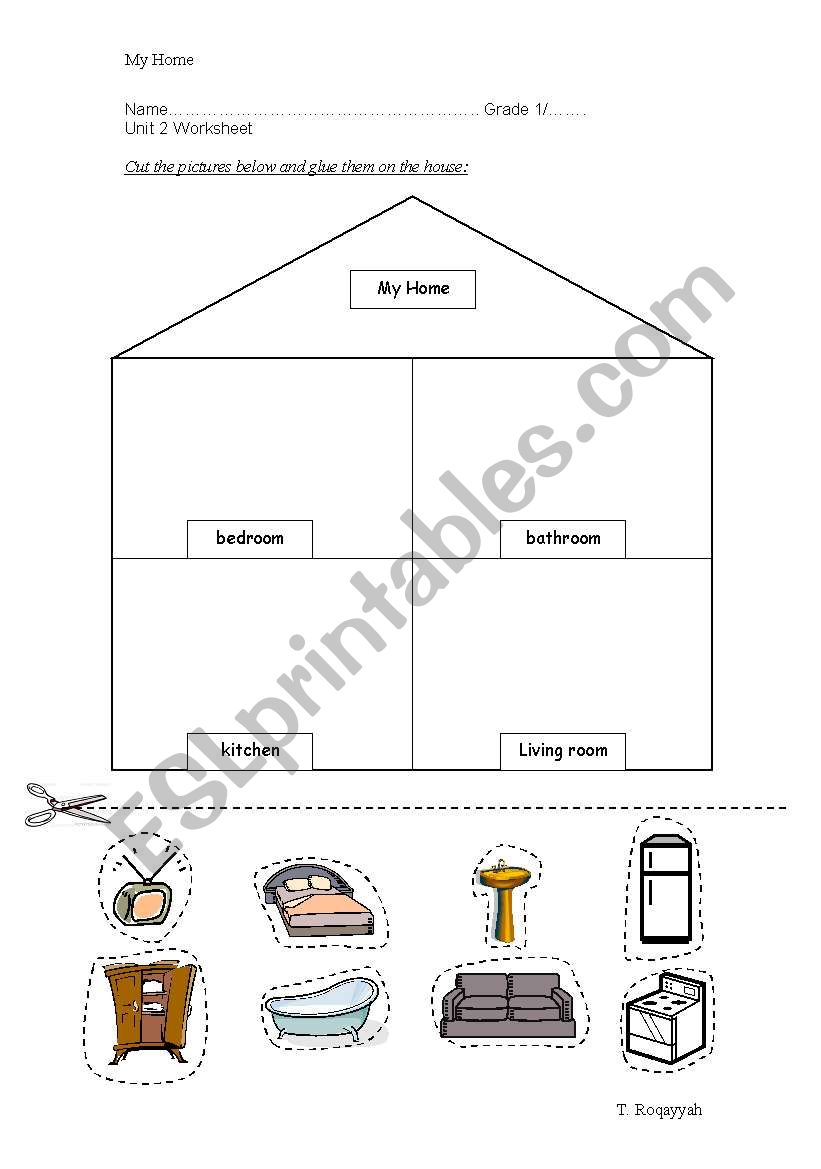

AT HOME ESL worksheet by Saleta

Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Adjusted basis of the home you sold gain. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the. The sale of your main.

Sale Of Home Worksheet —

Be sure to click the info icon on the screen titled sale. The sale of your main home is recorded by following this path: Web number of days property used as main home during 5 year period ending on date of sale > taxpayer: Web sale of your main home. Basic info about the sale:

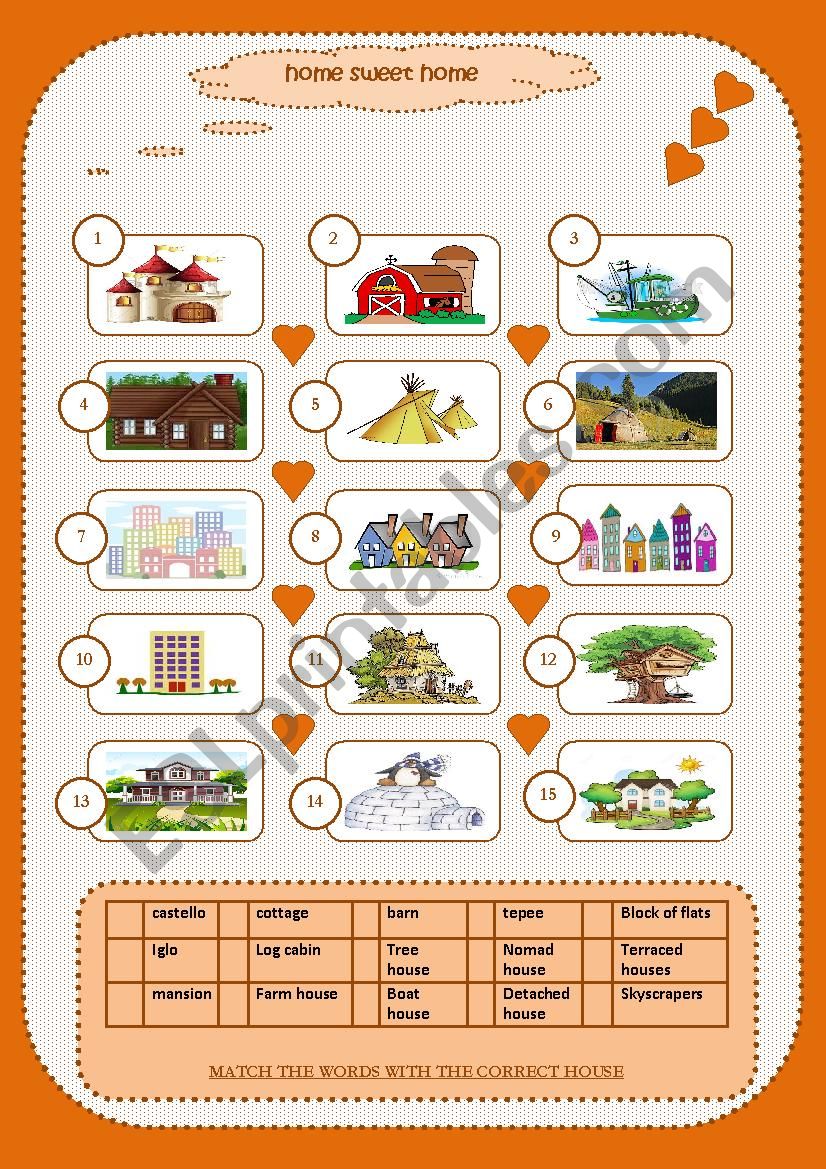

home ESL worksheet by moitifa

Web to access the sale of main home worksheet for in the tax program, from the main menu of the tax return (form 1040) select: Web sale of main home worksheet; Adjusted basis of the home you sold gain. Basic information about your home: Web use test — you must live in/use the home as your main home for at.

Sale Of Main Home Worksheet —

The amount you realize on the sale of your home and the adjusted basis of your home are important. Web gain from the sale of your home from your income and avoid paying taxes on it. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Web.

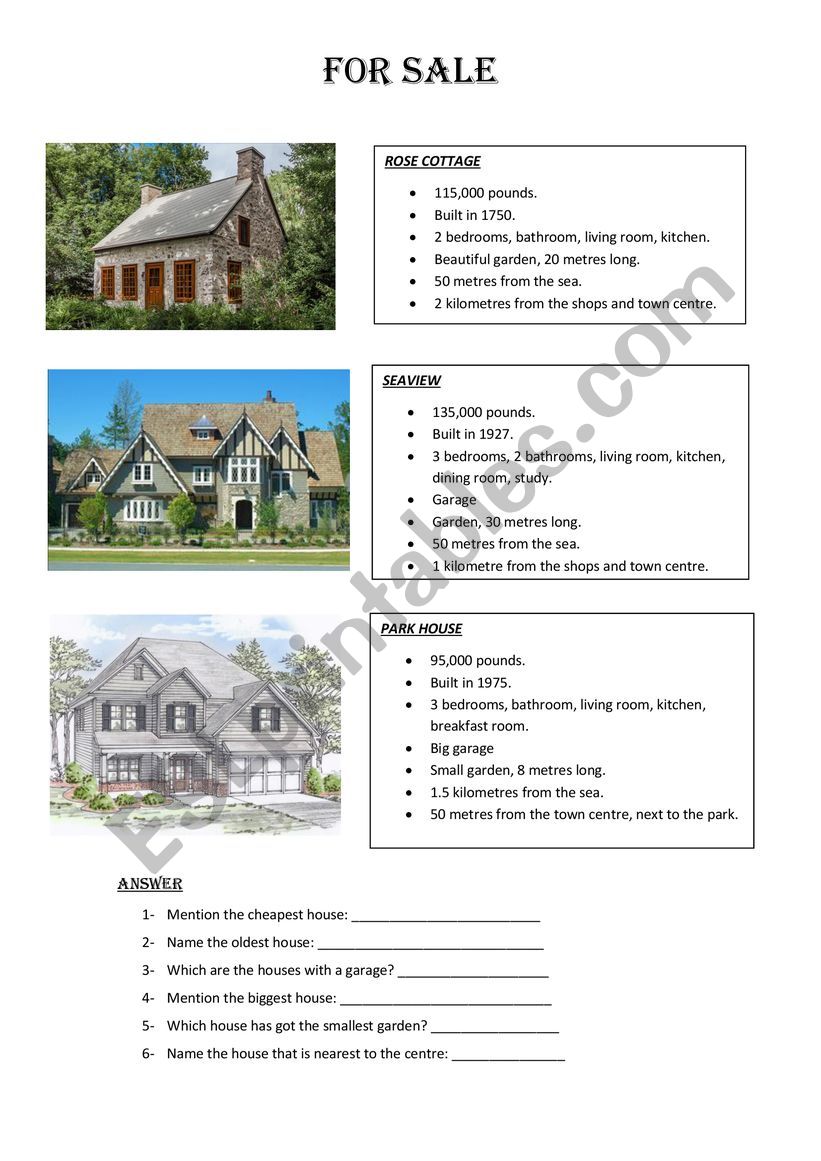

Houses for sale ESL worksheet by emi7717

Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of. The amount you realize on the sale of your home and the adjusted basis of your home are important. Web sale of your main home. Web sale of main home.

At home ESL worksheet by mahaenglish

You may take the exclusion, whether maximum or partial, only on the sale of a home that is your principal. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the. Web taxslayer support selling your home if you sell your home during the year, you may.

Sale Of Main Home Worksheet —

Web sale of your main home. The sale of your main home is recorded by following this path: You haven't remarried at the time of the sale. Web number of days property used as main home during 5 year period ending on date of sale > taxpayer: Web use worksheet for basis adjustment in column (g) in instructions for form.

English worksheets My home

Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of. Web up to $250,000 in capital gains.

Sale Of Home Worksheet —

Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. The exclusion is increased to $500,000 for a married couple filing jointly. Web you will need to complete the sale of main home worksheet on your return. Web number of days property used as main home during.

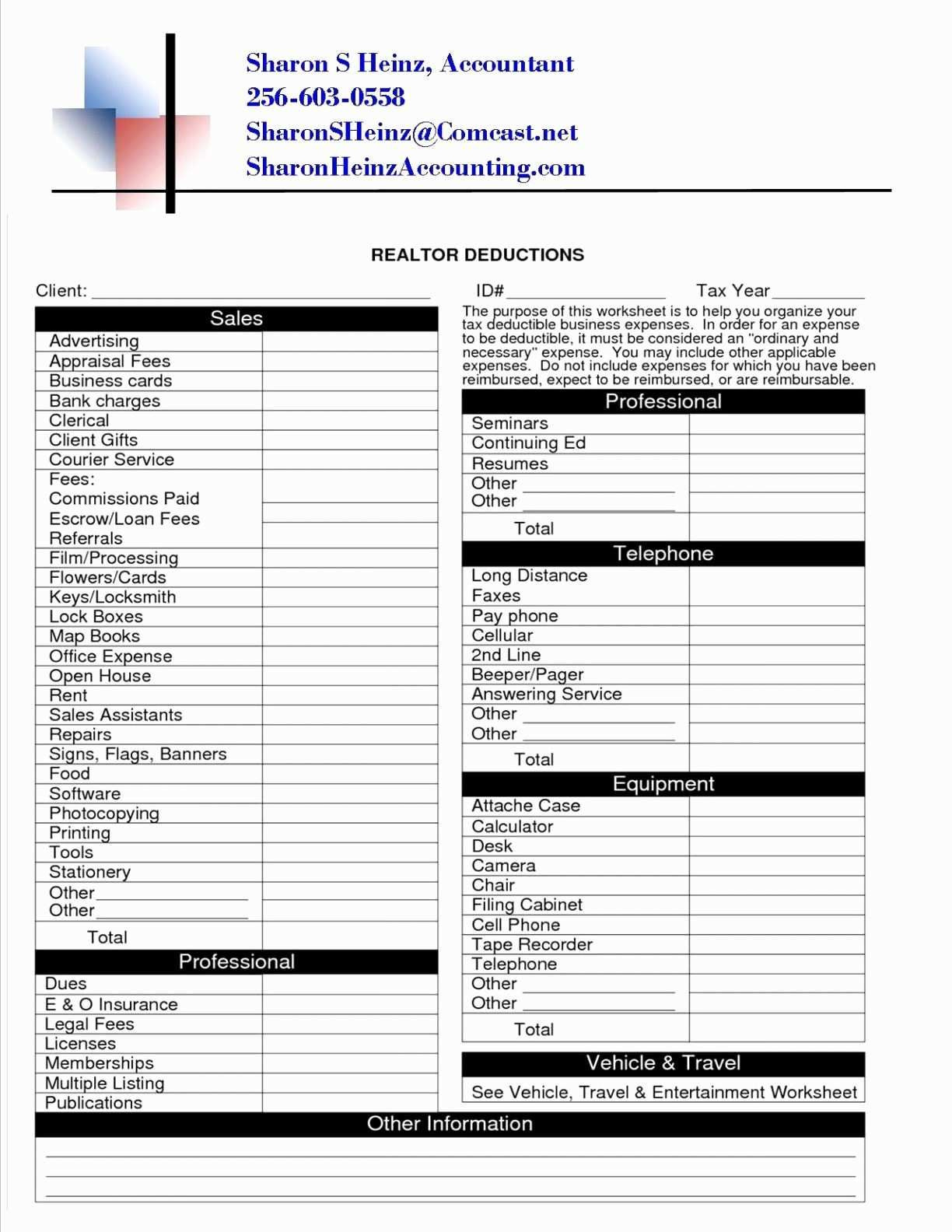

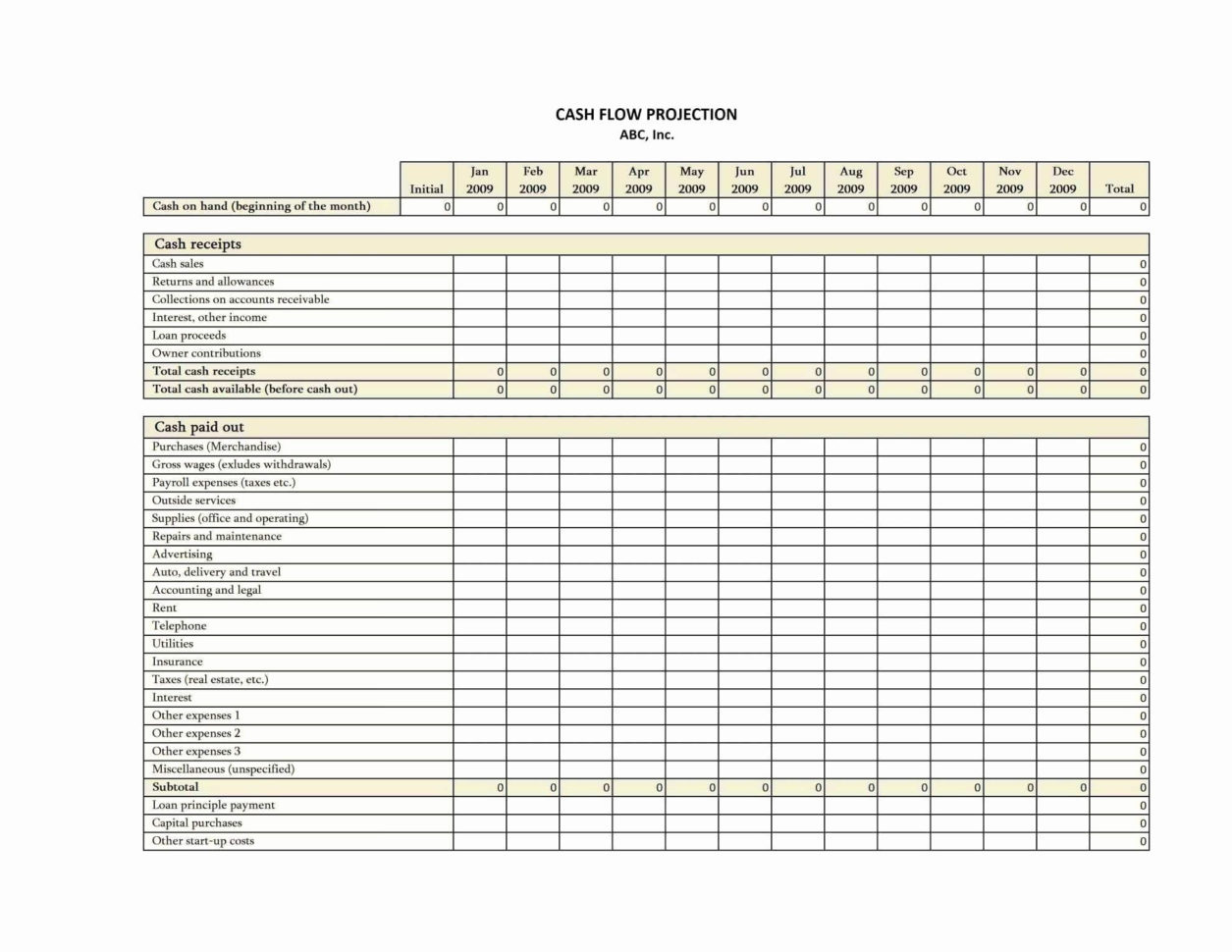

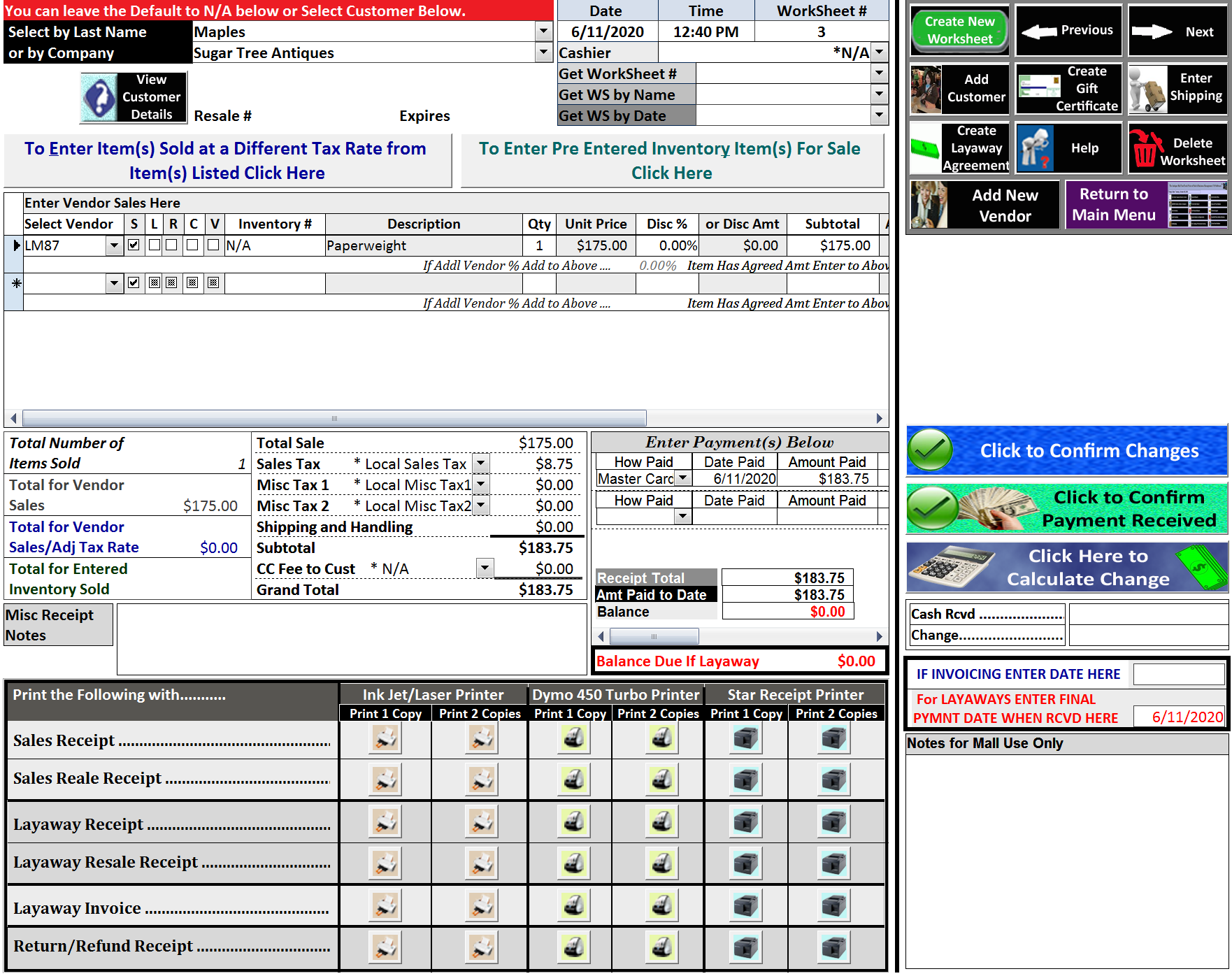

Antique Mall Point of Sale Software Sales WorkSheet

The amount you realize on the sale of your home and the adjusted basis of your home are important. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the. Web use worksheet for basis adjustment in column (g) in instructions for form 8949, sale and other dispositions of capital. Web.

Basic information about your home: The sale of your main home is recorded by following this path: Web number of days property used as main home during 5 year period ending on date of sale > taxpayer: If you sell your main home during the tax year, you should report the gain or loss on the. Web follow these steps to enter the sale of a home using the home sale worksheet: Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Make sure you have your previous year’s records so. You haven't remarried at the time of the sale. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of. You may take the exclusion, whether maximum or partial, only on the sale of a home that is your principal. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the. Web you will need to complete the sale of main home worksheet on your return. The amount you realize on the sale of your home and the adjusted basis of your home are important. Web taxslayer support selling your home if you sell your home during the year, you may be able to exclude some or all of the gain. You sell your home within 2 years of the death of your spouse. Web sale of main home worksheet; Web taxslayer support how do i report the sale of my main home? Web to access the sale of main home worksheet for in the tax program, from the main menu of the tax return (form 1040) select: The exclusion is increased to $500,000 for a married couple filing jointly. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the.

Web Worksheets Are Included In Publication 523, Selling Your Home, To Help You Figure The:

Web you will need to complete the sale of main home worksheet on your return. The amount you realize on the sale of your home and the adjusted basis of your home are important. The sale of your main home is recorded: Web taxslayer support how do i report the sale of my main home?

Web Sale Of Your Main Home.

Web what is the sale of main home worksheet? Web follow these steps to enter the sale of a home using the home sale worksheet: You may take the exclusion, whether maximum or partial, only on the sale of a home that is your principal. Web use test — you must live in/use the home as your main home for at least two of the last five years, ending on the date of sale.

The Exclusion Is Increased To $500,000 For A Married Couple Filing Jointly.

You sell your home within 2 years of the death of your spouse. Web use worksheet for basis adjustment in column (g) in instructions for form 8949, sale and other dispositions of capital. Be sure to click the info icon on the screen titled sale. Make sure you have your previous year’s records so.

The Sale Of Your Main Home Is Recorded By Following This Path:

You haven't remarried at the time of the sale. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of. Web sale of your main home: Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the.