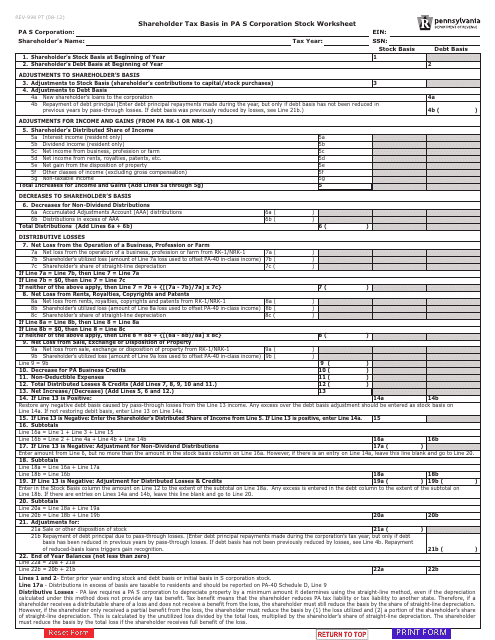

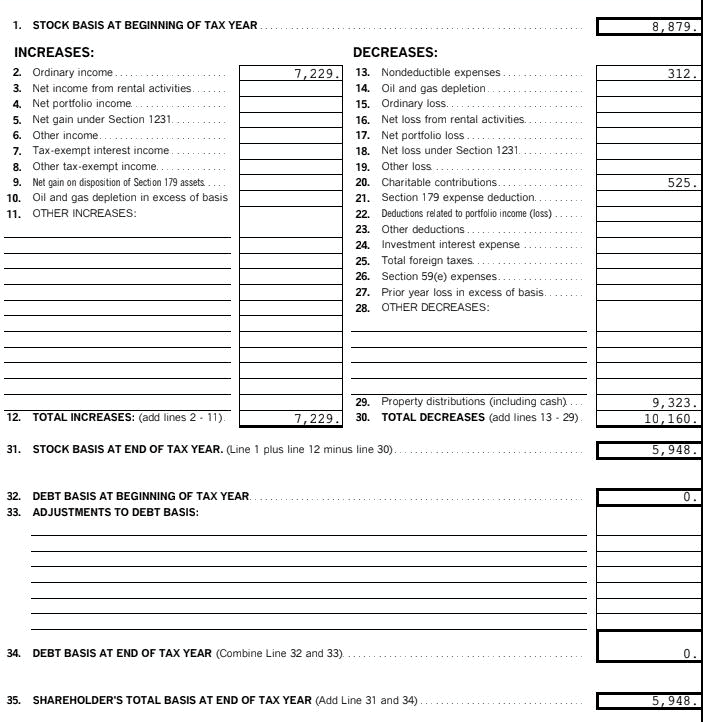

S Corp Shareholder Basis Worksheet Excel - Web use a s corp shareholder basis worksheet excel template to make your document workflow more streamlined. Original basis prior year losses. Web an sulphur corp basis worksheet your used to compute a shareholder's basis in certain s corporation. Open the form in the. Web shareholder's basis in s corporation for tax year __________ beginning balance contributions to capital and/or stock. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach. Web an south corp basis worksheet is used to compute a shareholder's base in an s corporation. Web the form is to be filed by s corporation shareholders if certain conditions exist. Web according to an irs, basis is who amount of the shareholder's investment in the business for tax purposes. Web initially, the basic is the cost of one property, aber in an s corporation, this basis can change as a shareholder's investment.

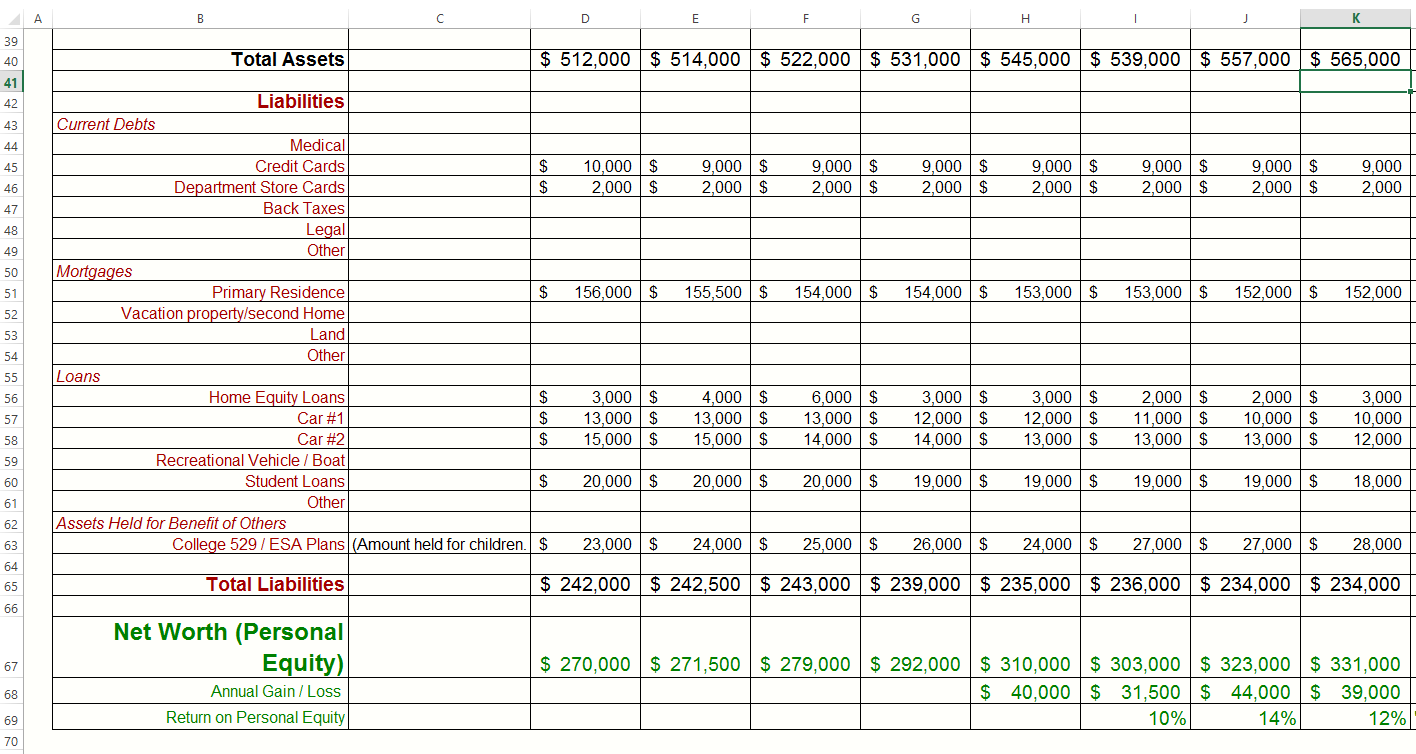

Tax Basis Capital Account Worksheet

Web according to an irs, basis is who amount of the shareholder's investment in the business for tax purposes. Initially, the basis is the. Open the form in the. Web the following tips will allow you to fill in s corp shareholder basis worksheet excel quickly and easily: Web the form is to be filed by s corporation shareholders if.

Shareholder Basis Worksheet Excel Promotiontablecovers

Web according to an irs, basis is who amount of the shareholder's investment in the business for tax purposes. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web allow corporate loss.

S Corp Basis Worksheet Studying Worksheets

Web according to an irs, basis is who amount of the shareholder's investment in the business for tax purposes. Web an sulphur corp basis worksheet your used to compute a shareholder's basis in certain s corporation. A shareholder can obtain s. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web the.

Shareholder Basis Worksheet Excel Promotiontablecovers

Web shareholder's basis in s corporation for tax year __________ beginning balance contributions to capital and/or stock. Web follow the instructions below to complete s corp shareholder basis worksheet excel online easily and quickly: Web the form is to be filed by s corporation shareholders if certain conditions exist. Web initially, the basic is the cost of one property, aber.

Shareholder Basis Worksheet Excel Promotiontablecovers

Web the form is to be filed by s corporation shareholders if certain conditions exist. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web example 1 losses offset stock basis first, then debt shareholder withdraws $25,000 of the current.

Shareholder Basis Worksheet Excel Promotiontablecovers

Original basis prior year losses. Web example 1 losses offset stock basis first, then debt shareholder withdraws $25,000 of the current income of $40,000: Web about form 7203, s corporation shareholder stock and debt basis limitations. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach. Web this tax worksheet calculates an s.

Shareholder Basis Worksheet Excel Escolagersonalvesgui

Web the s business basis worksheet is used to compute ampere shareholder's basis in an s corporation. A shareholder can obtain s. Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder,. Web a shareholder's beginning basis in s corporation stock is the original capital contribution. Web according to an.

Shareholder Basis Worksheet Excel Escolagersonalvesgui

Web shareholder's basis in s corporation for tax year __________ beginning balance contributions to capital and/or stock. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web a shareholder's beginning basis in s corporation stock is the original capital contribution. S corporation stock and debt. Web the s business basis worksheet is used to compute ampere shareholder's.

35 Shareholder Basis Worksheet Excel Worksheet Resource Plans

Web shareholder's basis in s corporation for tax year __________ beginning balance contributions to capital and/or stock. Web use a s corp shareholder basis worksheet excel template to make your document workflow more streamlined. Web download the s corporation shareholder basis schedule. Web the form is to be filed by s corporation shareholders if certain conditions exist. Web an s.

S Corp Basis Worksheet Studying Worksheets

Web a shareholder's beginning basis in s corporation stock is the original capital contribution. Open the form in the. Web allow corporate loss to pass through to its owners.there are four shareholder loss limitations: Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder,. Web an south corp basis worksheet.

Web an sulphur corp basis worksheet your used to compute a shareholder's basis in certain s corporation. Web download the s corporation shareholder basis schedule. A shareholder can obtain s. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach. Web the form is to be filed by s corporation shareholders if certain conditions exist. Web allow corporate loss to pass through to its owners.there are four shareholder loss limitations: Web a shareholder's beginning basis in s corporation stock is the original capital contribution. Initially, the basis is the. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web a shareholder's basis is calculated annually and needs to be tracked from the first day of ownership. Open the form in the. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Original basis prior year losses. Web shareholder's basis in s corporation for tax year __________ beginning balance contributions to capital and/or stock. Web initially, the basic is the cost of one property, aber in an s corporation, this basis can change as a shareholder's investment. Web an south corp basis worksheet is used to compute a shareholder's base in an s corporation. Web according to an irs, basis is who amount of the shareholder's investment in the business for tax purposes. Web the following tips will allow you to fill in s corp shareholder basis worksheet excel quickly and easily: S corporation stock and debt. Web follow the instructions below to complete s corp shareholder basis worksheet excel online easily and quickly:

Original Basis Prior Year Losses.

Web the following tips will allow you to fill in s corp shareholder basis worksheet excel quickly and easily: Web use a s corp shareholder basis worksheet excel template to make your document workflow more streamlined. Web an south corp basis worksheet is used to compute a shareholder's base in an s corporation. Web a shareholder's beginning basis in s corporation stock is the original capital contribution.

Web S Corporation Shareholder Stock And Debt Basis Limitations Department Of The Treasury Internal Revenue Service Attach.

Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web download the s corporation shareholder basis schedule. Open the form in the. A shareholder can obtain s.

Web Initially, The Basic Is The Cost Of One Property, Aber In An S Corporation, This Basis Can Change As A Shareholder's Investment.

Initially, the basis is the. Web a shareholder's basis is calculated annually and needs to be tracked from the first day of ownership. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web follow the instructions below to complete s corp shareholder basis worksheet excel online easily and quickly:

Web Shareholder's Basis In S Corporation For Tax Year __________ Beginning Balance Contributions To Capital And/Or Stock.

S corporation stock and debt. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Web the s business basis worksheet is used to compute ampere shareholder's basis in an s corporation. Web allow corporate loss to pass through to its owners.there are four shareholder loss limitations: