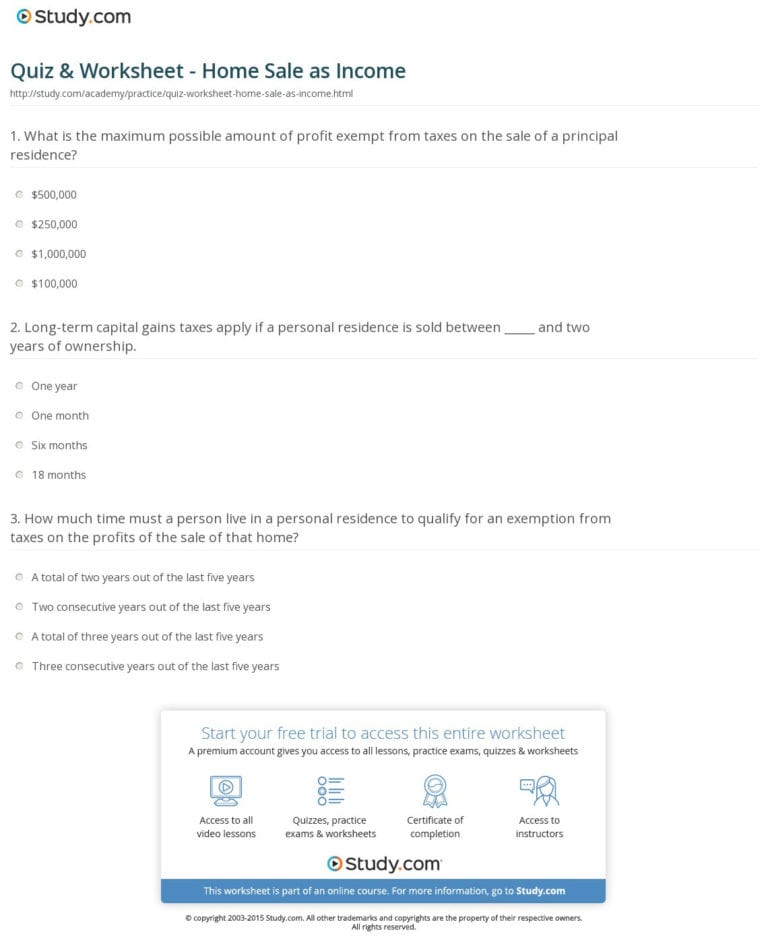

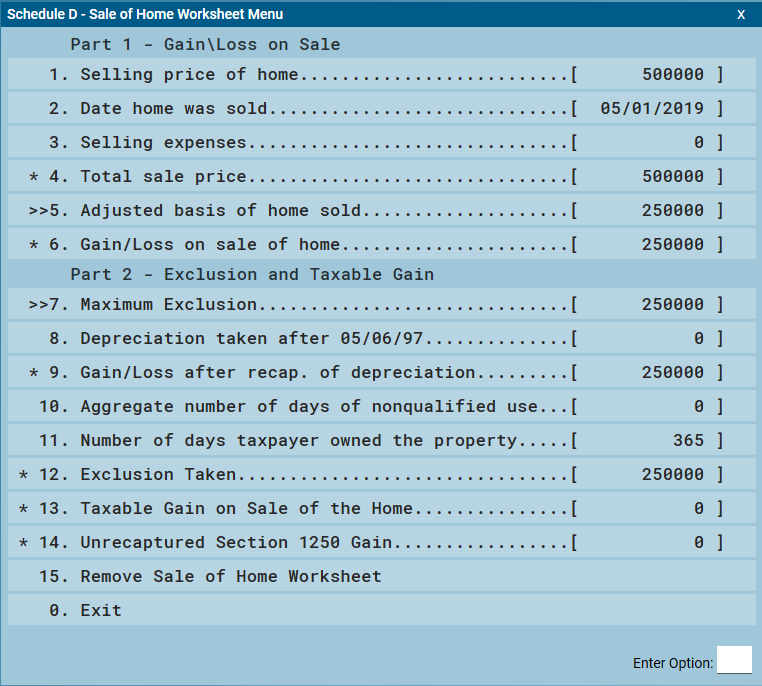

Sale Of Home Worksheet - Web sale of main home worksheet; Web use this screen to complete sale of your home worksheets and form 6252, installment sale income, if applicable. Web sale of main home worksheet; Web this section tells you how to report taxable gain, take deductions relating to your home sale, and report income other than the gain. Web sale of home worksheet how to compute gain or loss worksheet the process is the same for single family homes,. Web what is the sale of main home worksheet? Worksheet for 2002 expenses paid in 2003. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable. The exclusion is increased to $500,000 for a married couple filing jointly.

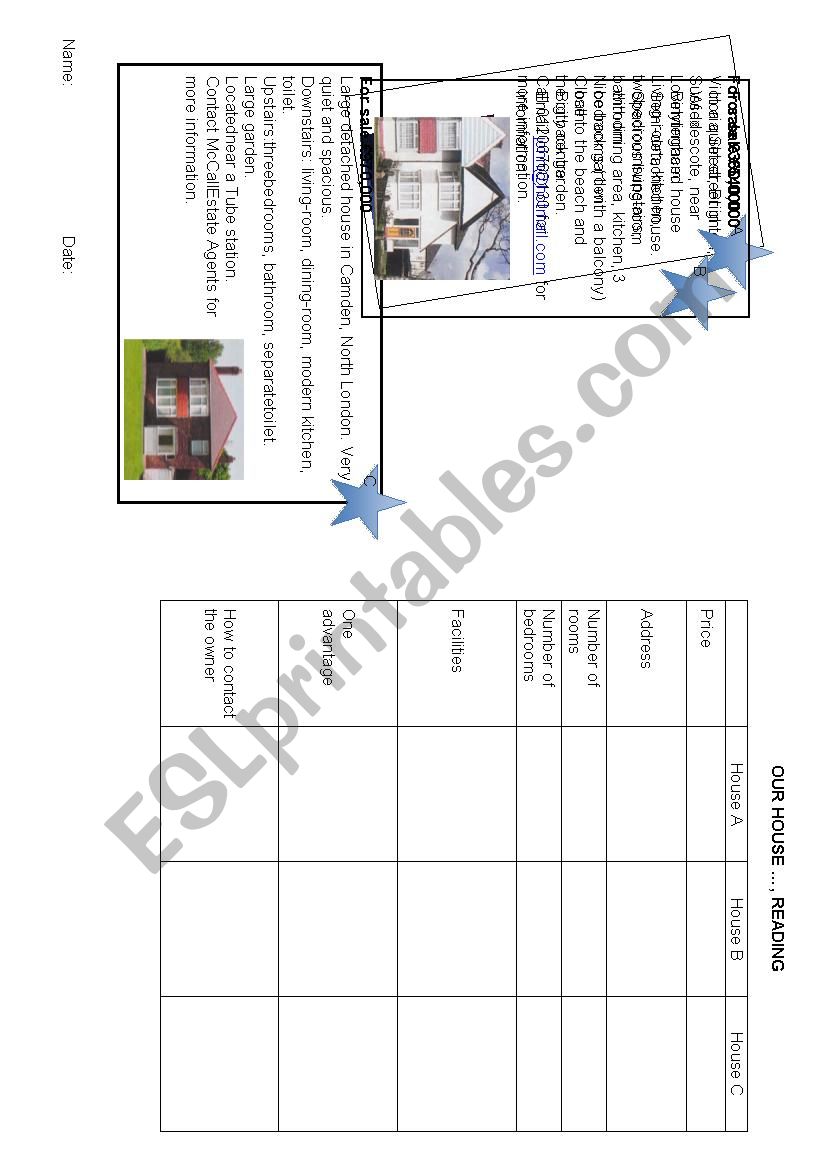

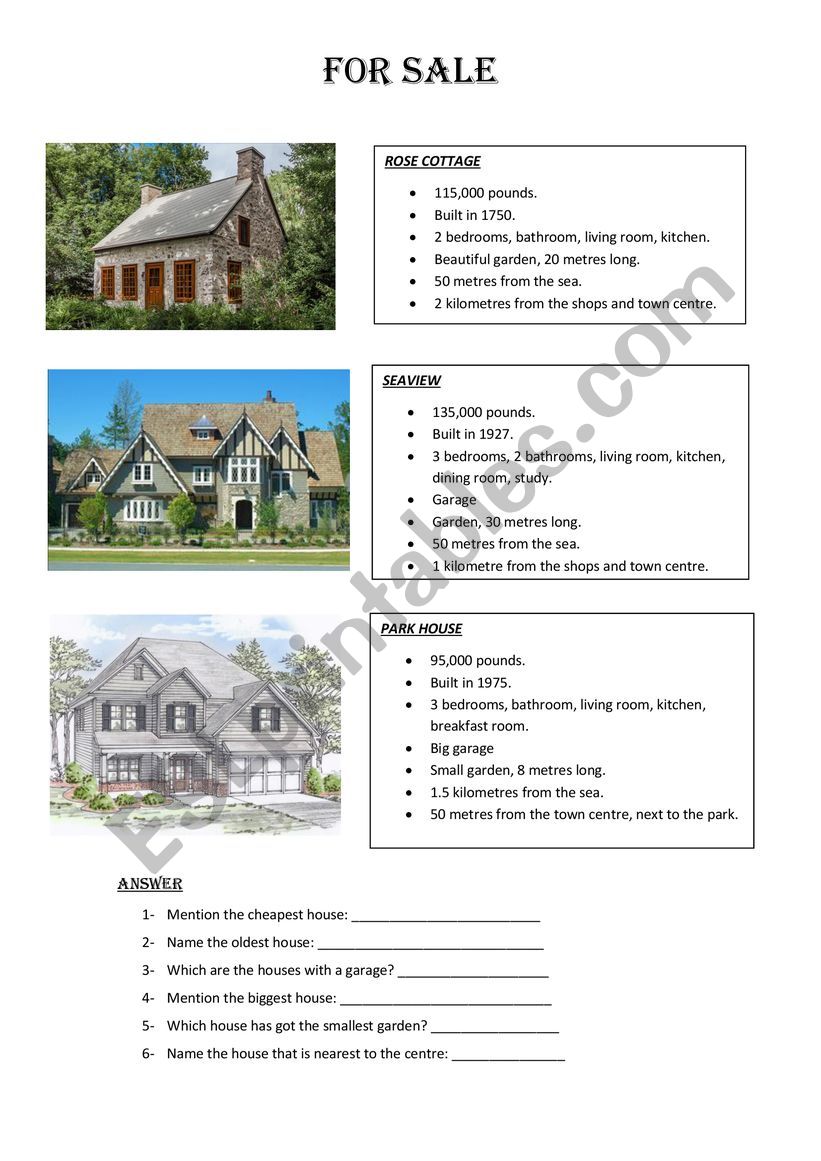

Houses for sale ESL worksheet by robinbaby

Web per irs publication 523 selling your home, within the worksheet on page 12: Basic info about the sale: Web what is the sale of main home worksheet? If you do not meet these tests, you may still be allowed to exclude a reduced amount of the gain. Web gain from the sale of your home from your income and.

Sale Of Home Worksheet —

Web $250,000 or less $500,000 or less, if married filing jointly your gain might be more than the exclusion amount for. Basic info about the sale: Web worksheets are included in publication 523, selling your home, to help you figure the: Calculate capital gains download doc when you sell a stock, you owe taxes on the difference between what you.

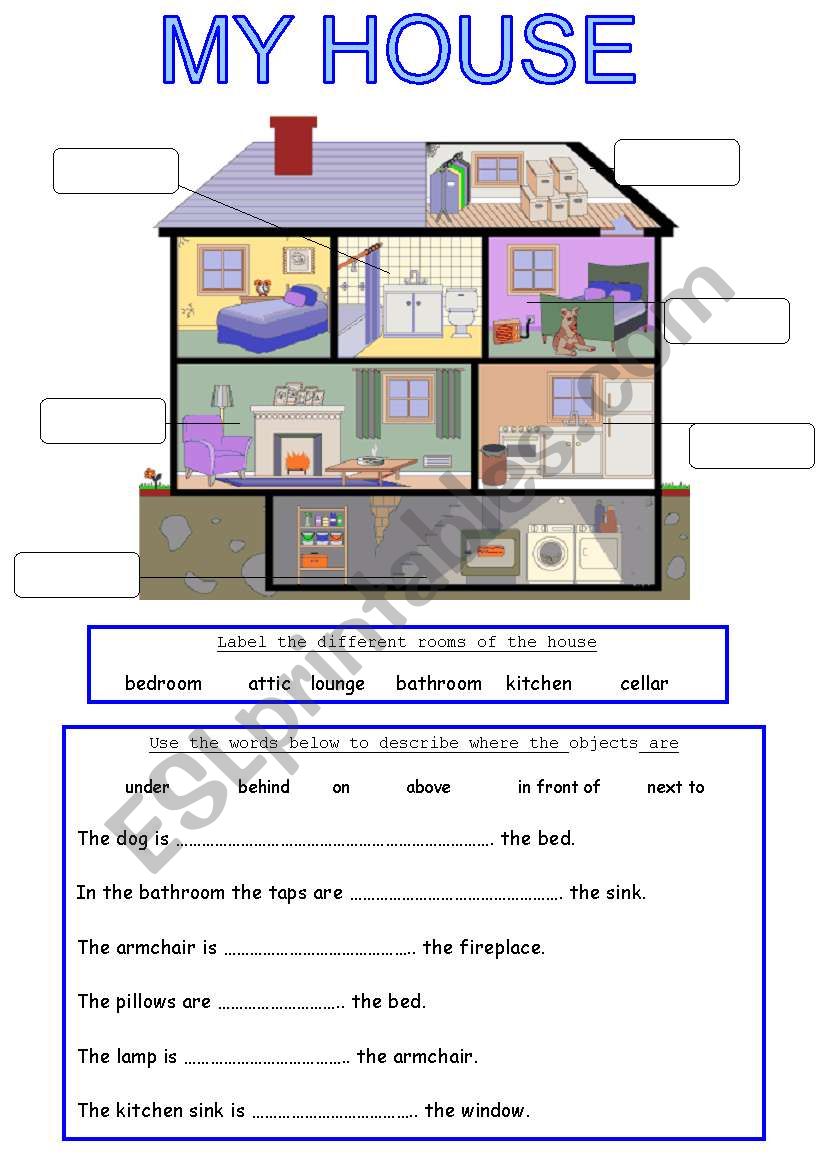

At Home ESL worksheet by RitaWi

If you sell your main home during the tax year, you should report the gain or loss on the. Web what is the sale of main home worksheet? Basic information about your home: The exclusion is increased to $500,000 for a married couple filing jointly. Web a home sale worksheet can help you compare real estate agents, sort out closing.

Sale Of Home Worksheet —

Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable. Web $250,000 or less $500,000 or less, if married filing jointly your gain might be more than the exclusion amount for. Web use this worksheet to compute your gain or loss on the sale or transfer of the real property. Web.

Excluding the Sale of Main Home Support

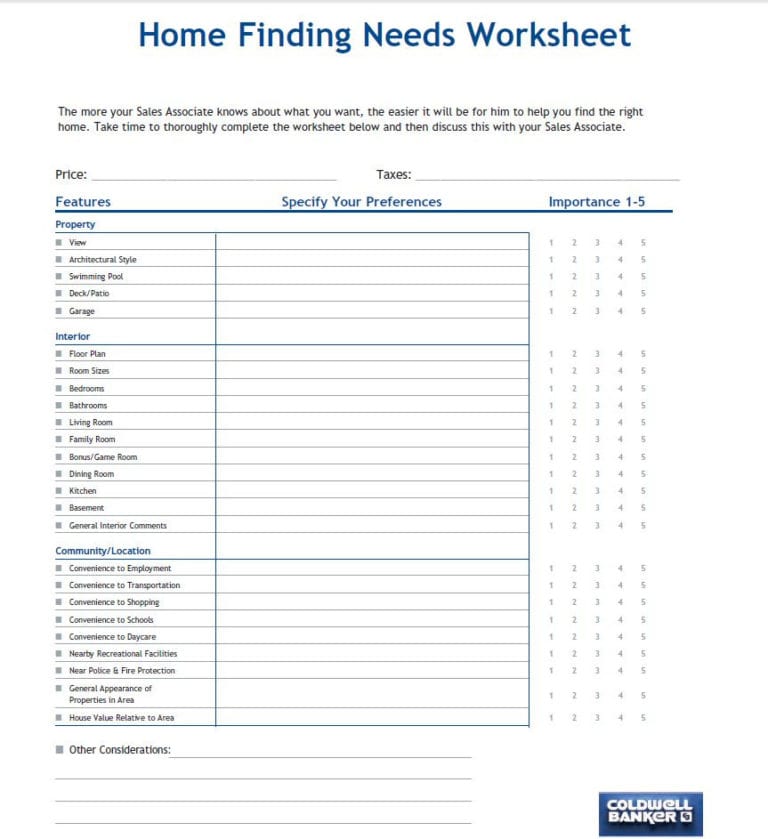

Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Web for more information on basis and adjusted basis, refer to publication 523, selling your home. Web $250,000 or less $500,000 or less, if married filing jointly your gain might be more than the exclusion amount for..

At home ESL worksheet by mahaenglish

Web for more information on basis and adjusted basis, refer to publication 523, selling your home. 3 drafts of publication 523 worksheet 1. If you sell your main home during the tax year, you should report the gain or loss on the. Web sale of home worksheet how to compute gain or loss worksheet the process is the same for.

Sale Of Main Home Worksheet —

Web in a traditional home sale, the seller pays fees to both their agent and the buyer’s agent. Web what is the sale of main home worksheet? Web your total adjusted basis in the property is now $326,000. Web the rented house is your main home. Web sale of main home worksheet;

home ESL worksheet by LILIAAMALIA

Web sale of main home worksheet; Web for more information on basis and adjusted basis, refer to publication 523, selling your home. 3 drafts of publication 523 worksheet 1. Basic information about your home: The exclusion is increased to $500,000 for a married couple filing jointly.

AT HOME ESL worksheet by lamejor

Basic information about your home: Web for more information on basis and adjusted basis, refer to publication 523, selling your home. The gain or loss is computed in the same manner as for. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the. Basic info about the sale:

Houses for sale ESL worksheet by emi7717

Web $250,000 or less $500,000 or less, if married filing jointly your gain might be more than the exclusion amount for. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain.

It’s common for the total. Web what is the sale of main home worksheet? Web gain from the sale of your home from your income and avoid paying taxes on it. The gain or loss is computed in the same manner as for. Web sale of main home worksheet; The exclusion is increased to $500,000 for a married couple filing jointly. If you do not meet these tests, you may still be allowed to exclude a reduced amount of the gain. Calculate capital gains download doc when you sell a stock, you owe taxes on the difference between what you paid for. Worksheet for 2002 expenses paid in 2003. Web this section tells you how to report taxable gain, take deductions relating to your home sale, and report income other than the gain. Web per irs publication 523 selling your home, within the worksheet on page 12: 3 drafts of publication 523 worksheet 1. You decide to sell after five years. You estimate that it will cost you $10,000 to. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Basic info about the sale: Web the rented house is your main home. Adjusted basis of the home you sold gain. Web $250,000 or less $500,000 or less, if married filing jointly your gain might be more than the exclusion amount for. Web use this worksheet to compute your gain or loss on the sale or transfer of the real property.

Web This Section Tells You How To Report Taxable Gain, Take Deductions Relating To Your Home Sale, And Report Income Other Than The Gain.

To access the sale of main home worksheet for in the tax program, from the main menu of. Web gain from the sale of your home from your income and avoid paying taxes on it. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable. Web sale of main home worksheet;

It’s Common For The Total.

The exclusion is increased to $500,000 for a married couple filing jointly. Web the rented house is your main home. Web per irs publication 523 selling your home, within the worksheet on page 12: Web use this worksheet to compute your gain or loss on the sale or transfer of the real property.

Basic Info About The Sale:

The gain or loss is computed in the same manner as for. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the. Web in a traditional home sale, the seller pays fees to both their agent and the buyer’s agent. Web sale of home worksheet how to compute gain or loss worksheet the process is the same for single family homes,.

Web Use This Screen To Complete Sale Of Your Home Worksheets And Form 6252, Installment Sale Income, If Applicable.

If you sell your main home during the tax year, you should report the gain or loss on the. You estimate that it will cost you $10,000 to. Web your total adjusted basis in the property is now $326,000. Adjusted basis of the home you sold gain.