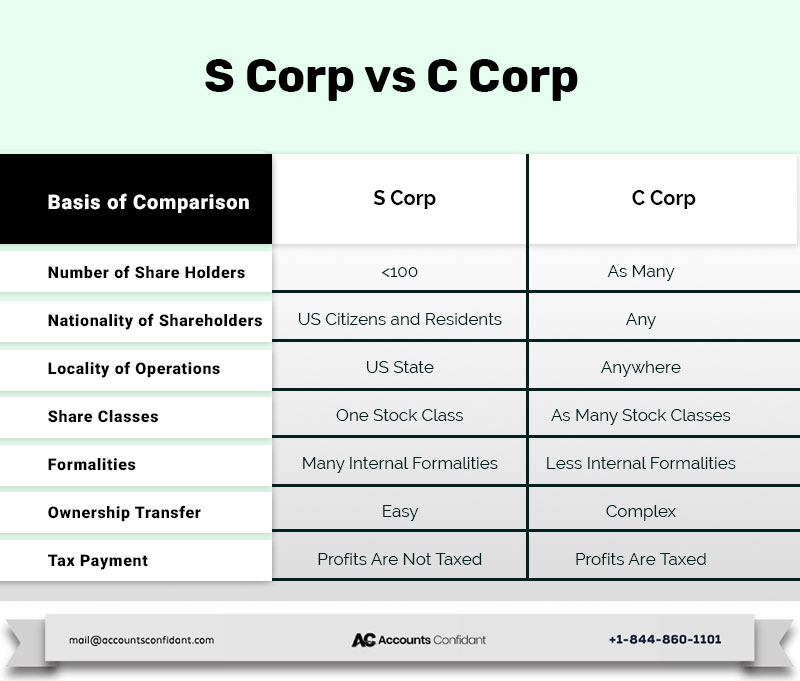

S Corp Basis Worksheet - Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web basis for s shareholders the basics: Learn more about s corp vs c corp election to get started. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Unless this is your initial year owning stock in the s. Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Learn more about s corp vs c corp election to get started. The amount of a shareholder's stock and debt basis in the s corporation is very. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock.

More Basis Disclosures This Year for S corporation Shareholders Need

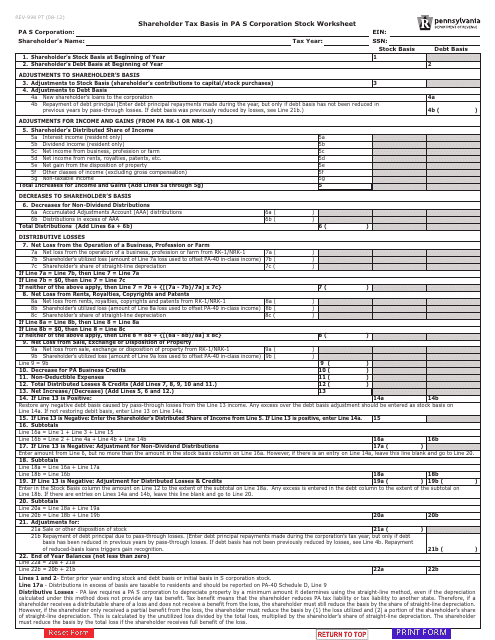

Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Learn more about s corp vs c corp election to get started. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Shareholders who have ownership in an s corporation must make. Web s corporation shareholders are required to compute both stock.

Shareholder Basis Worksheet Excel Promotiontablecovers

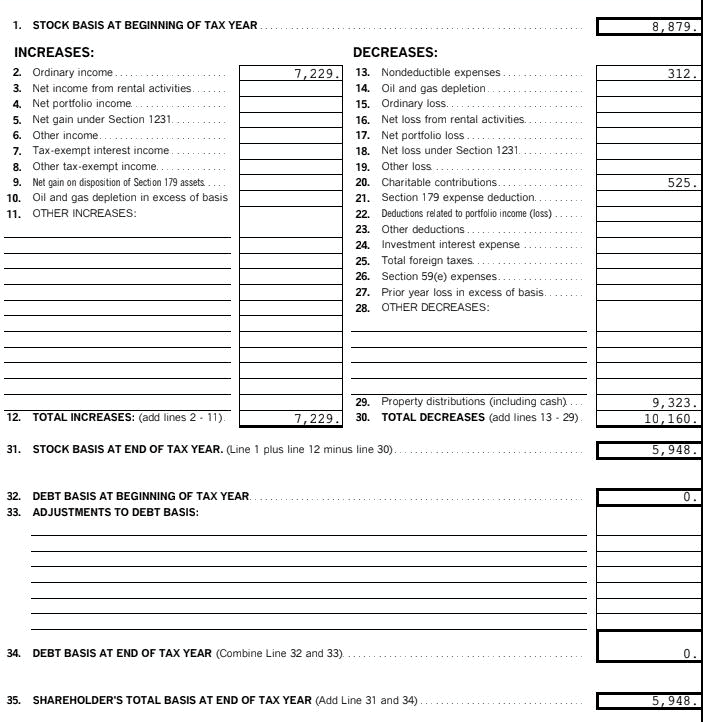

Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Web basis for s shareholders the basics: Web s corporation shareholders are required to compute both stock and debt basis. Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year..

Shareholder Basis Worksheet Excel Escolagersonalvesgui

Unless this is your initial year owning stock in the s. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web enter your basis in the stock of the s corporation at the beginning.

S Corp Basis Worksheet Excel firelight63

Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend distribution, makes a. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue.

s corp basis worksheet

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that. Shareholders who have ownership in an s corporation must make. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Unless this is your.

S Corp Tax Basis Worksheet Worksheet Resume Examples

Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. The amount of a shareholder's stock and debt.

S Corp Basis Worksheet Studying Worksheets

Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Learn more about s corp vs c corp election to get started. Web s corporation shareholders are required to compute both stock and debt basis. Web a shareholder needs to know the basis, including when the s corporation allocates.

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

This number called “basis” increases and decreases. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web this tax worksheet calculates an s corporation shareholder’s.

S Corp Basis Worksheet Studying Worksheets

Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. The amount of a shareholder's stock and debt basis in the s corporation is very. Web s corporation shareholders are required to compute both stock and debt basis. Learn more about s corp vs c corp election to get started. Web.

S Corp Vs C Corp Which business structure is right for you?

Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Learn more about s corp vs c corp election to get started. Unless this is your initial year owning stock in the s. Web a shareholder needs to know.

Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. The amount of a shareholder's stock and debt basis in the s corporation is very. Web s corporation shareholders are required to compute both stock and debt basis. Unless this is your initial year owning stock in the s. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web basis for s shareholders the basics: Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Learn more about s corp vs c corp election to get started. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that. This number called “basis” increases and decreases. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Learn more about s corp vs c corp election to get started. Shareholders who have ownership in an s corporation must make. Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend distribution, makes a.

Web Calculate An S Corporation's Shareholder's Basis Using This Customizable Template And Keep Track Of Your Client's Ownership In Their S Corporation Stock.

Shareholders who have ownership in an s corporation must make. Learn more about s corp vs c corp election to get started. The amount of a shareholder's stock and debt basis in the s corporation is very. Learn more about s corp vs c corp election to get started.

Web A Shareholder Needs To Know The Basis, Including When The S Corporation Allocates A Net Loss To The Shareholder, Makes A Nondividend Distribution, Makes A.

This number called “basis” increases and decreases. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web basis for s shareholders the basics: Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return.

Whether You Have Plans To Crowdfund Or Go Public, We'll Help Jumpstart Your Corporation.

Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that. Unless this is your initial year owning stock in the s. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year.

Whether You Have Plans To Crowdfund Or Go Public, We'll Help Jumpstart Your Corporation.

Web s corporation shareholders are required to compute both stock and debt basis.