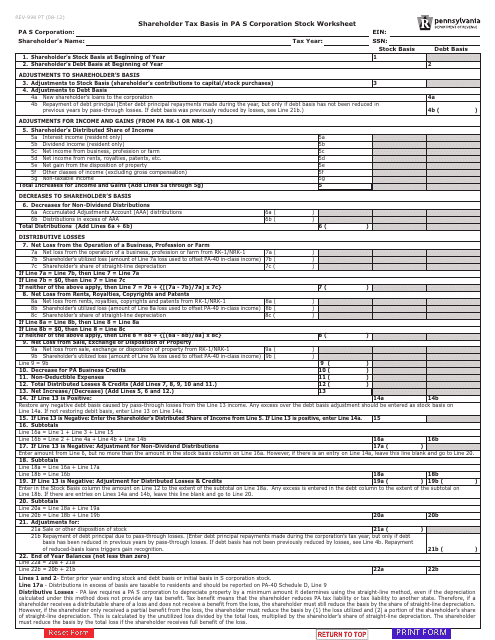

S Corp Basis Calculation Worksheet - You need to calculate that outside of the. Web february 1, 2022 related topics distributions & shareholder basis editor: Web shareholder basis input and calculation in the s corporation module of lacerte. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s. Web based on the prior s corporation's tax returns, an auditor may compute the shareholder's. Original basis prior year losses. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach. Web example 1 losses offset stock basis first, then debt shareholder withdraws $25,000 of the current income of $40,000: Web 1) add contributions to capital to stock basis 2) add new loans shareholder has made to the corporation to loan basis and loan.

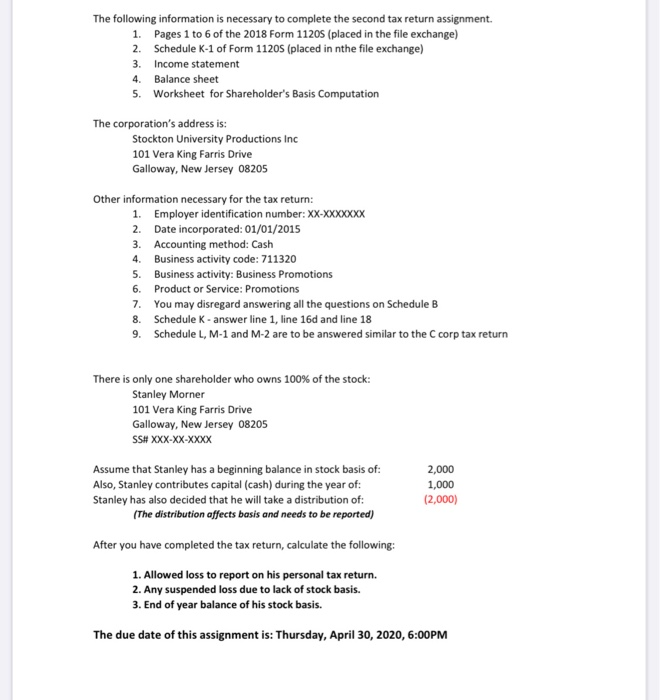

More Basis Disclosures This Year for S corporation Shareholders Need

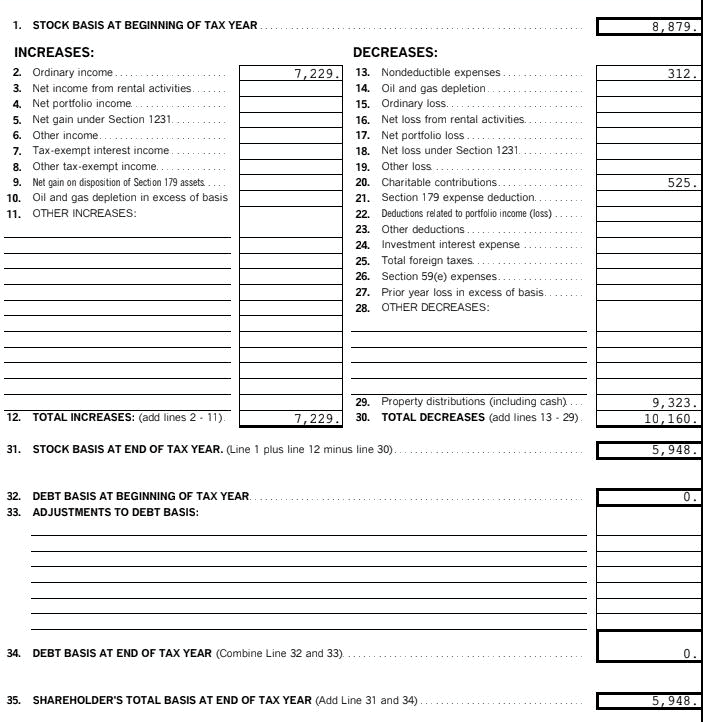

Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Web 1) add contributions to capital to stock basis 2) add new loans shareholder has made to the corporation to loan basis and loan. You need to calculate that outside of the. Web example 1 losses offset stock basis first,.

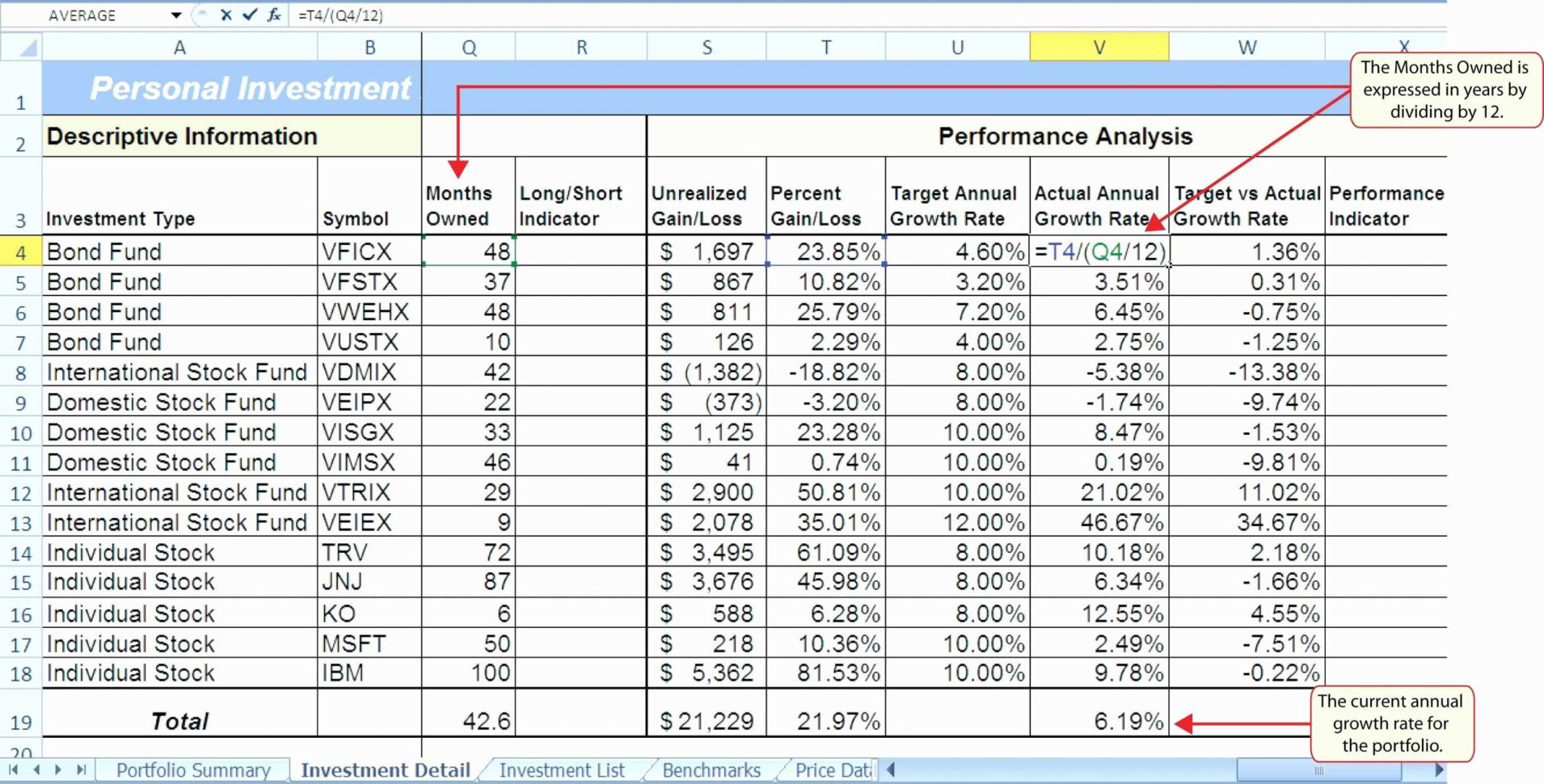

S Corp Basis Worksheet Excel

Web initial basis is generally the cash paid for the s corporation shares, property contributed to the corporation, carryover basis if gifted. Think of basis like a checking account. Original basis prior year losses. Web example 1 losses offset stock basis first, then debt shareholder withdraws $25,000 of the current income of $40,000: An s corp basis worksheet is used.

would you rather worksheet

Web updated july 14, 2020: Solved • by intuit • 149 • updated. Web computing basis with historical records. Think of basis like a checking account. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s.

Using turbotax for s corp partner doppedia

Web initial basis is generally the cash paid for the s corporation shares, property contributed to the corporation, carryover basis if gifted. Web the basis of s corporation stock is adjusted on an ongoing basis (unlike for a c corporation, where stock basis remains. Original basis prior year losses. Web turbotax does not actually track your basis in the s.

Stock Cost Basis Spreadsheet 1 Printable Spreadshee stock cost basis

Your initial tax basis in an s corporation is what you paid or contributed. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web updated july 14, 2020: Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web calculate an s corporation's.

S Corp Basis Calculation Worksheets

Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Your initial tax basis in an s corporation is what you paid or contributed. Web computing basis with historical records. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web calculate an.

What Is the Basis for My SCorporation? TL;DR Accounting

Web updated july 14, 2020: The aggregate amount of losses and deductions that a shareholder may take into account for any taxable year may not. Web 1) add contributions to capital to stock basis 2) add new loans shareholder has made to the corporation to loan basis and loan. Web this tax worksheet calculates an s corporation shareholder’s basis in.

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

Web computing basis with historical records. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Web shareholder basis input and calculation in the s corporation module of lacerte. Your initial tax basis in an s corporation is what you paid or contributed. Web initial basis is generally the cash.

S Corp Basis Worksheet Studying Worksheets

Web shareholder basis input and calculation in the s corporation module of lacerte. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. The shareholder’s initial cost of the stock and additional paid in capital,. Web february 1, 2022 related topics distributions & shareholder basis editor: Web the basis of.

S Corp Basis Worksheet Studying Worksheets

Ad save thousands in taxes, talk to an advisor today. An s corp basis worksheet is used to compute a shareholder's basis includes an s. Web how basis is calculated: Your initial tax basis in an s corporation is what you paid or contributed. Web the basis of s corporation stock is adjusted on an ongoing basis (unlike for a.

Web initial basis is generally the cash paid for the s corporation shares, property contributed to the corporation, carryover basis if gifted. Your initial tax basis in an s corporation is what you paid or contributed. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s. Web updated july 14, 2020: Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the. Think of basis like a checking account. Web how basis is calculated: Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. You need to calculate that outside of the. Ad save thousands in taxes, talk to an advisor today. An s corp basis worksheet is used to compute a shareholder's basis includes an s. According to the irs, basis is. Web shareholder basis input and calculation in the s corporation module of lacerte. The aggregate amount of losses and deductions that a shareholder may take into account for any taxable year may not. Web an siemens corp basis worksheet is used to compute a shareholder's basis in an s corporation. When there is a deposit of. Solved • by intuit • 149 • updated. Web february 1, 2022 related topics distributions & shareholder basis editor: Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web computing basis with historical records.

The Shareholder’s Initial Cost Of The Stock And Additional Paid In Capital,.

Web an siemens corp basis worksheet is used to compute a shareholder's basis in an s corporation. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. The aggregate amount of losses and deductions that a shareholder may take into account for any taxable year may not. Web computing basis with historical records.

Web How Basis Is Calculated:

According to the irs, basis is. Web the basis of s corporation stock is adjusted on an ongoing basis (unlike for a c corporation, where stock basis remains. When there is a deposit of. Web turbotax does not actually track your basis in the s corporation;

Web Example 1 Losses Offset Stock Basis First, Then Debt Shareholder Withdraws $25,000 Of The Current Income Of $40,000:

Ad save thousands in taxes, talk to an advisor today. Web based on the prior s corporation's tax returns, an auditor may compute the shareholder's. Web initial basis is generally the cash paid for the s corporation shares, property contributed to the corporation, carryover basis if gifted. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the.

An S Corp Basis Worksheet Is Used To Compute A Shareholder's Basis Includes An S.

Web 1) add contributions to capital to stock basis 2) add new loans shareholder has made to the corporation to loan basis and loan. Your initial tax basis in an s corporation is what you paid or contributed. Web shareholder basis input and calculation in the s corporation module of lacerte. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach.